Answered step by step

Verified Expert Solution

Question

1 Approved Answer

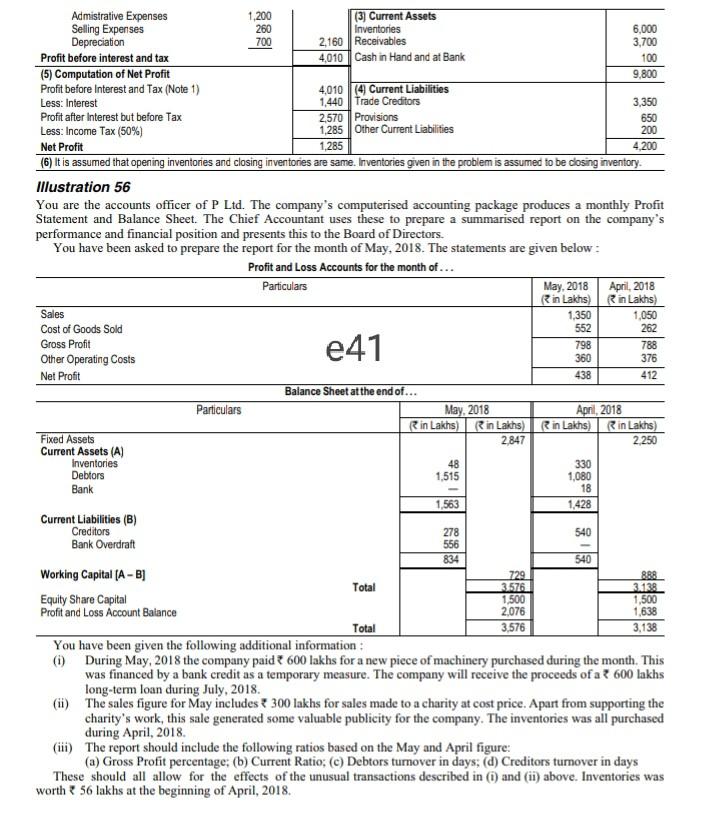

Inventories 700 e41 360 Admistrative Expenses 1,200 (3) Current Assets Selling Expenses 260 6,000 Depreciation 2,160 Receivables 3,700 Profit before interest and tax 4,010 Cash

Inventories 700 e41 360 Admistrative Expenses 1,200 (3) Current Assets Selling Expenses 260 6,000 Depreciation 2,160 Receivables 3,700 Profit before interest and tax 4,010 Cash in Hand and at Bank 100 (5) Computation of Net Profit 9,800 Profit before Interest and Tax (Note 1) 4,010 (4) Current Liabilities Less: Interest 1.440 Trade Creditors 3,350 Profit after Interest but before Tax 2,570 Provisions 650 Less: Income Tax (50%) 1,285 Other Current Liabilities 200 Net Profit 1.285 4,200 (6) It is assumed that opening inventories and closing inventories are same. Inventories given in the problem is assumed to be closing inventory. Illustration 56 You are the accounts officer of P Ltd. The company's computerised accounting package produces a monthly Profit Statement and Balance Sheet. The Chief Accountant uses these to prepare a summarised report on the company's performance and financial position and presents this to the Board of Directors. You have been asked to prepare the report for the month of May, 2018. The statements are given below: Profit and Loss Accounts for the month of... Particulars May, 2018 April, 2018 in Lakhs) in Lakhs) Sales 1,350 1.050 Cost of Goods Sold 552 262 Gross Profit 798 788 Other Operating Costs 376 Net Profit 438 412 Balance Sheet at the end of... Particulars May, 2018 April, 2018 Rin Lakhs) in Lakhs) Rin Lakhs) Rin Lakhs) Fixed Assets 2 847 2.250 Current Assets (A) Inventories 48 330 Debtors 1,515 1,080 Bank 18 1,563 1,428 Current Liabilities (B) Creditors 278 Bank Overdraft 556 834 540 Working Capital (A - B 729 BRS 3576 3128 Equity Share Capital 1,500 1,500 Profit and Loss Account Balance 2,076 1,638 Total 3,576 3,138 You have been given the following additional information: (0) During May, 2018 the company paid 600 lakhs for a new piece of machinery purchased during the month. This was financed by a bank credit as a temporary measure. The company will receive the proceeds of a 600 lakhs long-term loan during July, 2018. (ii) The sales figure for May includes 300 lakhs for sales made to a charity at cost price. Apart from supporting the charity's work, this sale generated some valuable publicity for the company. The inventories was all purchased during April, 2018 (ii) The report should include the following ratios based on the May and April figure: (a) Gross Profit percentage; (b) Current Ratio: (e) Debtors tumover in days; (d) Creditors tumover in days These should all allow for the effects of the unusual transactions described in (1) and (ii) above. Inventories was worth 56 lakhs at the beginning of April, 2018. 540 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started