__________

____________

__________

______________

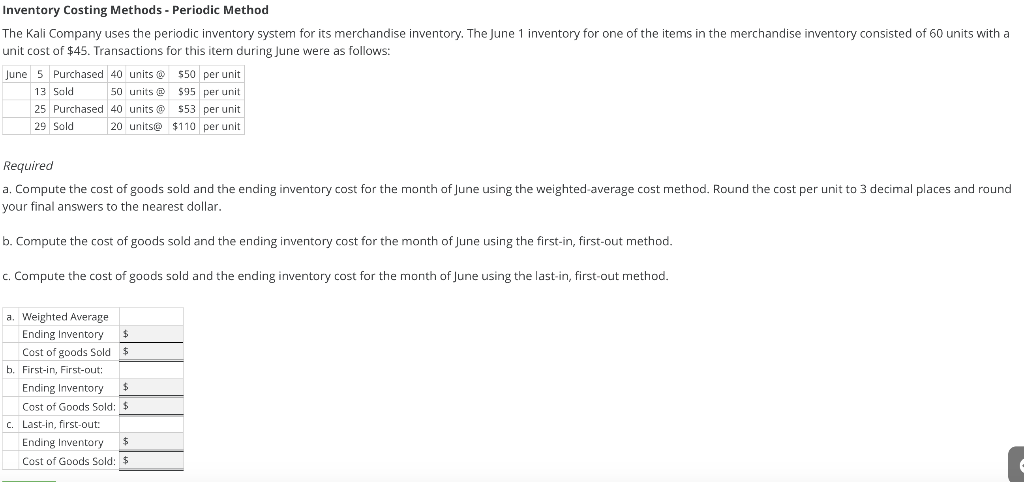

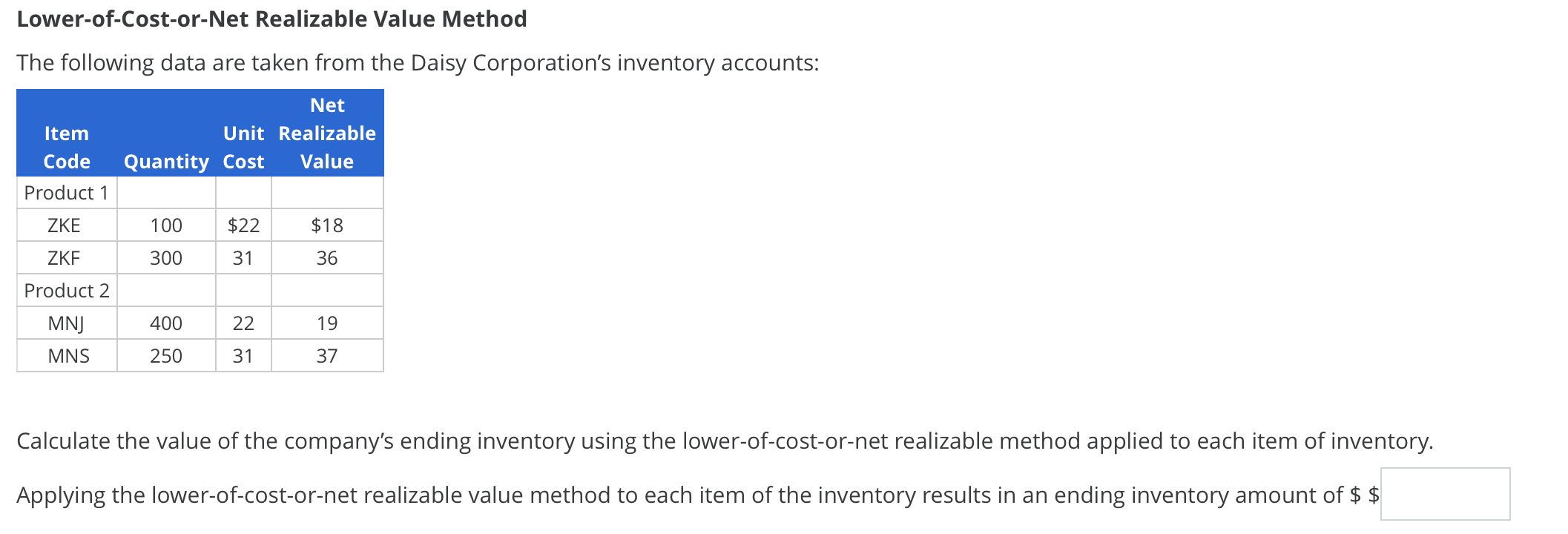

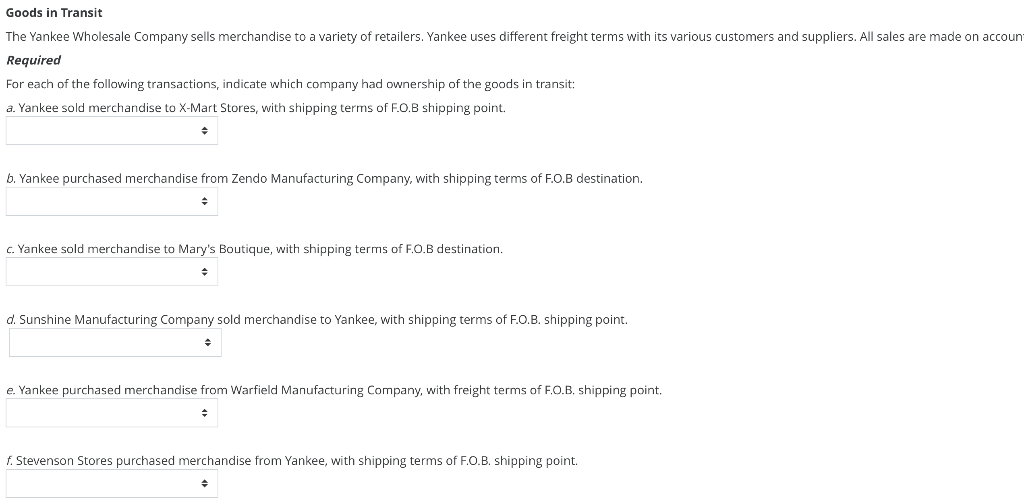

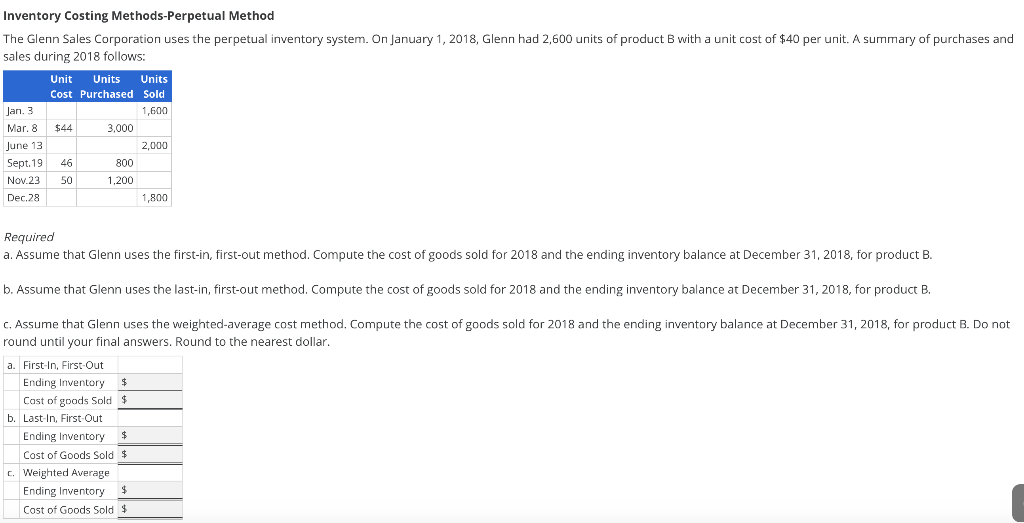

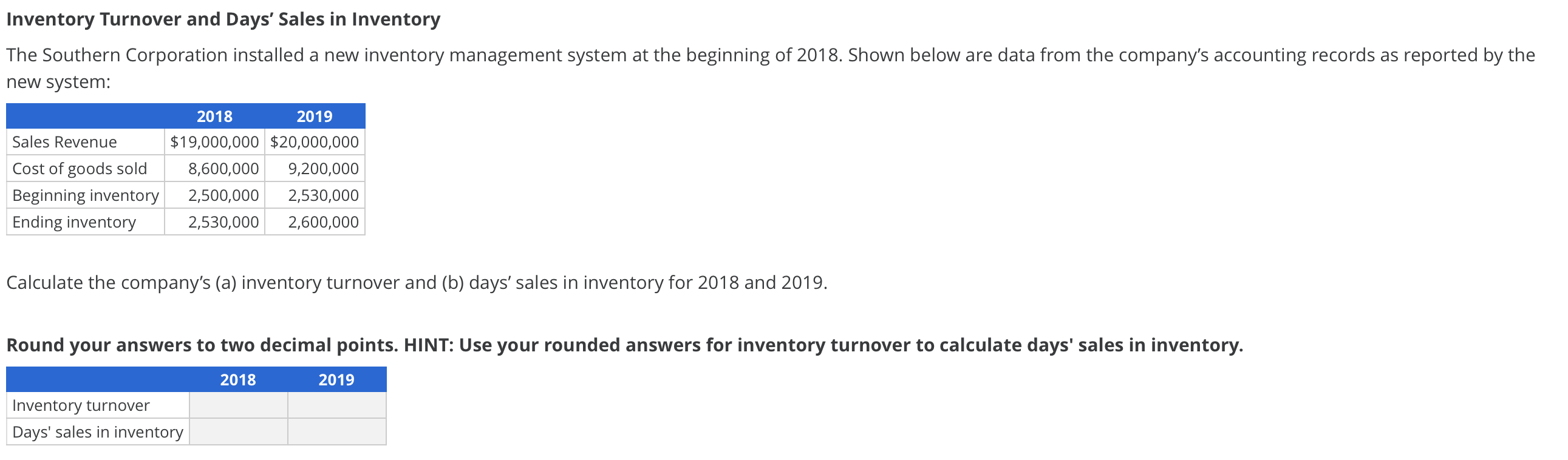

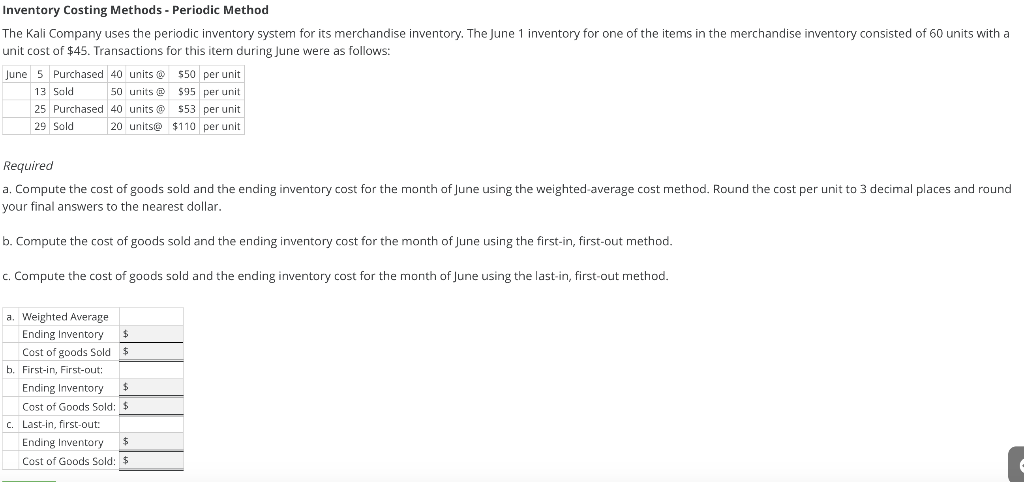

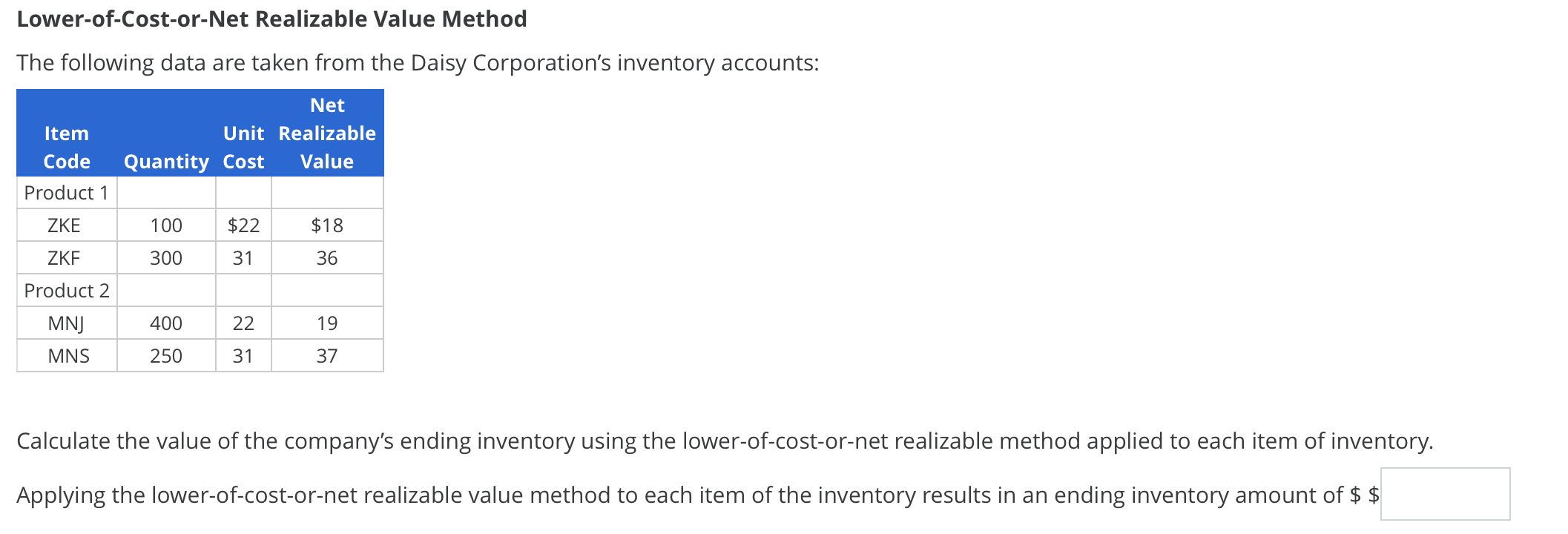

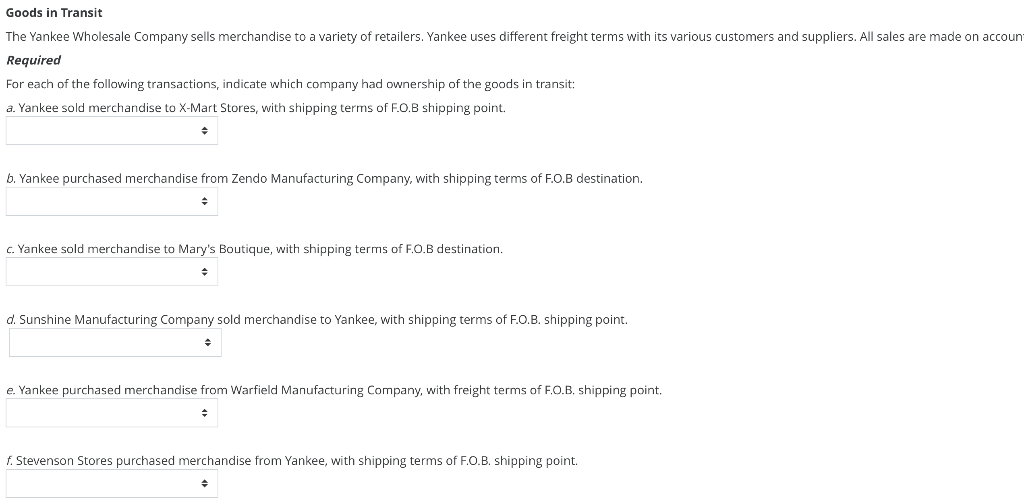

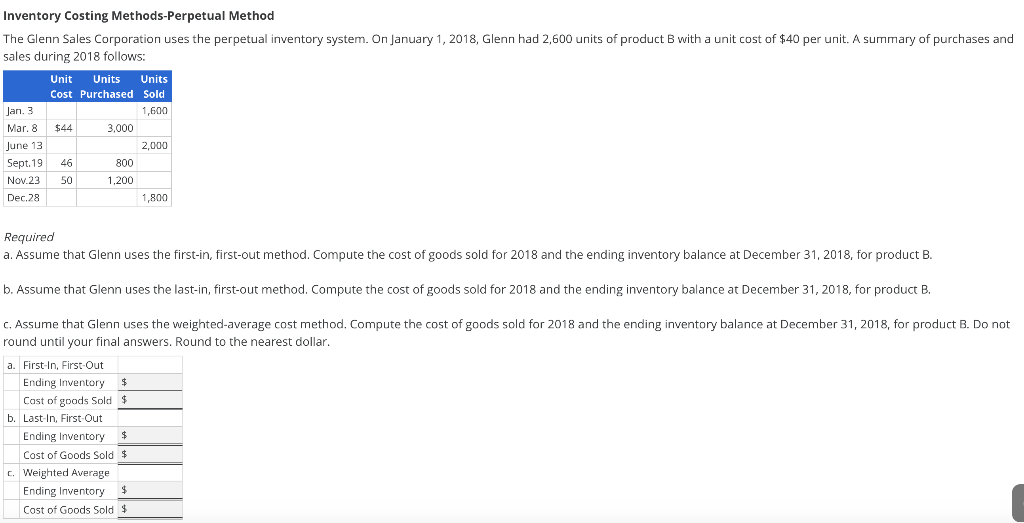

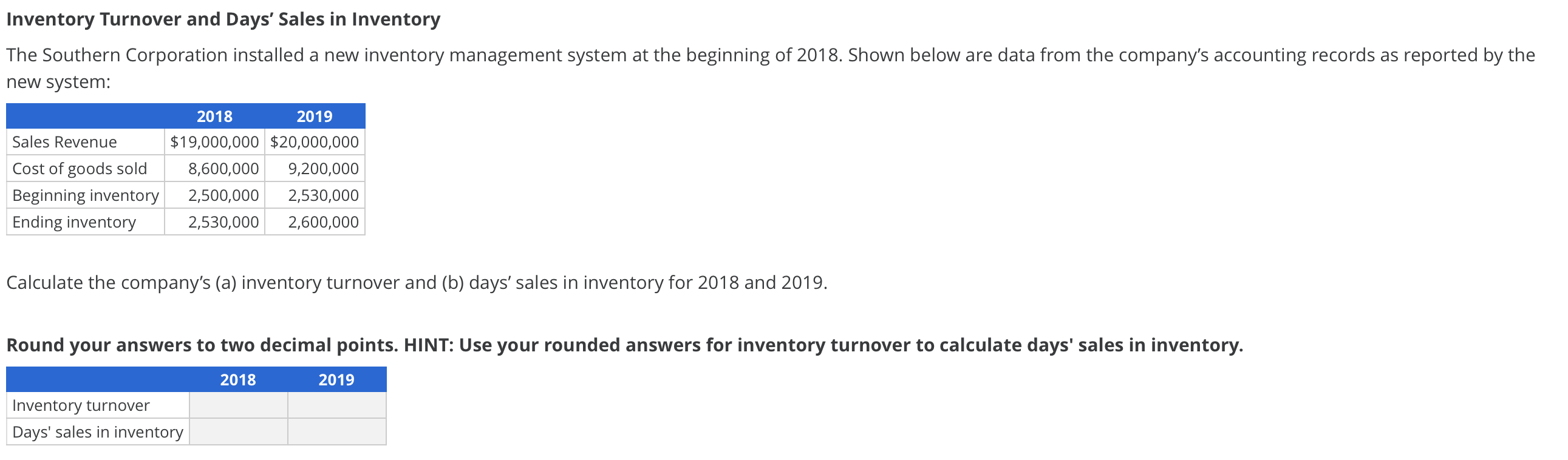

Inventory Costing Methods - Periodic Method The Kali Company uses the periodic inventory system for its merchandise inventory. The June 1 inventory for one of the items in the merchandise inventory consisted of 60 units with a unit cost of $45. Transactions for this item during June were as follows: June 5 Purchased 40 units @ $50 per unit 13 Sold 50 units @ $95 per unit 25 Purchased 40 units @ $53 per unit 29 Sold 20 units@ $110 per unit Required a. Compute the cost of goods sold and the ending inventory cost for the month of June using the weighted average cost method. Round the cost per unit to 3 decimal places and round your final answers to the nearest dollar. b. Compute the cost of goods sold and the ending inventory cost for the month of June using the first-in, first-out method. C. Compute the cost of goods sold and the ending inventory cost for the month of June using the last-in, first-out method. a. Weighted Average Ending Inventory Cost of goods Sold $ b. First-in, First-out: Ending Inventory $ Cost of Goods Sold: $ C. Last-in, first-out: Ending Inventory $ Cost of Goods Sold: $ Lower-of-Cost-or-Net Realizable Value Method The following data are taken from the Daisy Corporation's inventory accounts: Net Item Unit Realizable Code Quantity Cost Value Product 1 ZKE 100 300 $22 $18 3136 ZKE Product 2 MNJ MNS 400 250 22 19 3137 Calculate the value of the company's ending inventory using the lower-of-cost-or-net realizable method applied to each item of inventory. Applying the lower-of-cost-or-net realizable value method to each item of the inventory results in an ending inventory amount of $ $ Inventory Costing Methods-Perpetual Method The Glenn Sales Corporation uses the perpetual inventory system. On January 1, 2018, Glenn had 2,600 units of product B with a unit cost of $40 per unit. A summary of purchases and sales during 2018 follows: Unit Units Units Cost Purchased Sold Jan. 3 1,600 Mar. 8 $44 3.000 June 13 2,000 Sept.1946 Nov.23 50 1,200 Dec, 28 1,800 800 Required a. Assume that Glenn uses the first-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product B. b. Assume that Glenn uses the last-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product B. C. Assume that Glenn uses the weighted average cost method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product B. Do not round until your final answers. Round to the nearest dollar. a. First-In, First Out Ending Inventory $ Cost of goods Sold $ b. Last-In, First Out Ending Inventory $ Cost of Goods Sold $ c. Weighted Average Ending Inventory $ Cost of Goods Sold $ Inventory Turnover and Days' Sales in Inventory The Southern Corporation installed a new inventory management system at the beginning of 2018. Shown below are data from the company's accounting records as reported by the new system: Sales Revenue Cost of goods sold Beginning inventory Ending inventory 2018 2019 $19,000,000 $20,000,000 8,600,000 9,200,000 2,500,000 2,530,000 2,530,000 2,600,000 Calculate the company's (a) inventory turnover and (b) days' sales in inventory for 2018 and 2019. Round your answers to two decimal points. HINT: Use your rounded answers for inventory turnover to calculate days' sales in inventory. 2018 2019 Inventory turnover Days' sales in inventory