Answered step by step

Verified Expert Solution

Question

1 Approved Answer

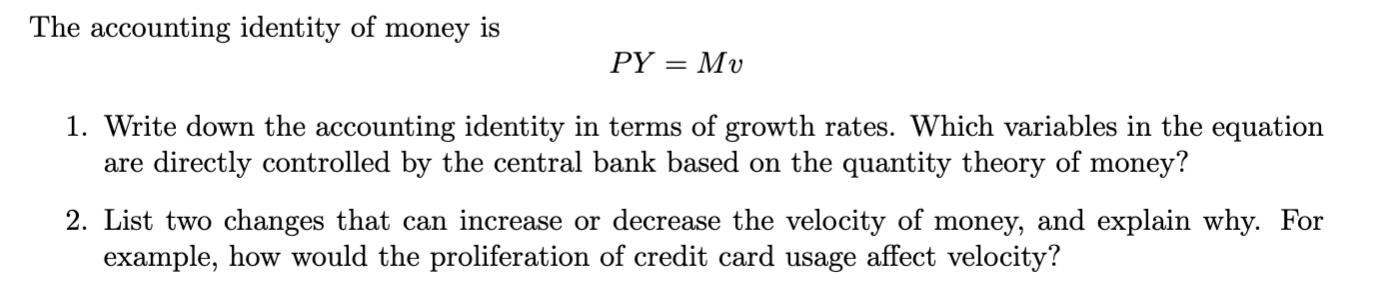

The accounting identity of money is PY = Mv 1. Write down the accounting identity in terms of growth rates. Which variables in the

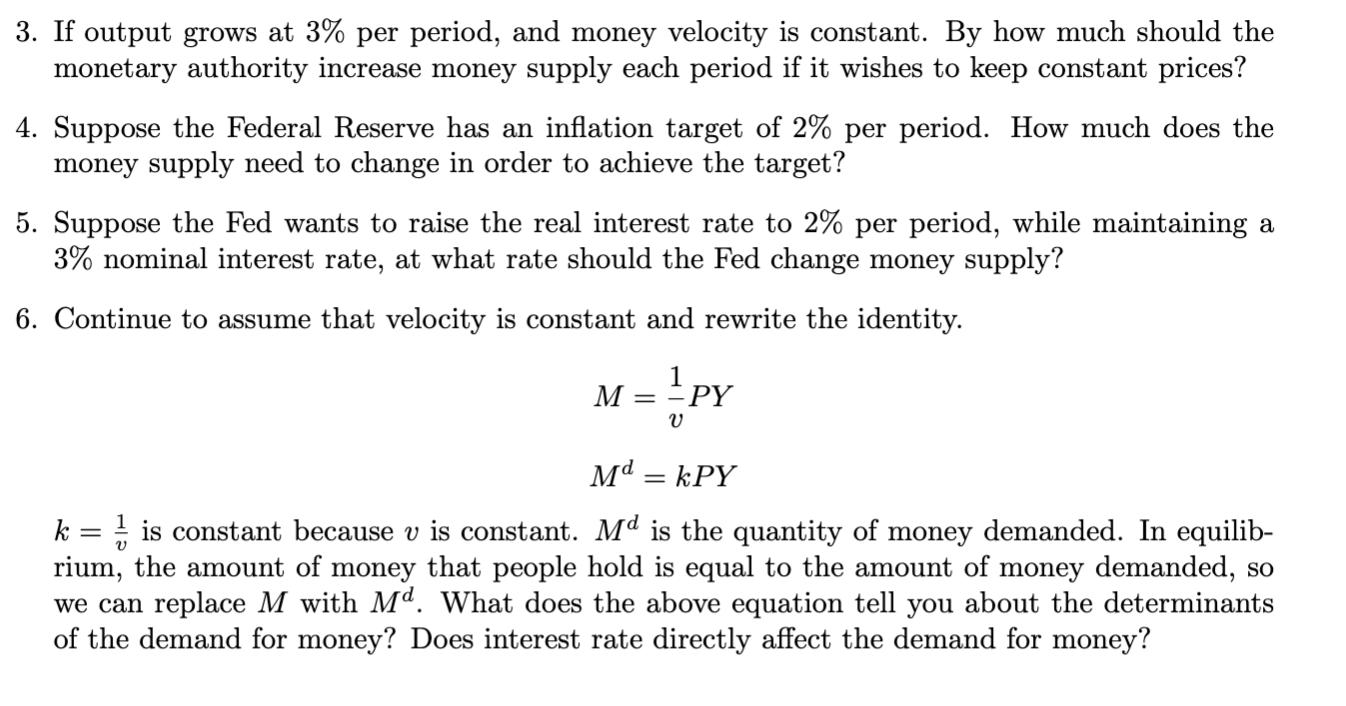

The accounting identity of money is PY = Mv 1. Write down the accounting identity in terms of growth rates. Which variables in the equation are directly controlled by the central bank based on the quantity theory of money? 2. List two changes that can increase or decrease the velocity of money, and explain why. For example, how would the proliferation of credit card usage affect velocity? 3. If output grows at 3% per period, and money velocity is constant. By how much should the monetary authority increase money supply each period if it wishes to keep constant prices? 4. Suppose the Federal Reserve has an inflation target of 2% per period. How much does the money supply need to change in order to achieve the target? 5. Suppose the Fed wants to raise the real interest rate to 2% per period, while maintaining a 3% nominal interest rate, at what rate should the Fed change money supply? 6. Continue to assume that velocity is constant and rewrite the identity. M PY = V Md = kPY V k = is constant because v is constant. M is the quantity of money demanded. In equilib- rium, the amount of money that people hold is equal to the amount of money demanded, so we can replace M with Md. What does the above equation tell you about the determinants of the demand for money? Does interest rate directly affect the demand for money?

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 PY Mv PY MPv PY MV PY MPVV PY MP1g PY MV1g PY MVM1g PY V1g The central bank controls the money supply M 2 An increase in the number of transactions would increase the velocity of money This could be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started