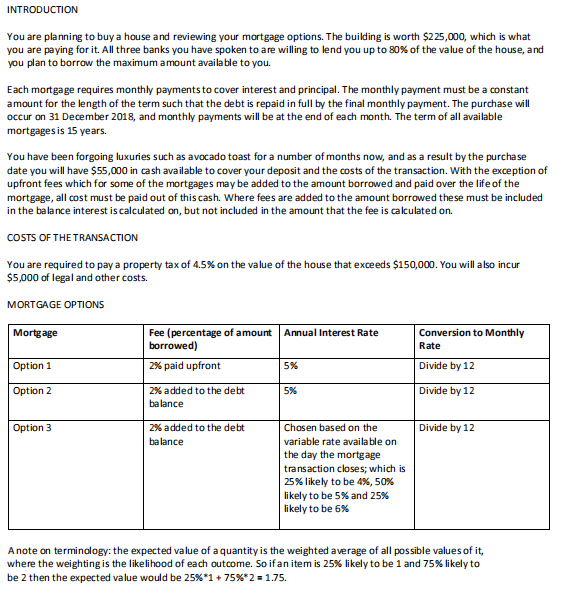

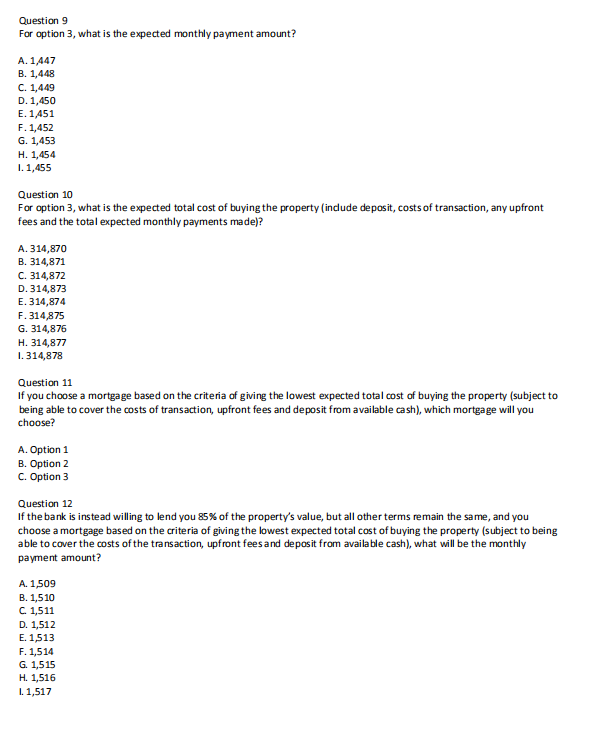

INTRODUCTION You are planning to buy a house and reviewing your mortgage options. The building is worth $225,000, which is what you are paying for it. All three banks you have spoken to are willing to lend you up to 80% of the value of the house, and you plan to borrow the maximum amount available to you. Each mortgage requires monthly payments to cover interest and principal. The monthly payment must be a constant amount for the length of the term such that the debt is repaid in full by the final monthly payment. The purchase will occur on 31 December 2018, and monthly payments will be at the end of each month. The term of all available mortgages is 15 years. You have been forgoing luxuries such as avocado toast for a number of months now, and as a result by the purchase date you will have $55,000 in cash available to cover your deposit and the costs of the transaction. With the exception of upfront fees which for some of the mortgages may be added to the amount borrowed and paid over the life of the mortgage, all cost must be paid out of this cash. Where fees are added to the amount borrowed these must be included in the balance interest is calculated on, but not included in the amount that the fee is calculated on COSTS OF THE TRANSACTION You are required to pay a property tax of 4.5% on the value of the house that exceeds $150,000. You will also incur $5,000 of legal and other costs. MORTGAGE OPTIONS Mortgage Fee (percentage of amount Annual Interest Rate borrowed) Conversion to Monthly Rate Option 1 2% paid upfront Divide by 12 Option 2 Divide by 12 2% added to the debt balance Option 3 Divide by 12 2% added to the debt balance Chosen based on the variable rate available on the day the mortgage transaction closes; which is 25% likely to be 4%, 50% likely to be 5% and 25% likely to be 6% A note on terminology: the expected value of a quantity is the weighted average of all possible values of it, where the weighting is the likelihood of each outcome. So if an item is 25% likely to be 1 and 75% likely to be 2 then the expected value would be 25%*1 +75%*2 = 1.75. Question 9 For option 3, what is the expected monthly payment amount? A. 1,447 B. 1,448 C. 1,449 D. 1,450 E. 1.451 F. 1,452 G. 1,453 H. 1,454 I. 1,455 Question 10 For option 3, what is the expected total cost of buying the property include deposit, costs of transaction, any upfront fees and the total expected monthly payments made)? A. 314,870 B. 314,871 C. 314,872 D. 314,873 E. 314,874 F. 314,875 G. 314,876 H. 314,877 1.314,878 Question 11 If you choose a mortgage based on the criteria of giving the lowest expected total cost of buying the property (subject to being able to cover the costs of transaction, upfront fees and deposit from available cash), which mortgage will you choose? A. Option 1 B. Option 2 C. Option 3 Question 12 If the bank is instead willing to lend you 85% of the property's value, but all other terms remain the same, and you choose a mortgage based on the criteria of giving the lowest expected total cost of buying the property (subject to being able to cover the costs of the transaction, upfront fees and deposit from available cash), what will be the monthly payment amount? A. 1,509 B. 1,510 C. 1,511 D. 1,512 E. 1,513 F. 1,514 G. 1,515 H. 1,516 I. 1,517 INTRODUCTION You are planning to buy a house and reviewing your mortgage options. The building is worth $225,000, which is what you are paying for it. All three banks you have spoken to are willing to lend you up to 80% of the value of the house, and you plan to borrow the maximum amount available to you. Each mortgage requires monthly payments to cover interest and principal. The monthly payment must be a constant amount for the length of the term such that the debt is repaid in full by the final monthly payment. The purchase will occur on 31 December 2018, and monthly payments will be at the end of each month. The term of all available mortgages is 15 years. You have been forgoing luxuries such as avocado toast for a number of months now, and as a result by the purchase date you will have $55,000 in cash available to cover your deposit and the costs of the transaction. With the exception of upfront fees which for some of the mortgages may be added to the amount borrowed and paid over the life of the mortgage, all cost must be paid out of this cash. Where fees are added to the amount borrowed these must be included in the balance interest is calculated on, but not included in the amount that the fee is calculated on COSTS OF THE TRANSACTION You are required to pay a property tax of 4.5% on the value of the house that exceeds $150,000. You will also incur $5,000 of legal and other costs. MORTGAGE OPTIONS Mortgage Fee (percentage of amount Annual Interest Rate borrowed) Conversion to Monthly Rate Option 1 2% paid upfront Divide by 12 Option 2 Divide by 12 2% added to the debt balance Option 3 Divide by 12 2% added to the debt balance Chosen based on the variable rate available on the day the mortgage transaction closes; which is 25% likely to be 4%, 50% likely to be 5% and 25% likely to be 6% A note on terminology: the expected value of a quantity is the weighted average of all possible values of it, where the weighting is the likelihood of each outcome. So if an item is 25% likely to be 1 and 75% likely to be 2 then the expected value would be 25%*1 +75%*2 = 1.75. Question 9 For option 3, what is the expected monthly payment amount? A. 1,447 B. 1,448 C. 1,449 D. 1,450 E. 1.451 F. 1,452 G. 1,453 H. 1,454 I. 1,455 Question 10 For option 3, what is the expected total cost of buying the property include deposit, costs of transaction, any upfront fees and the total expected monthly payments made)? A. 314,870 B. 314,871 C. 314,872 D. 314,873 E. 314,874 F. 314,875 G. 314,876 H. 314,877 1.314,878 Question 11 If you choose a mortgage based on the criteria of giving the lowest expected total cost of buying the property (subject to being able to cover the costs of transaction, upfront fees and deposit from available cash), which mortgage will you choose? A. Option 1 B. Option 2 C. Option 3 Question 12 If the bank is instead willing to lend you 85% of the property's value, but all other terms remain the same, and you choose a mortgage based on the criteria of giving the lowest expected total cost of buying the property (subject to being able to cover the costs of the transaction, upfront fees and deposit from available cash), what will be the monthly payment amount? A. 1,509 B. 1,510 C. 1,511 D. 1,512 E. 1,513 F. 1,514 G. 1,515 H. 1,516 I. 1,517