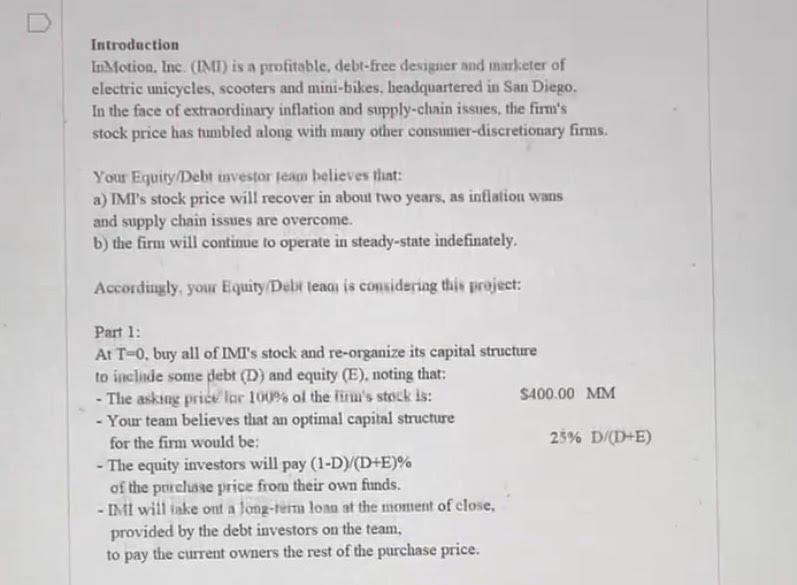

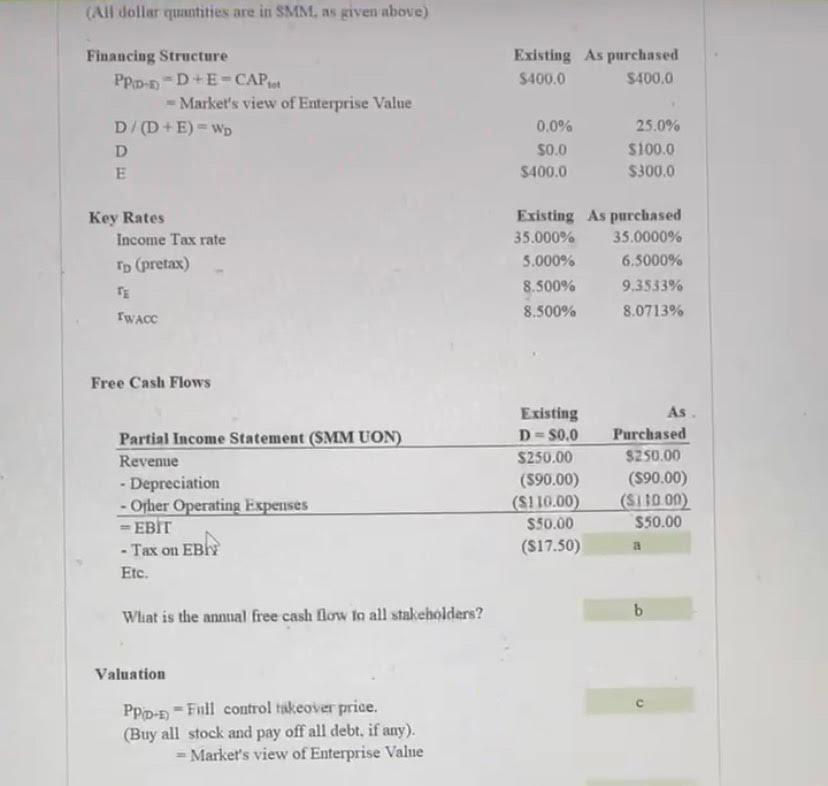

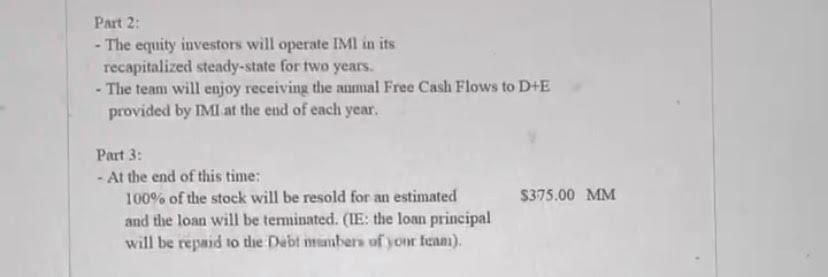

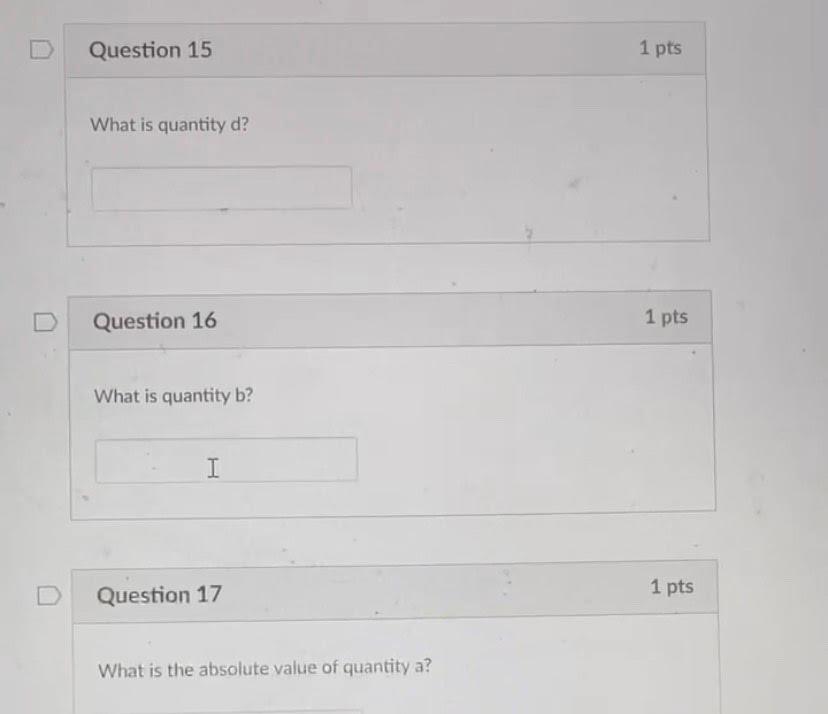

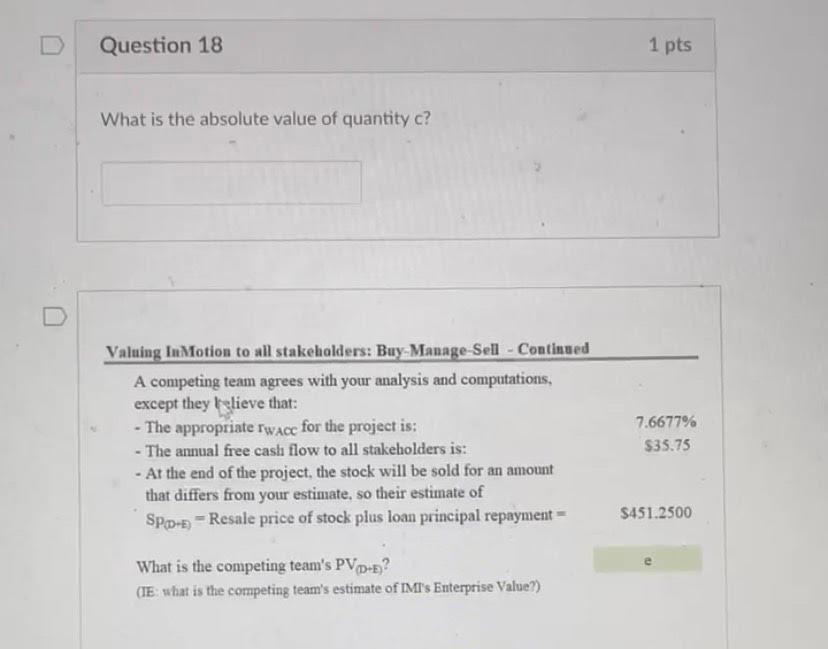

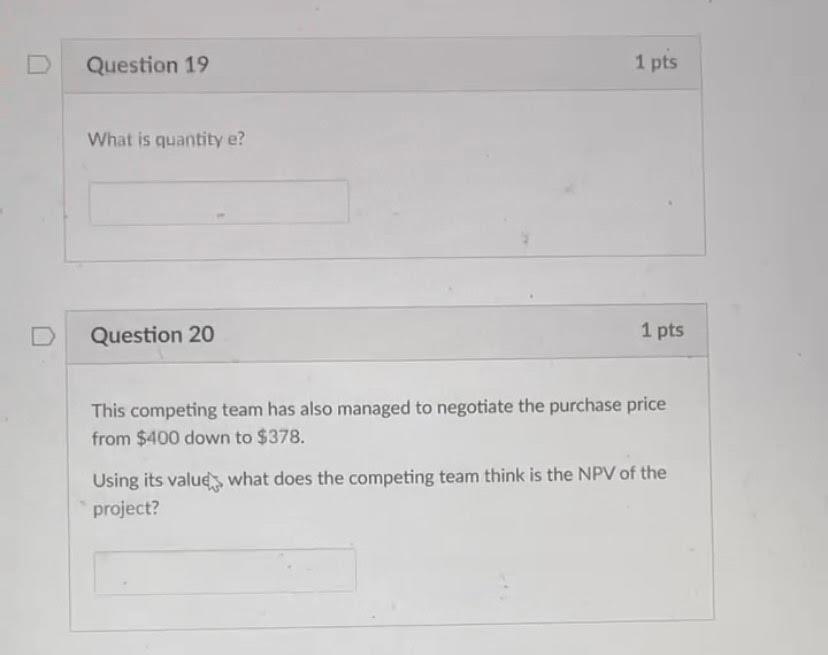

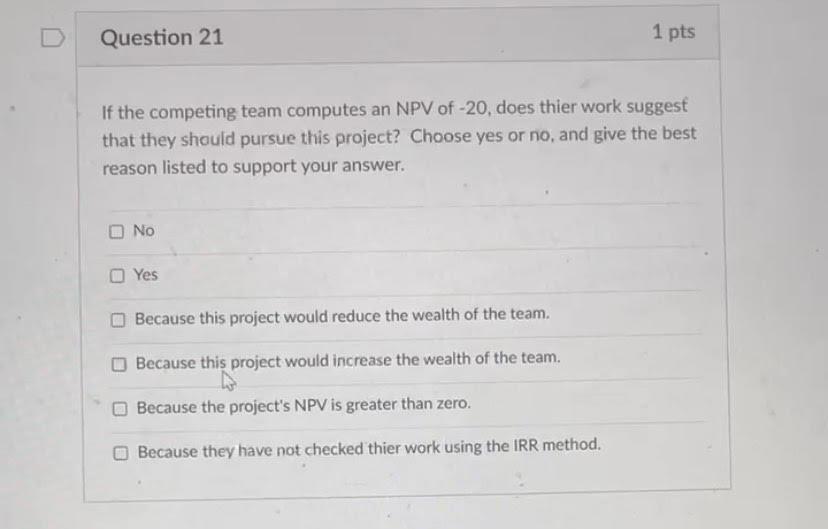

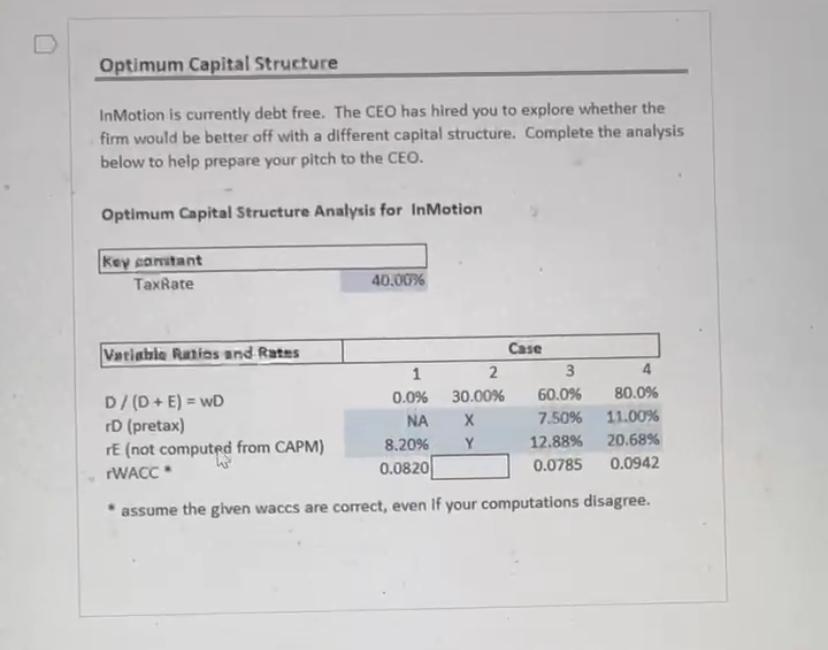

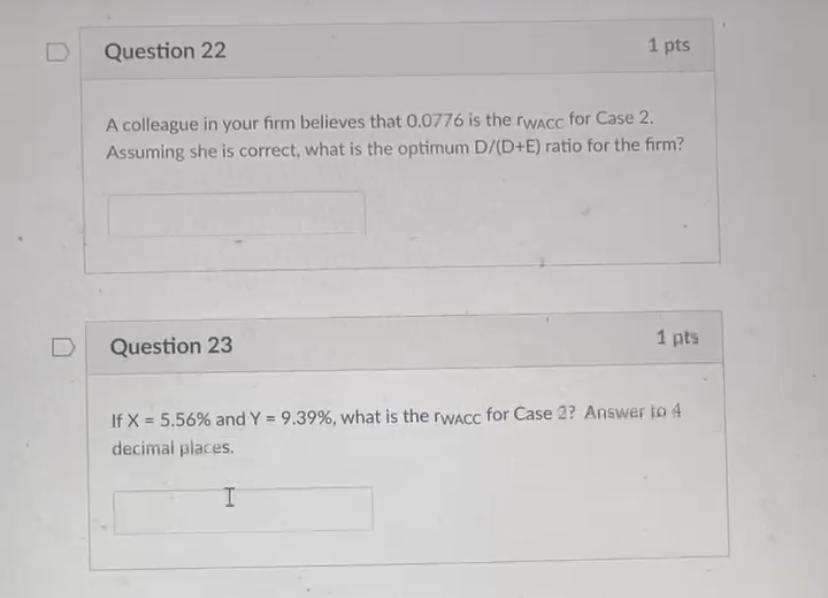

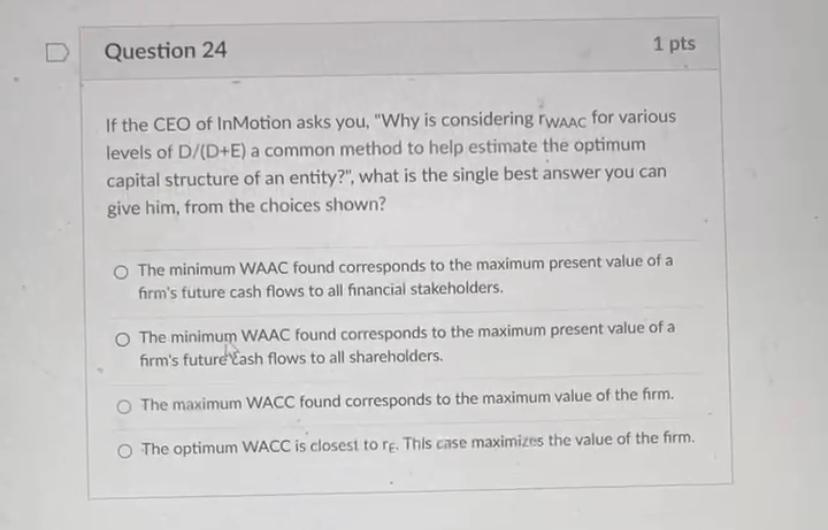

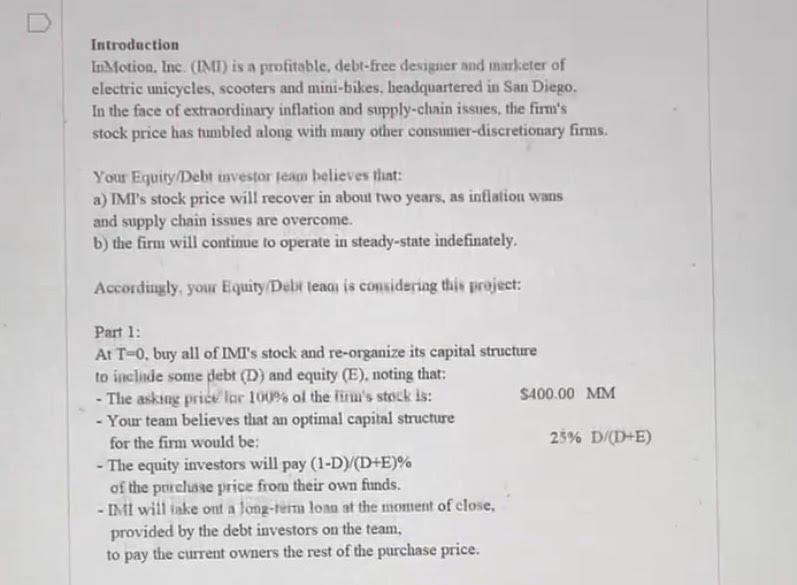

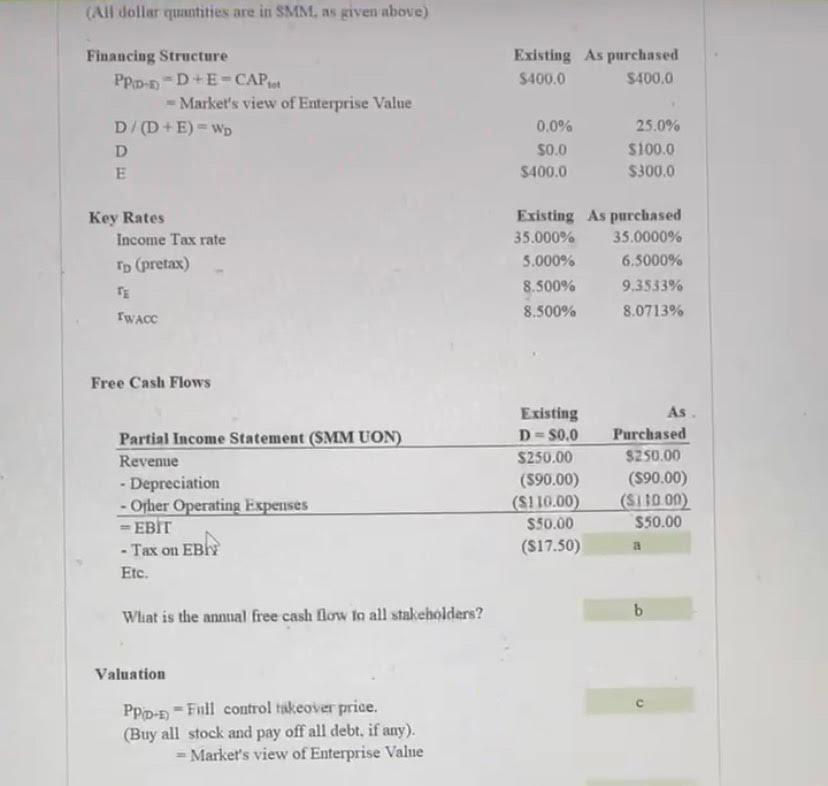

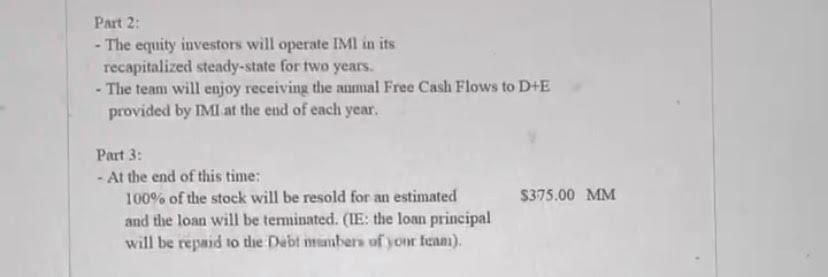

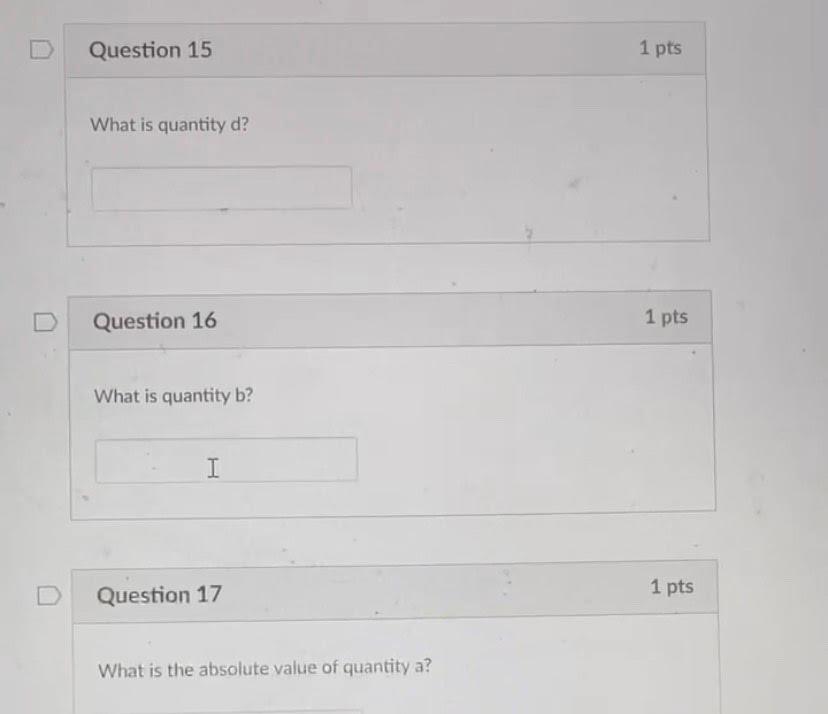

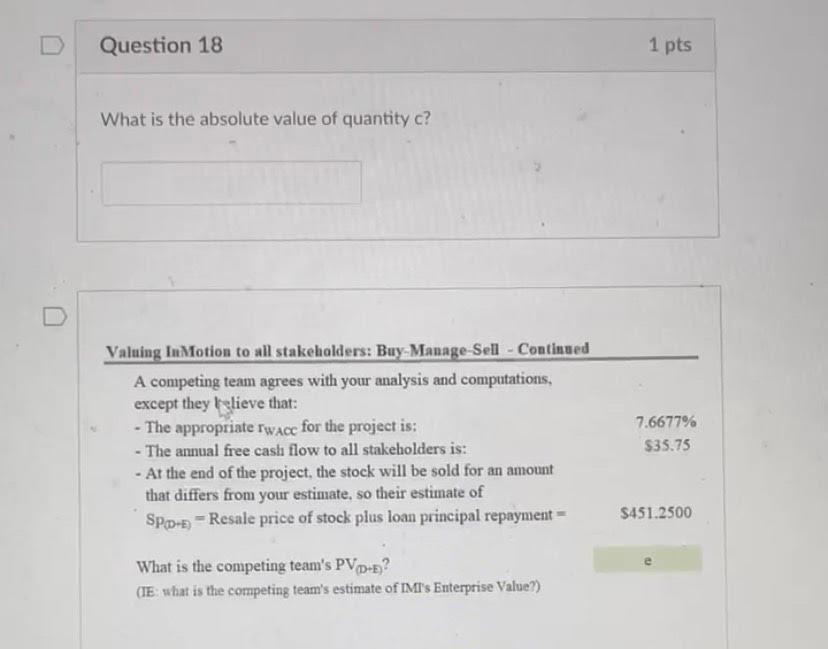

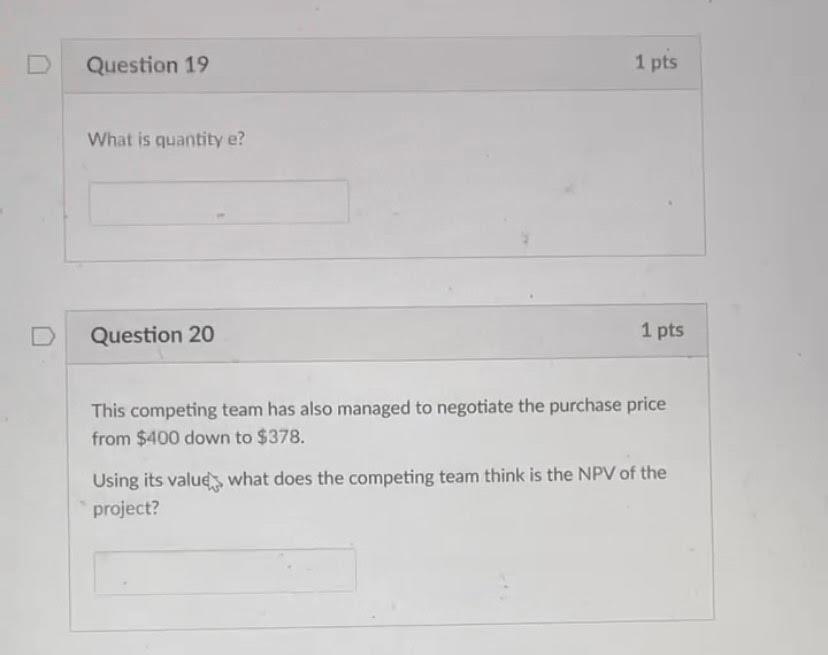

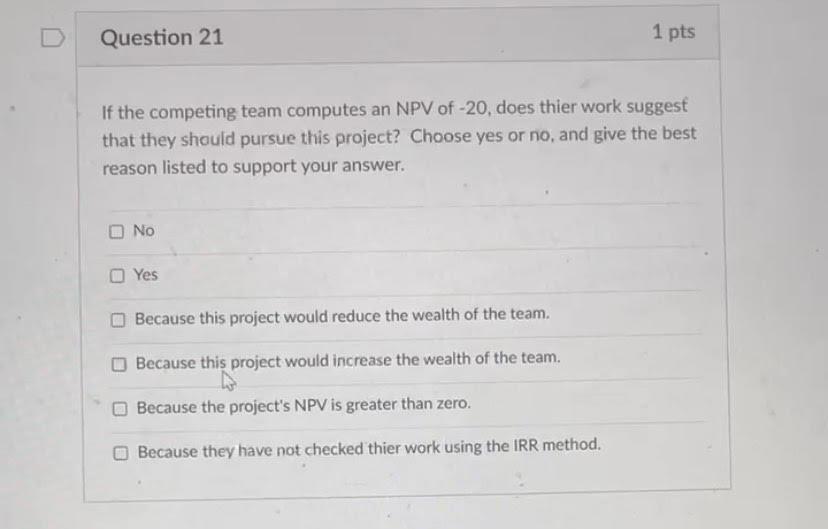

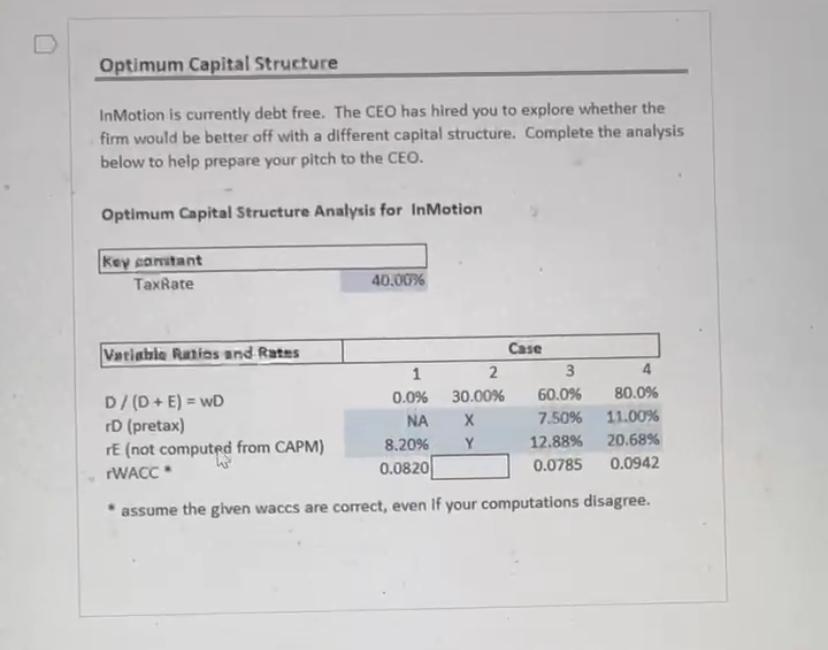

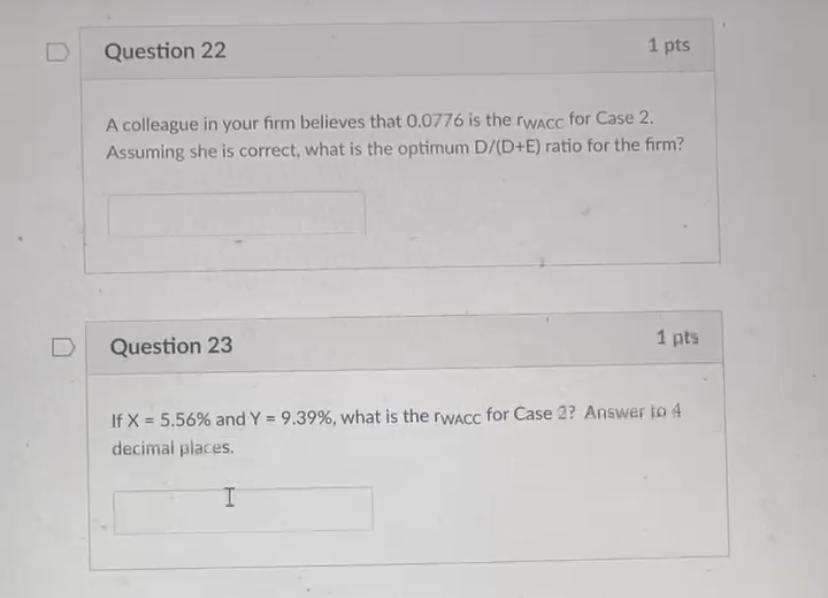

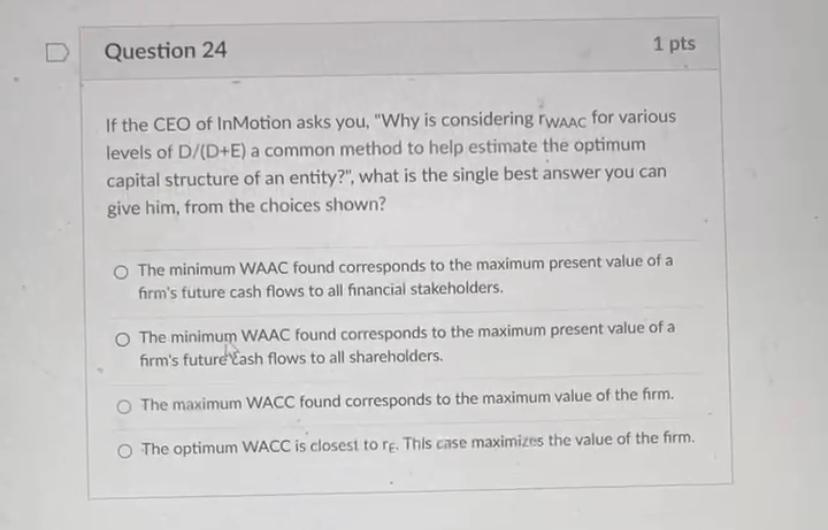

Introduction In Motion, Inc. (INT) is a profitable, debt-free designer and marketer of electric unicycles, scooters and mini-bikes, headquartered in San Diego In the face of extraordinary inflation and supply-chain issues, the firm's stock price has tumbled along with many other consumer-discretionary firms. Your Equity/Debt investor leave believes that: a) IMI's stock price will recover in about two years, as inflation wars and supply chain issues are overcome. b) the firm will contime to operate in steady-state indefinately, Accordingly, your Equity/Debit leach is considering this project: Part 1: At T-0. buy all of IMI's stock and re-organize its capital structure to include some debt (D) and equity (E), noting that: - The asking priclar 100% of the firm's stock is: S400.00 MM - Your team believes that an optimal capital structure for the firm would be: 25% D/(D+E) - The equity investors will pay (1-D)/(D+E)% of the pureluse price from their own funds. - IMI will take ont a long-terma long at the moment of close. provided by the debt investors on the team, to pay the current owners the rest of the purchase price. (All dollar quantities are in SMM. as given above) Existing As purchased $400.0 $400.0 Financing Structure Ppp-n-D+E - CAP - Market's view of Enterprise Value D/(D+E) - WD D E 0.0% $0.0 $400.0 25.0% $100.0 $300.0 Key Rates Income Tax rate To (pretax) TE WAcc Existing As purchased 35.000% 35.0000% 3.000% 6.5000% 8.500% 9.3533% 8.500% 8.0713% Free Cash Flows Partial Income Statement (SMM UON) Revenue - Depreciation - Opher Operating Expenses - EBIT - Tax on EBI Etc. Existing D = $0.0 S250.00 (590.00) (SI 10.00) $50.00 ($17.50) As Purchased $250.00 (590.00) (SHOON) $50.00 b What is the annual free cash flow to all stakeholders? Valuation c Ppp- - Full control makeover price, (Buy all stock and pay off all debt, if any). Market's view of Enterprise Value Part 2: - The equity investors will operate IML in its recapitalized steady-state for two years. The team will enjoy receiving the amal Free Cash Flows to D+E provided by IMI at the end of each year. Part 3: - At the end of this time: 100% of the stock will be resold for an estimated and the loan will be terminated. (IE: the loan principal will be repaid to the Debt member of your fami). 5375.00 MM Question 15 1 pts What is quantity d? D Question 16 1 pts What is quantity b? I 1 pts Question 17 What is the absolute value of quantity a? Question 18 1 pts What is the absolute value of quantity c? Valuing In Motion to all stakeholders: Buy Manage-Sell - Continued A competing team agrees with your analysis and computations, except they lelieve that: - The appropriate rwace for the project is: - The annual free cash flow to all stakeholders is: - At the end of the project, the stock will be sold for an amount that differs from your estimate, so their estimate of SPp-e) - Resale price of stock plus loan principal repayment 7.6677% $35.75 $451.2500 What is the competing team's PVp-? (IE: what is the competing team's estimate of IMI's Enterprise Value?) Question 19 1 pts What is quantity e? D Question 20 1 pts This competing team has also managed to negotiate the purchase price from $400 down to $378. Using its values what does the competing team think is the NPV of the project? Question 21 1 pts If the competing team computes an NPV of -20, does thier work suggest that they should pursue this project? Choose yes or no, and give the best reason listed to support your answer. No Yes Because this project would reduce the wealth of the team. Because this project would increase the wealth of the team. Because the project's NPV is greater than zero. Because they have not checked thier work using the IRR method. Optimum Capital Structure In Motion is currently debt free. The CEO has hired you to explore whether the firm would be better off with a different capital structure. Complete the analysis below to help prepare your pitch to the CEO. Optimum Capital Structure Analysis for InMotion Key constant TaxRate 40.00% Variable Ranies and Rates D/(D+E) = WD rD (pretax) TE (not computed from CAPM) WACC 1 0.0% NA 8.20% 0.0820 Case 2 3 30.00% 60.0% 7.50% Y 12.88% 0.0785 4 80.0% 11.00% 20.68% 0.0942 assume the given waces are correct, even if your computations disagree. Question 22 1 pts A colleague in your firm believes that 0.0776 is the rwacc for Case 2. Assuming she is correct, what is the optimum D/(D+E) ratio for the firm? 1 pts Question 23 If X = 5.56% and Y = 9.39%, what is the rwacc for Case 2? Answer to 4 decimal places. I Question 24 1 pts If the CEO of InMotion asks you, "Why is considering waac for various levels of D/(D+E) a common method to help estimate the optimum capital structure of an entity?", what is the single best answer you can give him, from the choices shown? O The minimum WAAC found corresponds to the maximum present value of a firm's future cash flows to all financial stakeholders. The minimum WAAC found corresponds to the maximum present value of a firm's future 'Cash flows to all shareholders. The maximum WACC found corresponds to the maximum value of the firm. The optimum WACC is closest to re. This case maximizes the value of the firm. Introduction In Motion, Inc. (INT) is a profitable, debt-free designer and marketer of electric unicycles, scooters and mini-bikes, headquartered in San Diego In the face of extraordinary inflation and supply-chain issues, the firm's stock price has tumbled along with many other consumer-discretionary firms. Your Equity/Debt investor leave believes that: a) IMI's stock price will recover in about two years, as inflation wars and supply chain issues are overcome. b) the firm will contime to operate in steady-state indefinately, Accordingly, your Equity/Debit leach is considering this project: Part 1: At T-0. buy all of IMI's stock and re-organize its capital structure to include some debt (D) and equity (E), noting that: - The asking priclar 100% of the firm's stock is: S400.00 MM - Your team believes that an optimal capital structure for the firm would be: 25% D/(D+E) - The equity investors will pay (1-D)/(D+E)% of the pureluse price from their own funds. - IMI will take ont a long-terma long at the moment of close. provided by the debt investors on the team, to pay the current owners the rest of the purchase price. (All dollar quantities are in SMM. as given above) Existing As purchased $400.0 $400.0 Financing Structure Ppp-n-D+E - CAP - Market's view of Enterprise Value D/(D+E) - WD D E 0.0% $0.0 $400.0 25.0% $100.0 $300.0 Key Rates Income Tax rate To (pretax) TE WAcc Existing As purchased 35.000% 35.0000% 3.000% 6.5000% 8.500% 9.3533% 8.500% 8.0713% Free Cash Flows Partial Income Statement (SMM UON) Revenue - Depreciation - Opher Operating Expenses - EBIT - Tax on EBI Etc. Existing D = $0.0 S250.00 (590.00) (SI 10.00) $50.00 ($17.50) As Purchased $250.00 (590.00) (SHOON) $50.00 b What is the annual free cash flow to all stakeholders? Valuation c Ppp- - Full control makeover price, (Buy all stock and pay off all debt, if any). Market's view of Enterprise Value Part 2: - The equity investors will operate IML in its recapitalized steady-state for two years. The team will enjoy receiving the amal Free Cash Flows to D+E provided by IMI at the end of each year. Part 3: - At the end of this time: 100% of the stock will be resold for an estimated and the loan will be terminated. (IE: the loan principal will be repaid to the Debt member of your fami). 5375.00 MM Question 15 1 pts What is quantity d? D Question 16 1 pts What is quantity b? I 1 pts Question 17 What is the absolute value of quantity a? Question 18 1 pts What is the absolute value of quantity c? Valuing In Motion to all stakeholders: Buy Manage-Sell - Continued A competing team agrees with your analysis and computations, except they lelieve that: - The appropriate rwace for the project is: - The annual free cash flow to all stakeholders is: - At the end of the project, the stock will be sold for an amount that differs from your estimate, so their estimate of SPp-e) - Resale price of stock plus loan principal repayment 7.6677% $35.75 $451.2500 What is the competing team's PVp-? (IE: what is the competing team's estimate of IMI's Enterprise Value?) Question 19 1 pts What is quantity e? D Question 20 1 pts This competing team has also managed to negotiate the purchase price from $400 down to $378. Using its values what does the competing team think is the NPV of the project? Question 21 1 pts If the competing team computes an NPV of -20, does thier work suggest that they should pursue this project? Choose yes or no, and give the best reason listed to support your answer. No Yes Because this project would reduce the wealth of the team. Because this project would increase the wealth of the team. Because the project's NPV is greater than zero. Because they have not checked thier work using the IRR method. Optimum Capital Structure In Motion is currently debt free. The CEO has hired you to explore whether the firm would be better off with a different capital structure. Complete the analysis below to help prepare your pitch to the CEO. Optimum Capital Structure Analysis for InMotion Key constant TaxRate 40.00% Variable Ranies and Rates D/(D+E) = WD rD (pretax) TE (not computed from CAPM) WACC 1 0.0% NA 8.20% 0.0820 Case 2 3 30.00% 60.0% 7.50% Y 12.88% 0.0785 4 80.0% 11.00% 20.68% 0.0942 assume the given waces are correct, even if your computations disagree. Question 22 1 pts A colleague in your firm believes that 0.0776 is the rwacc for Case 2. Assuming she is correct, what is the optimum D/(D+E) ratio for the firm? 1 pts Question 23 If X = 5.56% and Y = 9.39%, what is the rwacc for Case 2? Answer to 4 decimal places. I Question 24 1 pts If the CEO of InMotion asks you, "Why is considering waac for various levels of D/(D+E) a common method to help estimate the optimum capital structure of an entity?", what is the single best answer you can give him, from the choices shown? O The minimum WAAC found corresponds to the maximum present value of a firm's future cash flows to all financial stakeholders. The minimum WAAC found corresponds to the maximum present value of a firm's future 'Cash flows to all shareholders. The maximum WACC found corresponds to the maximum value of the firm. The optimum WACC is closest to re. This case maximizes the value of the firm