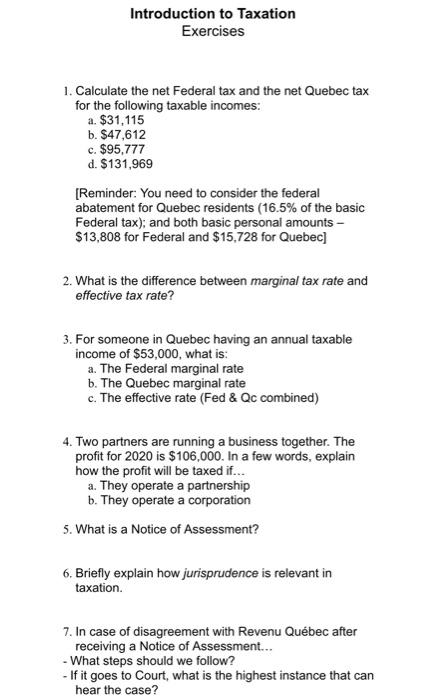

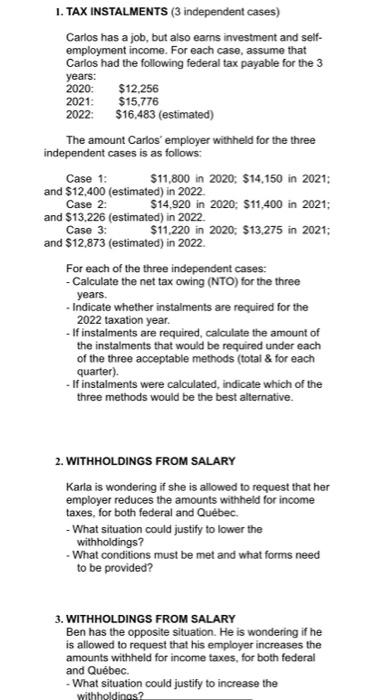

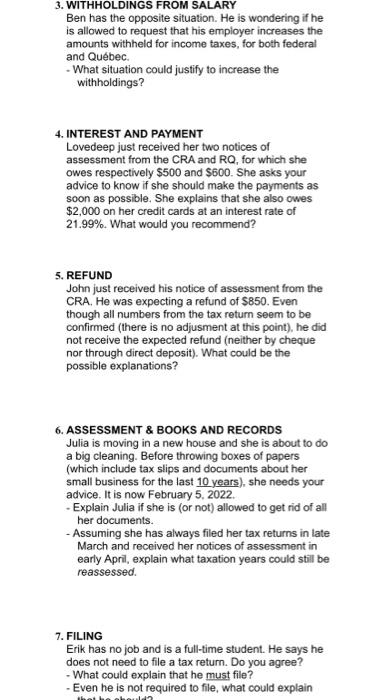

Introduction to Taxation Exercises 1. Calculate the net Federal tax and the net Quebec tax for the following taxable incomes: a. $31,115 b. $47,612 c. $95.777 d. $131,969 [Reminder: You need to consider the federal abatement for Quebec residents (16.5% of the basic Federal tax), and both basic personal amounts - $13,808 for Federal and $15,728 for Quebec] 2. What is the difference between marginal tax rate and effective tax rate? 3. For someone in Quebec having an annual taxable income of $53,000, what is: a. The Federal marginal rate b. The Quebec marginal rate c. The effective rate (Fed & Qc combined) 4. Two partners are running a business together. The profit for 2020 is $106,000. In a few words, explain how the profit will be taxed if... a. They operate a partnership b. They operate a corporation 5. What is a Notice of Assessment? 6. Briefly explain how jurisprudence is relevant in taxation. 7. In case of disagreement with Revenu Qubec after receiving a Notice of Assessment... - What steps should we follow? - If it goes to Court, what is the highest instance that can hear the case? 1. TAX INSTALMENTS (3 independent cases) Carlos has a job, but also earns investment and self- employment income. For each case, assume that Carlos had the following federal tax payable for the 3 years: 2020: $12,256 2021: $15.776 2022: $16,483 (estimated) The amount Carlos' employer withheld for the three independent cases is as follows: Case 1: $11,800 in 2020: $14,150 in 2021; and $12.400 (estimated) in 2022 Case 2: $14.920 in 2020: $11,400 in 2021; and $13.226 (estimated) in 2022 Case 3: $11,220 in 2020: $13,275 in 2021; and $12,873 (estimated) in 2022. For each of the three independent cases: - Calculate the net tax owing (NTO) for the three years. - Indicate whether instalments are required for the 2022 taxation year. - If instalments are required, calculate the amount of the instalments that would be required under each of the three acceptable methods (total & for each quarter). - If instalments were calculated, indicate which of the three methods would be the best alternative. 2. WITHHOLDINGS FROM SALARY Karla is wondering if she is allowed to request that her employer reduces the amounts withheld for income taxes, for both federal and Quebec. - What situation could justify to lower the withholdings? - What conditions must be met and what forms need to be provided? 3. WITHHOLDINGS FROM SALARY Ben has the opposite situation. He is wondering if he is allowed to request that his employer increases the amounts withheld for income taxes, for both federal and Quebec. - What situation could justify to increase the withholdings? 3. WITHHOLDINGS FROM SALARY Ben has the opposite situation. He is wondering if he is allowed to request that his employer increases the amounts withheld for income taxes, for both federal and Qubec - What situation could justify to increase the withholdings? 4. INTEREST AND PAYMENT Lovedeep just received her two notices of assessment from the CRA and RQ, for which she owes respectively $500 and $600. She asks your advice to know if she should make the payments as soon as possible. She explains that she also owes $2,000 on her credit cards at an interest rate of 21.99%. What would you recommend? 5. REFUND John just received his notice of assessment from the CRA. He was expecting a refund of $850. Even though all numbers from the tax return seem to be confirmed (there is no adjusment at this point), he did not receive the expected refund (neither by cheque nor through direct deposit). What could be the possible explanations? 6. ASSESSMENT & BOOKS AND RECORDS Julia is moving in a new house and she is about to do a big cleaning. Before throwing boxes of papers (which include tax slips and documents about her small business for the last 10 years), she needs your advice. It is now February 5, 2022. - Explain Julia if she is (or not) allowed to get rid of all her documents. - Assuming she has always filed her tax returns in late March and received her notices of assessment in early April, explain what taxation years could still be reassessed. 7. FILING Erik has no job and is a full-time student. He says he does not need to file a tax return. Do you agree? - What could explain that he must file? -Even he is not required to file, what could explain