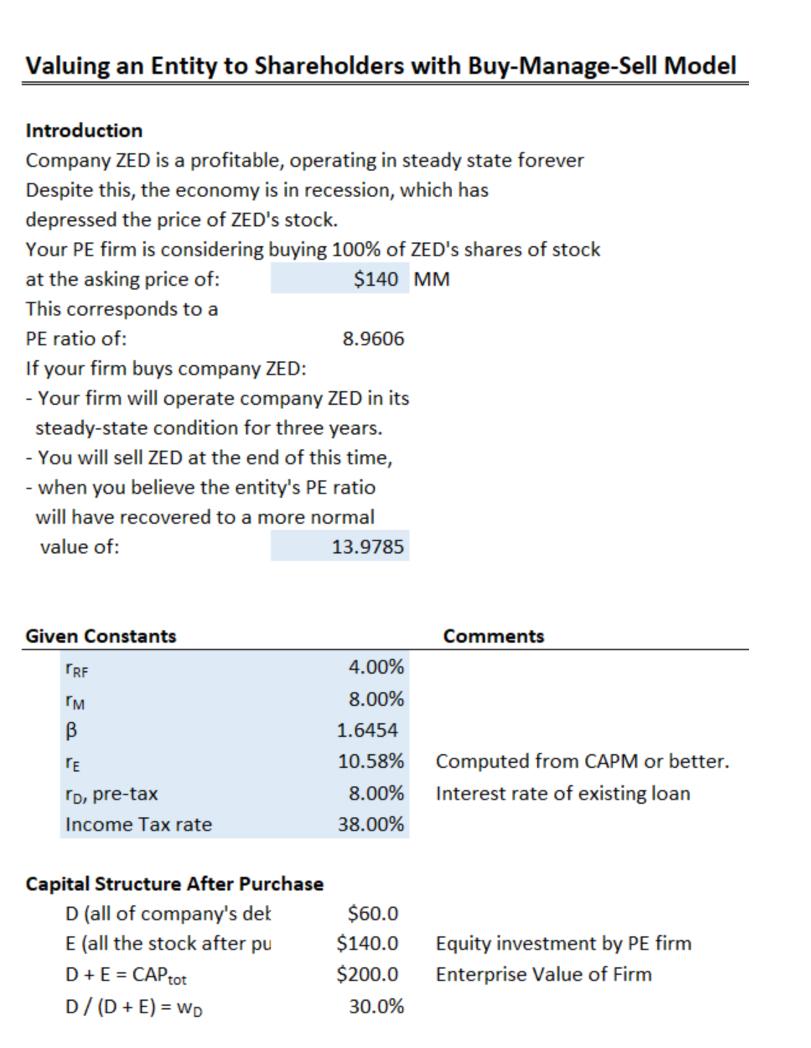

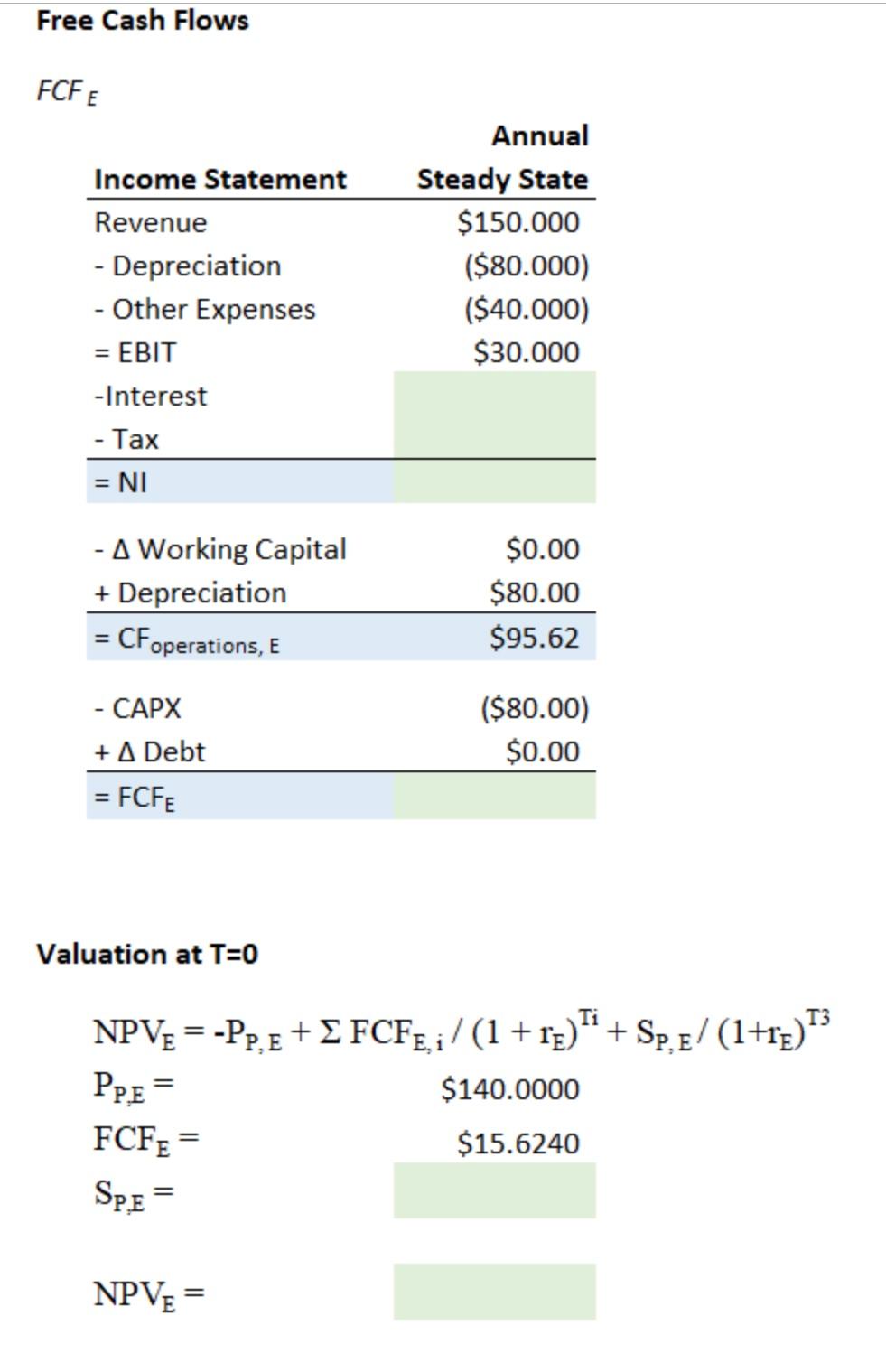

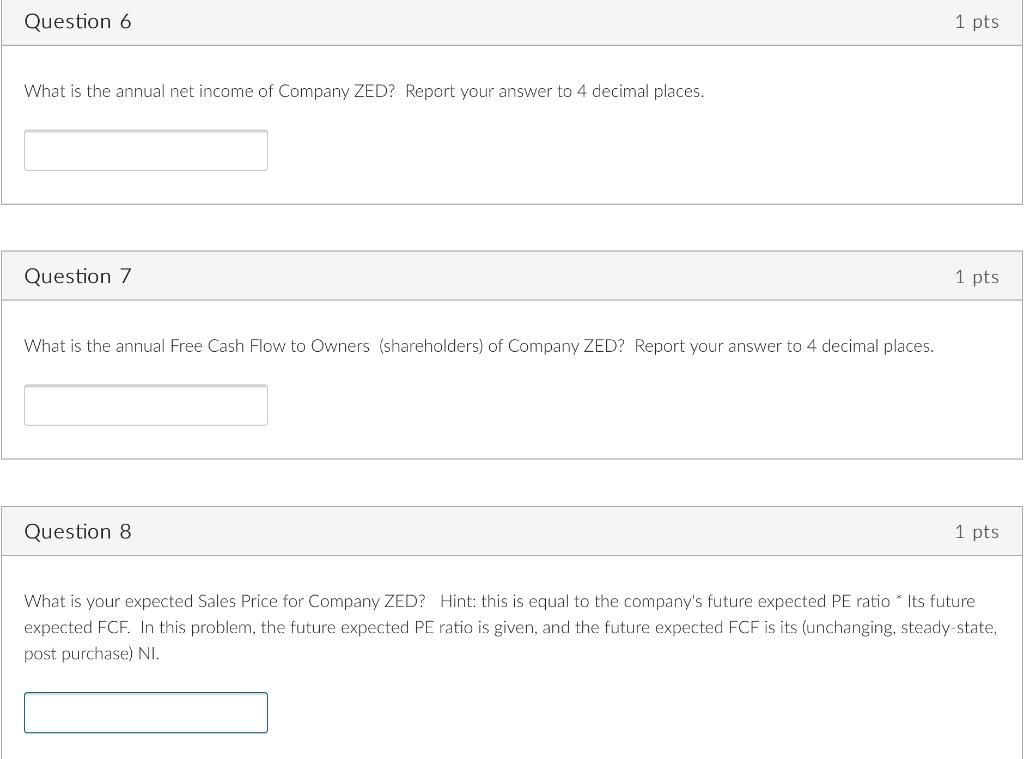

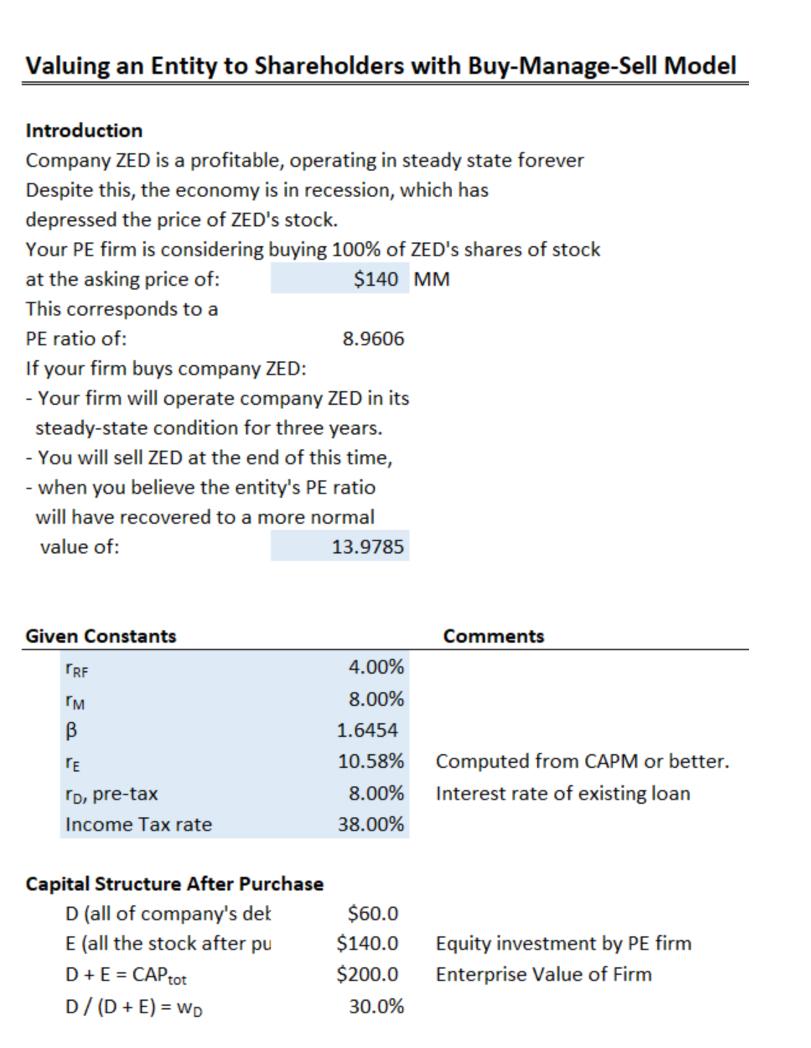

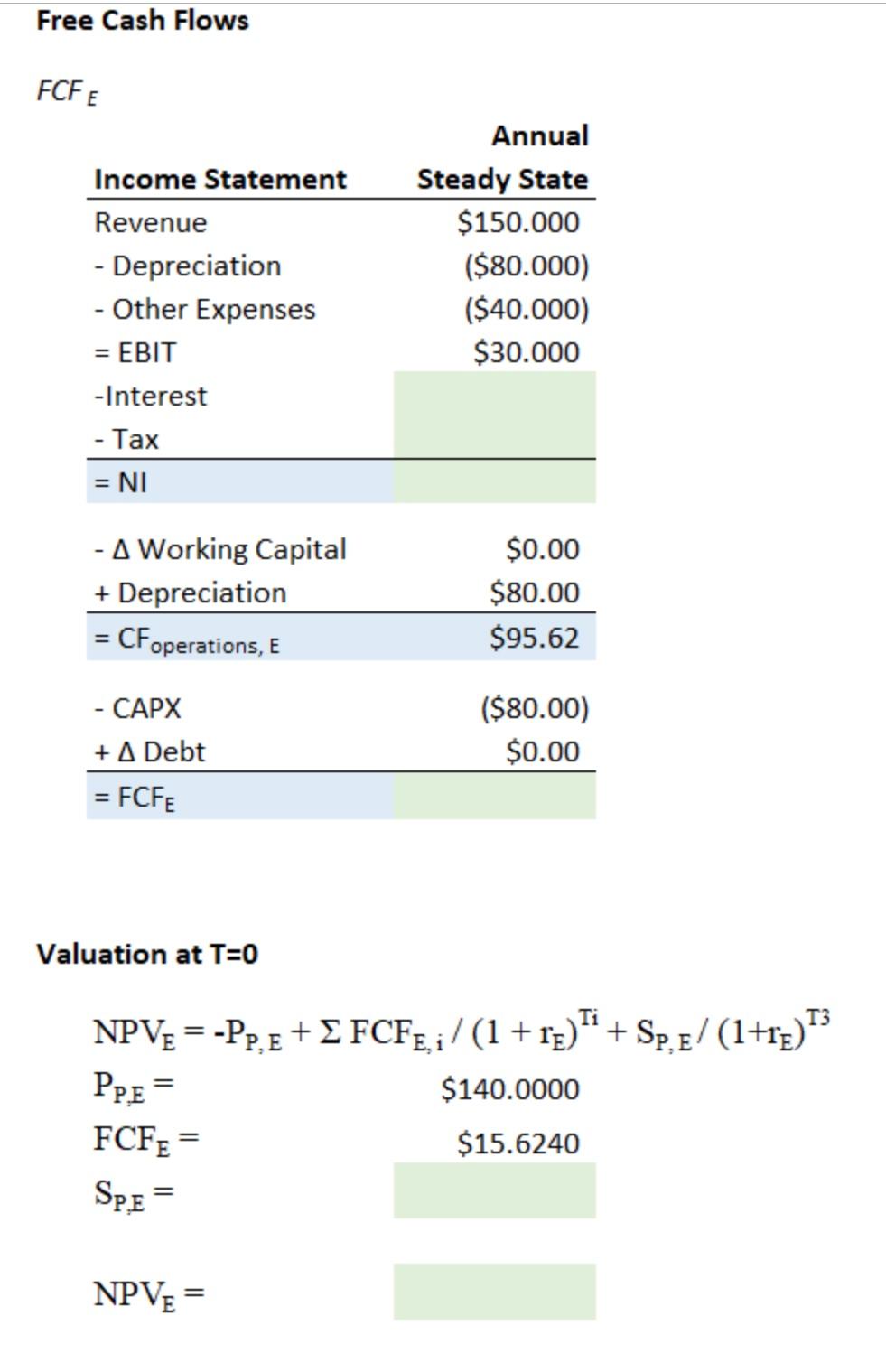

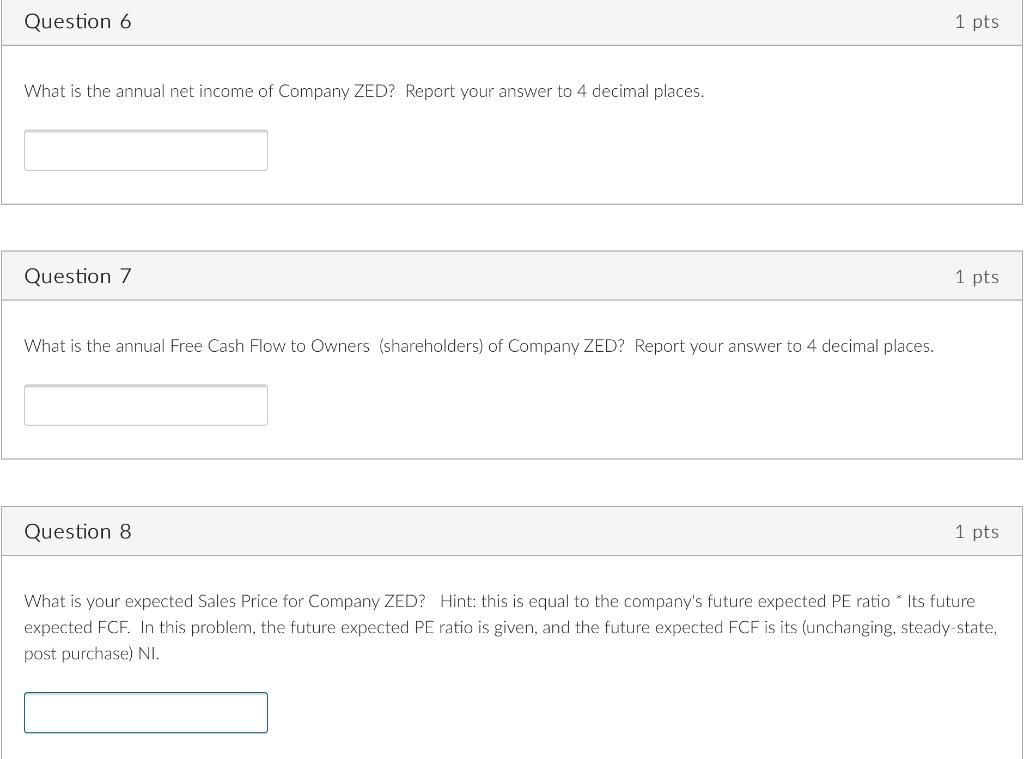

Introduction Company ZED is a profitable, operating in steady state forever Despite this, the economy is in recession, which has depressed the price of ZED's stock. Your PE firm is considering buying 100% of ZED's shares of stock at the asking price of: MM This corresponds to a PE ratio of: 8.9606 If your firm buys company ZED: - Your firm will operate company ZED in its steady-state condition for three years. - You will sell ZED at the end of this time, - when you believe the entity's PE ratio will have recovered to a more normal value of: Valuation at T=0 NPVE=PP,E+FCFE,i/(1+rE)Ti+SP,E/(1+rE)T3 What is the annual net income of Company ZED? Report your answer to 4 decimal places. Question 7 1 pts What is the annual Free Cash Flow to Owners (shareholders) of Company ZED? Report your answer to 4 decimal places. Question 8 1 pts What is your expected Sales Price for Company ZED? Hint: this is equal to the company's future expected PE ratio * Its future expected FCF. In this problem, the future expected PE ratio is given, and the future expected FCF is its (unchanging, steady-state, post purchase) NI. Introduction Company ZED is a profitable, operating in steady state forever Despite this, the economy is in recession, which has depressed the price of ZED's stock. Your PE firm is considering buying 100% of ZED's shares of stock at the asking price of: MM This corresponds to a PE ratio of: 8.9606 If your firm buys company ZED: - Your firm will operate company ZED in its steady-state condition for three years. - You will sell ZED at the end of this time, - when you believe the entity's PE ratio will have recovered to a more normal value of: Valuation at T=0 NPVE=PP,E+FCFE,i/(1+rE)Ti+SP,E/(1+rE)T3 What is the annual net income of Company ZED? Report your answer to 4 decimal places. Question 7 1 pts What is the annual Free Cash Flow to Owners (shareholders) of Company ZED? Report your answer to 4 decimal places. Question 8 1 pts What is your expected Sales Price for Company ZED? Hint: this is equal to the company's future expected PE ratio * Its future expected FCF. In this problem, the future expected PE ratio is given, and the future expected FCF is its (unchanging, steady-state, post purchase) NI