Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Introduction Following several years of declining revenues and profits, in late 2011 Sears Holding Inc. (Sears) began to hive off its business divisions. As part

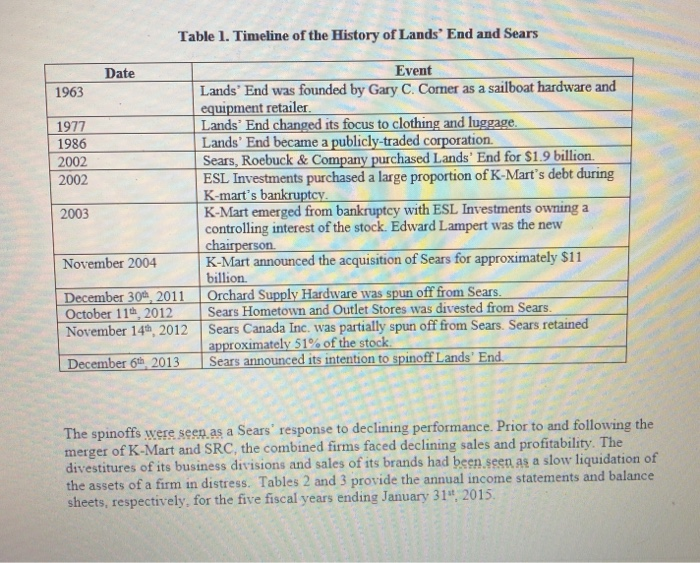

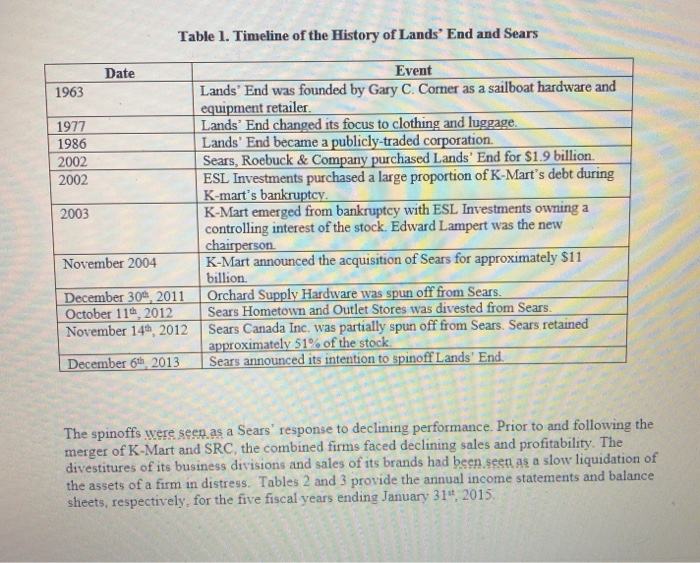

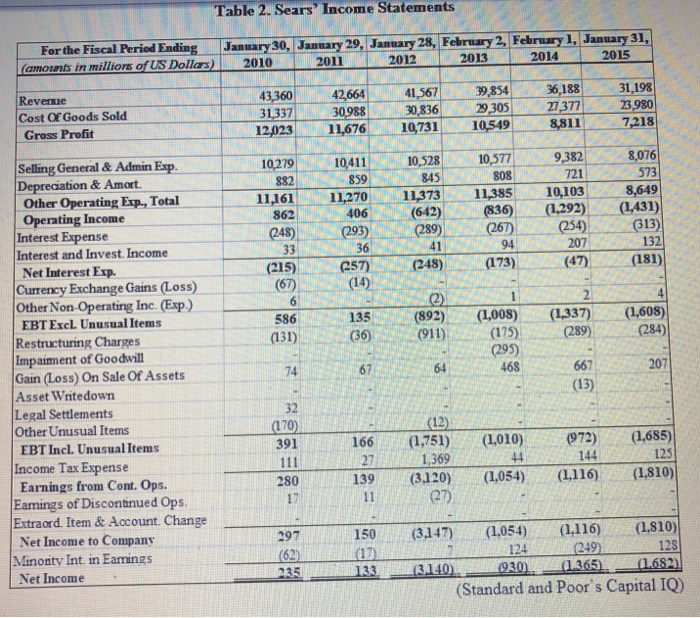

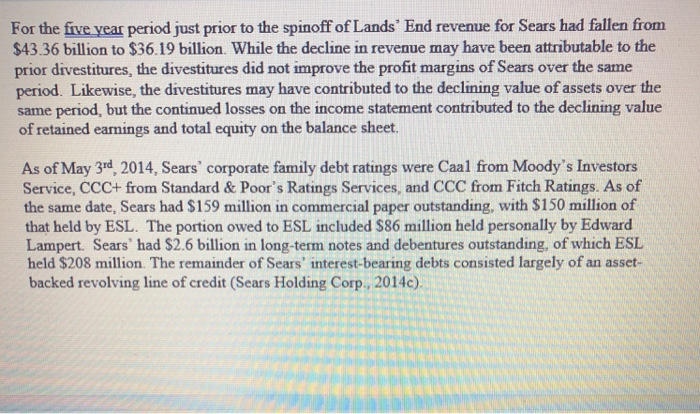

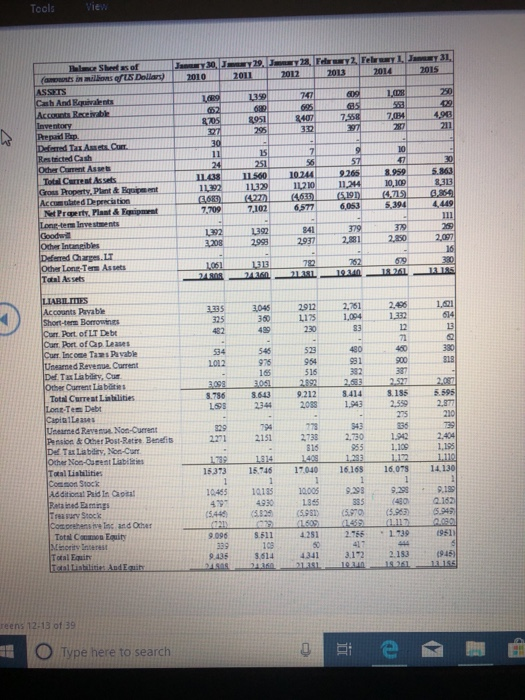

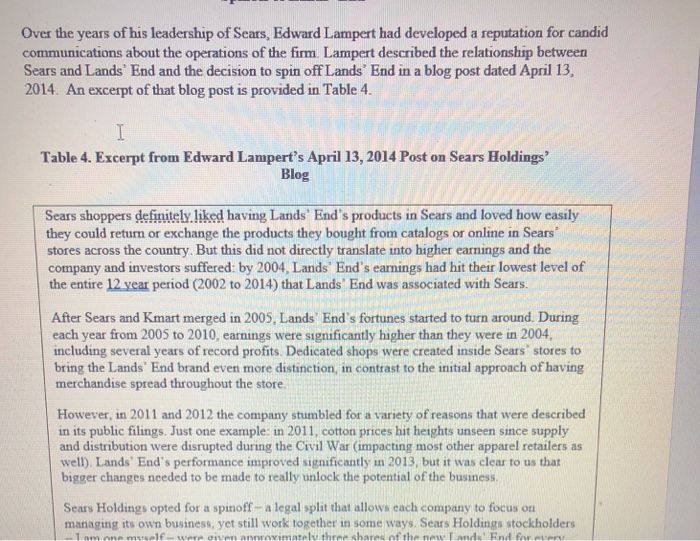

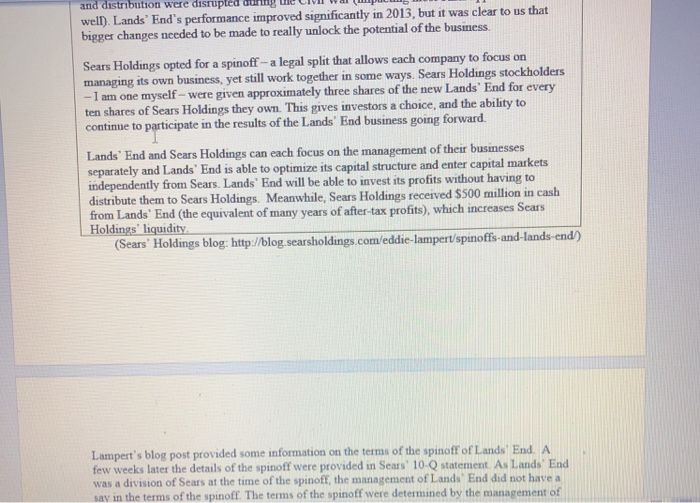

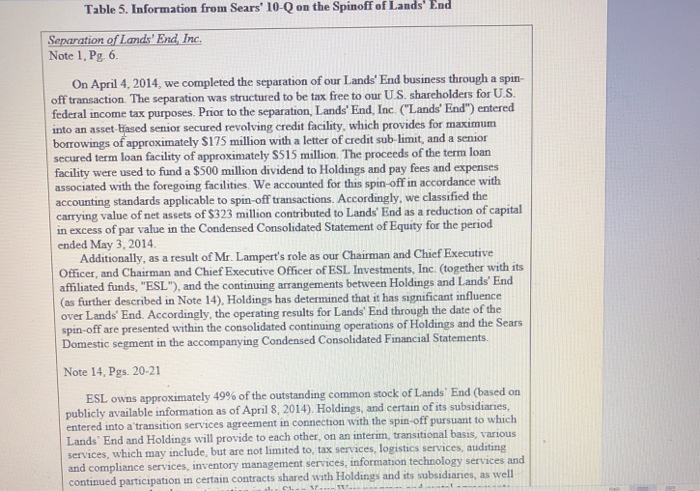

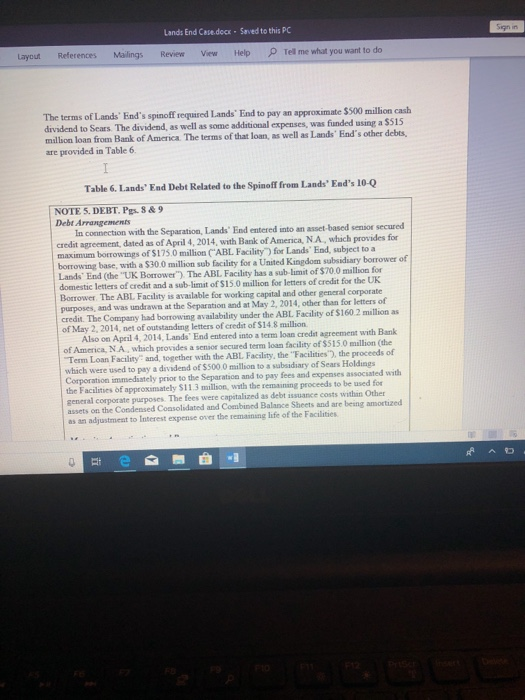

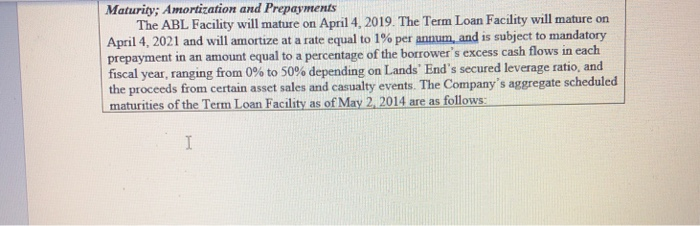

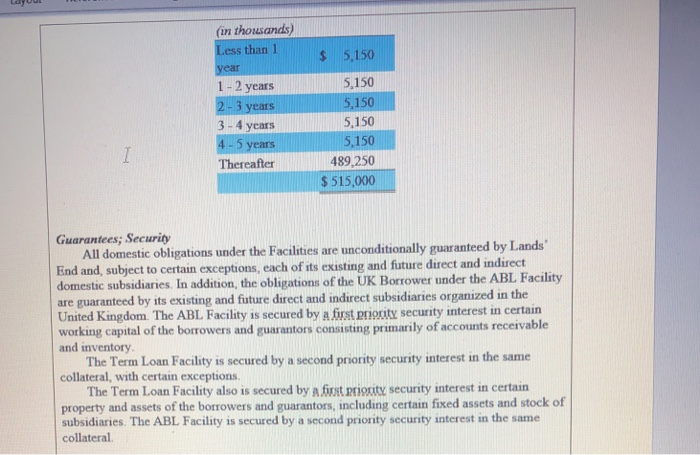

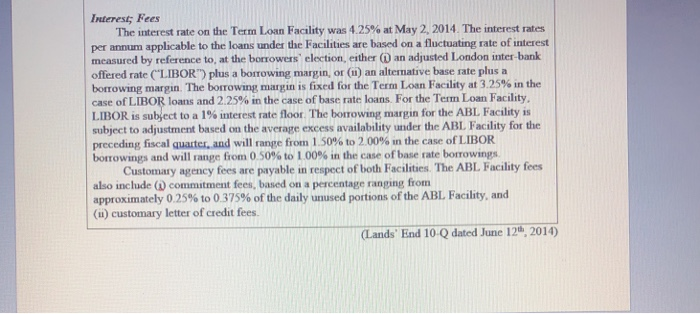

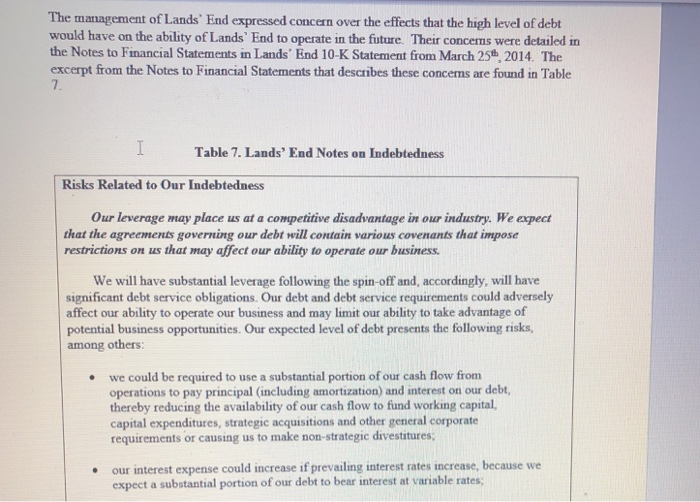

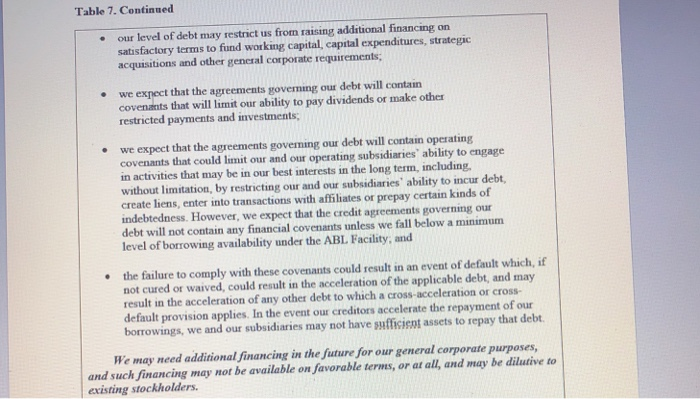

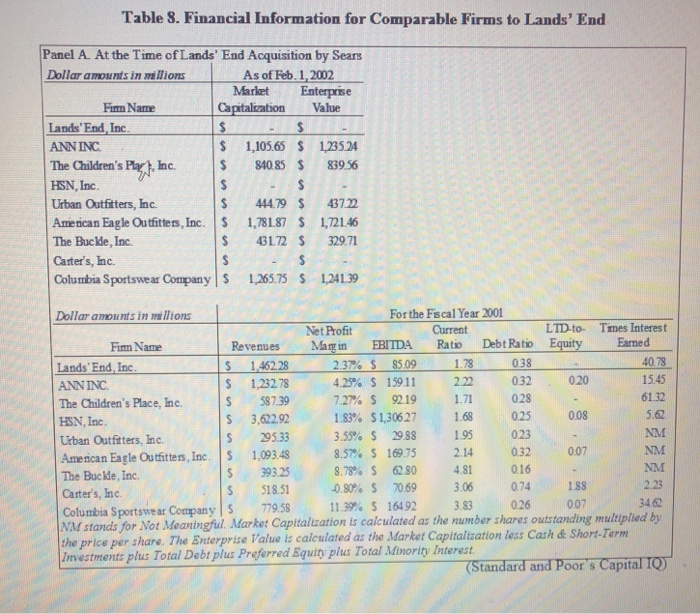

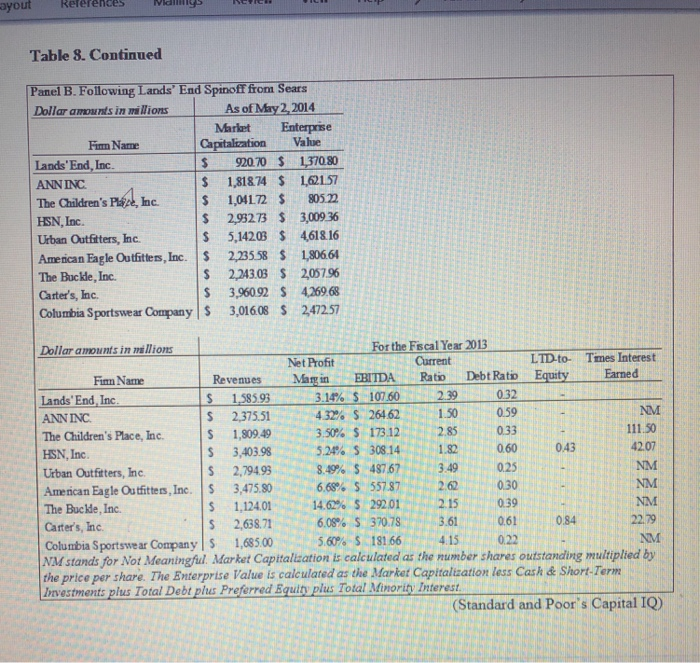

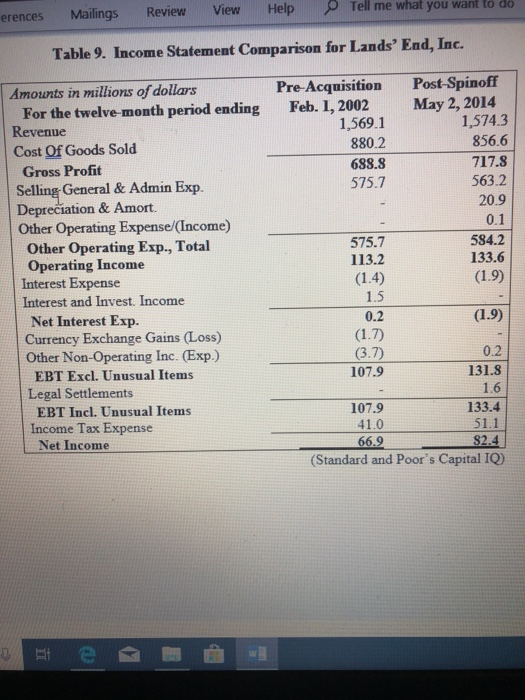

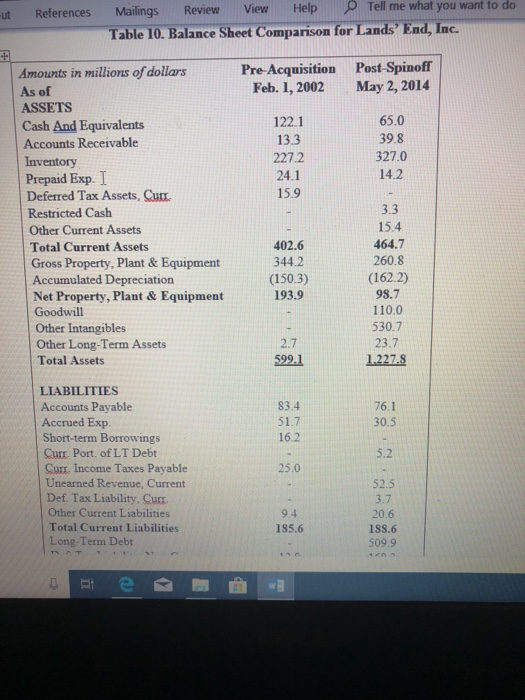

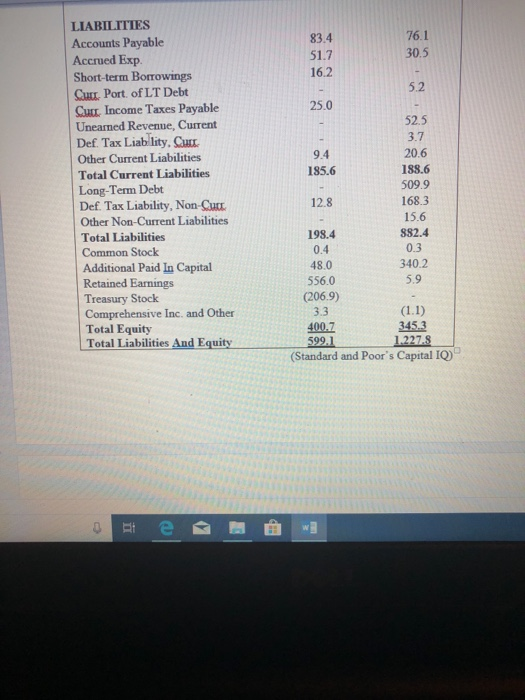

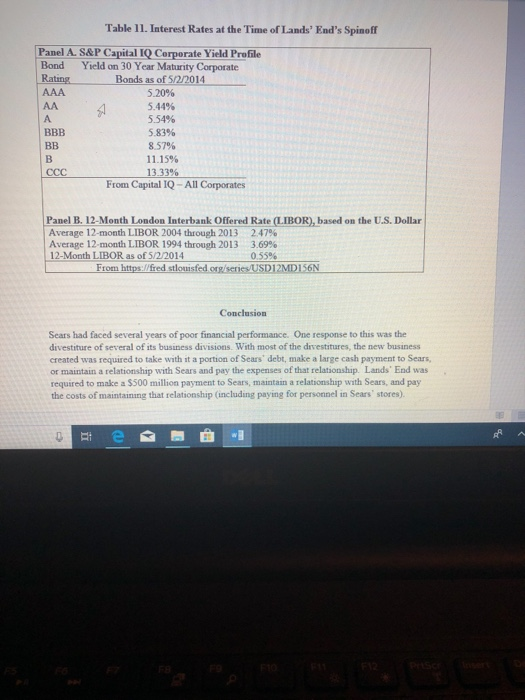

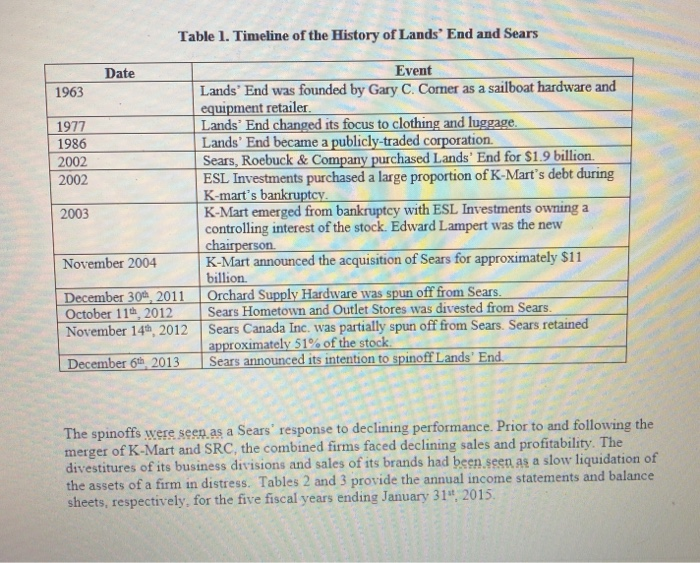

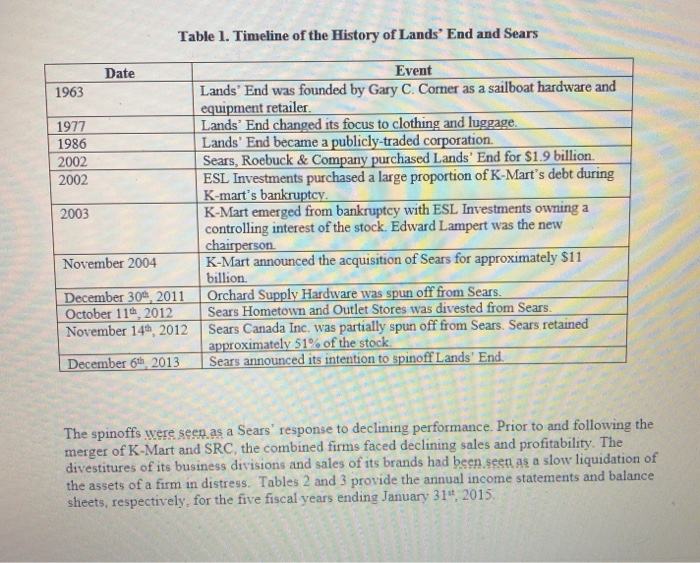

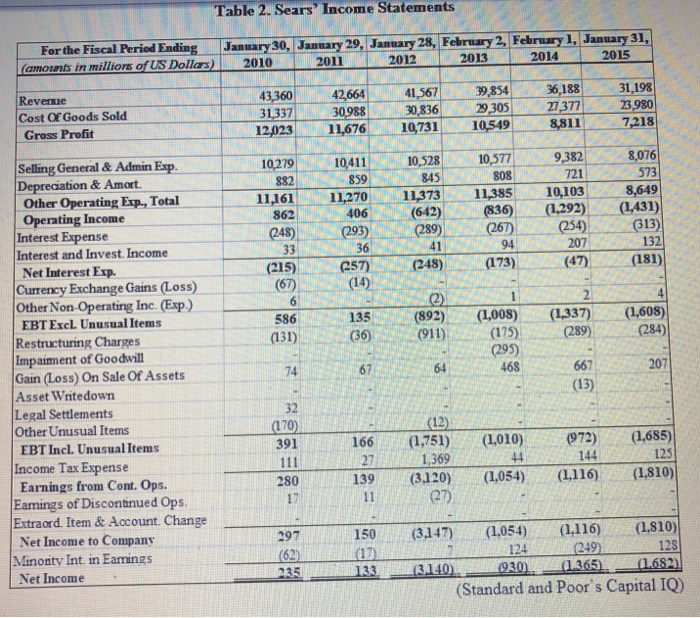

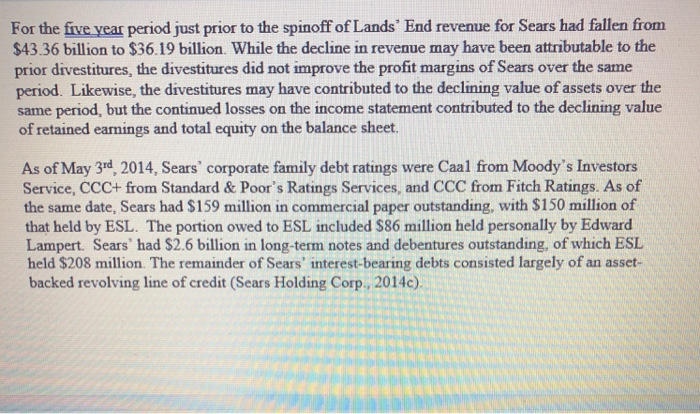

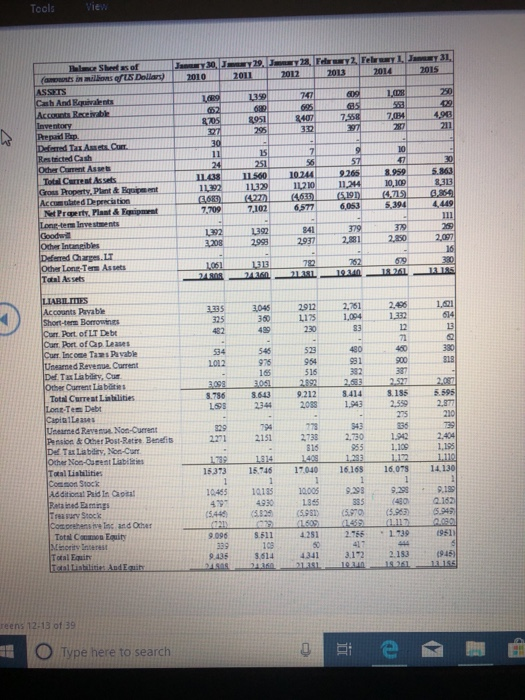

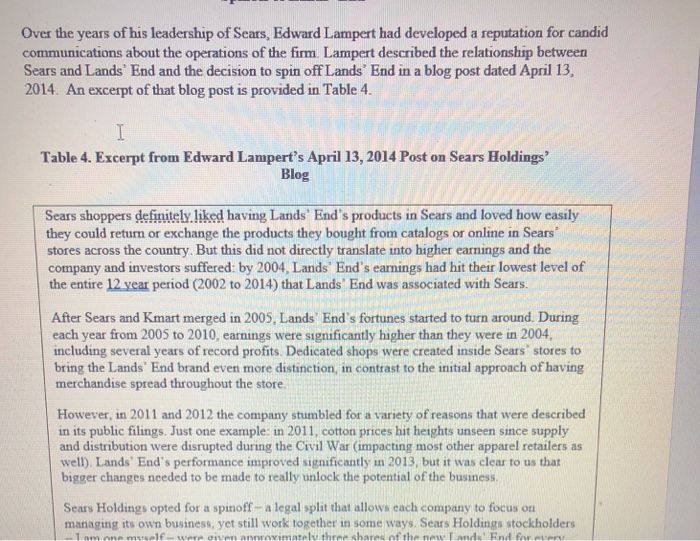

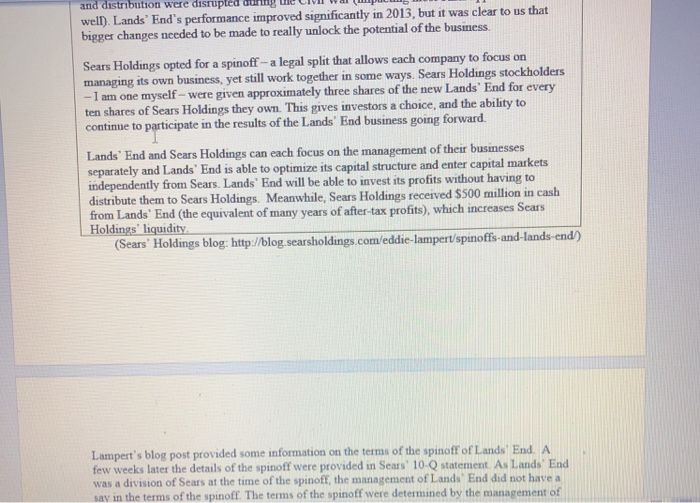

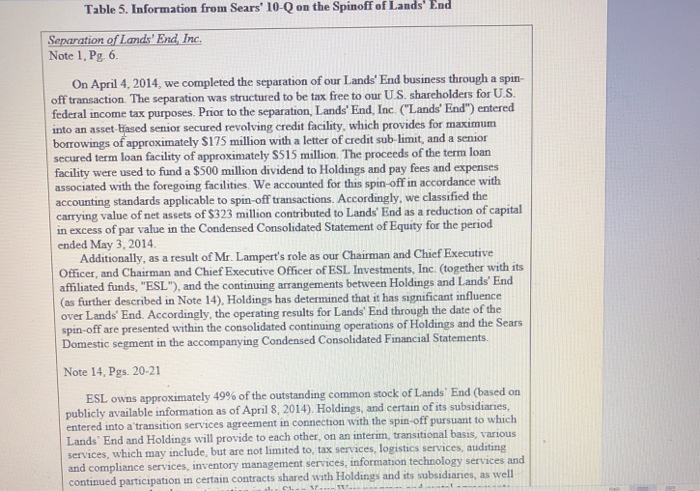

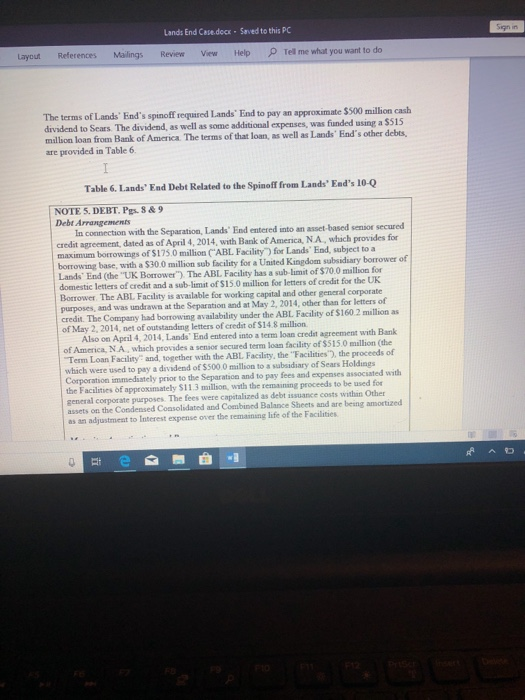

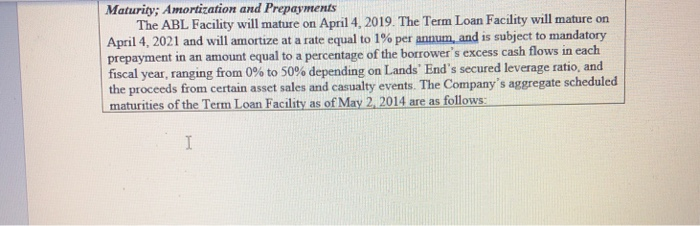

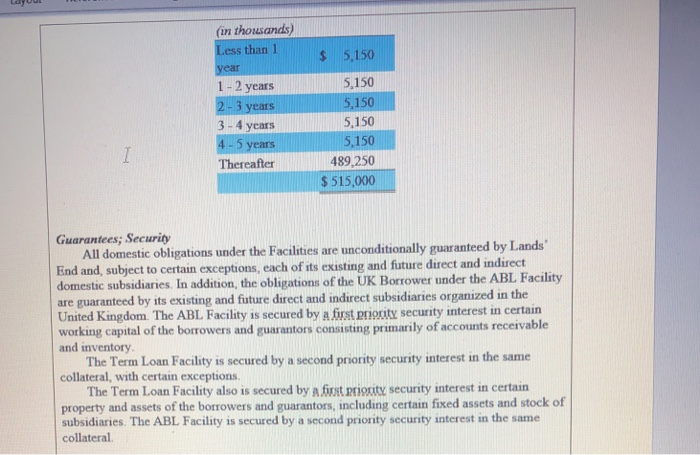

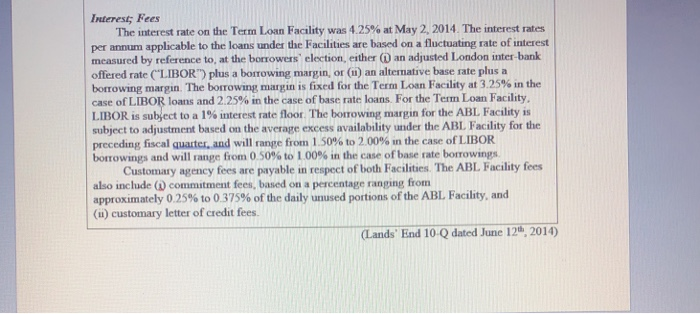

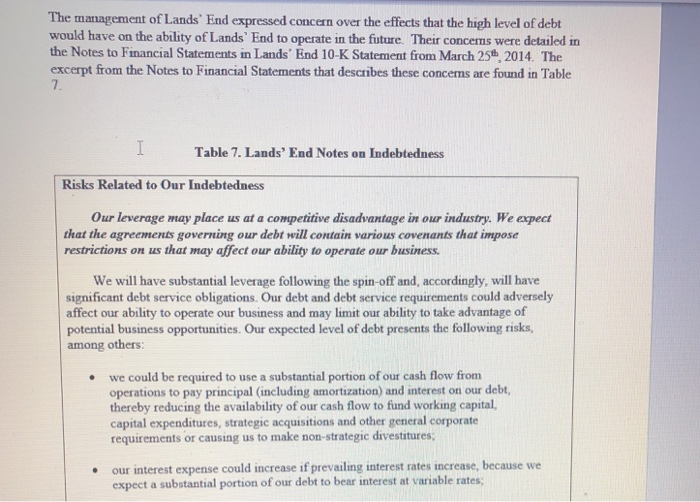

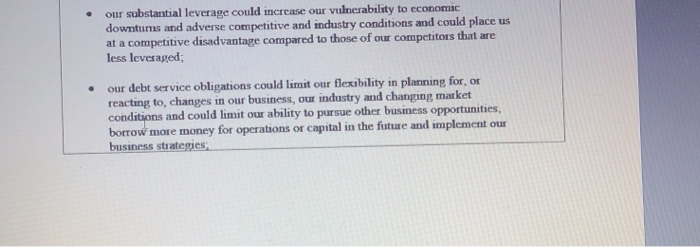

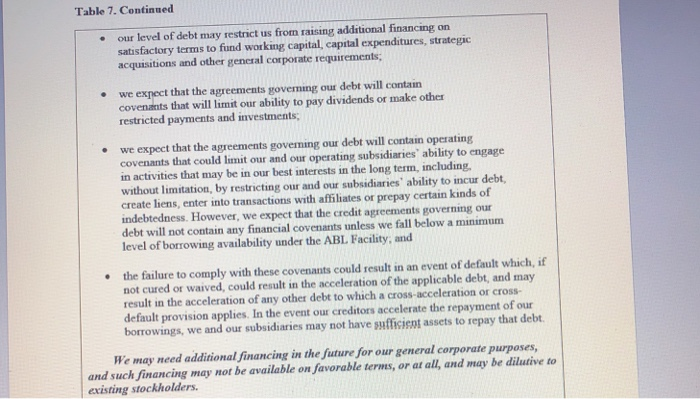

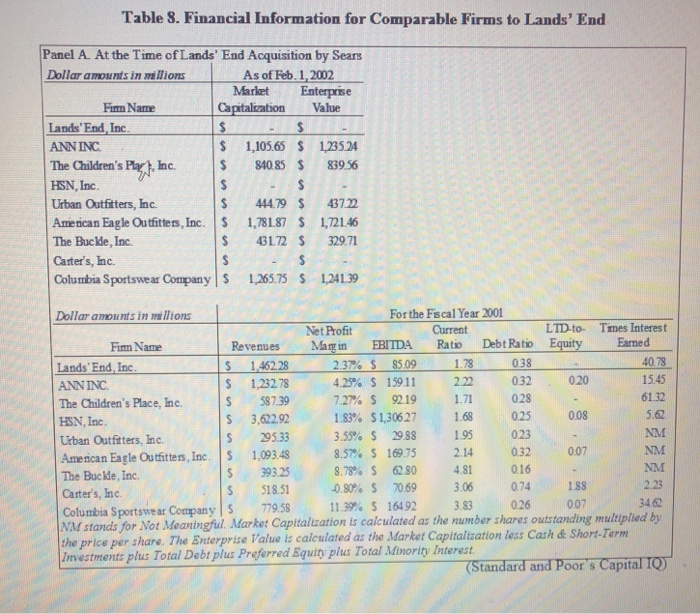

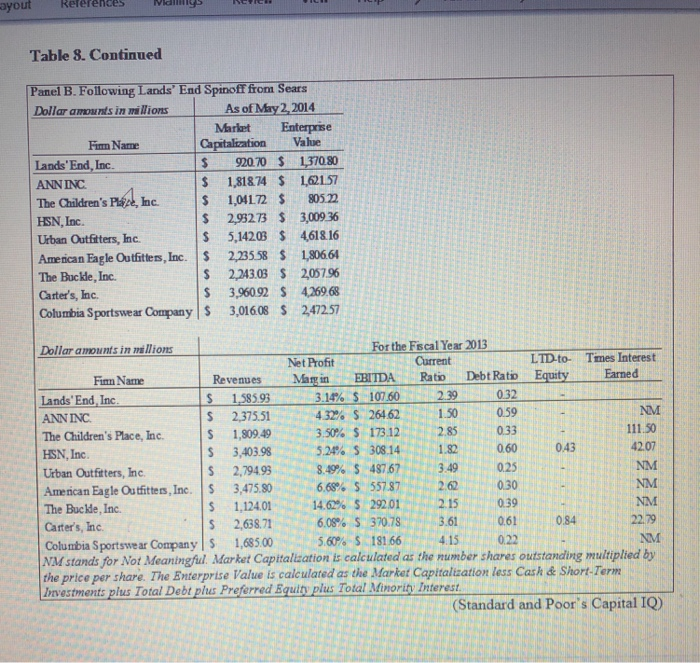

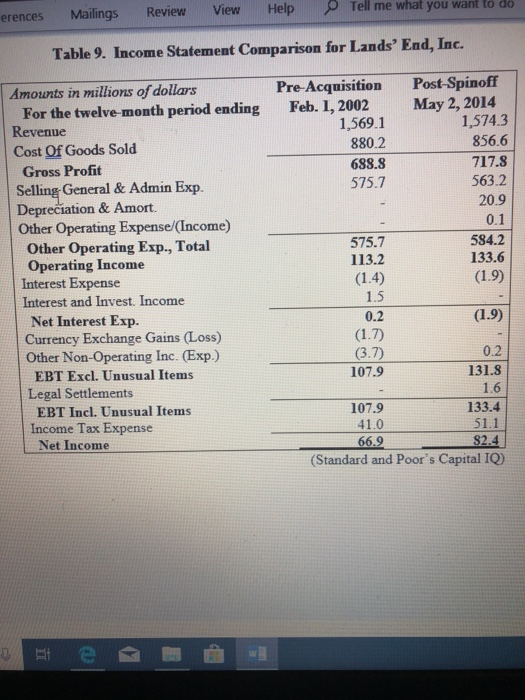

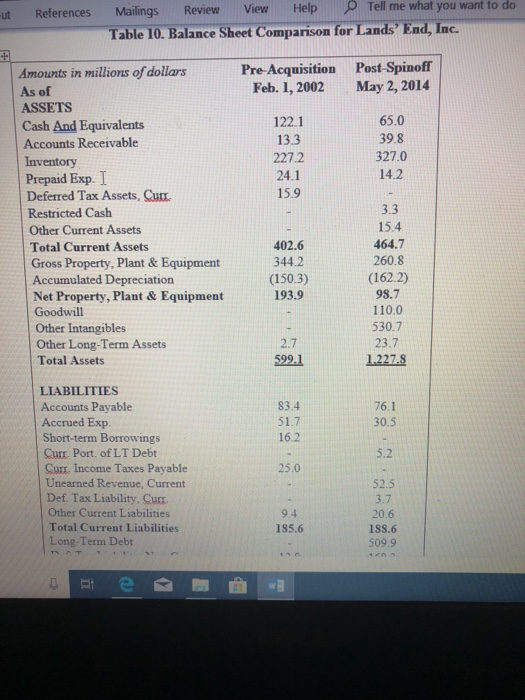

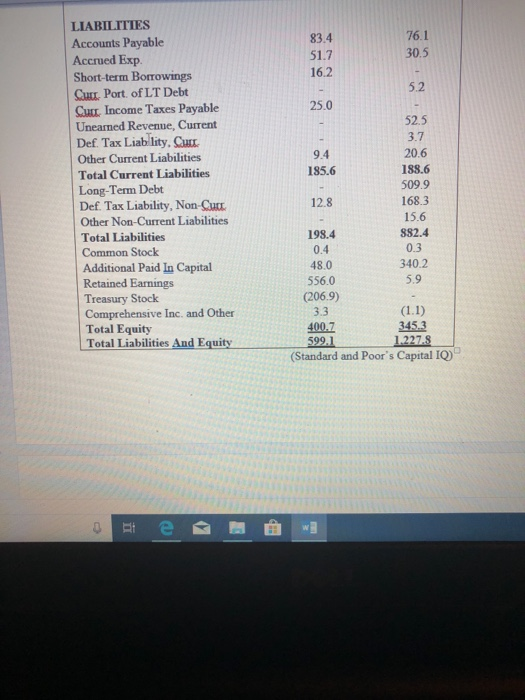

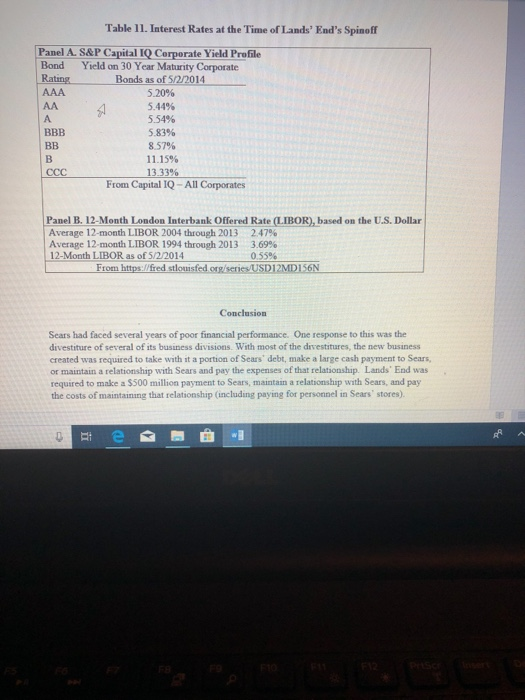

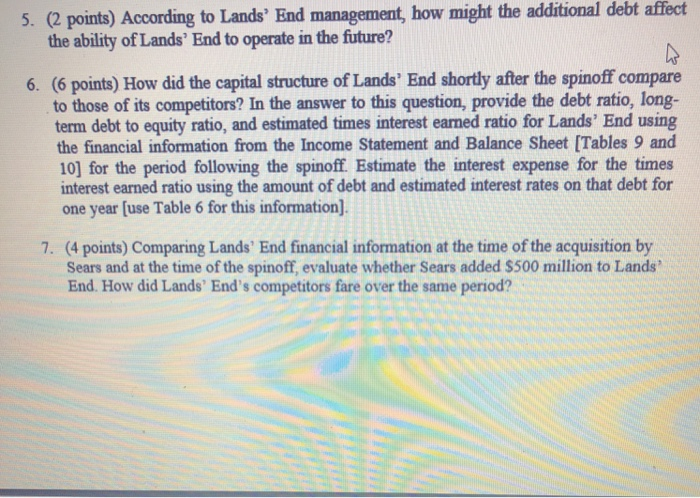

Introduction Following several years of declining revenues and profits, in late 2011 Sears Holding Inc. ("Sears") began to hive off its business divisions. As part of its series of divestitures Sears announced its intention to spin off one of its clothing divisions, Lands' End, in a stock distribution to the existing Sears shareholders on December 6h, 2013 (Sears Holding Corp., 2013b) To explain why Sears was spinning off Lands' End, along with Sears Auto Centers business, Sears released the following statement: We believe separating the management of these two businesses from Sears Holdings would allow them to pursue their own strategic opportunities, optimize their capital structures, attract talent, and allocate capital in a more focused manner (Hammond, 2013) With the spinoff Sears would receive a cash payment of $500 million dollars from Lands' End which would be funded from the proceeds of a $515 million term loan from Bank of America. Each Sears shareholder received approximately 0.3 shares of Lands End stock for each share of Sears stock that they owned and (Sears Holding Corp., 2014a). The spinoff of Lands' End would result in the same stockholders retaining their proportional ownership of the same basket of assets. In light of the terms of the spinoff the stockholders and other stakeholders of Sears and Lands End needed to evaluate their relationships with the firms. Should Lands End's shareholders keep their shars or sell them? What assets were transferred from Sears to Lands End as part of the spinoff? Would the terms of the spinoff hurt the ability of Lands End to operate in the future? Background of Lands' End Lands' End was a multi-channel retailer of apparel and home products. The firm's channels of distribution were: standalone stores, stores within Sears stores, internet, phone, and catalogs. Lands' End had operations in the US, Europe, and Asia. The firm was founded by Gary C Comer in 1963 as a catalog retailer selling sailboat hardware and equipment. In 1977, Lands End began to focus its operations on clothing and luggage. In 1978, Lands' End moved its operations to Dodgeville, WI. The firm went public in 1986 and began its intenational operations in 1991. Through the late 1990s, Lands' End launched its website and developed innovative methods to improve the customer experience such as tools that allowed customers to create 3-D models of themselves and create custom pants Sears, Roebuck & Company Acquires Lands' End Sears, Roebuck & Co. ("SRC") acquired Lands End for approximately $1.9 billion in cash in 2002. At the time of the announcement of the acquisition, the amount provided Lands' End's shareholders with a 21.5% premium over the existing market value of the stock. The acquisition provided Lands' End the potential to grow their in-store retail sales by providing 870 new stores for their products. For SRC, the acquisition provided the opportunity to improve the brand image of its apparel and make the brand recognition for apparel more consistent with that of SRC's hardline categories (e.g Craftsman, Diehard, and Kenmore) (CNNMoney, 2012) Ultimately, SRC's goal with the acquisition was to improve its waning sales and improve profit Orchard did have approximately $220 million in long term debt at the time of the spinoff (Orchard Supply Hardware, 2012). Sears Canada Inc. was partially spun off by Sears on November 14t, 2012. Sears distributed 44.5% of Sears Canada to the Sears stockholders on a pro rata basis and retained approximately 51% of Sears Canada stock. Each Sears stockholder received 0.4283 shares for each share of Sears' stock that they owned (Sears Holding Corp., 2012). Sears Hometown and Outlet Stores ("SHOS") was divested from by Sears on October 11, 2012 Sears created and sold shares of the new company for which Sears received $346.5 million (Sears Holding Corp., 2012). Additionally, SHOS was required to pay Sears $100 million, a continuing commission of its online sales, and fees for shared services with Sears. For the first four months following the divestiture, SHOS reported that these costs were approximately $5 million. The dividend paid to Sears was financed with a long-term debt with a variable interest rate which was 4.50% as of February 2nd, 2013 (Sears Hometown and Outlet Stores, 2013). With each of the spinoffs, the newly created firms were required to maintain a business relationship with Sears. For Lands' End this relationship included maintaining a presence in Sears' retail locations and remaining a partner in Sears Shop Your Way8 rewards program Lands End was required to pay for the expenses of maintaining a presence in Sears retail locations, including the cost of personnel Lands' End Inc., 2014) Table 1 provides a timeline of the history of Lands End and Sears Table 1. Timeline of the History of Lands' End and Sears Date Event 1963 1977 2002 Lands' End was founded by Gary C. Comer as a sailboat hardware and equipment retailer. Lands' End changed its focus to clothing and luggage Lands' End became a publicly traded corporation Sears, Roebuck& Company purchased Lands' End for $1.9 billion ESL Investments purchased a large proportion of K-Mart's debt during K-mart's bankruptcy K-Mart emerged from bankruptcy with ESL Investments owning a controlling interest of the stock. Edward Lampert was the new 1986S 2002 2003 November 2004 K-Mart announced the acquisition of Sears for approximately $11 billion. December 30 2011 Orchard Supply Hardware was spun off from Sears October 11t 2012 Sears Hometown and Outlet Stores was divested from Sears November 14, 2012 Sears Canada Inc. was partially spun off from Sears. Sears retained approximately 51% of the stock Sears announced its intention to spinoff Lands' End December 6th 2013 The spinoffs wers seen as a Sears' response to declining performance. Prior to and following the merger of K-Mart and SRC, the combined firms faced declining sales and profitability. The of its business divisions and sales of its brands had been seen as a slow liquidation of the assets of a firm in distress. Tables 2 and 3 provide the annual income statements and balance sheets, respectively, for the five fiscal years ending January 31, 2015 Table 2. Sears' Income Statements For the Fiscal Period amounts in milliors of US Dollas) ing January 30, Janmary 29, January 28 2, February l 31 2010 2013 2015 43360 42664 41567 98546188 31,198 39,85436,188 31,3371 30,988-30,836 29,305| 27,377 Cost Of Goods Sold Gross Profit 12023 11676 107311054988117218 10279 10411 105281057 9382 721 8,076 Selling General&Admin Exp. Depreciation & Amort. 859 11,270 845 808 ii,385 8,649 406 (642)36 292) 1431) 132 Other Operating Exp., Total il,l61 ,373 10,103 Operating Income Interest Expense Interest and Invest. Income 862 048 293) 289) 6 54613) 36 41 94 (215) C57) (248) a73) (47) (181) as Net Interest Exp. Currency Exchange Gains (Loss) Other Non-Operating Inc. (Exp) . (67) 586 131) 135 (892) (L008) (337) 1608) EBT Excl Unusual Items Restructuring Charges Impairment of Goodwill Gain (Loss) On Sale Of Assets Asset Writedown Legal Settlements Other Unusual Items EBT Incl. Unusual Items Income Tax Expense Earnings from Cont. Ops. Eamings of Disconinued Ops. Extraord. Item & Account Change Net Income to Company Minonty Int. in Eamings Net Income 361)289) ) 295) 667 (13) 64 32 166(751) 010) 72)1.685) 125 391 27 1369 144 280 17 139 3120) (1,054) 116 810) 27) 150 (3147 (1.054)(116 (1.810) 297 128 (Standard and Poor's Capital IQ) For the five year period just prior to the spinoff of Lands' End revenue for Sears had fallen from $43.36 billion to $36.19 billion. While the decline in revenue may have been attributable to the prior divestitures, the divestitures did not improve the profit margins of Sears over the same period. Likewise, the divestitures may have contributed to the declining value of assets over the same period, but the continued losses on the income statement contributed to the declining value of retained earnings and total equity on the balance sheet. As of May 3rd, 2014, Sears' corporate family debt ratings were Caal from Moody's Investors Service, CCC+ from Standard& Poor's Ratings Services, and CCC from Fitch Ratings. As of the same date, Sears had $159 million in commercial paper outstanding, with $150 million of that held by ESL. The portion owed to ESL included $86 million held personally by Edward Lampert. Sears had $2.6 billion in long-term notes and debentures outstanding, of which ESL Semof May held $208 million. The remainder of Sears' interest-bearing debts consisted largely of an asset- backed revolving line of credit (Sears Holding Corp, 2014c). Oms in milions of LS Deliar) 2010 ASSETS 2011-1-2012 - 2013 - 2014--201s- Cash And Eoivalents 70B4498 Prepaid Eip. Other Current Assets Total Current Assets Gross Propesty Plnt & Equipent Accumulated Depeeciation 11433 11560 1024492658959 1139211329 1121011,24410,10 7.709 7,10265776 8,313 6,053 5,394 4,449 Net Property. Plast &Equipment Lonr-temm Inve stme nts Other Intaneibles Deferred Qharges.L Other Lone-Tem As sets Totnl As sets 32092993 13 104 325360 1175 1,04 13324 Accounts Paya ble Short-term Borrownss Corr Port of LT Debt Cun. Port of Cap Leases Curr. Inc ome Tazs Pavable Unearned Revenue Carrent 29122,761 2,4% 4 230, - 534 545 529.400 40 33 1012976 165 516 Other Current Labites Total Currest Lnbilities 8.786 3.643 9212 8.414 8.1355595 Ten Debr Uceamed Rve Non-Current Pension & Other Post-Ratse. Beneits 21 2151 273 27301422.404 9651,1091,195 15373 15746 17040 16168 16,0714 130 10465 10185 100699.135 Other Noa-Carent Labiiies Total Liabilitie Ratained Eamngs 974930 335 40 2162 1355 Conorehans ive lnc and Other Total Couamon Equity ceity Interest Total Equit 9.0968.511 42512.7661 739(951 9.436 3,6144341 31722183(945 eens 12-13 of 39 Type here to search aved to this PC (Standard and Poor's Capital IQ) Spinoff of Lands' End Over the years of his leadership of Sears, Edward Lampert had developed a reputation for candid communications about the operations of the firm. Lampert described the relationship be- tween Sears and Lands' End and the decision to spin off Lands' End in a blog post dated April 13, 2014. An excerpt of that blog post is provided in Table 4. Table 4. Excerpt from Edward Lampert's April 13, 2014 Post on Sears Holdings' Blog 7:11 PM Over the years of his leadership of Sears, Edward Lampert had developed a reputation for candid communications about the operations of the fim. Lampert described the relationship betweern Sears and Lands' End and the decision to spin off Lands' End in a blog post dated April 13, 2014. An excerpt of that blog post is provided in Table 4 Table 4. Excerpt from Edward Lampert's April 13, 2014 Post on Sears Holdings' Blog Sears shoppers definitely,liked having Lands' End's products in Sears and loved how easily they could return or exchange the products they bought from catalogs or online in Sears stores across the country. But this did not directly translate into higher earnings and the company and investors suffered: by 2004, Lands End's eanings had hit their lowest level of the entire 12 year period (2002 to 2014) that Lands End was associated with Sears. After Sears and Kmart merged in 2005, Lands End's fortunes started to turn around. During each year from 2005 to 2010, earnings were significantly higher than they were in 2004 including several years of record profits. Dedicated shops were created inside Sears' stores to bring the Lands' End brand even more distinction, in contrast to the initial approach of having merchandise spread throughout the store However, in 2011 and 2012 the company stumbled for a variety of reasons that were described in its public filings. Just one example: in 2011, cotton prices hit heights unseen since supply and distribution were disrupted during the Civil War (impacting most other apparel retailers as well). Lands' End's performance improved significantly in 2013, but it was clear to us that bigger changes needed to be made to really unlock the potential of the business. Sears Holdings opted for a spinoff- a legal split that allows each company to focus on managing its own business, yet still work together in some ways. Sears Holdings stockholders and distrnbution were disrupted dtriing the Cv war well). Lands End's performance bigger changes needed to be made to really unlock the potential of the business. improved significanth antly in 2013, but it was clear to us that Sears Holdings opted for a spinoff- a legal split that allows each company to focus on managing its own business, yet still work together in some ways. Sears Holdings stockholders 1 am one myself- were given approximately three shares of the new Lands' End for ev ten shares of Sears Holdings they continue to participate in the results of the Lands' End business going forward ery own. This gives investors a choice, and the ability to Lands'End and Sears Holdings can each focus on the management of their businesses separately and Lands' End is able to optimize its capital structure and enter capital markets independently from Sears. Lands' End will be able to invest its profits without having to distribute them to Sears Holdings. Meanwhile, Sears Holdings received $500 million in cash from Lands' End (the equivalent of many years of after- tax profits), which increases Sears Holdings liquidity (Sears' Holdings blog: htp /blog.searsholdings com/edie-lampert spinoffi- and-lands end) Lampert's blog post provided some information on the terms of the spinoff of Lands few weeks later the details of the spinoff were provided in Sears 10-Q statement. As Lands End was a division of Sears at the time of the spinoff, the management of Lands End did not have a sav in the terms of the spinoff. The terms of the spinoff were determined by the management of End. A Table 5. Information from Sears' 10-Q on the Spinoff of Lands End Separation of Lands'End Inc, Note 1, Pg. 6. On April 4, 2014, we completed the separation of our Lands' End business through a spin- off transaction The separation was structured to be tax free to our U.S. shareholders for U.S federal income tax purposes. Prior to the separation, Lands' End, Inc. ("Lands' End") entered into an asset tased senior secured revolving credit facility, which provides for maximum borrowings of approximately $175 million with a letter of credit sub-limit, and a senior secured term loan facility of approximately $515 million. The proceeds of the term loan facility were used to fund a $500 million dividend to Holdings and pay fees and expenses associated with the foregoing facilities. We accounted for this spin-off in accordance with accounting standards applicable to spin-off transactions. Accordingly, we classified the carrying value of net assets of $323 million contributed to Lands' End as a reduction of capital in excess of par value in the Condensed Consolidated Statement of Equity for the period ended May 3, 2014 Additionally, as a result of Mr.Lampert's role as our Chairman and Chief Executive Officer, and Chairman and Chief Executive Officer of ESL Investments, Inc. (together with its affiliated funds, "ESL"), and the continuing arrangements between Holdings and Lands' End (as further described in Note 14), Holdings has determined that it has significant influence over Lands' End. Accordingly, the operating results for Lands End through the date of the spin-off are presented within the consolidated continuing operations of Holdings and the Sears Domestic segment in the accompanying Condensed Consolidated Financial Statements Note 14, Pgs. 20-21 ESL owns approximately 49% of the outstanding common stock of Lands End (based on publicly available information as of April 8, 2014). Holdings, and certain of its subsidiaries, entered into a transition services agreement in connection with the spin-off pursuant to which Lands End and Holdings will provide to each other, on an interim, transitional basis, various services, which may include, but are not limited to, tax services, logistics services, auditing and compliance services, inventory management services continued participation in certain contracts shared with Holdings and its subsidiaries information technology services and Lands End Case.decx- Saved to this PC Layout References Mailings Review View Help Tell me what you want to do The terms of Lands End's spinoff required Lands End to pay an approximate S dividend to Sears. The dividend, as well as some additional expenses, was funded using a $S15 millon loan from Bank of America. The terms of that loan, as well as Lands End's other debts, are provided in Table 6. Table 6. Lands' End Debt Related to the Spinoff from Lands' End's 10-0 NOTE S.DEBT. Ps Debt Arrangements &9 In connection with the Separation, Lands End entered into an asset based sensor secured credit agreement, dated as of April 4, 2014, with Bank ofAmerica, N Awhich provides for maximum borrowings of $175.0 milion CABL. Facility for Lands End, subject to a subsidiary borrower of Lands End (the "UK Borrower") The ABL Facility has a sub-limit of $70.0 mallion for domestic letters of credit and a sub-limit of $15.0 mallion for letters of credit for the UK Borrower. The ABL Facility is available for working capital and other general corporate purposes, and was undrawn at the Separation and at May 2, 2014, other than for letters of credit The Company had borrowing availability under the ABL Facility of $160.2 million as of May 2, 2014, net of outstanding letters of credst of $14.8 mallion Also on April 4, 2014, Lands End entered into a term loan credst agreement with Bank of America, N. Term Loan Facility and, together with the ABL. Facility, the "Facilities"), the proceeds of which were used to pay a dividend of $500 0 million to a subsidiary of Sears Holdings Corporation immedistely prior to the Separation and to pay fees and expenses associated with the Facilities of approximately $11.3 million, with the remaining proceeds to be used for general corporate purposes. The fees were capitalized as debt issuance costs within Other assets on the Condensed Consolidated and Combined Balance Sheets and are being amortized as an adjustment to Interest expense over the remaining life of the Facilities A, which provides a senior secured term loan facility of $515.0 million (the Maturity; Amortization and Prepayments The ABL Facility will mature on April 4, 2019. The Term Loan Facility will mature on April 4, 2021 and will amortize at a rate equal to 1% per annun,and is subject to mandatory prepayment in an amount equal to a percentage of the borrower's excess cash flows in fiscal year, ranging from 0% to 50% depending o the proceeds from certain asset sales and casualty events. The Company's aggregate scheduled maturities of the Term Loan Facility as of May 2, 2014 are as follows: each n Lands End's secured leverage ratio, and in thousands) ess than J $ 5,150 5,150 5,150 5,150 5,150 489,250 $ 515,000 ear 1 -2 years 3-4 years ears Thereafter Guarantees; Security All domestic obligations under the Facilities are unconditionally guaranteed by Lands End and, subject to certain exceptions, each of its existing and future direct and indirect domestic subsidiaries. In addition, the obligations of the UK Borrower under the ABL Facility are guaranteed by its existing and future direct and indirect subsidiaries organized in the United Kingdom. The ABL Facility is secured by a first prioity security interest in certain working capital of the borrowers and guarantors consisting primarily of accounts receivable and inventory The Term Loan Facility is secured by a second priority security interest in the same collateral, with certain exceptions. The Term Loan Facility also is secured by a first prioxity security interest in certain property and assets of the borrowers and guarantors, including certain fixed assets and stock of subsidiaries. The ABL Facility is secured by a second priority security interest in the same collateral Interest Fees The interest rate on the Term Loan Facility was 4.25% at May 2, 2014 The interest rates per annum applicable to the loans under the Facilities are based on a fluctuating rate of interest measured by reference to, at the borrowers election, either () an adjusted London inter-bank offered rate ("LIBOR") plus a borrowing margin, or (i) an altemative base rate plus a borrowing margin The borrowing margin is fixed for the Term Loan Facility at 3 25% in the case of LIBOR loans and 2.25% in the case of base rate loans For the Term Loan Facility. LIBOR is subject to a 1% interest rate floor The borrowing margin for the ABL Facility is subject to adjustment based on the average excess availability under the ABL Facility for the preceding fiscal guate,and will range fron 1.50% to 2 00% in the case of LIBOR borrowings and will range from O 50% to 1 00% in the case of base rate borrowings Customary agency fees are payable in respect of both Facilities. The ABL Facility fees also include ( commitment fees, based on a percentage ranging from approximately 0.25% to 0 375% of the daily unused portions of the ABL Facility, and (i) customary letter of credit fees Lands End 10.Q dated June 12, 2014) The management of Lands' End expressed concern over the effects that the high level of debt would have on the ability of Lands' End to operate in the future. Their concems were detailed in the Notes to Financial Statements in Lands' End 10-K Statement from March 25. 2014. The excerpt from the Notes to Financial Statements that describes these concens are found in Table JTable 7. Lands' End Notes on Indebtednes Risks Related to Our Indebtedness Our leverage may place us at a competitive disadvantage in our industry. We expect that the agreements governing our debt will contain various covenants that impose restrictions on us that may affect our ability to operate our business. We will have substantial leverage following the spin-off and, accordingly, will have significant debt service obligations. Our debt and debt service requirements could adversely affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities. Our expected level of debt presents the following risks among others: .we could be required to use a substantial portion of our cash flow from operations to pay principal (including amortization) and interest on our debt thereby reducing the availability of our cash flow to fund working capital, capital expenditures, strategic acquisitions and other general corporate requirements or causing us to make non-strategic divestitures; our interest expense could increase if prevailing interest rates increase, expect a substantial portion of our debt to bear interest at variable rates; because we Table 7. Continued our level of debt may restrict us from raising additional financing on satisfactory terms to fund working capital, capital expenditures, strategic acquisitions and other general corporate requirements; we expect that the agreements goverming our debt will contain covenants that will limit our ability to pay dividends or make other we expect that the agreements goverming our debt will contain operating covenants that could limit our and our operating subsidiaries' ability to engage in activities that may be in our best interests in the long term, including without limitation, by restricting our and our subsidiaries' ability to incur debt, create liens, enter into transactions with affiliates or prepay certain kinds of indebtedness. However, we expect that the credit agreements governing our debt will not contain any financial covenants unless we fall below a minimum level of borrowing availability under the ABL. Facility, and the failure to comply with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of the applicable debt, and may result in the acceleration of any other debt to which a cross-acceleration or cross- default provision applies. In the event our creditors accelerate the repayment of our borrowings, we and our subsidiaries may not have sufficient assets to repay that debt We may need additional financing in the future for our general corporate purposes, and such financing may not be available on favorable terms, or at all, and may be dilutive to existing stockholders Lands End Case.docx Saved to this PC Sign in Design Layout References Mailings ReviewView Help Tell me what you want to do We may need to seek additional financing for our general corporate purposes, such as to finance our international expansion and the growth of our Retail segment We may be unable to obtain any desired additional financing on terms favorable to us, or at all. If adequate funds are not available on acceptable terms, we may be unable to fund our expansion, successfully develop or enhance our products, or respond to competitive pressures, any of which could negatively affect our business. If we raise additional funds through the issuance of equity securities, our stockholders could experience dilution of their ownership interest. If we raise additional funds by issuing debt, we may be subject to limitations on our operations due to restrictive covenants Lands End 10-K dated March 25, 2014) Table 8 provides financial information on Lands' End and a group of comparable firms at the time of and just prior to its acquisition by Sears, Roebuck & Co. and at the time of its spinoff and the prior period. The additional debt for Lands' End from the spinoff is not included in the Debt Ratio and I.TD-to Equity calculations, but is included in the calculation of the Enterprise Value as of May 2ad 2014 Table 8. Financial Information for Comparable Firms to Lands' End Panel A. At the Time of Lands' End Acquisition by Sears Dollar amounts in milions As of Feb. 1,2002 Market Enterprise Fim Name Capitalization Vahue Lands' End, Inc ANN INC The Children's Par, Ic. HSN, Inc. Urban Outfitters, Inc. Ameican Eagle Outitters, Inc. The Buckle, Inc. Carter's, hc. Columbia Sportswear Company S 1,105.6 S 123524 84085 S 83956 S 444.79 37.22 1,78187 S 1,721.46 S43172 S 329.71 1,265.75 S 124139 For the Fiscal Year 2001 Current Dollar amounts in ma lTions Net Profit LTD-to Tmes Interest RevenuesMagin EBITDA Ratio Debt Ratio EquityEarned S 146228 S 1,232.78 Fim Name 4078 1545 61.32 5.62 NM NM 2370 S 8509 43%S 159.11 7.27% S 0.38 032.020 028 222 ANNINC. The Children's Place, Inc. HSN, Inc. Urban Outfitters, Inc. Amencan Eagle Outfitters , Inc The Buckle, Inc. Carter's, Inc. Columbia Sportswear Company S 779.58 NM stands for Not Meaningful. Market Capitalization is calculated as the number shares outstanding multiplied by the price per share. The Enterprize Value is calculated as the Market Capitalization less Cash & Short-Term Investments plus Total Debt plus Preferred Equity plus Total Mimority Interest IS 58739 92.19 1.71 S 3.62292 1.83%S1,30627 1.68 025 008 295.33 3.55% s 2988 195 023 007 8.57%S16975 8.79% s 6280 2.14 4.81 0.32 0.16 1,093.48 S 393.25 S 518.51 0% 7069 3.06 074 18S 2.23 34.62 11.39% s 16492 3.83 , .0.26 007 Standard and Poor's Capital IQ) yout Refrehces MlalinQS Table 8. Continued Panel B. Following Lands' End Spinoff from Sears As of May2,2014 Market Enterprise Dollar amounts in miMions Fim Name Value S 92070 S 137080 $ 1,81874 S 12157 1,04172 S 80522 Lands'End, Inc ANN INC The Children's P, c. HSN, Inc. Urban Outfitters, Inc. Ametican Eagle Outfitters, Inc. The Buckle, Inc. Carter's, Inc. 2,98273 s 3,00936 S 5,14203 461816 223538 s 18066 S 2,243.03 S 2057.96 S 3,96092 S 426968 Columbia Sportswear Company S 3,01608 S 247257 For the Fscal Year 2013 Current Dollar amounts in mallions LID-to- Times Interest Net Profit Revenues MaginBITDA Ratio Debt Ratio EquityEarned S 158593 S 2,375.51 Fim Name 3.14%$107,60 432% s 26462 2.39 1.50 032 0.59 Lands' End, Inc ANN INC The Children's Place, Inc. S 1,809.493.50% S 17312 2.85 033 HSN, Inc. Urban Outfiters, Inc. Amenican Eagle Outitters,Inc. 3,4750 6 The Buckle, Inc. Carters, Inc. Colunbia Sportswe ar Company 1,68500 NM stands for Not Meaningful Market Capitalization is calculated as the number shares outstanding multiplied by the price per share. The Enterprise Value is calculated as the Market Capitalization less Cask & Short-Term Investments plus Total Debt plus Preferred Equity plus Total Minority Interest 111.50 42.07 NM NM NM 22.79 NM $ 3,40398 5.24% S 308.14 132 060 043 S 2,79493 8.8% s 48767 6.68% s 557.87 349 2 62 0.25 0.30 $ 1,124.01 14.62% S 29201 215 039 S 2,638.71 084 6.08% s 37078 3.61 061 5.60% S 181 66 4.15 0.22 (Standard and Poor's Capital IO) Lands End Case.docx-Saved to this PC Layout References Mailings Review View HelpTell me what you want to do Lands End's enterprise value of $1.371 billion on May 2d, 2014 represented a significant loss in value for Lands' End from its approximate enterprise value of $1.7 billion just prior to the acquisition announcement in 2002. Despite being a part of Sears for eleven years, Lands' End's sales in Sears retail locations only accounted for 15% of Lands' End total sales for fiscal year 2013 Lands' End, 2014). Tables 9 and 1Q provide the Income Statement and Balance Sheet, respectively, for Lands' End just prior to its acquisition in 2002 and just following its spinoff in 2014. As can be seen in Table 9, revenues fell slightly for the Lands End between 2002 and 2014. while operating and net income increased. The $500 billion in debt is reflected as Long-Term Debt on the May 2, 2014 balance sheet presented in Table 10. Other Intangibles consisted primarily of Trade Names, which were valued at $528.3 million on May 2d 2014 (Lands' End 2014) Tell what to do erences Mailings Review View Help me you want Table 9. Income Statement Comparison for Lands' End, Inc. Post-Spinoff May 2, 2014 Pre-Acquisition Amounts in millions of dollars Revenue Cost Of Goods Sold For the twelve-month period ending Feb. 1, 2002 1,574.3 856.6 1,569.1 880.2 688.8 575.7 Gross Profit Selling General & Admin Exp. Depreciation & Amort. Other Operating Expense/(Income) Other Operating Exp., Total Operating Income Interest Expense Interest and Invest. Income 563.2 20.9 0.1 584.2 133.6 575.7 113.2 1.5 0.2 Net Interest Exp. Currency Exchange Gains Loss) Other Non-Operating Inc. (Exp.) (3.7) 107.9 EBT Excl. Unusual Items EBT Incl. Unusual Items Net Income 0.2 131.8 1.6 133.4 51.1 Legal Settlements 107.9 41.0 Income Tax Expense (Standard and Poor's Capital IQ) ut References Mailings Review View Help Tell me what you want to do e Sheet Comparison for Lands End, Inc. Pre-Acquisition Feb. 1, 2002 Post-Spinoff May 2, 2014 Amounts in millions of dollars As of ASSETS Cash And Equivalents Accounts Receivable Inventory Prepaid Exp.I Deferred Tax Assets, Cur Restricted Cash Other Current Assets Total Current Assets Gross Property, Plant & Equipment 122.1 13.3 227.2 24.1 15.9 65.0 39.8 327.0 14.2 3.3 15.4 464.7 260.8 (162.2) 98.7 110.0 530.7 23.7 2278 402.6 344.2 (150.3) 193.9 Accumulated Depreciation Net Property, Plant & Equipment Goodwill Other Intangibles Other Long-Term Assets Total Assets 2.7 599.1 LIABILITIES Accounts Payable 83.4 51.7 16.2 76.1 30.5 Accrued Exp. Short-term Borrowings Curr. Port. of LT Debt Cui. Income Taxes Payable Unearned Revenue, Current Def. Tax Liability, Curr Other Current Liabilities Total Current Liabilities Long-Term Debt 5.2 25.0 52.5 3.7 20.6 188.6 509.9 9.4 185.6 Lands End Case.docx- Saved to this Pc rout References Mailings Review View Help Tell me what you want to do Post Financial Crisis Spinoff Activity in the United States When a spinoff occurs the parent firm separates a division of the firm into an independent business entity with separate ownership, assets, employees, products, etc. A spinoff differs from other forms of divestitures in that the division is not being sold off to another party, but that existing shareholders of the parent firm are given shares of stock in the new business that they may choose to sell if they choose. With the spinoff of Lands End, Sears' stockholders were given 0.3 shares in the new Lands End for each share of Sears that the owned. Since only the existing shareholders were given shares in Lands' End, Sears' shareholders maintained their proportional ownership in Lands' End Caxxetta, Farina, Graziono, and Reale (2013) provided two reasons why firms choose to spinoff their divisions. The first is that the parent firm has attempted to sell a division, but cannot find a buyer at a price that they find reasonable. The second is that a firm with many divisions may be valued at a lower price in the market due to a conglomerate discount A conglomerate discount is defined as difference in the value that an investor assigns to segmented firm less the sum of the values that an investor would assign to the segments if they were not part of a c which would increase the value of the firms to shareholders. The difference in values occur due to the perceived ability of management of a single segment firm to attain and utilize a higher level of expertise for a single segment and the ability of investors understand and make better decisions regarding the potential risks and rewards of a single segment compared to a multi segment conglomerate firm (see Berger and Ofek. 1995: Burch and Nanda, 2003). Seeking a focus 4, that one reason for the spinoff was so that the management and stockholders of the two firms could focus on the individual firms rather than the larger conglomerate a multi e firm Spinning off companies may result in a focus premium, premium is consistent with the explanation provided by Edward Lampert, found in Table The spinoffs of Orchard Hardware Supply, Sears Canada, Inc, and Lands End were part of an overall trend of increased spinoffs following the financial crisis. A study by Zenner, Junek, and Chisukula (2015) found that the pace of corporate spinoffs increased following the financial crisis. Specifically, they found that the average number of spinoffs from firms in the S&P 500 index was only two per year for the years 2008 and 2009; these increased to an average of seven per vear for the vears 2010 throueh 2012 and finallv increased to an average of 15 per vear for ages. (5 points) At the time of the spinoff, corporate divestitures had been increasing i popularity. Per the information provided in the case, why do parent firms spin of business divisions? Why were divestitures increasing in popularity at the time? (3 points) Calculate and provide the current and quick ratios for Sears for each of the six years of balance sheets provided in the case. (4 points) How did Sears account for the spinoff of Lands' End on its financial Specifically, which asset categories would have decreased in value and which asset categories would have increased as a result of the spinoff? 4. (6 points) At the time of the spinoff, what would have been the estimated yield-to- maturity on public debt issued by Sears? What was the interest rate on the debt that Lands' End took out to pay the dividend to Sears? What were the terms of the debt that Lands' End took out from Bank of America? Introduction Following several years of declining revenues and profits, in late 2011 Sears Holding Inc. ("Sears") began to hive off its business divisions. As part of its series of divestitures Sears announced its intention to spin off one of its clothing divisions, Lands' End, in a stock distribution to the existing Sears shareholders on December 6h, 2013 (Sears Holding Corp., 2013b) To explain why Sears was spinning off Lands' End, along with Sears Auto Centers business, Sears released the following statement: We believe separating the management of these two businesses from Sears Holdings would allow them to pursue their own strategic opportunities, optimize their capital structures, attract talent, and allocate capital in a more focused manner (Hammond, 2013) With the spinoff Sears would receive a cash payment of $500 million dollars from Lands' End which would be funded from the proceeds of a $515 million term loan from Bank of America. Each Sears shareholder received approximately 0.3 shares of Lands End stock for each share of Sears stock that they owned and (Sears Holding Corp., 2014a). The spinoff of Lands' End would result in the same stockholders retaining their proportional ownership of the same basket of assets. In light of the terms of the spinoff the stockholders and other stakeholders of Sears and Lands End needed to evaluate their relationships with the firms. Should Lands End's shareholders keep their shars or sell them? What assets were transferred from Sears to Lands End as part of the spinoff? Would the terms of the spinoff hurt the ability of Lands End to operate in the future? Background of Lands' End Lands' End was a multi-channel retailer of apparel and home products. The firm's channels of distribution were: standalone stores, stores within Sears stores, internet, phone, and catalogs. Lands' End had operations in the US, Europe, and Asia. The firm was founded by Gary C Comer in 1963 as a catalog retailer selling sailboat hardware and equipment. In 1977, Lands End began to focus its operations on clothing and luggage. In 1978, Lands' End moved its operations to Dodgeville, WI. The firm went public in 1986 and began its intenational operations in 1991. Through the late 1990s, Lands' End launched its website and developed innovative methods to improve the customer experience such as tools that allowed customers to create 3-D models of themselves and create custom pants Sears, Roebuck & Company Acquires Lands' End Sears, Roebuck & Co. ("SRC") acquired Lands End for approximately $1.9 billion in cash in 2002. At the time of the announcement of the acquisition, the amount provided Lands' End's shareholders with a 21.5% premium over the existing market value of the stock. The acquisition provided Lands' End the potential to grow their in-store retail sales by providing 870 new stores for their products. For SRC, the acquisition provided the opportunity to improve the brand image of its apparel and make the brand recognition for apparel more consistent with that of SRC's hardline categories (e.g Craftsman, Diehard, and Kenmore) (CNNMoney, 2012) Ultimately, SRC's goal with the acquisition was to improve its waning sales and improve profit Orchard did have approximately $220 million in long term debt at the time of the spinoff (Orchard Supply Hardware, 2012). Sears Canada Inc. was partially spun off by Sears on November 14t, 2012. Sears distributed 44.5% of Sears Canada to the Sears stockholders on a pro rata basis and retained approximately 51% of Sears Canada stock. Each Sears stockholder received 0.4283 shares for each share of Sears' stock that they owned (Sears Holding Corp., 2012). Sears Hometown and Outlet Stores ("SHOS") was divested from by Sears on October 11, 2012 Sears created and sold shares of the new company for which Sears received $346.5 million (Sears Holding Corp., 2012). Additionally, SHOS was required to pay Sears $100 million, a continuing commission of its online sales, and fees for shared services with Sears. For the first four months following the divestiture, SHOS reported that these costs were approximately $5 million. The dividend paid to Sears was financed with a long-term debt with a variable interest rate which was 4.50% as of February 2nd, 2013 (Sears Hometown and Outlet Stores, 2013). With each of the spinoffs, the newly created firms were required to maintain a business relationship with Sears. For Lands' End this relationship included maintaining a presence in Sears' retail locations and remaining a partner in Sears Shop Your Way8 rewards program Lands End was required to pay for the expenses of maintaining a presence in Sears retail locations, including the cost of personnel Lands' End Inc., 2014) Table 1 provides a timeline of the history of Lands End and Sears Table 1. Timeline of the History of Lands' End and Sears Date Event 1963 1977 2002 Lands' End was founded by Gary C. Comer as a sailboat hardware and equipment retailer. Lands' End changed its focus to clothing and luggage Lands' End became a publicly traded corporation Sears, Roebuck& Company purchased Lands' End for $1.9 billion ESL Investments purchased a large proportion of K-Mart's debt during K-mart's bankruptcy K-Mart emerged from bankruptcy with ESL Investments owning a controlling interest of the stock. Edward Lampert was the new 1986S 2002 2003 November 2004 K-Mart announced the acquisition of Sears for approximately $11 billion. December 30 2011 Orchard Supply Hardware was spun off from Sears October 11t 2012 Sears Hometown and Outlet Stores was divested from Sears November 14, 2012 Sears Canada Inc. was partially spun off from Sears. Sears retained approximately 51% of the stock Sears announced its intention to spinoff Lands' End December 6th 2013 The spinoffs wers seen as a Sears' response to declining performance. Prior to and following the merger of K-Mart and SRC, the combined firms faced declining sales and profitability. The of its business divisions and sales of its brands had been seen as a slow liquidation of the assets of a firm in distress. Tables 2 and 3 provide the annual income statements and balance sheets, respectively, for the five fiscal years ending January 31, 2015 Table 2. Sears' Income Statements For the Fiscal Period amounts in milliors of US Dollas) ing January 30, Janmary 29, January 28 2, February l 31 2010 2013 2015 43360 42664 41567 98546188 31,198 39,85436,188 31,3371 30,988-30,836 29,305| 27,377 Cost Of Goods Sold Gross Profit 12023 11676 107311054988117218 10279 10411 105281057 9382 721 8,076 Selling General&Admin Exp. Depreciation & Amort. 859 11,270 845 808 ii,385 8,649 406 (642)36 292) 1431) 132 Other Operating Exp., Total il,l61 ,373 10,103 Operating Income Interest Expense Interest and Invest. Income 862 048 293) 289) 6 54613) 36 41 94 (215) C57) (248) a73) (47) (181) as Net Interest Exp. Currency Exchange Gains (Loss) Other Non-Operating Inc. (Exp) . (67) 586 131) 135 (892) (L008) (337) 1608) EBT Excl Unusual Items Restructuring Charges Impairment of Goodwill Gain (Loss) On Sale Of Assets Asset Writedown Legal Settlements Other Unusual Items EBT Incl. Unusual Items Income Tax Expense Earnings from Cont. Ops. Eamings of Disconinued Ops. Extraord. Item & Account Change Net Income to Company Minonty Int. in Eamings Net Income 361)289) ) 295) 667 (13) 64 32 166(751) 010) 72)1.685) 125 391 27 1369 144 280 17 139 3120) (1,054) 116 810) 27) 150 (3147 (1.054)(116 (1.810) 297 128 (Standard and Poor's Capital IQ) For the five year period just prior to the spinoff of Lands' End revenue for Sears had fallen from $43.36 billion to $36.19 billion. While the decline in revenue may have been attributable to the prior divestitures, the divestitures did not improve the profit margins of Sears over the same period. Likewise, the divestitures may have contributed to the declining value of assets over the same period, but the continued losses on the income statement contributed to the declining value of retained earnings and total equity on the balance sheet. As of May 3rd, 2014, Sears' corporate family debt ratings were Caal from Moody's Investors Service, CCC+ from Standard& Poor's Ratings Services, and CCC from Fitch Ratings. As of the same date, Sears had $159 million in commercial paper outstanding, with $150 million of that held by ESL. The portion owed to ESL included $86 million held personally by Edward Lampert. Sears had $2.6 billion in long-term notes and debentures outstanding, of which ESL Semof May held $208 million. The remainder of Sears' interest-bearing debts consisted largely of an asset- backed revolving line of credit (Sears Holding Corp, 2014c). Oms in milions of LS Deliar) 2010 ASSETS 2011-1-2012 - 2013 - 2014--201s- Cash And Eoivalents 70B4498 Prepaid Eip. Other Current Assets Total Current Assets Gross Propesty Plnt & Equipent Accumulated Depeeciation 11433 11560 1024492658959 1139211329 1121011,24410,10 7.709 7,10265776 8,313 6,053 5,394 4,449 Net Property. Plast &Equipment Lonr-temm Inve stme nts Other Intaneibles Deferred Qharges.L Other Lone-Tem As sets Totnl As sets 32092993 13 104 325360 1175 1,04 13324 Accounts Paya ble Short-term Borrownss Corr Port of LT Debt Cun. Port of Cap Leases Curr. Inc ome Tazs Pavable Unearned Revenue Carrent 29122,761 2,4% 4 230, - 534 545 529.400 40 33 1012976 165 516 Other Current Labites Total Currest Lnbilities 8.786 3.643 9212 8.414 8.1355595 Ten Debr Uceamed Rve Non-Current Pension & Other Post-Ratse. Beneits 21 2151 273 27301422.404 9651,1091,195 15373 15746 17040 16168 16,0714 130 10465 10185 100699.135 Other Noa-Carent Labiiies Total Liabilitie Ratained Eamngs 974930 335 40 2162 1355 Conorehans ive lnc and Other Total Couamon Equity ceity Interest Total Equit 9.0968.511 42512.7661 739(951 9.436 3,6144341 31722183(945 eens 12-13 of 39 Type here to search aved to this PC (Standard and Poor's Capital IQ) Spinoff of Lands' End Over the years of his leadership of Sears, Edward Lampert had developed a reputation for candid communications about the operations of the firm. Lampert described the relationship be- tween Sears and Lands' End and the decision to spin off Lands' End in a blog post dated April 13, 2014. An excerpt of that blog post is provided in Table 4. Table 4. Excerpt from Edward Lampert's April 13, 2014 Post on Sears Holdings' Blog 7:11 PM Over the years of his leadership of Sears, Edward Lampert had developed a reputation for candid communications about the operations of the fim. Lampert described the relationship betweern Sears and Lands' End and the decision to spin off Lands' End in a blog post dated April 13, 2014. An excerpt of that blog post is provided in Table 4 Table 4. Excerpt from Edward Lampert's April 13, 2014 Post on Sears Holdings' Blog Sears shoppers definitely,liked having Lands' End's products in Sears and loved how easily they could return or exchange the products they bought from catalogs or online in Sears stores across the country. But this did not directly translate into higher earnings and the company and investors suffered: by 2004, Lands End's eanings had hit their lowest level of the entire 12 year period (2002 to 2014) that Lands End was associated with Sears. After Sears and Kmart merged in 2005, Lands End's fortunes started to turn around. During each year from 2005 to 2010, earnings were significantly higher than they were in 2004 including several years of record profits. Dedicated shops were created inside Sears' stores to bring the Lands' End brand even more distinction, in contrast to the initial approach of having merchandise spread throughout the store However, in 2011 and 2012 the company stumbled for a variety of reasons that were described in its public filings. Just one example: in 2011, cotton prices hit heights unseen since supply and distribution were disrupted during the Civil War (impacting most other apparel retailers as well). Lands' End's performance improved significantly in 2013, but it was clear to us that bigger changes needed to be made to really unlock the potential of the business. Sears Holdings opted for a spinoff- a legal split that allows each company to focus on managing its own business, yet still work together in some ways. Sears Holdings stockholders and distrnbution were disrupted dtriing the Cv war well). Lands End's performance bigger changes needed to be made to really unlock the potential of the business. improved significanth antly in 2013, but it was clear to us that Sears Holdings opted for a spinoff- a legal split that allows each company to focus on managing its own business, yet still work together in some ways. Sears Holdings stockholders 1 am one myself- were given approximately three shares of the new Lands' End for ev ten shares of Sears Holdings they continue to participate in the results of the Lands' End business going forward ery own. This gives investors a choice, and the ability to Lands'End and Sears Holdings can each focus on the management of their businesses separately and Lands' End is able to optimize its capital structure and enter capital markets independently from Sears. Lands' End will be able to invest its profits without having to distribute them to Sears Holdings. Meanwhile, Sears Holdings received $500 million in cash from Lands' End (the equivalent of many years of after- tax profits), which increases Sears Holdings liquidity (Sears' Holdings blog: htp /blog.searsholdings com/edie-lampert spinoffi- and-lands end) Lampert's blog post provided some information on the terms of the spinoff of Lands few weeks later the details of the spinoff were provided in Sears 10-Q statement. As Lands End was a division of Sears at the time of the spinoff, the management of Lands End did not have a sav in the terms of the spinoff. The terms of the spinoff were determined by the management of End. A Table 5. Information from Sears' 10-Q on the Spinoff of Lands End Separation of Lands'End Inc, Note 1, Pg. 6. On April 4, 2014, we completed the separation of our Lands' End business through a spin- off transaction The separation was structured to be tax free to our U.S. shareholders for U.S federal income tax purposes. Prior to the separation, Lands' End, Inc. ("Lands' End") entered into an asset tased senior secured revolving credit facility, which provides for maximum borrowings of approximately $175 million with a letter of credit sub-limit, and a senior secured term loan facility of approximately $515 million. The proceeds of the term loan facility were used to fund a $500 million dividend to Holdings and pay fees and expenses associated with the foregoing facilities. We accounted for this spin-off in accordance with accounting standards applicable to spin-off transactions. Accordingly, we classified the carrying value of net assets of $323 million contributed to Lands' End as a reduction of capital in excess of par value in the Condensed Consolidated Statement of Equity for the period ended May 3, 2014 Additionally, as a result of Mr.Lampert's role as our Chairman and Chief Executive Officer, and Chairman and Chief Executive Officer of ESL Investments, Inc. (together with its affiliated funds, "ESL"), and the continuing arrangements between Holdings and Lands' End (as further described in Note 14), Holdings has determined that it has significant influence over Lands' End. Accordingly, the operating results for Lands End through the date of the spin-off are presented within the consolidated continuing operations of Holdings and the Sears Domestic segment in the accompanying Condensed Consolidated Financial Statements Note 14, Pgs. 20-21 ESL owns approximately 49% of the outstanding common stock of Lands End (based on publicly available information as of April 8, 2014). Holdings, and certain of its subsidiaries, entered into a transition services agreement in connection with the spin-off pursuant to which Lands End and Holdings will provide to each other, on an interim, transitional basis, various services, which may include, but are not limited to, tax services, logistics services, auditing and compliance services, inventory management services continued participation in certain contracts shared with Holdings and its subsidiaries information technology services and Lands End Case.decx- Saved to this PC Layout References Mailings Review View Help Tell me what you want to do The terms of Lands End's spinoff required Lands End to pay an approximate S dividend to Sears. The dividend, as well as some additional expenses, was funded using a $S15 millon loan from Bank of America. The terms of that loan, as well as Lands End's other debts, are provided in Table 6. Table 6. Lands' End Debt Related to the Spinoff from Lands' End's 10-0 NOTE S.DEBT. Ps Debt Arrangements &9 In connection with the Separation, Lands End entered into an asset based sensor secured credit agreement, dated as of April 4, 2014, with Bank ofAmerica, N Awhich provides for maximum borrowings of $175.0 milion CABL. Facility for Lands End, subject to a subsidiary borrower of Lands End (the "UK Borrower") The ABL Facility has a sub-limit of $70.0 mallion for domestic letters of credit and a sub-limit of $15.0 mallion for letters of credit for the UK Borrower. The ABL Facility is available for working capital and other general corporate purposes, and was undrawn at the Separation and at May 2, 2014, other than for letters of credit The Company had borrowing availability under the ABL Facility of $160.2 million as of May 2, 2014, net of outstanding letters of credst of $14.8 mallion Also on April 4, 2014, Lands End entered into a term loan credst agreement with Bank of America, N. Term Loan Facility and, together with the ABL. Facility, the "Facilities"), the proceeds of which were used to pay a dividend of $500 0 million to a subsidiary of Sears Holdings Corporation immedistely prior to the Separation and to pay fees and expenses associated with the Facilities of approximately $11.3 million, with the remaining proceeds to be used for general corporate purposes. The fees were capitalized as debt issuance costs within Other assets on the Condensed Consolidated and Combined Balance Sheets and are being amortized as an adjustment to Interest expense over the remaining life of the Facilities A, which provides a senior secured term loan facility of $515.0 million (the Maturity; Amortization and Prepayments The ABL Facility will mature on April 4, 2019. The Term Loan Facility will mature on April 4, 2021 and will amortize at a rate equal to 1% per annun,and is subject to mandatory prepayment in an amount equal to a percentage of the borrower's excess cash flows in fiscal year, ranging from 0% to 50% depending o the proceeds from certain asset sales and casualty events. The Company's aggregate scheduled maturities of the Term Loan Facility as of May 2, 2014 are as follows: each n Lands End's secured leverage ratio, and in thousands) ess than J $ 5,150 5,150 5,150 5,150 5,150 489,250 $ 515,000 ear 1 -2 years 3-4 years ears Thereafter Guarantees; Security All domestic obligations under the Facilities are unconditionally guaranteed by Lands End and, subject to certain exceptions, each of its existing and future direct and indirect domestic subsidiaries. In addition, the obligations of the UK Borrower under the ABL Facility are guaranteed by its existing and future direct and indirect subsidiaries organized in the United Kingdom. The ABL Facility is secured by a first prioity security interest in certain working capital of the borrowers and guarantors consisting primarily of accounts receivable and inventory The Term Loan Facility is secured by a second priority security interest in the same collateral, with certain exceptions. The Term Loan Facility also is secured by a first prioxity security interest in certain property and assets of the borrowers and guarantors, including certain fixed assets and stock of subsidiaries. The ABL Facility is secured by a second priority security interest in the same collateral Interest Fees The interest rate on the Term Loan Facility was 4.25% at May 2, 2014 The interest rates per annum applicable to the loans under the Facilities are based on a fluctuating rate of interest measured by reference to, at the borrowers election, either () an adjusted London inter-bank offered rate ("LIBOR") plus a borrowing margin, or (i) an altemative base rate plus a borrowing margin The borrowing margin is fixed for the Term Loan Facility at 3 25% in the case of LIBOR loans and 2.25% in the case of base rate loans For the Term Loan Facility. LIBOR is subject to a 1% interest rate floor The borrowing margin for the ABL Facility is subject to adjustment based on the average excess availability under the ABL Facility for the preceding fiscal guate,and will range fron 1.50% to 2 00% in the case of LIBOR borrowings and will range from O 50% to 1 00% in the case of base rate borrowings Customary agency fees are payable in respect of both Facilities. The ABL Facility fees also include ( commitment fees, based on a percentage ranging from approximately 0.25% to 0 375% of the daily unused portions of the ABL Facility, and (i) customary letter of credit fees Lands End 10.Q dated June 12, 2014) The management of Lands' End expressed concern over the effects that the high level of debt would have on the ability of Lands' End to operate in the future. Their concems were detailed in the Notes to Financial Statements in Lands' End 10-K Statement from March 25. 2014. The excerpt from the Notes to Financial Statements that describes these concens are found in Table JTable 7. Lands' End Notes on Indebtednes Risks Related to Our Indebtedness Our leverage may place us at a competitive disadvantage in our industry. We expect that the agreements governing our debt will contain various covenants that impose restrictions on us that may affect our ability to operate our business. We will have substantial leverage following the spin-off and, accordingly, will have significant debt service obligations. Our debt and debt service requirements could adversely affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities. Our expected level of debt presents the following risks among others: .we could be required to use a substantial portion of our cash flow from operations to pay principal (including amortization) and interest on our debt thereby reducing the availability of our cash flow to fund working capital, capital expenditures, strategic acquisitions and other general corporate requirements or causing us to make non-strategic divestitures; our interest expense could increase if prevailing interest rates increase, expect a substantial portion of our debt to bear interest at variable rates; because we Table 7. Continued our level of debt may restrict us from raising additional financing on satisfactory terms to fund working capital, capital expenditures, strategic acquisitions and other general corporate requirements; we expect that the agreements goverming our debt will contain covenants that will limit our ability to pay dividends or make other we expect that the agreements goverming our debt will contain operating covenants that could limit our and our operating subsidiaries' ability to engage in activities that may be in our best interests in the long term, including without limitation, by restricting our and our subsidiaries' ability to incur debt, create liens, enter into transactions with affiliates or prepay certain kinds of indebtedness. However, we expect that the credit agreements governing our debt will not contain any financial covenants unless we fall below a minimum level of borrowing availability under the ABL. Facility, and the failure to comply with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of the applicable debt, and may result in the acceleration of any other debt to which a cross-acceleration or cross- default provision applies. In the event our creditors accelerate the repayment of our borrowings, we and our subsidiaries may not have sufficient assets to repay that debt We may need additional financing in the future for our general corporate purposes, and such financing may not be available on favorable terms, or at all, and may be dilutive to existing stockholders Lands End Case.docx Saved to this PC Sign in Design Layout References Mailings ReviewView Help Tell me what you want to do We may need to seek additional financing for our general corporate purposes, such as to finance our international expansion and the growth of our Retail segment We may be unable to obtain any desired additional financing on terms favorable to us, or at all. If adequate funds are not available on acceptable terms, we may be unable to fund our expansion, successfully develop or enhance our products, or respond