Answered step by step

Verified Expert Solution

Question

1 Approved Answer

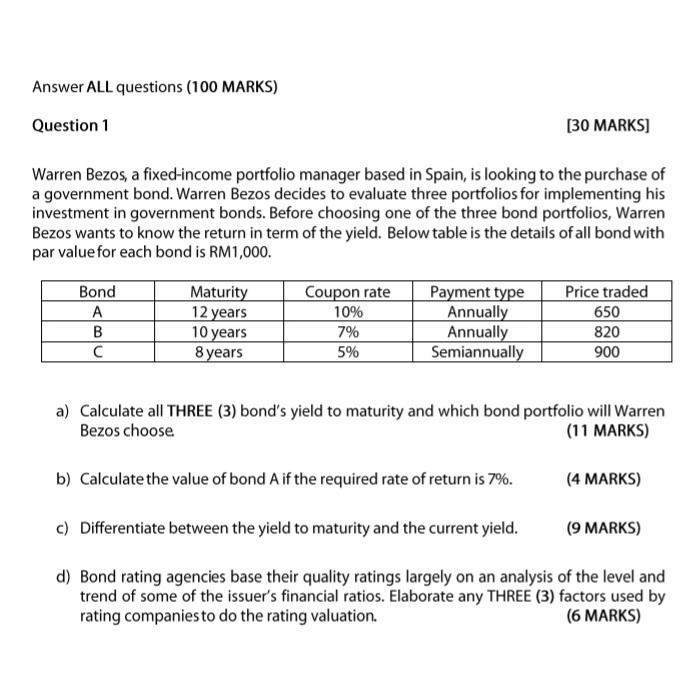

introduction to finance Answer ALL questions (100 MARKS) Question 1 [30 MARKS] Warren Bezos, a fixed-income portfolio manager based in Spain, is looking to the

introduction to finance

Answer ALL questions (100 MARKS) Question 1 [30 MARKS] Warren Bezos, a fixed-income portfolio manager based in Spain, is looking to the purchase of a government bond. Warren Bezos decides to evaluate three portfolios for implementing his investment in government bonds. Before choosing one of the three bond portfolios, Warren Bezos wants to know the return in term of the yield. Below table is the details of all bond with par value for each bond is RM1,000. Bond A B Maturity 12 years 10 years 8 years Coupon rate 10% 7% 5% Payment type Annually Annually Semiannually Price traded 650 820 900 a) Calculate all THREE (3) bond's yield to maturity and which bond portfolio will Warren Bezos choose (11 MARKS) b) Calculate the value of bond Aif the required rate of return is 7%. (4 MARKS) c) Differentiate between the yield to maturity and the current yield. (9 MARKS) d) Bond rating agencies base their quality ratings largely on an analysis of the level and trend of some of the issuer's financial ratios. Elaborate any THREE (3) factors used by rating companies to do the rating valuation. (6 MARKS)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started