Answered step by step

Verified Expert Solution

Question

1 Approved Answer

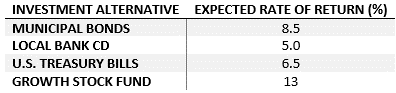

Invana, an individual investor, has $ 3 2 5 , 0 0 0 to invest right before retiring. She is considering the following four investment

Invana, an individual investor, has $ to invest right before retiring. She is considering the following four investment options. The investment options, along with their anticipated rate of return, are identified in the table below:

Each investment alternative has a perceived risk to Invana, so she aims to diversify her portfolio while maximizing the expected return on her investment. She has identified the following guidelines to manage risk in her portfolio:

No more than of the total investment should be in municipal bonds.

The amount invested in the Local Bank CD should not exceed the amount invested in the other three alternatives.

At least of the investment should be on US Treasury Bills and the Local Bank CD

To be safe, more should be invested in the Local Bank CD and the US Treasury Bills than in municipal bonds and the growth stock fund by a ratio of at least to

a Generate a mathematical LP model to address the portfolio selection problem.

i What is the overall expected rate of return for the recommended portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started