Answered step by step

Verified Expert Solution

Question

1 Approved Answer

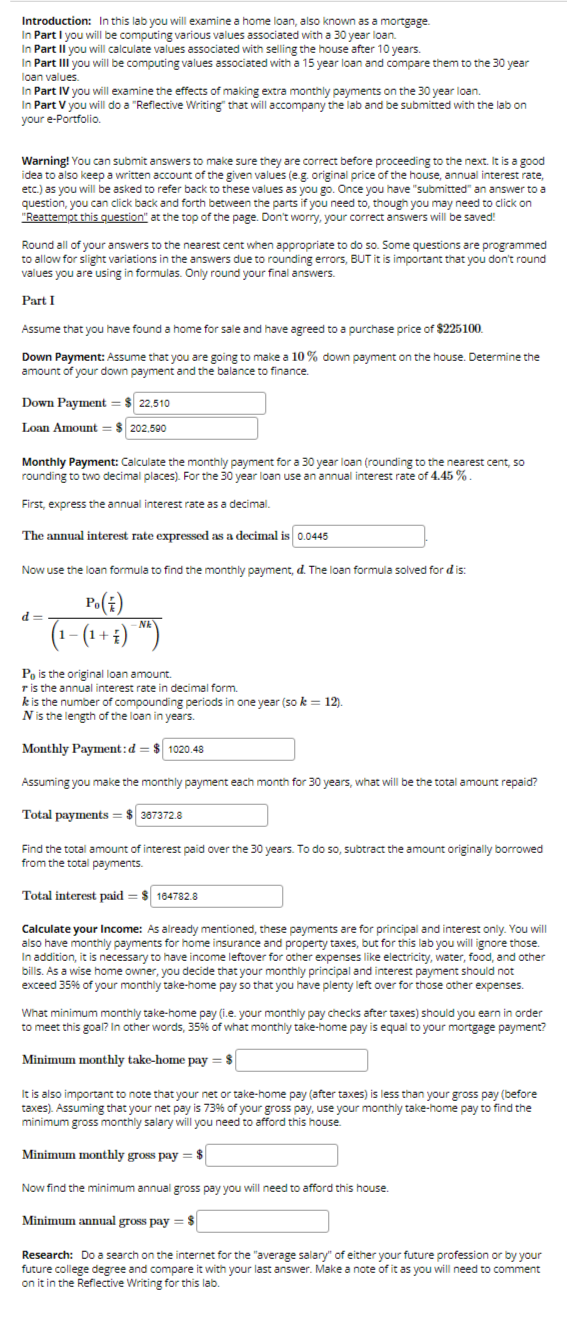

Introduction: In this lab you will examine a home loan, also known as a mortgage. In Part I you will be computing various values associated

Introduction: In this lab you will examine a home loan, also known as a mortgage.

In Part I you will be computing various values associated with a year loan.

In Part II you will calculate values associated with selling the house after years.

In Part III you will be computing values associated with a year loan and compare them to the year

loan values.

In Part IV you will examine the effects of making extra monthly payments on the year loan.

In Part you will do a "Reflective Writing" that will accompany the lab and be submitted with the lab on

your ePortfolio.

Warning! You can submit answers to make sure they are correct before proceeding to the next. It is a good

idea to also keep a written account of the given values eg original price of the house, annual interest rate,

etc. as you will be asked to refer back to these values as you go Once you have "submitted" an answer to a

question, you can click back and forth between the parts if you need to though you may need to click on

"Reattempt this question" at the top of the page. Don't worry, your correct answers will be saved!

Round all of your answers to the nearest cent when appropriate to do so Some questions are programmed

to allow for slight variations in the answers due to rounding errors, BUT it is important that you don't round

values you are using in formulas. Only round your final answers.

Part I

Assume that you have found a home for sale and have agreed to a purchase price of $

Down Payment: Assume that you are going to make a down payment on the house. Determine the

amount of your down payment and the balance to finance.

Down Payment

Loan Amount $

Monthly Payment: Calculate the monthly payment for a year loan rounding to the nearest cent,

rounding to two decimal places For the year loan use an annual interest rate of

First, express the annual interest rate as a decimal.

The annual interest rate expressed as a decimal i:

Now use the loan formula to find the monthly payment, The loan formula solved for is:

is the original loan amount.

is the annual interest rate in decimal form.

is the number of compounding periods in one year so

is the length of the loan in years.

Monthly Payment:

Assuming you make the monthly payment each month for years, what will be the total amount repaid?

Total payments

Find the total amount of interest paid over the years. To do so subtract the amount originally borrowed

from the total payments.

Total interest paid $

Calculate your Income: As already mentioned, these payments are for principal and interest only. You will

also have monthly payments for home insurance and property taxes, but for this lab you will ignore those.

In addition, it is necessary to have income leftover for other expenses like electricity, water, food, and other

bills. As a wise home owner, you decide that your monthly principal and interest payment should not

exceed of your monthly takehome pay so that you have plenty left over for those other expenses.

What minimum monthly takehome pay ie your monthly pay checks after taxes should you earn in order

to meet this goal? In other words, of what monthly takehome pay is equal to your mortgage payment?

Minimum monthly takehome pay $

It is also important to note that your net or takehome pay after taxes is less than your gross pay before

taxes Assuming that your net pay is of your gross pay, use your monthly takehome pay to find the

minimum gross monthly salary will you need to afford this house.

Minimum monthly gross pay $

Now find the minimum annual gross pay you will need to afford this house.

Minimum annual gross pay $

Research: Do a search on the internet for the "average salary" of either your future profession or by your

future college degree and compare it with your last answer. Make a note of it as you will need to comment

on it in the Reflective Writing for this lab.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started