Answered step by step

Verified Expert Solution

Question

1 Approved Answer

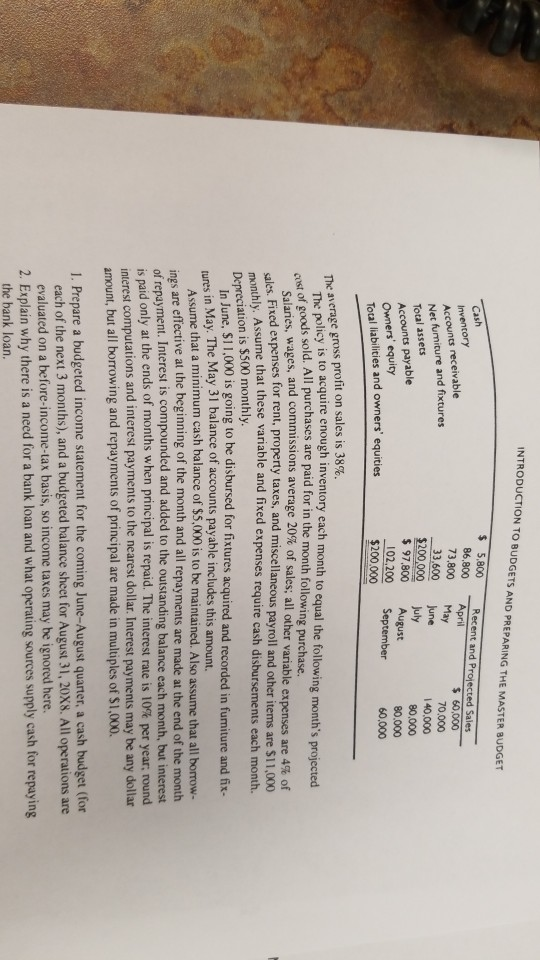

INTRODUCTION TO BUDGETS AND PREPARING THE MASTER BUDGET $ 5,800 86,800 April 73800 May 33,600 June Recent and Projected Sales S 60,000 70.000 40,000 80,000

INTRODUCTION TO BUDGETS AND PREPARING THE MASTER BUDGET $ 5,800 86,800 April 73800 May 33,600 June Recent and Projected Sales S 60,000 70.000 40,000 80,000 Inventory counts receivable Net furniture and fixtures 200000 july Total assets Accounts payable 97,800 August 80.000 ' equity 102,200September Owners Total liabilities and owners' equities $200,000 The average gross profit on sales is 38% The micy i to acquire enough inventory each month to equal the followin st of goods sold. All purchases are paid for in the month following purchase. tory each month to equal the following month's projected Salaries, wages, and commissions average 20% of sales, all other variable expenses are 4% of ales Fixed expenses for rent, property taxes, and miscellaneous payroll and other items are $11,000 aneshiv. Assume that these variable and fixed expenses require cash disbursements each month. Depreciation is $500 monthly ie lune, $11.000 is going to be disbursed for fixtures acquired and recorded in fumiture and fix Assume that a minimum cash balance of $5,000 is to be maintained. Also assume that all borrow ures in May. The May 31 balance of accounts payable includes this amount. ings of repay are effective at the beginning of the month and all repayments are made at the end of the month ment. Interest is compounded and added to the outstanding balance each month, but interest is paid only at the ends of months when principal is repaid. The interest rate is 10% per year, round interest computations and interest payments to the nearest dollar. Interest payments may be any dollar amount, but all borrowing and repayments of principal are made in multiples of $1,000 1. Prepare a budgeted income statement for the coming June-August quarter, a cash budget (for each of the next 3 months), and a budgeted balance sheet for August 31, 20X8. All operations are evaluated on a before-income-tax basis, so income taxes may be ignored here. 2. Explain why there is a need for a bank loan and what operating sources supply cash for repaying the bank loan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started