Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Intro You own 500 shares of Apple and you plan to hold on to them for the foreseeable future. You are afraid that the shares

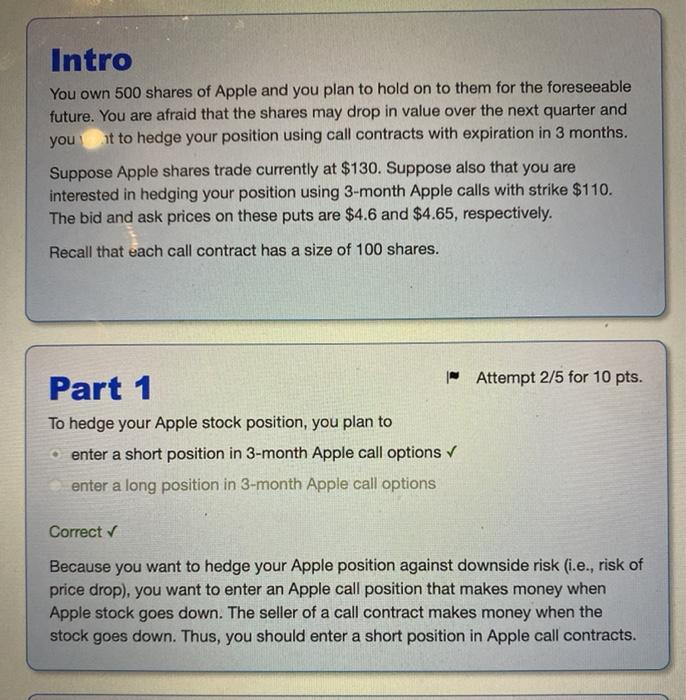

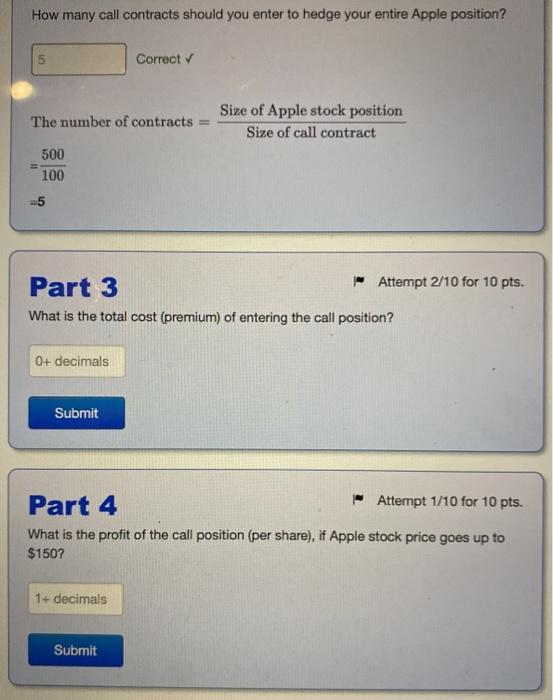

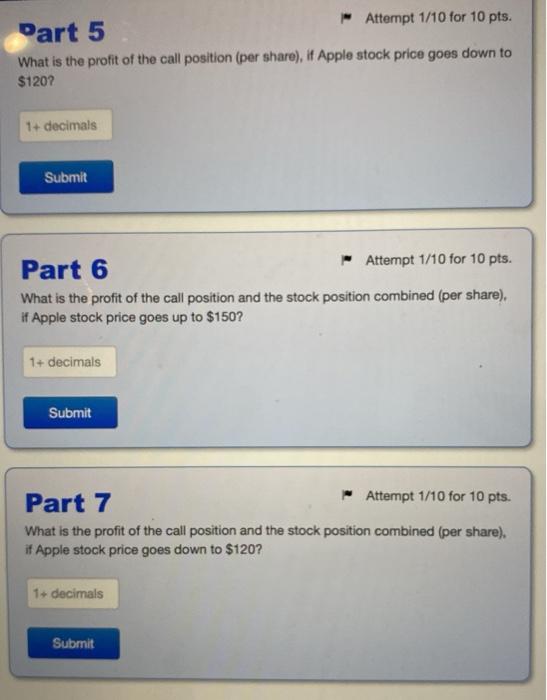

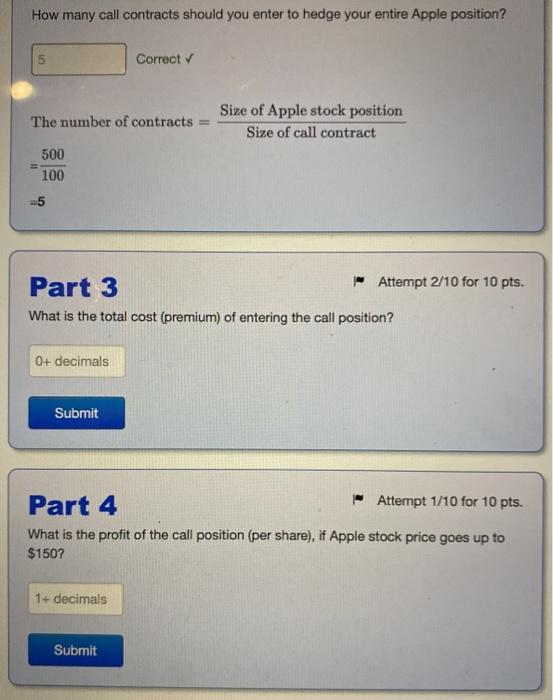

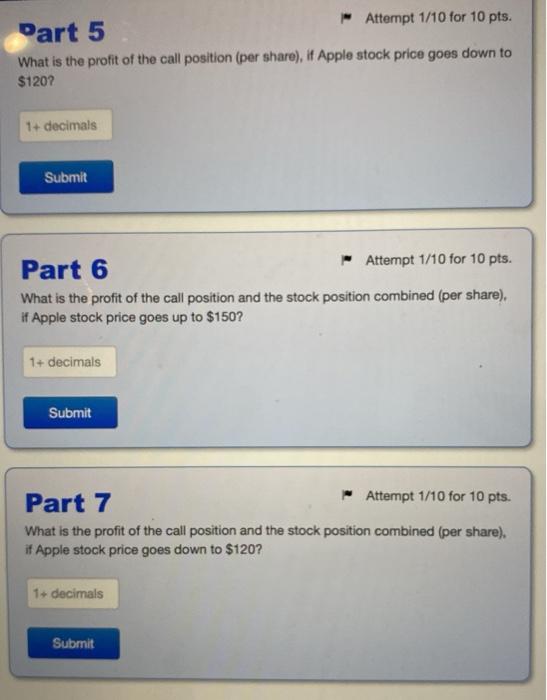

Intro You own 500 shares of Apple and you plan to hold on to them for the foreseeable future. You are afraid that the shares may drop in value over the next quarter and it to hedge your position using call contracts with expiration in 3 months. Suppose Apple shares trade currently at $130. Suppose also that you are interested in hedging your position using 3-month Apple calls with strike $110. The bid and ask prices on these puts are $4.6 and $4.65, respectively. you Recall that each call contract has a size of 100 shares. Attempt 2/5 for 10 pts. Part 1 To hedge your Apple stock position, you plan to enter a short position in 3-month Apple call options enter a long position in 3-month Apple call options Correct Because you want to hedge your Apple position against downside risk (i.e., risk of price drop), you want to enter an Apple call position that makes money when Apple stock goes down. The seller of a call contract makes money when the stock goes down. Thus, you should enter a short position in Apple call contracts. How many call contracts should you enter to hedge your entire Apple position? 5 Correct The number of contracts = Size of Apple stock position Size of call contract 500 100 -5 Part 3 | Attempt 2/10 for 10 pts. What is the total cost (premium) of entering the call position? 0+ decimals Submit Part 4 | Attempt 1/10 for 10 pts. What is the profit of the call position (per share), if Apple stock price goes up to $150? 1+ decimals Submit Attempt 1/10 for 10 pts. Dart 5 What is the profit of the call position (per share), if Apple stock price goes down to $120? 1+ decimals Submit Part 6 Attempt 1/10 for 10 pts. What is the profit of the call position and the stock position combined (per share). if Apple stock price goes up to $150? 1+ decimals Submit Part 7 Attempt 1/10 for 10 pts. What is the profit of the call position and the stock position combined (per share). if Apple stock price goes down to $120? 1+ decimals Submit Intro You own 500 shares of Apple and you plan to hold on to them for the foreseeable future. You are afraid that the shares may drop in value over the next quarter and it to hedge your position using call contracts with expiration in 3 months. Suppose Apple shares trade currently at $130. Suppose also that you are interested in hedging your position using 3-month Apple calls with strike $110. The bid and ask prices on these puts are $4.6 and $4.65, respectively. you Recall that each call contract has a size of 100 shares. Attempt 2/5 for 10 pts. Part 1 To hedge your Apple stock position, you plan to enter a short position in 3-month Apple call options enter a long position in 3-month Apple call options Correct Because you want to hedge your Apple position against downside risk (i.e., risk of price drop), you want to enter an Apple call position that makes money when Apple stock goes down. The seller of a call contract makes money when the stock goes down. Thus, you should enter a short position in Apple call contracts. How many call contracts should you enter to hedge your entire Apple position? 5 Correct The number of contracts = Size of Apple stock position Size of call contract 500 100 -5 Part 3 | Attempt 2/10 for 10 pts. What is the total cost (premium) of entering the call position? 0+ decimals Submit Part 4 | Attempt 1/10 for 10 pts. What is the profit of the call position (per share), if Apple stock price goes up to $150? 1+ decimals Submit Attempt 1/10 for 10 pts. Dart 5 What is the profit of the call position (per share), if Apple stock price goes down to $120? 1+ decimals Submit Part 6 Attempt 1/10 for 10 pts. What is the profit of the call position and the stock position combined (per share). if Apple stock price goes up to $150? 1+ decimals Submit Part 7 Attempt 1/10 for 10 pts. What is the profit of the call position and the stock position combined (per share). if Apple stock price goes down to $120? 1+ decimals Submit

Intro You own 500 shares of Apple and you plan to hold on to them for the foreseeable future. You are afraid that the shares may drop in value over the next quarter and it to hedge your position using call contracts with expiration in 3 months. Suppose Apple shares trade currently at $130. Suppose also that you are interested in hedging your position using 3-month Apple calls with strike $110. The bid and ask prices on these puts are $4.6 and $4.65, respectively. you Recall that each call contract has a size of 100 shares. Attempt 2/5 for 10 pts. Part 1 To hedge your Apple stock position, you plan to enter a short position in 3-month Apple call options enter a long position in 3-month Apple call options Correct Because you want to hedge your Apple position against downside risk (i.e., risk of price drop), you want to enter an Apple call position that makes money when Apple stock goes down. The seller of a call contract makes money when the stock goes down. Thus, you should enter a short position in Apple call contracts. How many call contracts should you enter to hedge your entire Apple position? 5 Correct The number of contracts = Size of Apple stock position Size of call contract 500 100 -5 Part 3 | Attempt 2/10 for 10 pts. What is the total cost (premium) of entering the call position? 0+ decimals Submit Part 4 | Attempt 1/10 for 10 pts. What is the profit of the call position (per share), if Apple stock price goes up to $150? 1+ decimals Submit Attempt 1/10 for 10 pts. Dart 5 What is the profit of the call position (per share), if Apple stock price goes down to $120? 1+ decimals Submit Part 6 Attempt 1/10 for 10 pts. What is the profit of the call position and the stock position combined (per share). if Apple stock price goes up to $150? 1+ decimals Submit Part 7 Attempt 1/10 for 10 pts. What is the profit of the call position and the stock position combined (per share). if Apple stock price goes down to $120? 1+ decimals Submit Intro You own 500 shares of Apple and you plan to hold on to them for the foreseeable future. You are afraid that the shares may drop in value over the next quarter and it to hedge your position using call contracts with expiration in 3 months. Suppose Apple shares trade currently at $130. Suppose also that you are interested in hedging your position using 3-month Apple calls with strike $110. The bid and ask prices on these puts are $4.6 and $4.65, respectively. you Recall that each call contract has a size of 100 shares. Attempt 2/5 for 10 pts. Part 1 To hedge your Apple stock position, you plan to enter a short position in 3-month Apple call options enter a long position in 3-month Apple call options Correct Because you want to hedge your Apple position against downside risk (i.e., risk of price drop), you want to enter an Apple call position that makes money when Apple stock goes down. The seller of a call contract makes money when the stock goes down. Thus, you should enter a short position in Apple call contracts. How many call contracts should you enter to hedge your entire Apple position? 5 Correct The number of contracts = Size of Apple stock position Size of call contract 500 100 -5 Part 3 | Attempt 2/10 for 10 pts. What is the total cost (premium) of entering the call position? 0+ decimals Submit Part 4 | Attempt 1/10 for 10 pts. What is the profit of the call position (per share), if Apple stock price goes up to $150? 1+ decimals Submit Attempt 1/10 for 10 pts. Dart 5 What is the profit of the call position (per share), if Apple stock price goes down to $120? 1+ decimals Submit Part 6 Attempt 1/10 for 10 pts. What is the profit of the call position and the stock position combined (per share). if Apple stock price goes up to $150? 1+ decimals Submit Part 7 Attempt 1/10 for 10 pts. What is the profit of the call position and the stock position combined (per share). if Apple stock price goes down to $120? 1+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started