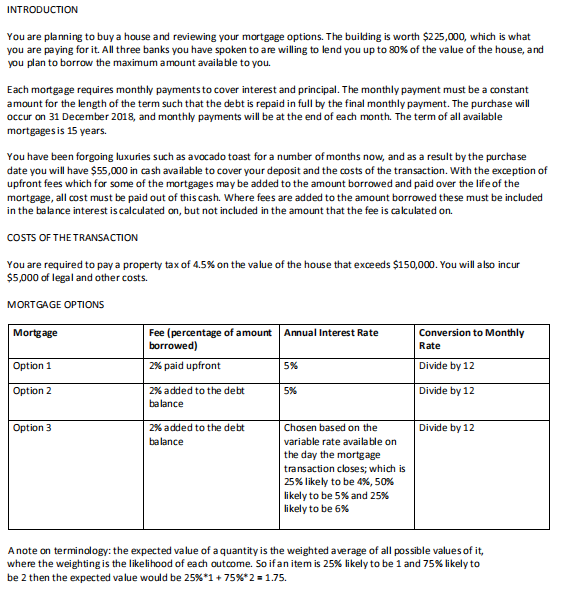

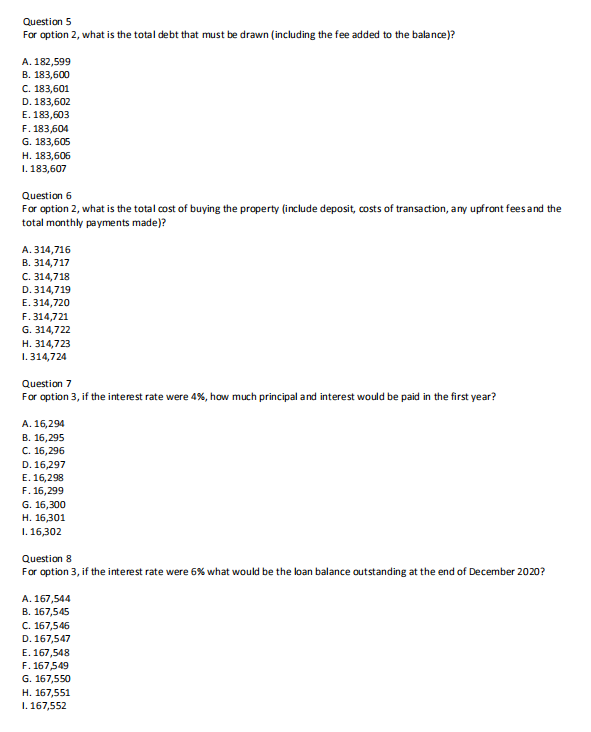

INTRODUCTION You are planning to buy a house and reviewing your mortgage options. The building is worth $225,000, which is what you are paying for it. All three banks you have spoken to are willing to lend you up to 80% of the value of the house, and you plan to borrow the maximum amount available to you. Each mortgage requires monthly payments to cover interest and principal. The monthly payment must be a constant amount for the length of the term such that the debt is repaid in full by the final monthly payment. The purchase will occur on 31 December 2018, and monthly payments will be at the end of each month. The term of all available mortgages is 15 years. You have been forgoing luxuries such as avocado toast for a number of months now, and as a result by the purchase date you will have $55,000 in cash available to cover your deposit and the costs of the transaction. With the exception of upfront fees which for some of the mortgages may be added to the amount borrowed and paid over the life of the mortgage, all cost must be paid out of this cash. Where fees are added to the amount borrowed these must be included in the balance interest is calculated on, but not included in the amount that the fee is calculated on COSTS OF THE TRANSACTION You are required to pay a property tax of 4.5% on the value of the house that exceeds $150,000. You will also incur $5,000 of legal and other costs. MORTGAGE OPTIONS Mortgage Fee (percentage of amount Annual Interest Rate borrowed) Conversion to Monthly Rate Option 1 2% paid upfront Divide by 12 Option 2 Divide by 12 2% added to the debt balance Option 3 Divide by 12 2% added to the debt balance Chosen based on the variable rate available on the day the mortgage transaction closes; which is 25% likely to be 4%, 50% likely to be 5% and 25% likely to be 6% A note on terminology: the expected value of a quantity is the weighted average of all possible values of it, where the weighting is the likelihood of each outcome. So if an item is 25% likely to be 1 and 75% likely to be 2 then the expected value would be 25%*1 +75%*2 = 1.75. Question 5 For option 2, what is the total debt that must be drawn (including the fee added to the balance)? A. 182,599 B. 183,600 C. 183,601 D. 183,602 E. 183,603 F. 183,604 G. 183,605 H. 183,606 1.183,607 Question 6 For option 2, what is the total cost of buying the property (include deposit, costs of transaction, any upfront fees and the total monthly payments made)? A. 314,716 B. 314,717 C. 314,718 D. 314,719 E. 314,720 F. 314,721 G. 314,722 H. 314,723 1.314,724 Question 7 For option 3, if the interest rate were 4%, how much principal and interest would be paid in the first year? A. 16,294 B. 16,295 C. 16,296 D. 16,297 E. 16,298 F. 16,299 G. 16,300 H. 16,301 1. 16,302 Question 8 For option 3, if the interest rate were 6% what would be the loan balance outstanding at the end of December 2020? A. 167,544 B. 167,545 C. 167,546 D. 167,547 E. 167,548 F. 167,549 G. 167,550 H. 167,551 1. 167,552