Answered step by step

Verified Expert Solution

Question

1 Approved Answer

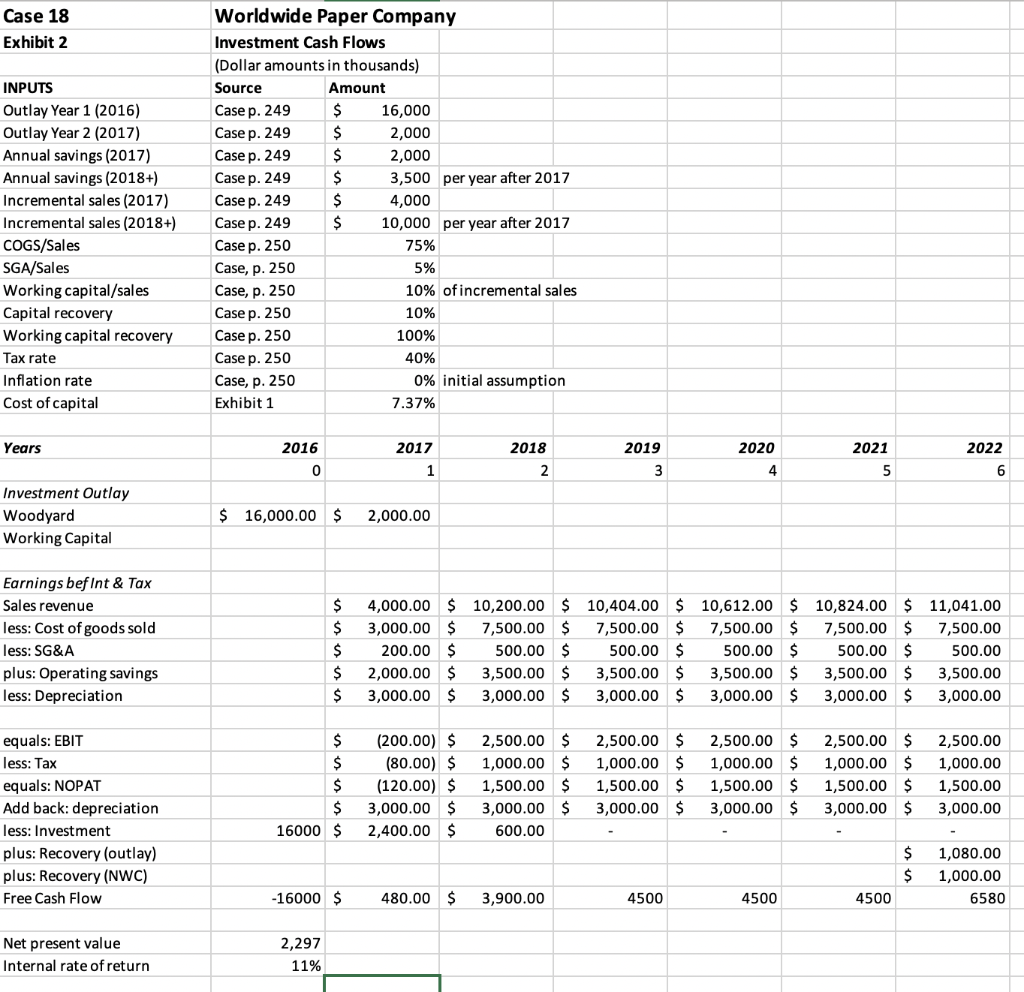

Introduce a small amount of inflation into the model and raise the cost of goods/sales ratio to 80%, on the assumption that the cost of

Introduce a small amount of inflation into the model and raise the cost of goods/sales ratio to 80%, on the assumption that the cost of inputs will be affected relatively more (i.e., the firm will be unable to pass on 100% of the price increase to its buyers). How will this affect the investment decision?

Case 18 Exhibit 2 INPUTS Outlay Year 1 (2016) Outlay Year 2 (2017) Annual savings (2017) Annual savings (2018+) Incremental sales (2017) Incremental sales (2018+) COGS/Sales SGA/Sales Working capital/sales Capital recovery Working capital recovery Tax rate Inflation rate Cost of capital Worldwide Paper Company Investment Cash Flows (Dollar amounts in thousands) Source Amount Case p. 249 $ 16,000 Case p. 249 $ 2,000 Case p. 249 $ 2,000 Case p. 249 $ 3,500 per year after 2017 Case p. 249 $ 4,000 Case p. 249 $ 10,000 per year after 2017 Casep. 250 75% Case, p. 250 5% Case, p. 250 10% of incremental sales Case p. 250 10% Case p. 250 100% Case p. 250 40% Case, p. 250 0% initial assumption Exhibit 1 7.37% Years 2017 2016 0 2018 2 2019 3 2020 4 2021 5 2022 6 1 Investment Outlay Woodyard Working Capital $ 16,000.00 $ 2,000.00 Earnings befint & Tax Sales revenue less: Cost of goods sold less: SG&A plus: Operating savings less: Depreciation $ $ $ 4,000.00 $ 10,200.00 $ 10,404.00 $ 10,612.00 $ 10,824.00 $ 11,041.00 3,000.00 $ 7,500.00 $ 7,500.00 $ 7,500.00 $ 7,500.00 $ 7,500.00 200.00 $ 500.00 $ 500.00 $ 500.00 $ 500.00 $ 500.00 2,000.00 $ 3,500.00 $ 3,500.00 $ 3,500.00 $ 3,500.00 $ 3,500.00 3,000.00 $ 3,000.00 $ 3,000.00 $ 3,000.00 $ 3,000.00 $ 3,000.00 $ $ $ $ $ $ 16000 $ (200.00) $ (80.00) $ (120.00) $ 3,000.00 $ 2,400.00 $ 2,500.00 $ 1,000.00 $ 1,500.00 $ 3,000.00 $ 600.00 2,500.00 $ 1,000.00 $ 1,500.00 $ 3,000.00 $ equals: EBIT less: Tax equals: NOPAT Add back: depreciation less: Investment plus: Recovery (outlay) plus: Recovery (NWC) Free Cash Flow 2,500.00 $ 1,000.00 $ 1,500.00 $ 3,000.00 $ 2,500.00 $ 1,000.00 $ 1,500.00 $ 3,000.00 $ 2,500.00 1,000.00 1,500.00 3,000.00 $ $ 1,080.00 1,000.00 6580 -16000 $ 480.00 $ 3,900.00 4500 4500 4500 Net present value Internal rate of return 2,297 11% Case 18 Exhibit 2 INPUTS Outlay Year 1 (2016) Outlay Year 2 (2017) Annual savings (2017) Annual savings (2018+) Incremental sales (2017) Incremental sales (2018+) COGS/Sales SGA/Sales Working capital/sales Capital recovery Working capital recovery Tax rate Inflation rate Cost of capital Worldwide Paper Company Investment Cash Flows (Dollar amounts in thousands) Source Amount Case p. 249 $ 16,000 Case p. 249 $ 2,000 Case p. 249 $ 2,000 Case p. 249 $ 3,500 per year after 2017 Case p. 249 $ 4,000 Case p. 249 $ 10,000 per year after 2017 Casep. 250 75% Case, p. 250 5% Case, p. 250 10% of incremental sales Case p. 250 10% Case p. 250 100% Case p. 250 40% Case, p. 250 0% initial assumption Exhibit 1 7.37% Years 2017 2016 0 2018 2 2019 3 2020 4 2021 5 2022 6 1 Investment Outlay Woodyard Working Capital $ 16,000.00 $ 2,000.00 Earnings befint & Tax Sales revenue less: Cost of goods sold less: SG&A plus: Operating savings less: Depreciation $ $ $ 4,000.00 $ 10,200.00 $ 10,404.00 $ 10,612.00 $ 10,824.00 $ 11,041.00 3,000.00 $ 7,500.00 $ 7,500.00 $ 7,500.00 $ 7,500.00 $ 7,500.00 200.00 $ 500.00 $ 500.00 $ 500.00 $ 500.00 $ 500.00 2,000.00 $ 3,500.00 $ 3,500.00 $ 3,500.00 $ 3,500.00 $ 3,500.00 3,000.00 $ 3,000.00 $ 3,000.00 $ 3,000.00 $ 3,000.00 $ 3,000.00 $ $ $ $ $ $ 16000 $ (200.00) $ (80.00) $ (120.00) $ 3,000.00 $ 2,400.00 $ 2,500.00 $ 1,000.00 $ 1,500.00 $ 3,000.00 $ 600.00 2,500.00 $ 1,000.00 $ 1,500.00 $ 3,000.00 $ equals: EBIT less: Tax equals: NOPAT Add back: depreciation less: Investment plus: Recovery (outlay) plus: Recovery (NWC) Free Cash Flow 2,500.00 $ 1,000.00 $ 1,500.00 $ 3,000.00 $ 2,500.00 $ 1,000.00 $ 1,500.00 $ 3,000.00 $ 2,500.00 1,000.00 1,500.00 3,000.00 $ $ 1,080.00 1,000.00 6580 -16000 $ 480.00 $ 3,900.00 4500 4500 4500 Net present value Internal rate of return 2,297 11%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started