Question

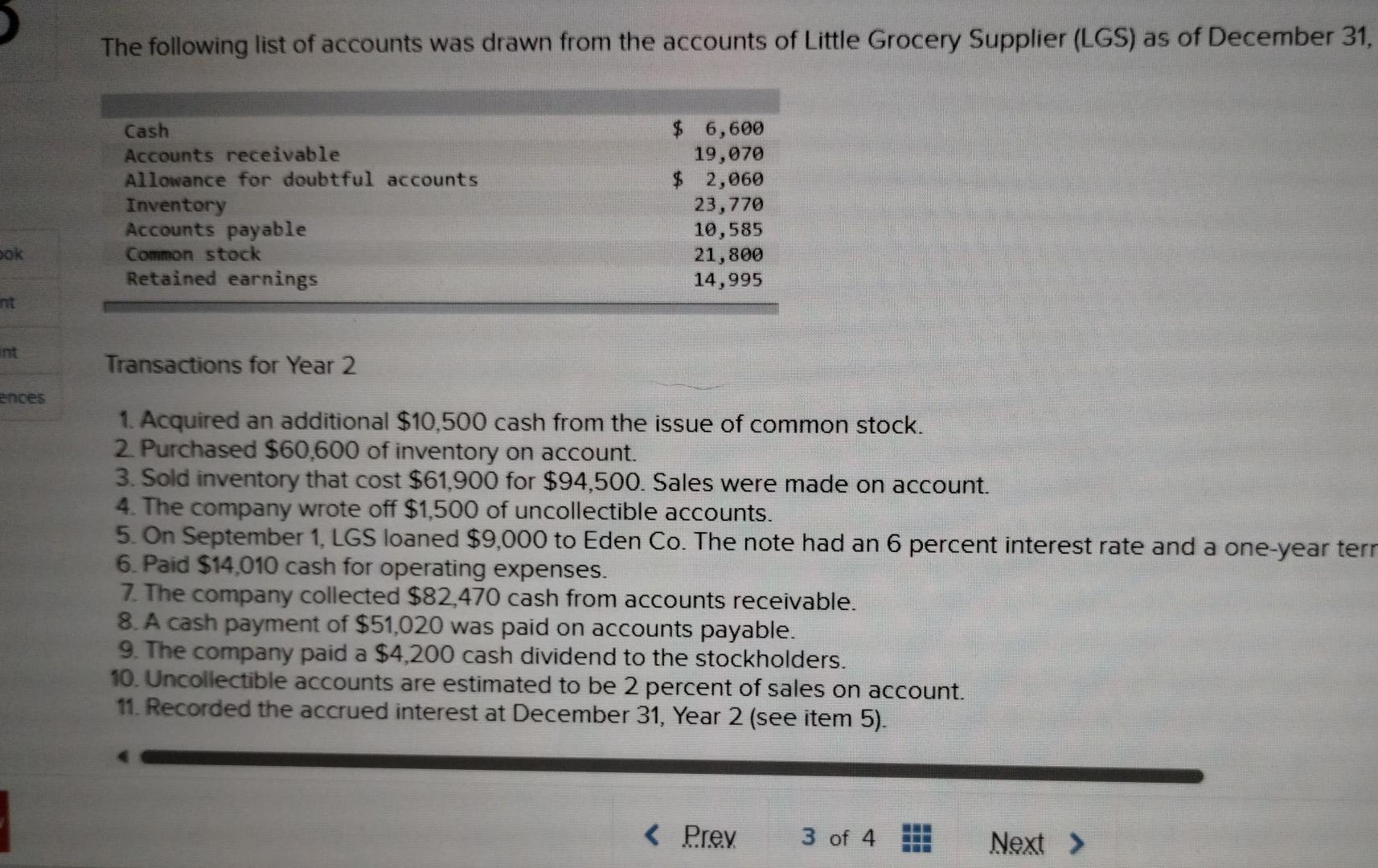

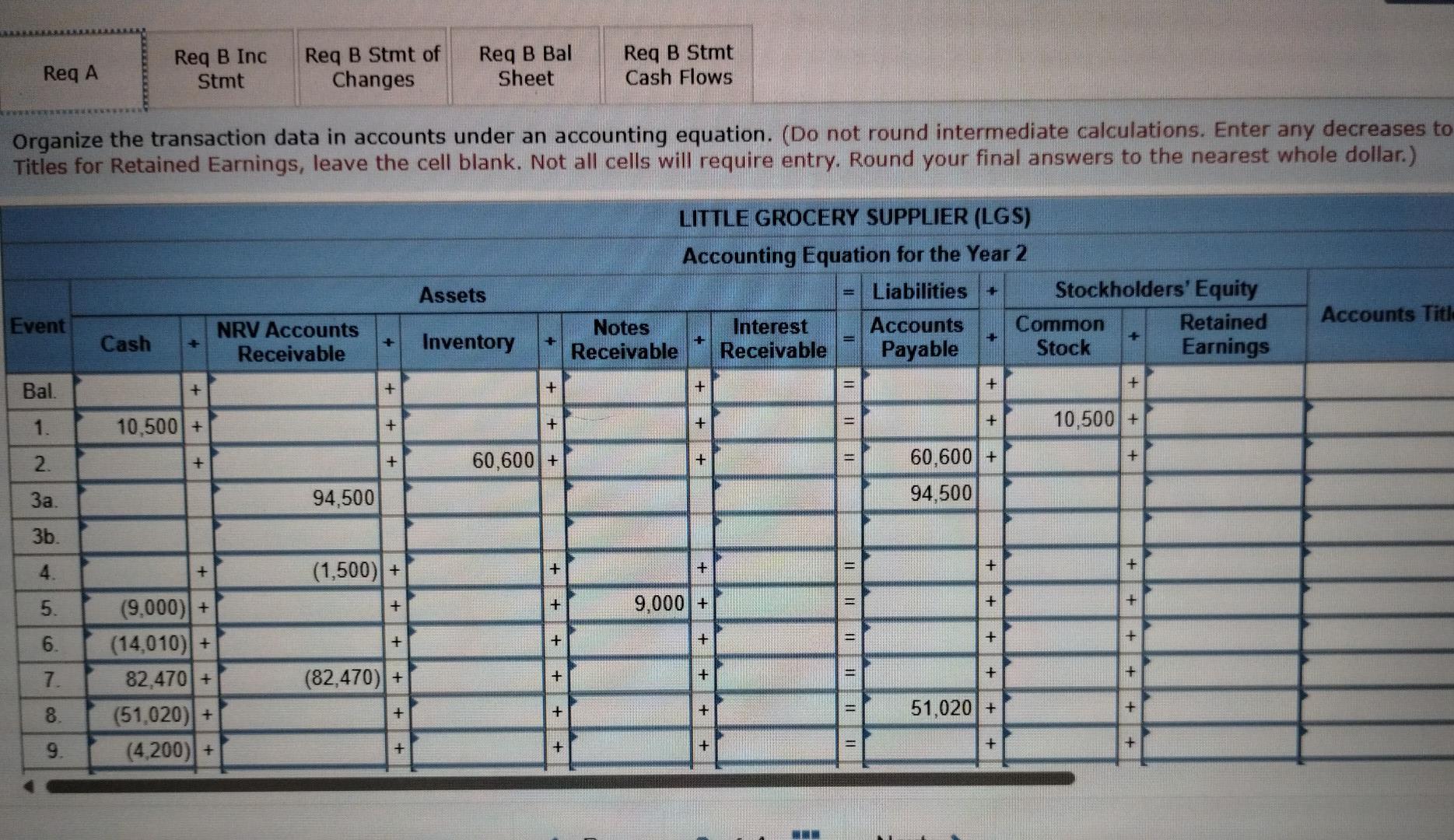

Inventory Accounts payable Common stock Retained earnings 23,770 10,585 21,800 14,995 Transactions for Year 2 1. Acquired an additional $10,500 cash from the issue of

Inventory

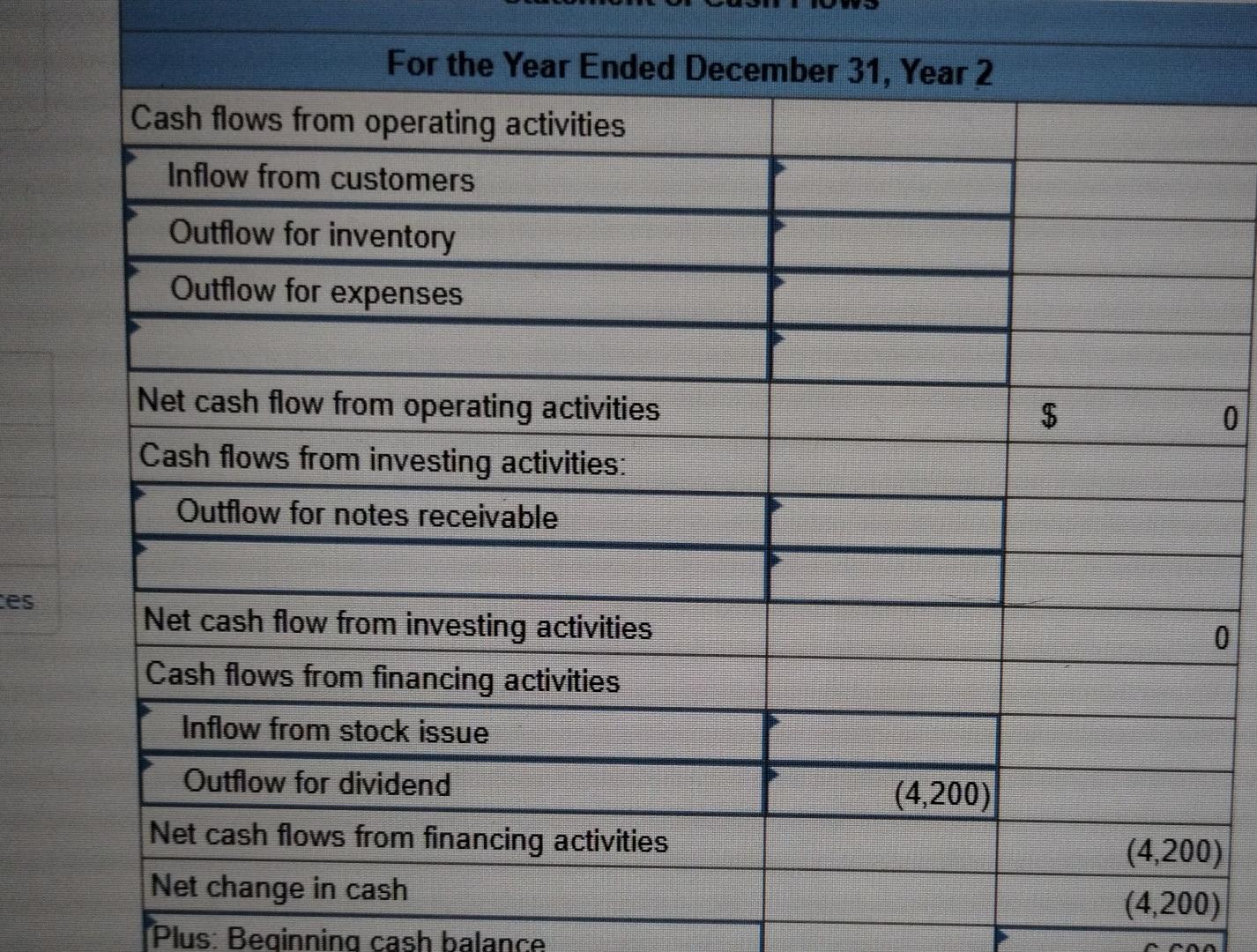

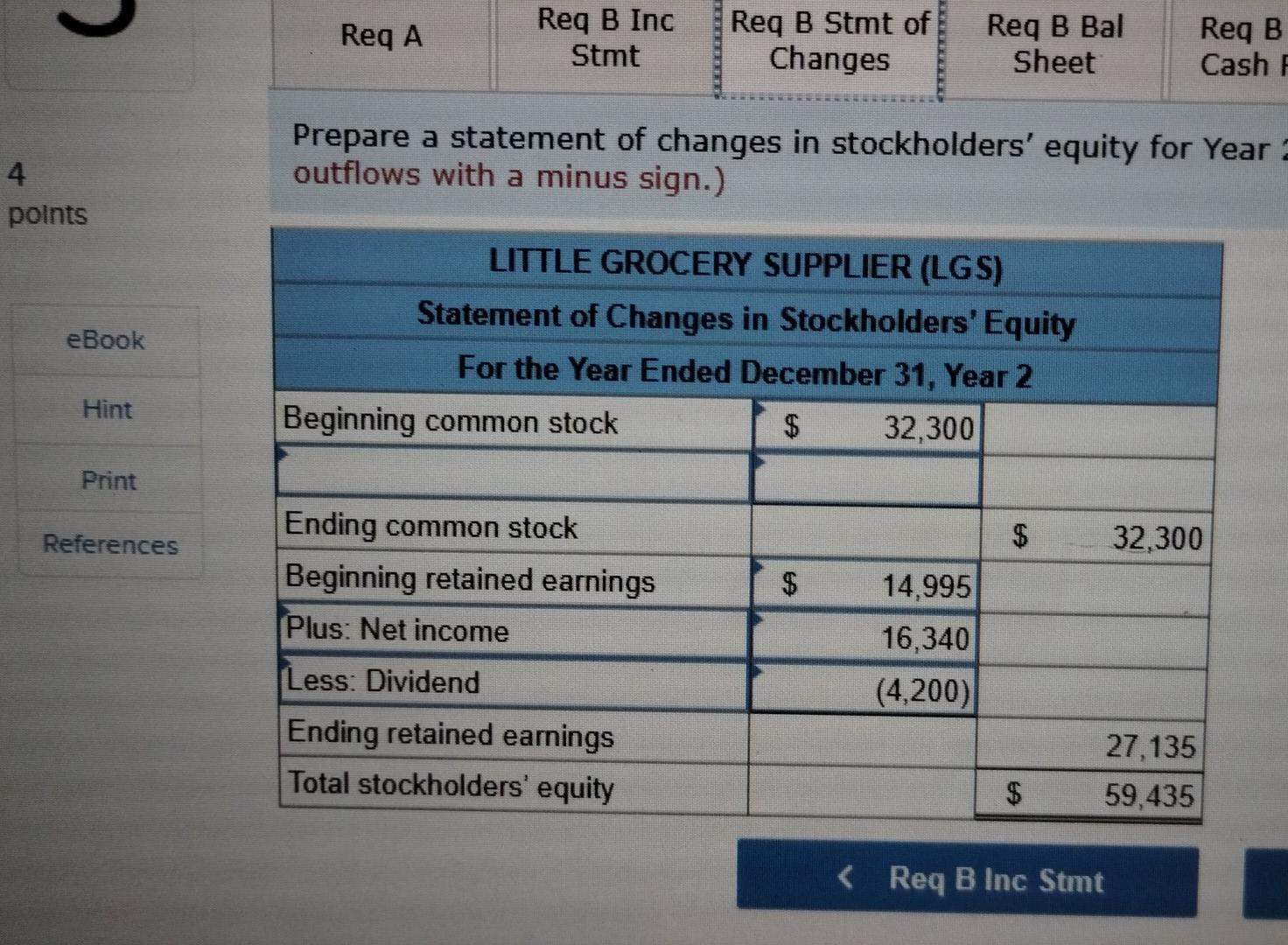

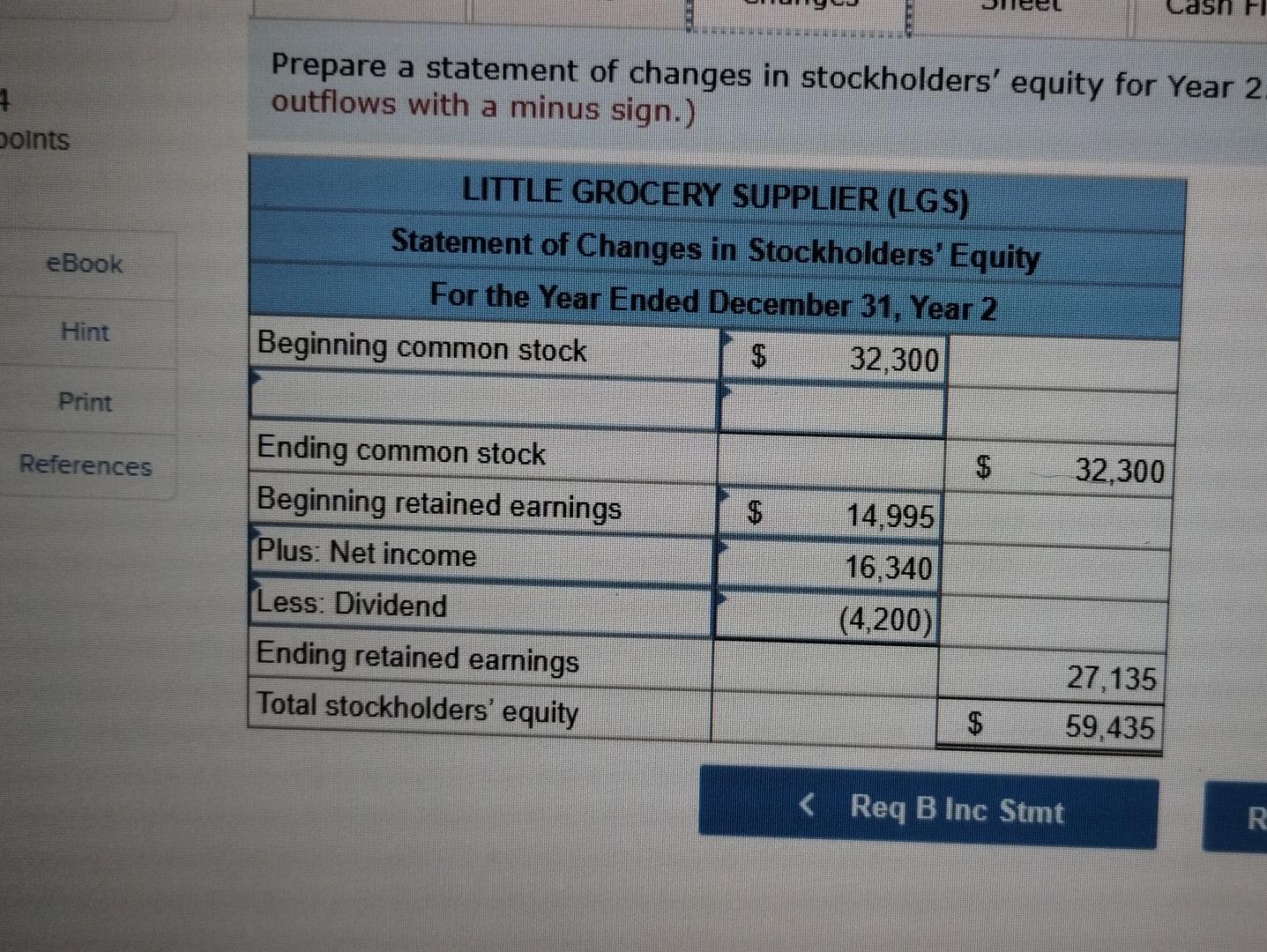

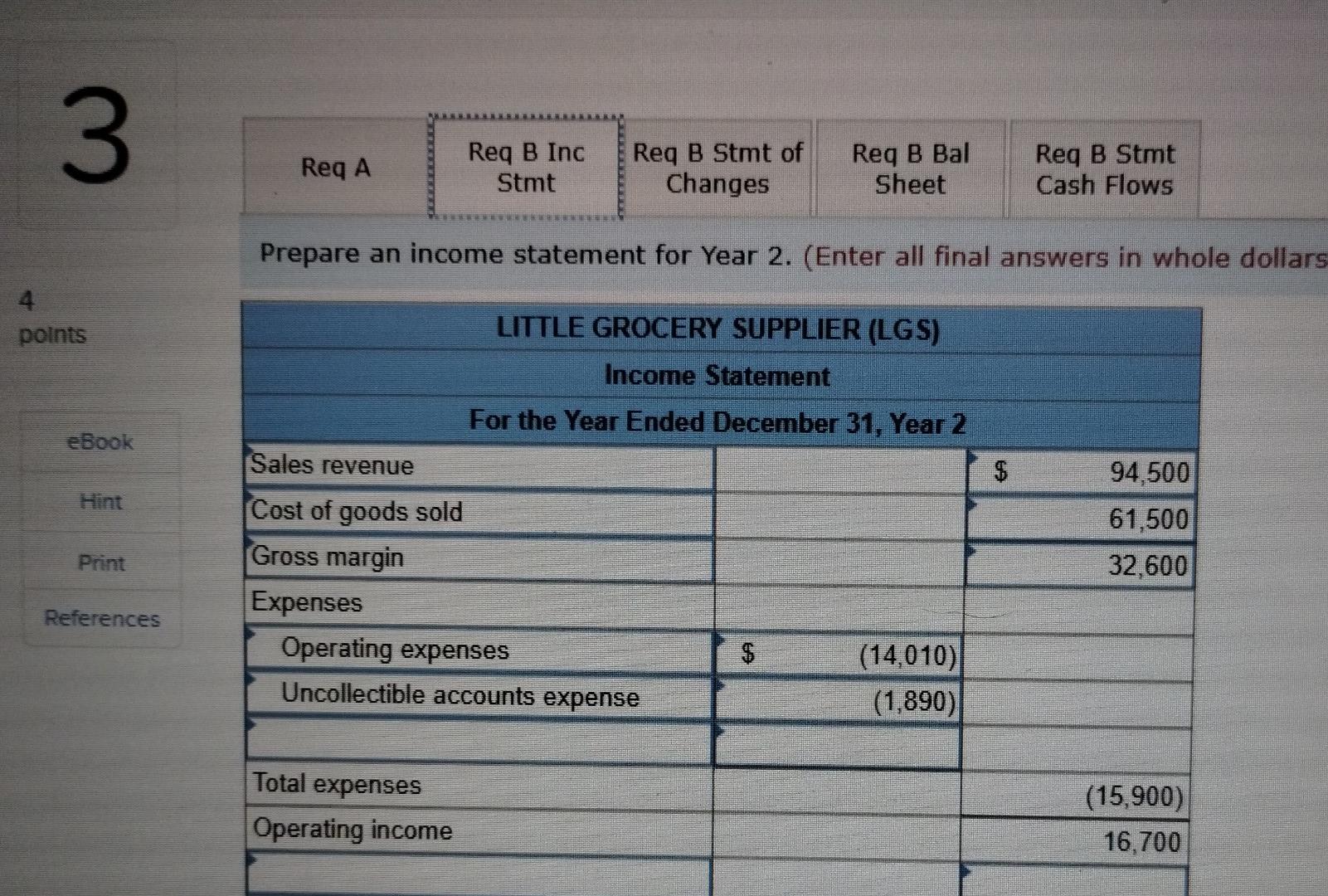

Accounts payable Common stock Retained earnings 23,770 10,585 21,800 14,995 Transactions for Year 2 1. Acquired an additional $10,500 cash from the issue of common stock. 2. Purchased $60,600 of inventory on account. 3. Sold inventory that cost $61,900 for $94,500. Sales were made on account. 4. The company wrote off $1,500 of uncollectible accounts. 5. On September 1, LGS loaned $9,000 to Eden Co. The note had an 6 percent interest rate and a one-year term. 6. Paid $14,010 cash for operating expenses. 7. The company collected $82,470 cash from accounts receivable. 8. A cash payment of $51,020 was paid on accounts payable. 9. The company paid a $4,200 cash dividend to the stockholders. 10. Uncollectible accounts are estimated to be 2 percent of sales on account. 11. Recorded the accrued interest at December 31, Year 2 (see item 5). O Search

Prepare an income statement for Year 2. (Enter all final answers in whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started