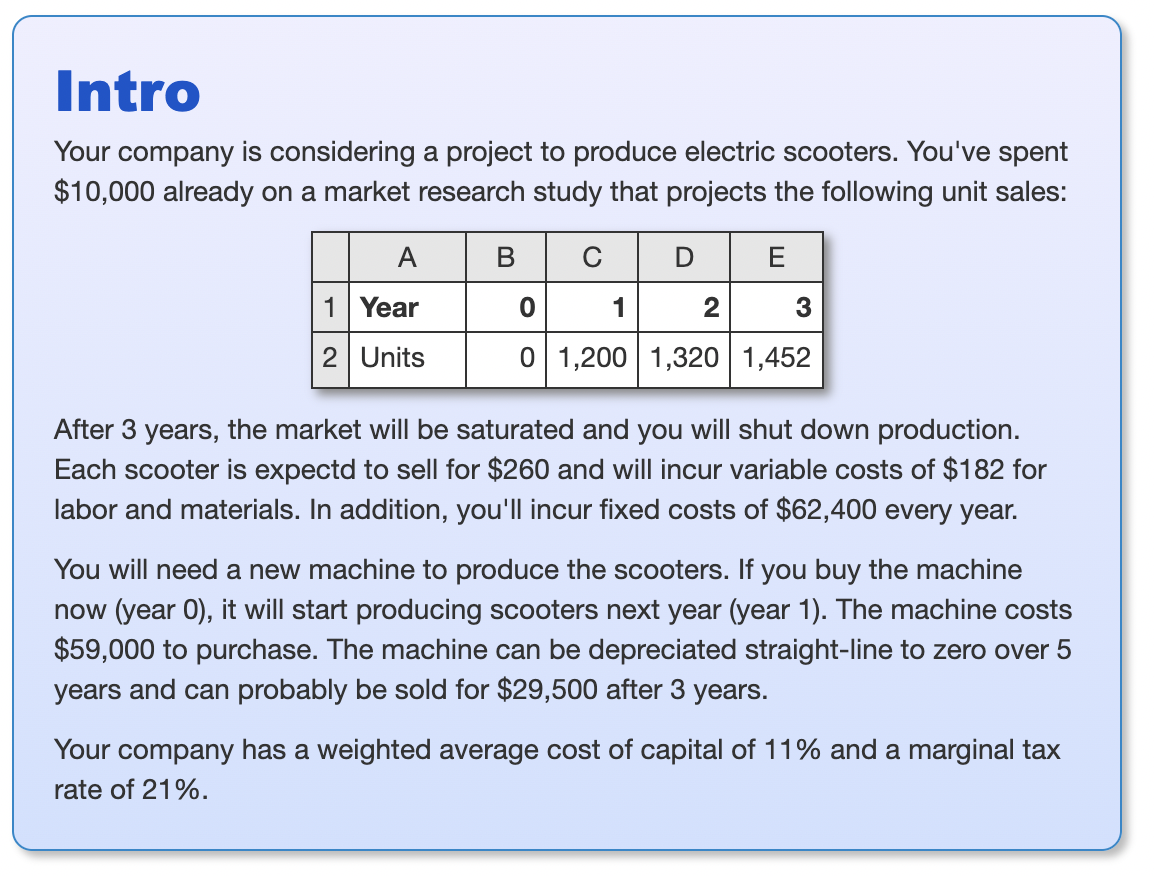

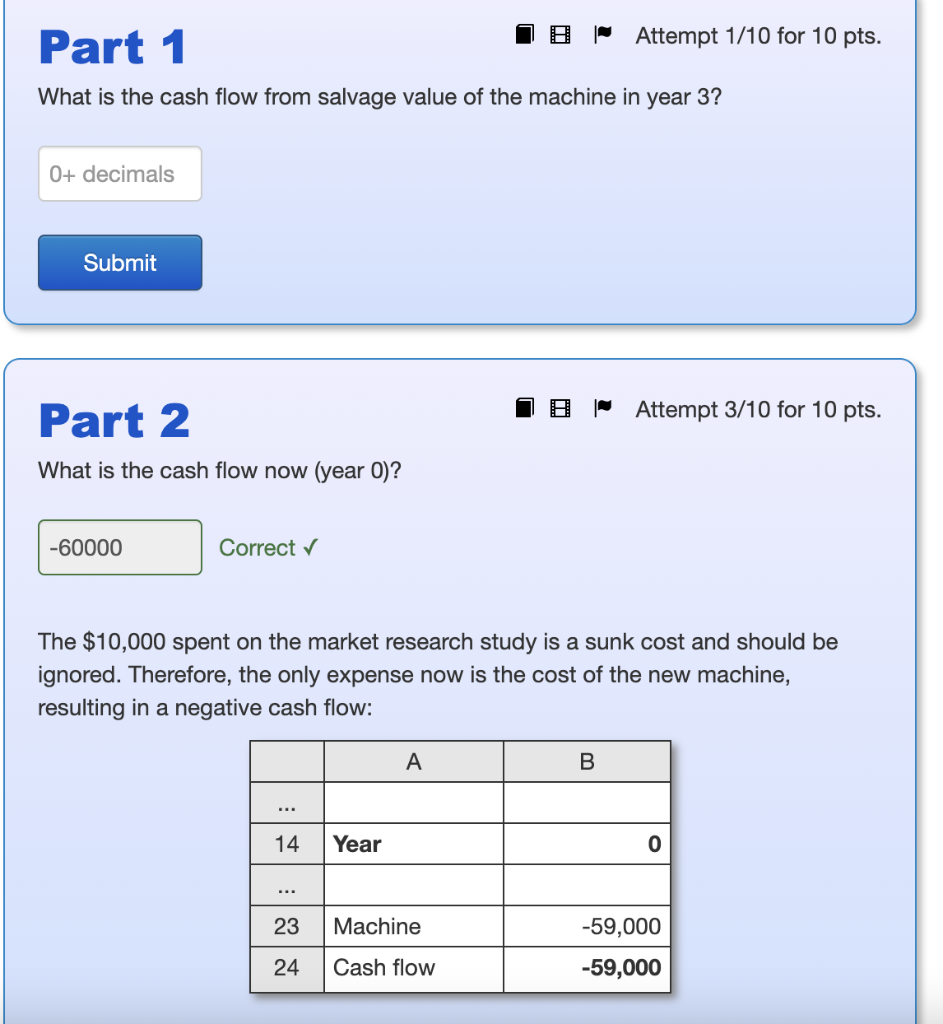

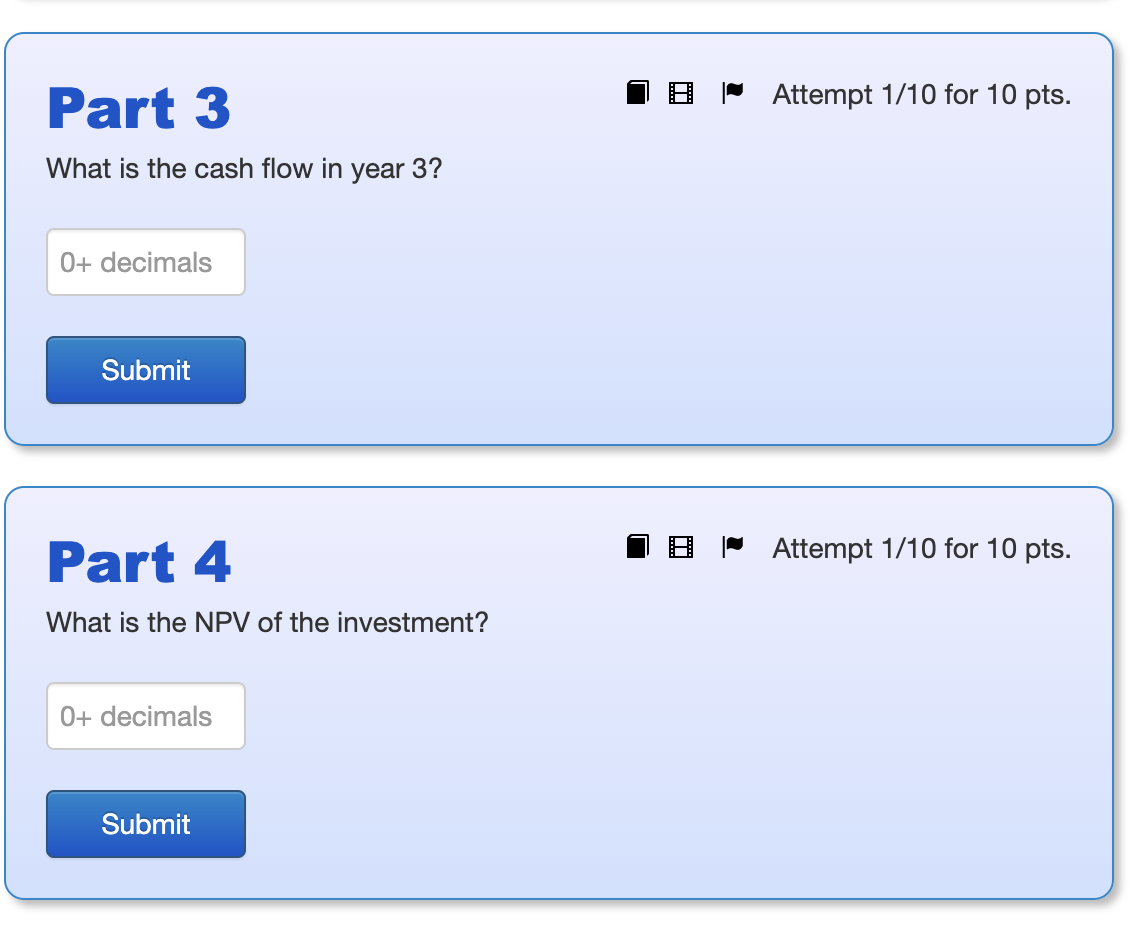

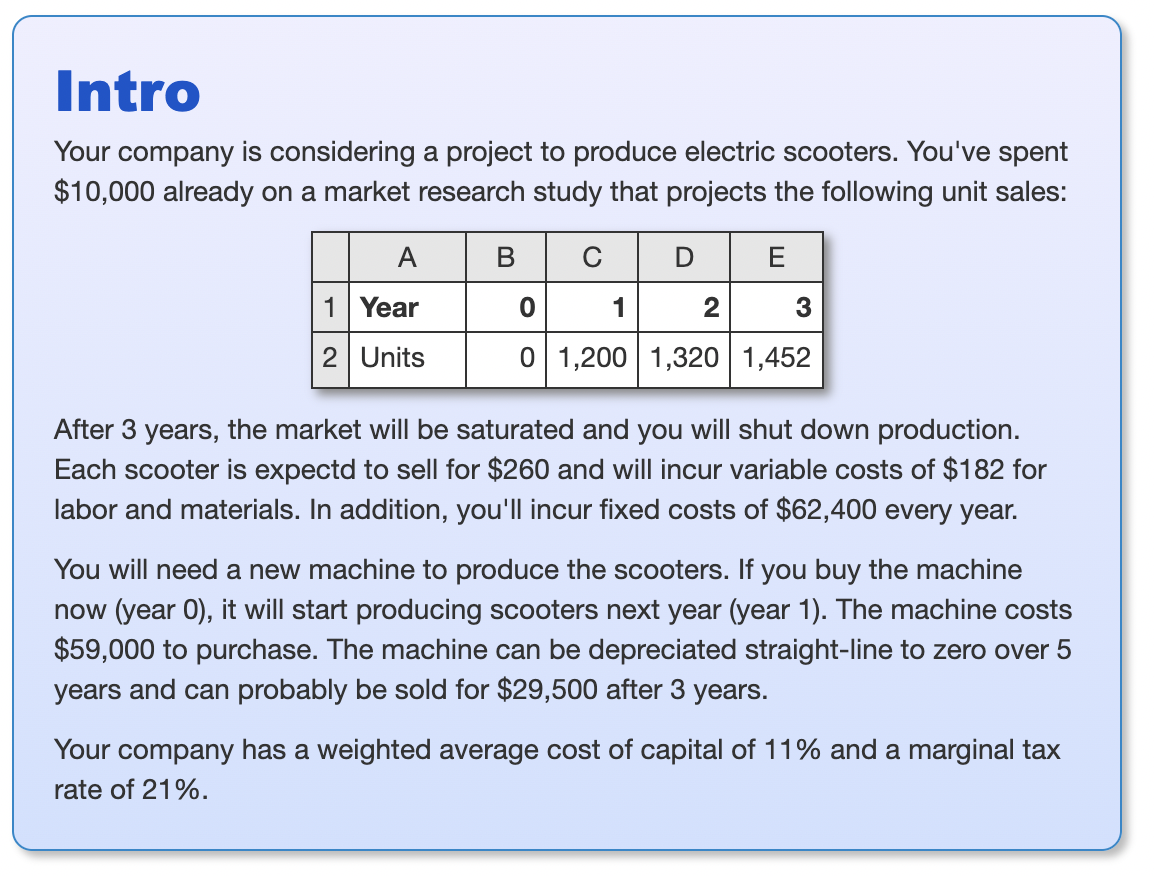

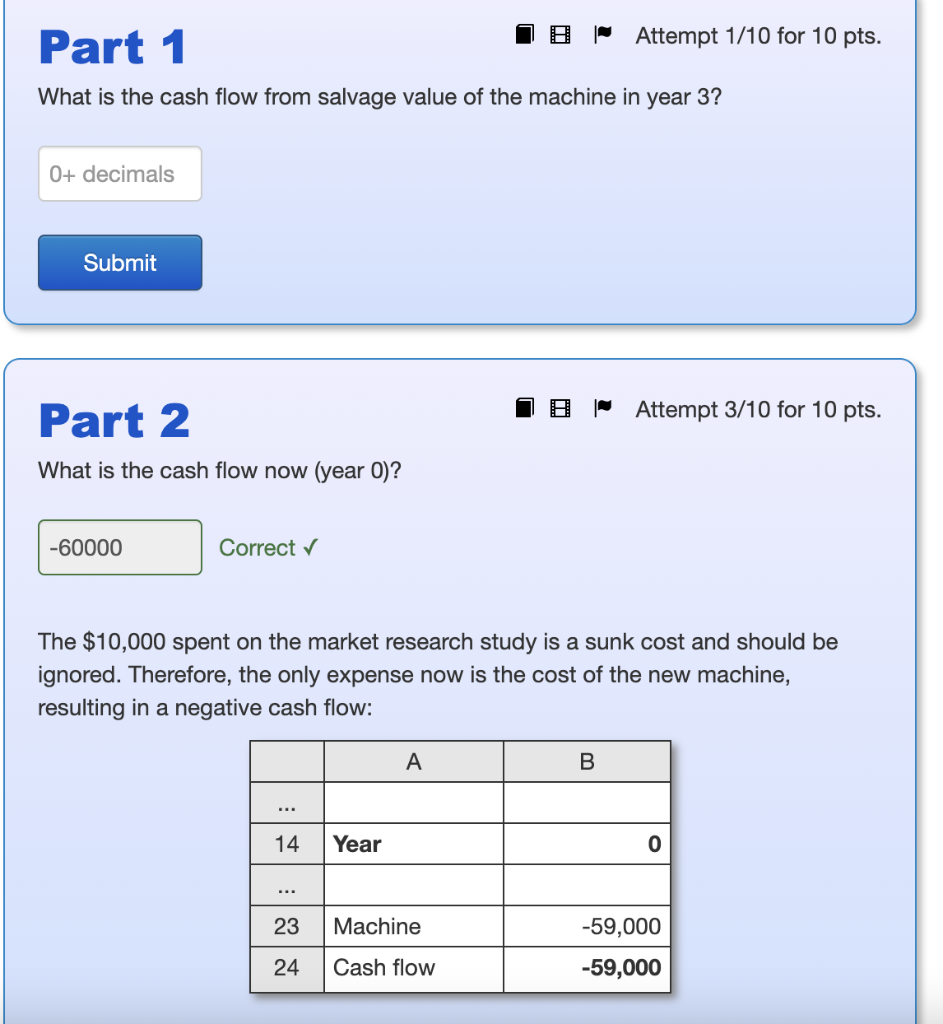

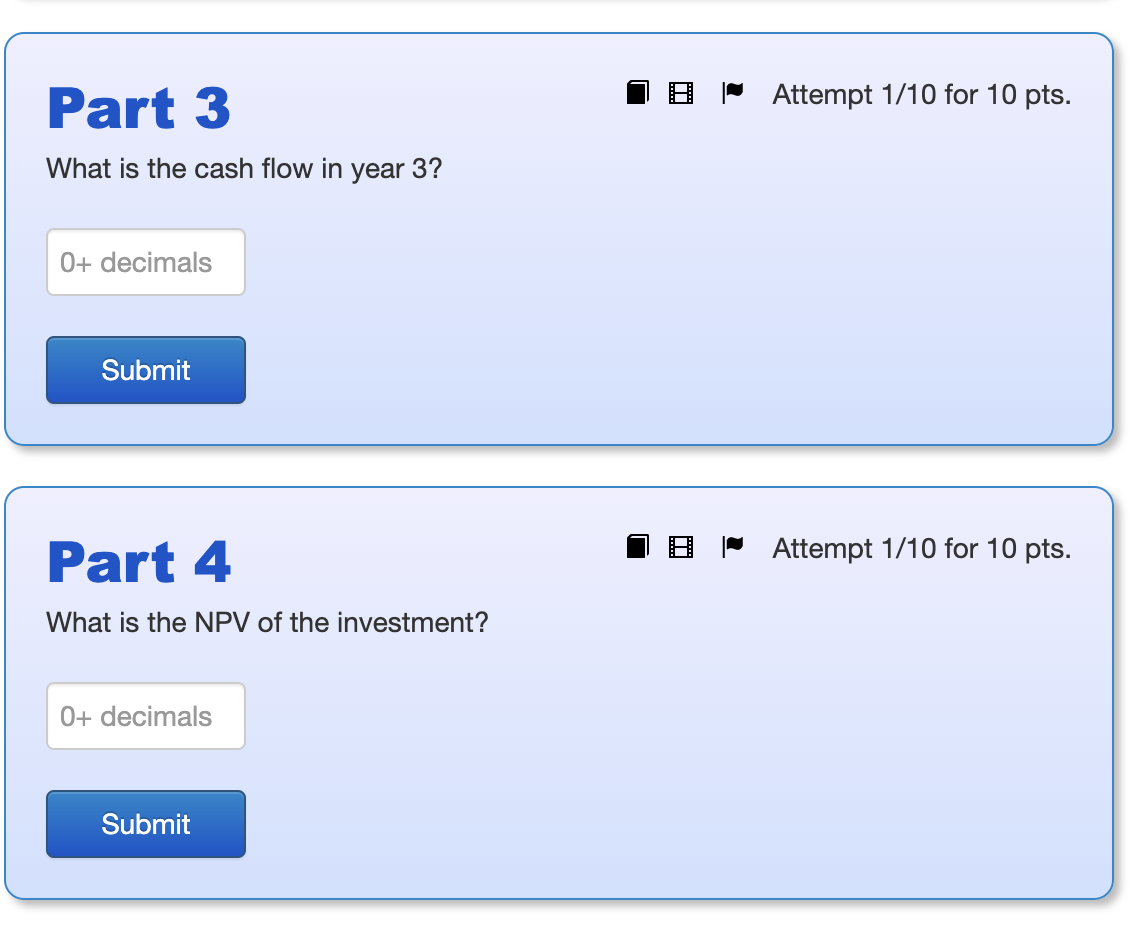

Intro Your company is considering a project to produce electric scooters. You've spent $10,000 already on a market research study that projects the following unit sales: A B. D E 1 Year 0 1 2 3 2 Units 0|1,200 1,320 1,452 After 3 years, the market will be saturated and you will shut down production. Each scooter is expectd to sell for $260 and will incur variable costs of $182 for labor and materials. In addition, you'll incur fixed costs of $62,400 every year. You will need a new machine to produce the scooters. If you buy the machine now (year 0), it will start producing scooters next year (year 1). The machine costs $59,000 to purchase. The machine can be depreciated straight-line to zero over 5 years and can probably be sold for $29,500 after 3 years. Your company has a weighted average cost of capital of 11% and a marginal tax rate of 21%. Part 1 | Attempt 1/10 for 10 pts. What is the cash flow from salvage value of the machine in year 3? 0+ decimals Submit | Attempt 3/10 for 10 pts. Part 2 What is the cash flow now (year 0)? -60000 Correct The $10,000 spent on the market research study is a sunk cost and should be ignored. Therefore, the only expense now is the cost of the new machine, resulting in a negative cash flow: A B 14 Year 0 23 Machine -59,000 -59,000 24 Cash flow Attempt 1/10 for 10 pts. Part 3 What is the cash flow in year 3? 0+ decimals Submit Attempt 1/10 for 10 pts. Part 4 What is the NPV of the investment? 0+ decimals Submit Intro Your company is considering a project to produce electric scooters. You've spent $10,000 already on a market research study that projects the following unit sales: A B. D E 1 Year 0 1 2 3 2 Units 0|1,200 1,320 1,452 After 3 years, the market will be saturated and you will shut down production. Each scooter is expectd to sell for $260 and will incur variable costs of $182 for labor and materials. In addition, you'll incur fixed costs of $62,400 every year. You will need a new machine to produce the scooters. If you buy the machine now (year 0), it will start producing scooters next year (year 1). The machine costs $59,000 to purchase. The machine can be depreciated straight-line to zero over 5 years and can probably be sold for $29,500 after 3 years. Your company has a weighted average cost of capital of 11% and a marginal tax rate of 21%. Part 1 | Attempt 1/10 for 10 pts. What is the cash flow from salvage value of the machine in year 3? 0+ decimals Submit | Attempt 3/10 for 10 pts. Part 2 What is the cash flow now (year 0)? -60000 Correct The $10,000 spent on the market research study is a sunk cost and should be ignored. Therefore, the only expense now is the cost of the new machine, resulting in a negative cash flow: A B 14 Year 0 23 Machine -59,000 -59,000 24 Cash flow Attempt 1/10 for 10 pts. Part 3 What is the cash flow in year 3? 0+ decimals Submit Attempt 1/10 for 10 pts. Part 4 What is the NPV of the investment? 0+ decimals Submit