Answered step by step

Verified Expert Solution

Question

1 Approved Answer

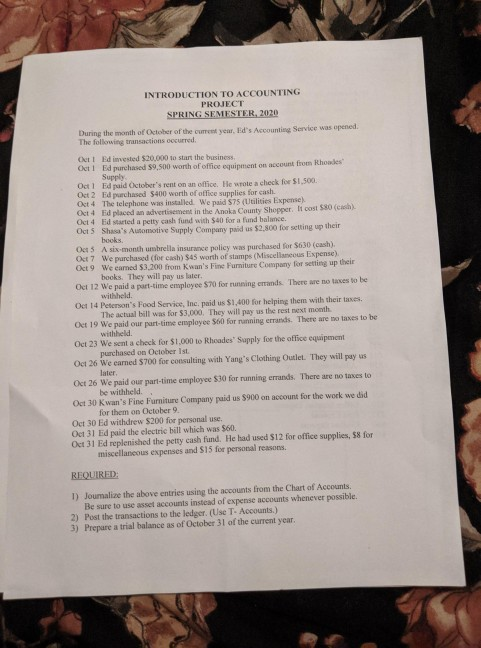

INTRODUCTION TO ACCOUNTING PROJECT SPRING SEMESTER, 2020 During the month of October of the current year, Id's Accounting Service was opened. The following transactions occurred.

INTRODUCTION TO ACCOUNTING PROJECT SPRING SEMESTER, 2020 During the month of October of the current year, Id's Accounting Service was opened. The following transactions occurred. Chet! dimested $20,000 to start the business Oct! Ed purchased 9.500 worth of office equipment on account from Rhodes Supply OctFaraid October's rent on an office. He wrote a check for $1.500 Oct 2 durchased $400 worth of office supplies for cash. Ost The telephone wis installed. We paid $75 (Utilities Expense) Oct 4 d placed an advertisement in the Anoka County Shopper It cost SSO (cash) Oct 4 Bd Marted a petty cash fund with $40 for a fund balance. Oct 5 Shaa's Automotive Supply Company paid us $2.500 for setting up their books. Octs A six-month umbrella insurance policy was purchased for $630 (cash). Oct 7 We purchased for cash) $45 worth of stamps (Miscellaneous Expense) Oct 9 We earned $3,200 from Kwan's Fine Furniture Company for setting up their books. They will pay us later. Oct 12 We paid a part-time employee 570 for running errands. There are no taxes to be withheld. Oct 14 Peterson's Food Service, Inc. paid us $1,400 for helping them with their taxes. The actual bill was for $3.000. They will pay us the rest next month. Oct 19 We paid our part-time employee Soo for running errands. There are no taxes to be withheld. Oct 23 We sent a check for $1,000 to Rhoades' Supply for the office equipment purchased on October 1st. Oct 26 We earned $700 for consulting with Yang's Clothing Outlet. They will pay us Oct 26 We paid our part-time employee $30 for running errands. There are no taxes to be withheld Oct 30 Kwan's Fine Furniture Company paid us $900 on account for the work we did for them on October 9. Oct 30 Ed withdrew $200 for personal use. Oct 31 Ed paid the electric bill which was $60. Oct 31 Ed replenished the petty cash fund. He had used $12 for office supplies, 58 for miscellaneous expenses and S15 for personal reasons. REQUIRED: Be sure to use asset accounts instead of expense accounts whenever possible. 2) Post the transactions to the ledger (Use T- Accounts.) 3) Prepare a trial balance as of October 31 of the current year. INTRODUCTION TO ACCOUNTING PROJECT SPRING SEMESTER, 2020 During the month of October of the current year, Id's Accounting Service was opened. The following transactions occurred. Chet! dimested $20,000 to start the business Oct! Ed purchased 9.500 worth of office equipment on account from Rhodes Supply OctFaraid October's rent on an office. He wrote a check for $1.500 Oct 2 durchased $400 worth of office supplies for cash. Ost The telephone wis installed. We paid $75 (Utilities Expense) Oct 4 d placed an advertisement in the Anoka County Shopper It cost SSO (cash) Oct 4 Bd Marted a petty cash fund with $40 for a fund balance. Oct 5 Shaa's Automotive Supply Company paid us $2.500 for setting up their books. Octs A six-month umbrella insurance policy was purchased for $630 (cash). Oct 7 We purchased for cash) $45 worth of stamps (Miscellaneous Expense) Oct 9 We earned $3,200 from Kwan's Fine Furniture Company for setting up their books. They will pay us later. Oct 12 We paid a part-time employee 570 for running errands. There are no taxes to be withheld. Oct 14 Peterson's Food Service, Inc. paid us $1,400 for helping them with their taxes. The actual bill was for $3.000. They will pay us the rest next month. Oct 19 We paid our part-time employee Soo for running errands. There are no taxes to be withheld. Oct 23 We sent a check for $1,000 to Rhoades' Supply for the office equipment purchased on October 1st. Oct 26 We earned $700 for consulting with Yang's Clothing Outlet. They will pay us Oct 26 We paid our part-time employee $30 for running errands. There are no taxes to be withheld Oct 30 Kwan's Fine Furniture Company paid us $900 on account for the work we did for them on October 9. Oct 30 Ed withdrew $200 for personal use. Oct 31 Ed paid the electric bill which was $60. Oct 31 Ed replenished the petty cash fund. He had used $12 for office supplies, 58 for miscellaneous expenses and S15 for personal reasons. REQUIRED: Be sure to use asset accounts instead of expense accounts whenever possible. 2) Post the transactions to the ledger (Use T- Accounts.) 3) Prepare a trial balance as of October 31 of the current year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started