Question

Introduction: Take-Two Grand Theft Auto is the sixth best-selling video game franchise of all time and easily ranks among the most controversial as well. The

Introduction: Take-Two

Grand Theft Auto

is the sixth best-selling video game franchise of all time and easily ranks

among the most controversial as well. The games adult content has resulted in caustic and

unrelenting criticism by prominent politicians, public service organizations, and major media

outlets. Despite that criticism,

Grand Theft Auto

has been hugely profitable for Take-Two

Interactive Software, Inc., its maker and distributor. Take-Two was founded in 1993 by 21-year-

old Ryan Brant, the son of a billionaire businessman.

An SEC investigation of Take-Twos financial statements resulted in the company being

forced to issue restated financial statements twice in two years shortly after the turn of the century.

Then, just a few years later, Take-Two was caught up in the huge options backdating scandal

and forced to restate its financial statements a third time. This case focuses on the underlying

cause of the initial restatement, which was primarily a series of fraudulent sales transactions

booked by the company in 2000 and 2001. Take-Two executives recorded those sham sales

transactions to ensure that the company met or surpassed its consensus quarterly earnings forecasts

established by Wall Street analysts.

Take-Twos longtime audit firm, PwC, was also caught up in the companys financial

reporting scandal. One of many SEC enforcement releases issued regarding that scandal focused

on the alleged misconduct of Robert Fish, the PwC partner who had supervised the 1994 through

2001 Take-Two audits. In particular, the SEC criticized the audit tests applied to Take-Twos

domestic receivables by Fish and his subordinates. In addition, the PwC auditors were chastised

by the SEC for their alleged failure to properly audit Take-Twos reserve for sales returns.

An interesting feature of this case is the close relationship between Robert Fish and Ryan Brant.

In addition to serving as the Take-Two audit engagement partner, Fish was apparently the much

younger Brants most trusted business advisor. In fact, in an interview with a business publication

Fish suggested that he and Brant effectively had a father-son type relationship. Also interesting is

the fact that PwC sharply discounted the professional fees that it charged Take-Two. Those

discounted fees almost certainly helped to cement PwCs relationship with the rapidly growing

company.

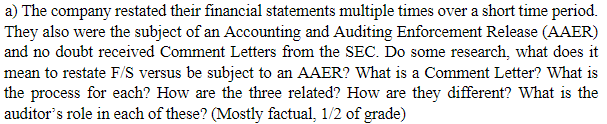

NEED ANSWER TO QUESTIONS IN PIC

a) The company restated their financial statements multiple times over a short time period. They also were the subject of an Accounting and Auditing Enforcement Release (AAER) and no doubt received Comment Letters from the SEC. Do some research, what does it mean to restate F/S versus be subject to an AAER? What is a Comment Letter? What is auditor's role in each of these? (Mostly factual, 1/2 of grade) a) The company restated their financial statements multiple times over a short time period. They also were the subject of an Accounting and Auditing Enforcement Release (AAER) and no doubt received Comment Letters from the SEC. Do some research, what does it mean to restate F/S versus be subject to an AAER? What is a Comment Letter? What is auditor's role in each of these? (Mostly factual, 1/2 of grade)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started