Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Introduction A life annuity is a financial product that you buy from a life insurance company. It pays a you a fixed amound of money

Introduction

A life annuity is a financial product that you buy from a life insurance company.

It pays a you a fixed amound of money for as long as you live.

This protects you from outliving your money.

Of course, the insurance company needs to make money, so they will price this financial product accordingly.

To find the value of the annuity, the insurance company considers your probability of survival.

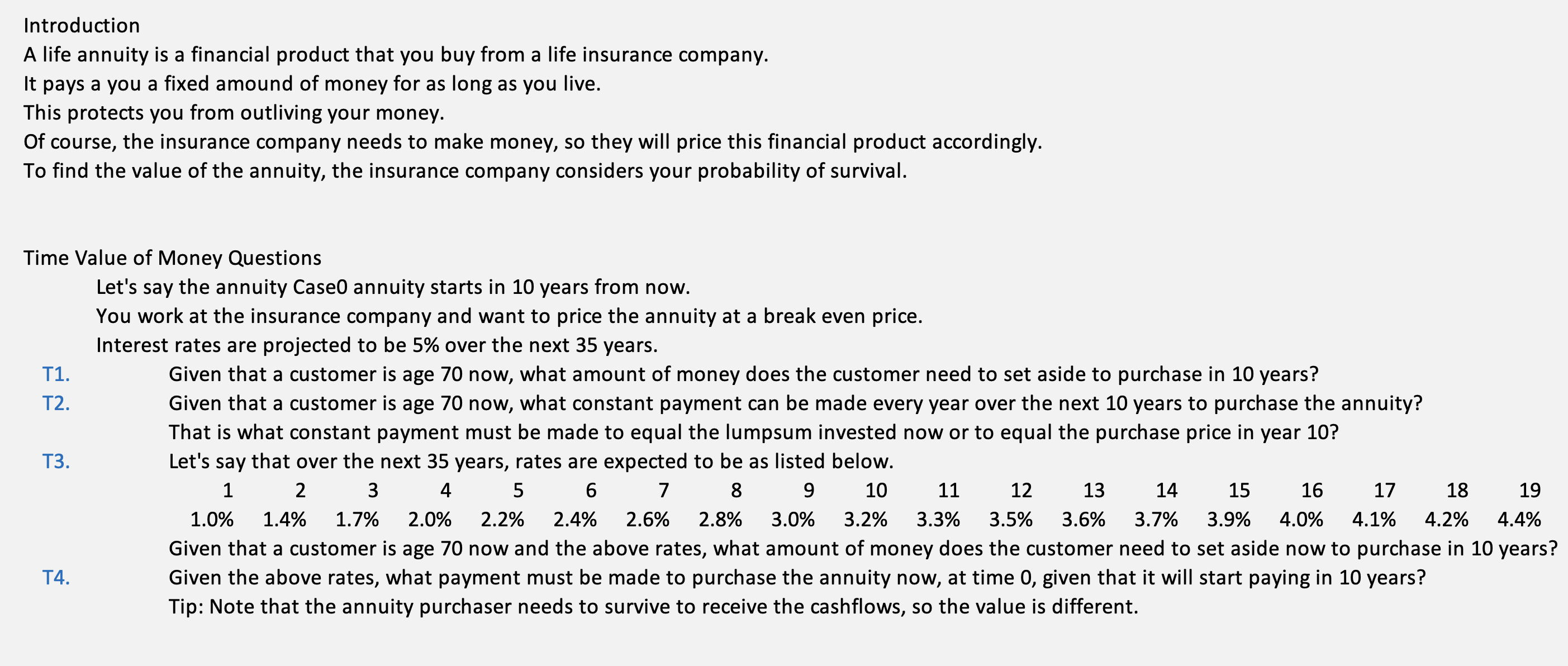

Time Value of Money Questions

Let's say the annuity Case annuity starts in years from now.

You work at the insurance company and want to price the annuity at a break even price.

Interest rates are projected to be over the next years.

T Given that a customer is age now, what amount of money does the customer need to set aside to purchase in years?

T Given that a customer is age now, what constant payment can be made every year over the next years to purchase the annuity?

That is what constant payment must be made to equal the lumpsum invested now or to equal the purchase price in year

T Let's say that over the next years, rates are expected to be as listed below.

Given that a customer is age now and the above rates, what amount of money does the customer need to set aside now to purchase in years?

T Given the above rates, what payment must be made to purchase the annuity now, at time given that it will start paying in years?

Tip: Note that the annuity purchaser needs to survive to receive the cashflows, so the value is different.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started