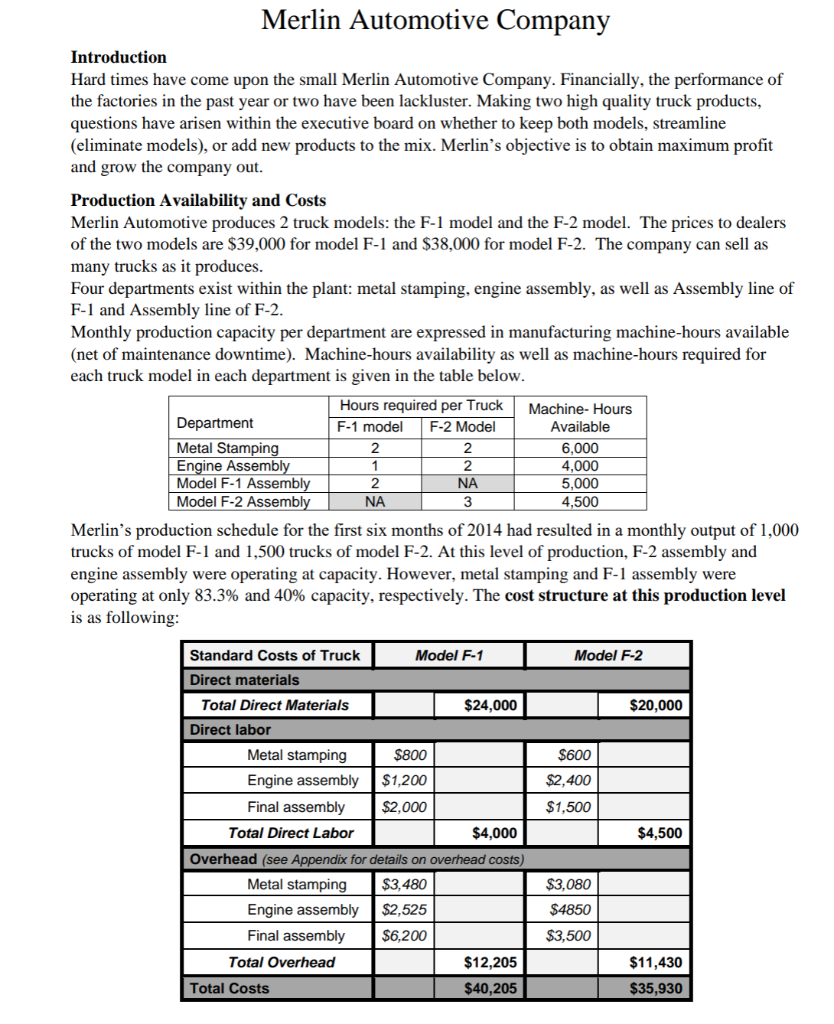

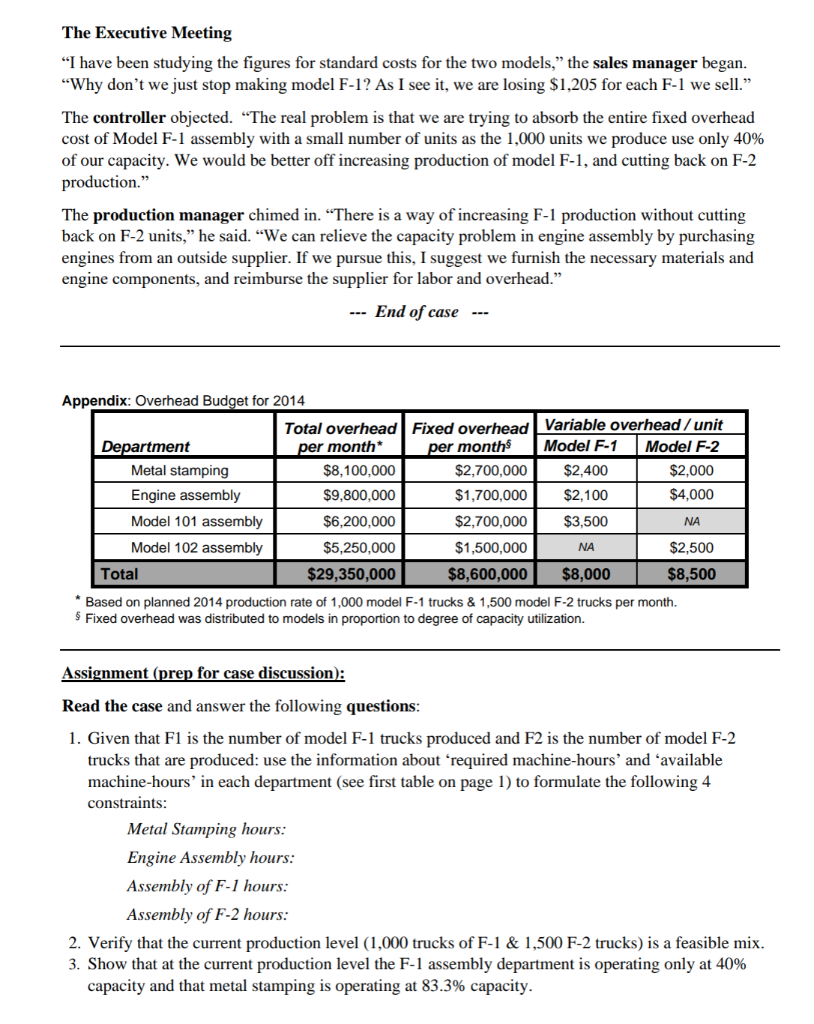

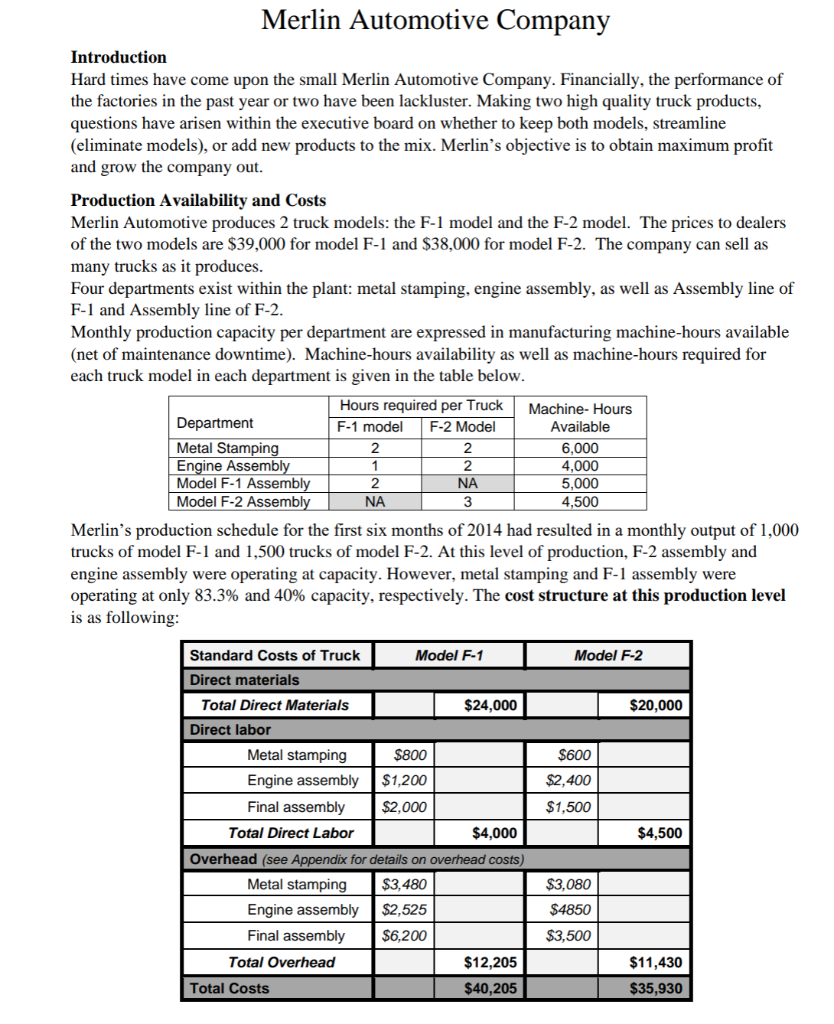

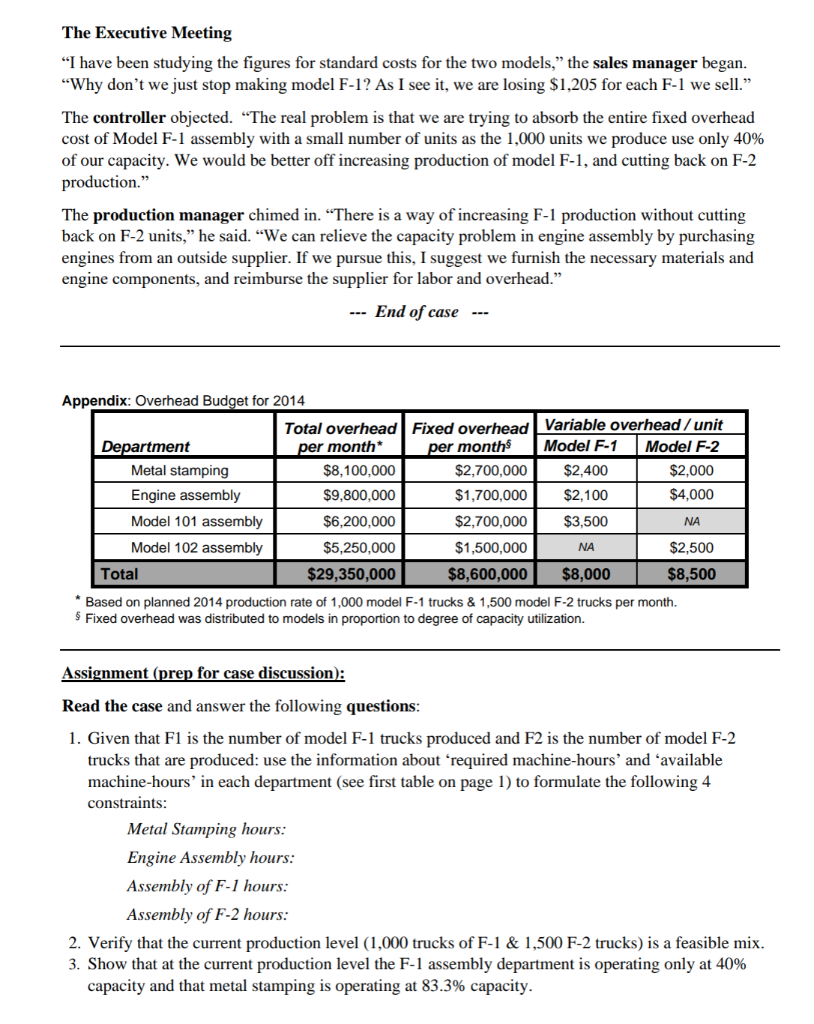

Introduction Hard times have come upon the small Merlin Automotive Company. Financially, the performance of the factories in the past year or two have been lackluster. Making two high quality truck products, questions have arisen within the executive board on whether to keep both models, streamline (eliminate models), or add new products to the mix. Merlin's objective is to obtain maximum profit and grow the company out. Production Availability and Costs Merlin Automotive produces 2 truck models: the F-1 model and the F-2 model. The prices to dealers of the two models are $39,000 for model F-1 and $38,000 for model F-2. The company can sell as many trucks as it produces. Four departments exist within the plant: metal stamping, engine assembly, as well as Assembly line of F-1 and Assembly line of F-2. Monthly production capacity per department are expressed in manufacturing machine-hours available (net of maintenance downtime). Machine-hours availability as well as machine-hours required for each truck model in each department is given in the table below. Merlin's production schedule for the first six months of 2014 had resulted in a monthly output of 1,000 trucks of model F-1 and 1,500 trucks of model F-2. At this level of production, F-2 assembly and engine assembly were operating at capacity. However, metal stamping and F-1 assembly were operating at only 83.3% and 40% capacity, respectively. The cost structure at this production level is as following: The Executive Meeting "I have been studying the figures for standard costs for the two models," the sales manager began. "Why don't we just stop making model F-1? As I see it, we are losing \$1,205 for each F-1 we sell." The controller objected. "The real problem is that we are trying to absorb the entire fixed overhead cost of Model F-1 assembly with a small number of units as the 1,000 units we produce use only 40% of our capacity. We would be better off increasing production of model F-1, and cutting back on F-2 production." The production manager chimed in. "There is a way of increasing F-1 production without cutting back on F-2 units," he said. "We can relieve the capacity problem in engine assembly by purchasing engines from an outside supplier. If we pursue this, I suggest we furnish the necessary materials and engine components, and reimburse the supplier for labor and overhead." End of case --- Apnendix: Overhead Rtnet for 2014 Based on planned 2014 production rate of 1,000 model F-1 trucks \& 1,500 model F-2 trucks per month. \$ Fixed overhead was distributed to models in proportion to degree of capacity utilization. Assignment (prep for case discussion): Read the case and answer the following questions: 1. Given that F1 is the number of model F-1 trucks produced and F2 is the number of model F-2 trucks that are produced: use the information about 'required machine-hours' and 'available machine-hours' in each department (see first table on page 1) to formulate the following 4 constraints: Metal Stamping hours: Engine Assembly hours: Assembly of F1 hours: Assembly of F2 hours: 2. Verify that the current production level (1,000 trucks of F-1 \& 1,500 F-2 trucks) is a feasible mix. 3. Show that at the current production level the F-1 assembly department is operating only at 40% capacity and that metal stamping is operating at 83.3% capacity. All 5 questions are independent (always look at the original problem; NOT the previous sensitivity probl 1. First, find the best product mix for a. What would be the best product mix if engine assembly capacity were raised by one unit, from 4,000 to 4,001 machine hours? What is the extra unit of capacity worth? b. Assume that a second additional unit of engine assembly capacity is worth the same as the first. Verify that if the capacity were increased to 4,100 machine hours, then the increase in contribution would be 100 times that in part (b). c. How many units of engine assembly capacity can be added before there is a change in the value of an addition unit of capacity? 2. Merlin's production manager suggests purchasing engines from an outside suppler in order to relieve the capacity problem in the engine assembly department. If Merlin decides to pursue this alternative, it will be effectively "renting" capacity: furnishing the necessary materials and engine components, and reimbursing the outside supplier for labor and overhead. Should the company adopt this alternative? If so, what is the maximum rent it should be willing to pay for a machine hour of engine assembly capacity? What is the maximum number of machine-hours it should rent? 3. The company president, in arguing that maximizing short-run contributions was not necessarily good for the company in the long run, wanted to produce as many F-1 trucks as possible. After some discussion, it was agreed to maximize the monthly contribution as long as the number of F-1s produced was three times the number of F-2s produced. What is the resulting "optimal" product mix? 4. Merlin is considering the introduction of a third line of vehicles, the F-3 model. Each F-3 truck would give a contribution of $2,000. The metal stamping capacity would be sufficient to produce 4,000 units of F-3 per month and the total engine assembly capacity would be sufficient to produce 5,000 units of F-3 per month. The new truck would be assembled in the F-1 assembly/finishing department. Each F-3 requires only half as much time as a F-1 unit. a. Should Merlin produce F-3 trucks? b. How high would the contribution on each F-3 have to be before it became a worthwhile investment? Solve this problem using the sensitivity report, then to confirm your answer, reformulate the problem with 3 variables (hint: review the new investment T for the W&V investment problem) 5. Engines can be assembled on overtime in the engine assembly department. Suppose production efficiencies do not change and 2,000 machine hours of engine assembly overtime capacity are available. Direct labor costs are higher by 50% for overtime production. While variable overhead would remain the same, an additional cost of $0.75 Million would be added for fixed overhead costs (increased electrical bills due to a second shift, etc.). Should Merlin Automotive produce engines on overtime? hint: you can reformulate this problem with 4 variables and 5 constraints and/or solve using sensitivity report