Answered step by step

Verified Expert Solution

Question

1 Approved Answer

inventory & COGS (add formulas) Accounts Receivable (add formula) Depreciation (add formula) Notes Payable Income Statement & Balance Sheet add formulas for all specify unreadable

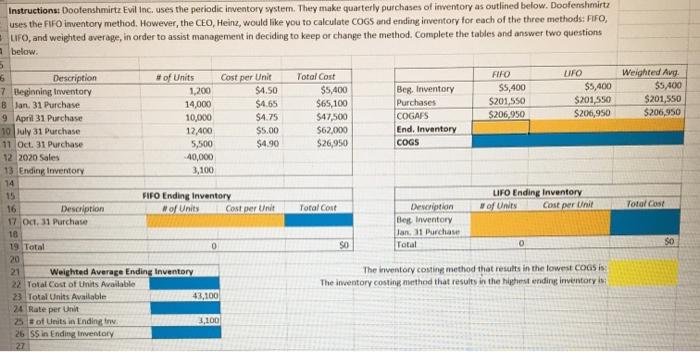

inventory & COGS (add formulas)

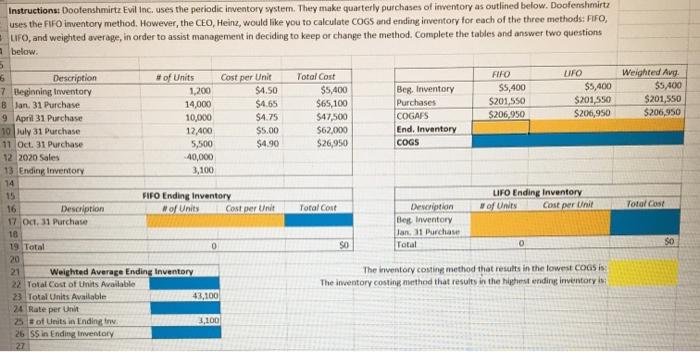

Accounts Receivable (add formula)

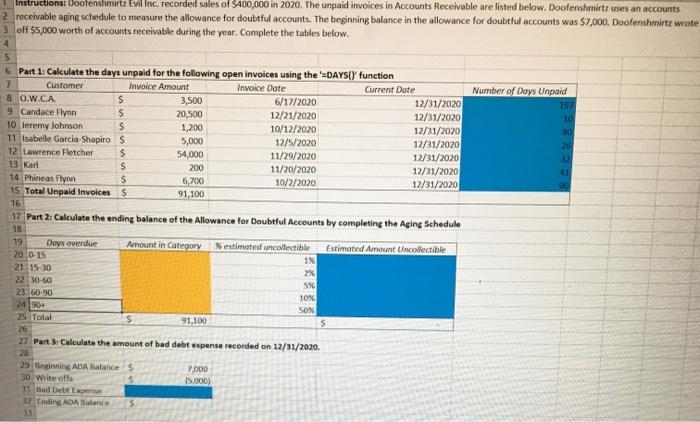

Depreciation (add formula)

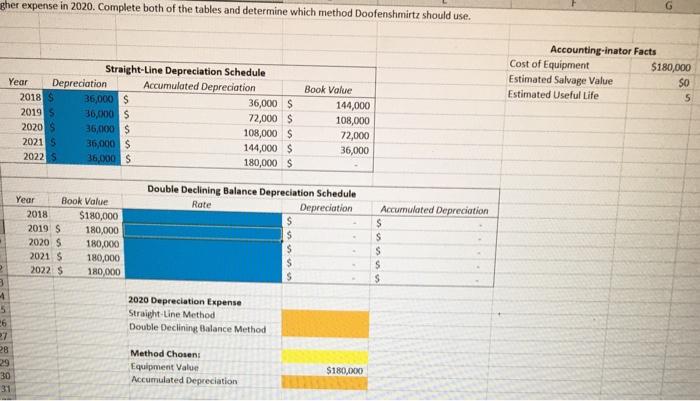

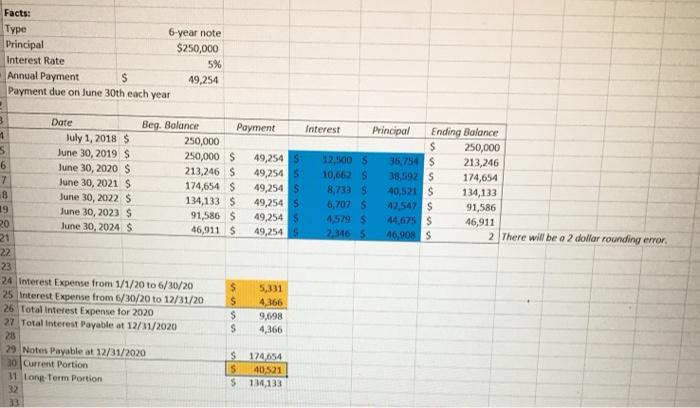

Notes Payable

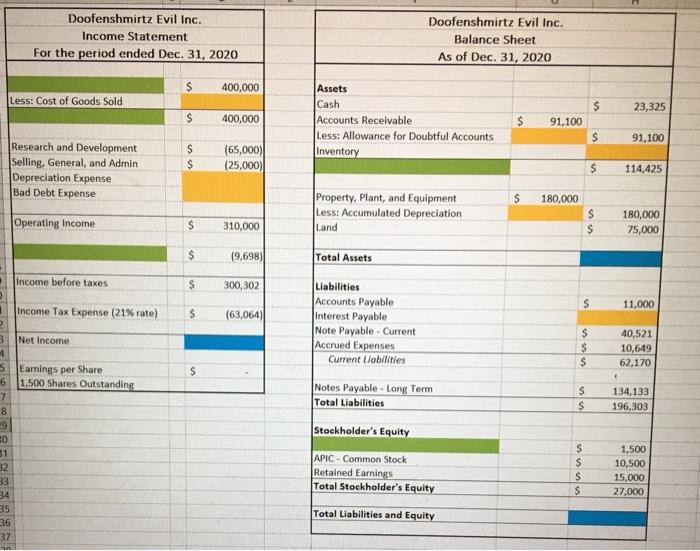

Income Statement & Balance Sheet

add formulas for all

specify unreadable pictures if any

InstructionsDoofenshmirtz Evil Inc. uses the periodic inventory system. They make quarterly purchases of inventory as outlined below. Doofenshmitz uses the FIFO inventory method. However, the CEO, Heinz, would like you to calculate COGS and ending inventory for each of the three methods: FIFO, LIFO, and weighted average, in order to assist management in deciding to keep or change the method. Complete the tables and answer two questions below. Total Cost $5,400 565,100 $47,500 $62,000 $26,950 Beg, Inventory Purchases COGAPS End. Inventory COGS FIRO S5,400 S201,550 $206,950 UFO $5,400 $201.550 $206,950 Weighted Avg $5,400 $201,550 $206,950 6 Description #of Units Cost per Unit 7. Beginning Inventory 1,200 $4.50 B Jan. 31 Purchase 14,000 $4.65 9 April 31 Purchase 10,000 $4.75 10 July 31 Purchase 12,400 $5.00 11 Oct 31 Purchase 5,500 $4.90 12 2020 Sales 40,000 13 Ending Inventory 3,100 14 15 FIFO Ending Inventory 16 Description of Units Cost per Unit 17 Oct 31 Purchase 10 19 Total 0 20 21 Weighted Average Ending Inventory 22 Total Cost of Units Available 23 Total Units Available 43,100 24 Rate per Unit 25 Bof Units in Ending tv. 2,100 26 SS in Ending Inventory 27 LIFO Ending Inventory of Units Cost per Unit Total Cost Total Cost Description Be Inventory lan. 11 Purchase Total SO 0 SO The inventory costing method that results in the lowest COGS: The inventory costing method that results in the highest ending inventory in Instructions: Doofenshmitz Evil Inc. recorded sales of $400,000 in 2020. The unpaid invoices in Accounts Receivable are listed below. Doofenshmitz uses an accounts 2 receivable aping schedule to measure the allowance for doubtful accounts. The beginning balance in the allowance for doubtful accounts was $7,000. Doofenshmirtz wrote 3 off $5,000 worth of accounts receivable during the year. Complete the tables below. 4 Number of Days Unpaid 197 30 20 22 5 6 Part 1: Calculate the days unpaid for the following open invoices using the 'DAYS() function Customer Invoice Amount Invoice Date Current Date 8 O.W.CA $ 3,500 6/17/2020 12/31/2020 9. Candace Flynn S 20,500 12/21/2020 12/31/2020 10 Jeremy Johnson S 1,200 10/12/2020 12/31/2020 11 Isabelle Garcia Shapiro $ 5,000 12/5/2020 12/31/2020 12 Lawrence Fletcher $ 54,000 11/29/2020 12/31/2020 13 Karl $ 200 11/20/2020 12/31/2020 14 Phineas Flynn $ 6,700 10/2/2020 12/31/2020 15 Total Unpaid Invoices 91,100 16 17 Part 2: Calculate the ending balance of the Allowance for Doubtful Accounts by completing the Aging Schedule 19 Days overdue Amount in Category estimated uncollectible Estimated Amount Uncollectible 2010-15 1% 21 15-30 2% 22 30 60 5% 23 60-90 10% 240 SON 25 Total 91.100 5 26 27 Part 3: Calculate the amount of bad debt expense recorded on 12/31/2020 28 29 Beginning ADA Balance 7.000 30 Write offs 15.000) 31 Bad Debt 32 Ending ADA Balance 33 gher expense in 2020. Complete both of the tables and determine which method Doofenshmirtz should use. Accounting-inator Facts Cost of Equipment $180,000 Estimated Salvage Value SO Estimated Useful Life 5 Straight-Line Depreciation Schedule Year Depreciation Accumulated Depreciation 2018 S 36,000 $ 36,000 $ 2019 36,000 $ 72,000 $ 2020 $ 36,000 $ 108,000 $ 20215 36,000 $ 144,000 $ 2022 S 36,000 $ 180,000 S Book Value 144,000 108,000 72,000 36,000 Double Declining Balance Depreciation Schedule Rate Depreciation $ Year Book Value 2018 $180,000 2019 S 180,000 2020 S 180,000 2021 $ 180,000 2022 $ 180,000 Accumulated Depreciation $ S $ S $ $ S 3 4 5 06 27 28 29 30 31 2020 Depreciation Expense Straight-Line Method Double Declining Balance Method Method Chosen: Equipment Value Accumulated Depreciation $180,000 Facts: Type 6-year note Principal $250,000 Interest Rate Annual Payment 49,254 Payment due on June 30th each year 5% 3 Date Beg. Balance Payment Interest Principal Ending Balance 1 July 1, 2018 $ 250,000 S S June 30, 2019 $ 250,000 250,000 $ 49,254 S 12,100 $ 36,754 $ 6 213,246 June 30, 2020 $ 213,246 S 49,254 10,662 S 38,592 $ 7 174,654 June 30, 2021 S 174,654 S 49,254 5 8,733 S 18 40,521 S 134,133 June 30, 2022 $ 134,133 $ 49,254 $ 6,7075 42,547 S 19 91,586 June 30, 2023 S 91,5865 49,254 20 4,579S 44,675 S June 30, 2024 S 46,911 46,911 5 49,254 2,3405 46,908 S 21 2 There will be a 2 dollar rounding error. 22 23 24 Interest Expense from 1/1/20 to 6/30/20 $ 5,331 25 Interest Expense from 6/30/20 to 12/31/20 S 4,366 26 Total Interest Expense for 2020 $ 9,098 27 Total Interest Payable at 12/31/2020 S 4,366 28 29 Notes Payable at 12/31/2020 S 174654 30 Current Portion s 40,521 31 Long Term Portion $ 114,133 32 Doofenshmirtz Evil Inc. Income Statement For the period ended Dec. 31, 2020 Doofenshmirtz Evil Inc. Balance Sheet As of Dec. 31, 2020 $ 400,000 Less: Cost of Goods Sold $ 23,325 $ 400,000 Assets Cash Accounts Receivable Less: Allowance for Doubtful Accounts Inventory 91,100 S 91,100 Research and Development Selling, General, and Admin Depreciation Expense Bad Debt Expense $ $ (65,000) (25,000) $ 114,425 S 180,000 Property, Plant, and Equipment Less: Accumulated Depreciation Land Operating Income $ $ $ 310,000 180,000 75,000 $ (9.698) Total Assets Income before taxes $ 300,302 S 11,000 Income Tax Expense (21% rate) $ (63,064) Liabilities Accounts Payable Interest Payable Note Payable - Current Accrued Expenses Current Llabilities Net Income $ $ $ 40,521 10,649 62,170 $ Earnings per Share 1,500 Shares Outstanding 2 3 1 5 6 7 9 80 31 32 33 Notes Payable - Long Term Total Liabilities S $ 134,133 196,303 Stockholder's Equity $ APIC - Common Stock Retained Earnings Total Stockholder's Equity us 1,500 10,500 15,000 27,000 $ Total Liabilities and Equity 35 36 37 InstructionsDoofenshmirtz Evil Inc. uses the periodic inventory system. They make quarterly purchases of inventory as outlined below. Doofenshmitz uses the FIFO inventory method. However, the CEO, Heinz, would like you to calculate COGS and ending inventory for each of the three methods: FIFO, LIFO, and weighted average, in order to assist management in deciding to keep or change the method. Complete the tables and answer two questions below. Total Cost $5,400 565,100 $47,500 $62,000 $26,950 Beg, Inventory Purchases COGAPS End. Inventory COGS FIRO S5,400 S201,550 $206,950 UFO $5,400 $201.550 $206,950 Weighted Avg $5,400 $201,550 $206,950 6 Description #of Units Cost per Unit 7. Beginning Inventory 1,200 $4.50 B Jan. 31 Purchase 14,000 $4.65 9 April 31 Purchase 10,000 $4.75 10 July 31 Purchase 12,400 $5.00 11 Oct 31 Purchase 5,500 $4.90 12 2020 Sales 40,000 13 Ending Inventory 3,100 14 15 FIFO Ending Inventory 16 Description of Units Cost per Unit 17 Oct 31 Purchase 10 19 Total 0 20 21 Weighted Average Ending Inventory 22 Total Cost of Units Available 23 Total Units Available 43,100 24 Rate per Unit 25 Bof Units in Ending tv. 2,100 26 SS in Ending Inventory 27 LIFO Ending Inventory of Units Cost per Unit Total Cost Total Cost Description Be Inventory lan. 11 Purchase Total SO 0 SO The inventory costing method that results in the lowest COGS: The inventory costing method that results in the highest ending inventory in Instructions: Doofenshmitz Evil Inc. recorded sales of $400,000 in 2020. The unpaid invoices in Accounts Receivable are listed below. Doofenshmitz uses an accounts 2 receivable aping schedule to measure the allowance for doubtful accounts. The beginning balance in the allowance for doubtful accounts was $7,000. Doofenshmirtz wrote 3 off $5,000 worth of accounts receivable during the year. Complete the tables below. 4 Number of Days Unpaid 197 30 20 22 5 6 Part 1: Calculate the days unpaid for the following open invoices using the 'DAYS() function Customer Invoice Amount Invoice Date Current Date 8 O.W.CA $ 3,500 6/17/2020 12/31/2020 9. Candace Flynn S 20,500 12/21/2020 12/31/2020 10 Jeremy Johnson S 1,200 10/12/2020 12/31/2020 11 Isabelle Garcia Shapiro $ 5,000 12/5/2020 12/31/2020 12 Lawrence Fletcher $ 54,000 11/29/2020 12/31/2020 13 Karl $ 200 11/20/2020 12/31/2020 14 Phineas Flynn $ 6,700 10/2/2020 12/31/2020 15 Total Unpaid Invoices 91,100 16 17 Part 2: Calculate the ending balance of the Allowance for Doubtful Accounts by completing the Aging Schedule 19 Days overdue Amount in Category estimated uncollectible Estimated Amount Uncollectible 2010-15 1% 21 15-30 2% 22 30 60 5% 23 60-90 10% 240 SON 25 Total 91.100 5 26 27 Part 3: Calculate the amount of bad debt expense recorded on 12/31/2020 28 29 Beginning ADA Balance 7.000 30 Write offs 15.000) 31 Bad Debt 32 Ending ADA Balance 33 gher expense in 2020. Complete both of the tables and determine which method Doofenshmirtz should use. Accounting-inator Facts Cost of Equipment $180,000 Estimated Salvage Value SO Estimated Useful Life 5 Straight-Line Depreciation Schedule Year Depreciation Accumulated Depreciation 2018 S 36,000 $ 36,000 $ 2019 36,000 $ 72,000 $ 2020 $ 36,000 $ 108,000 $ 20215 36,000 $ 144,000 $ 2022 S 36,000 $ 180,000 S Book Value 144,000 108,000 72,000 36,000 Double Declining Balance Depreciation Schedule Rate Depreciation $ Year Book Value 2018 $180,000 2019 S 180,000 2020 S 180,000 2021 $ 180,000 2022 $ 180,000 Accumulated Depreciation $ S $ S $ $ S 3 4 5 06 27 28 29 30 31 2020 Depreciation Expense Straight-Line Method Double Declining Balance Method Method Chosen: Equipment Value Accumulated Depreciation $180,000 Facts: Type 6-year note Principal $250,000 Interest Rate Annual Payment 49,254 Payment due on June 30th each year 5% 3 Date Beg. Balance Payment Interest Principal Ending Balance 1 July 1, 2018 $ 250,000 S S June 30, 2019 $ 250,000 250,000 $ 49,254 S 12,100 $ 36,754 $ 6 213,246 June 30, 2020 $ 213,246 S 49,254 10,662 S 38,592 $ 7 174,654 June 30, 2021 S 174,654 S 49,254 5 8,733 S 18 40,521 S 134,133 June 30, 2022 $ 134,133 $ 49,254 $ 6,7075 42,547 S 19 91,586 June 30, 2023 S 91,5865 49,254 20 4,579S 44,675 S June 30, 2024 S 46,911 46,911 5 49,254 2,3405 46,908 S 21 2 There will be a 2 dollar rounding error. 22 23 24 Interest Expense from 1/1/20 to 6/30/20 $ 5,331 25 Interest Expense from 6/30/20 to 12/31/20 S 4,366 26 Total Interest Expense for 2020 $ 9,098 27 Total Interest Payable at 12/31/2020 S 4,366 28 29 Notes Payable at 12/31/2020 S 174654 30 Current Portion s 40,521 31 Long Term Portion $ 114,133 32 Doofenshmirtz Evil Inc. Income Statement For the period ended Dec. 31, 2020 Doofenshmirtz Evil Inc. Balance Sheet As of Dec. 31, 2020 $ 400,000 Less: Cost of Goods Sold $ 23,325 $ 400,000 Assets Cash Accounts Receivable Less: Allowance for Doubtful Accounts Inventory 91,100 S 91,100 Research and Development Selling, General, and Admin Depreciation Expense Bad Debt Expense $ $ (65,000) (25,000) $ 114,425 S 180,000 Property, Plant, and Equipment Less: Accumulated Depreciation Land Operating Income $ $ $ 310,000 180,000 75,000 $ (9.698) Total Assets Income before taxes $ 300,302 S 11,000 Income Tax Expense (21% rate) $ (63,064) Liabilities Accounts Payable Interest Payable Note Payable - Current Accrued Expenses Current Llabilities Net Income $ $ $ 40,521 10,649 62,170 $ Earnings per Share 1,500 Shares Outstanding 2 3 1 5 6 7 9 80 31 32 33 Notes Payable - Long Term Total Liabilities S $ 134,133 196,303 Stockholder's Equity $ APIC - Common Stock Retained Earnings Total Stockholder's Equity us 1,500 10,500 15,000 27,000 $ Total Liabilities and Equity 35 36 37 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started