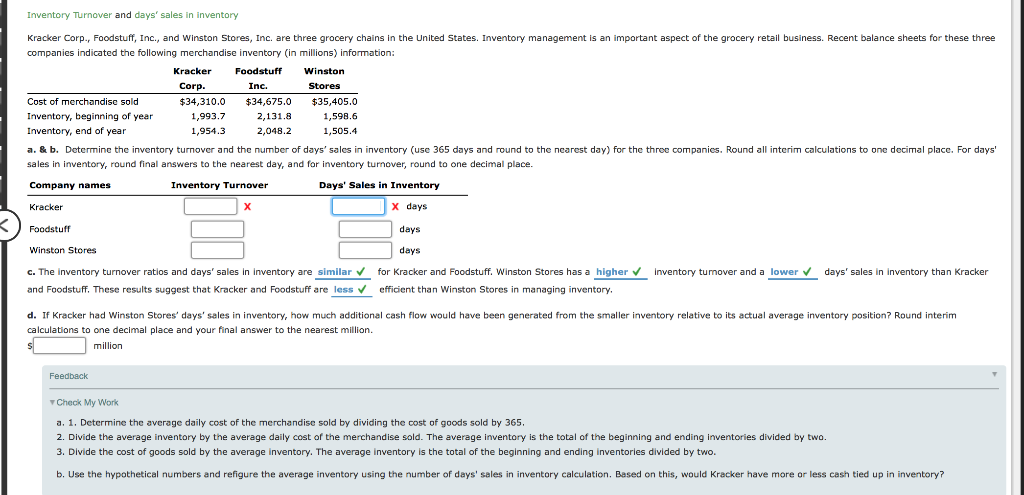

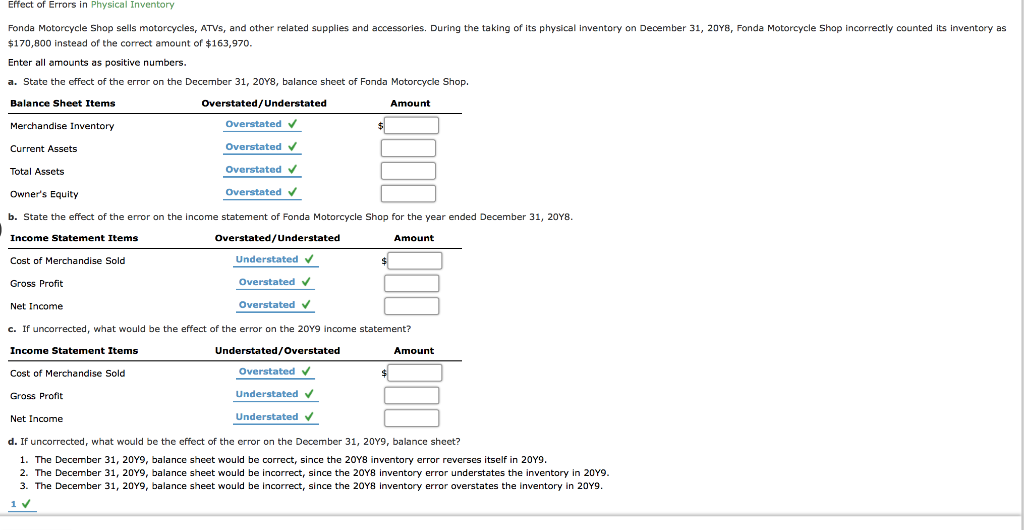

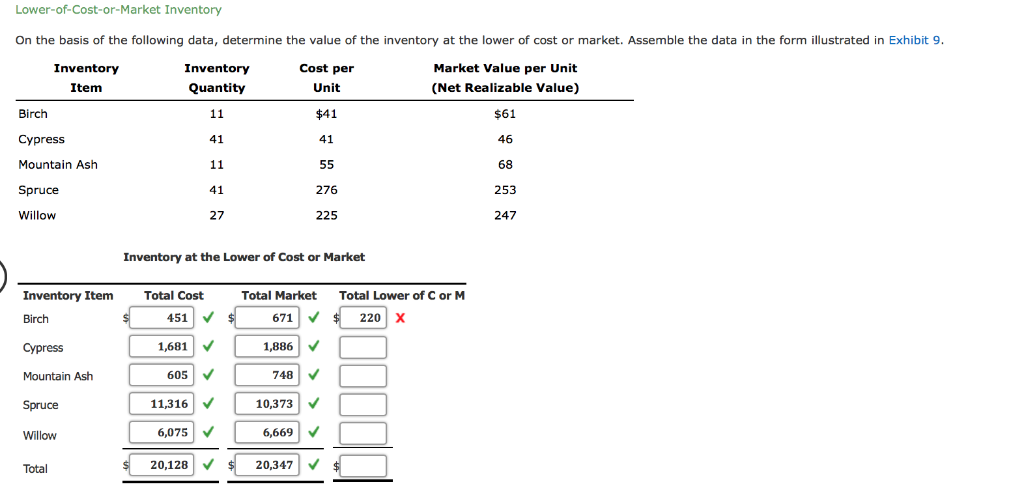

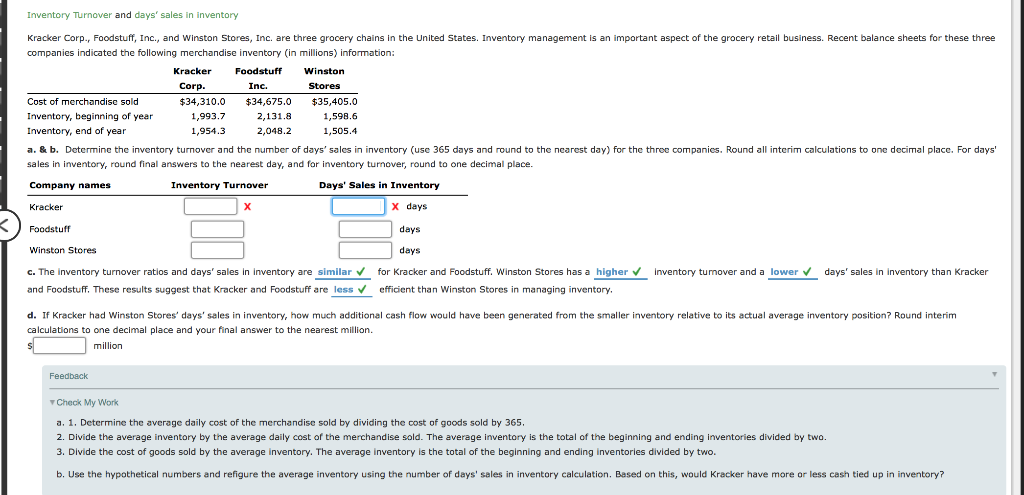

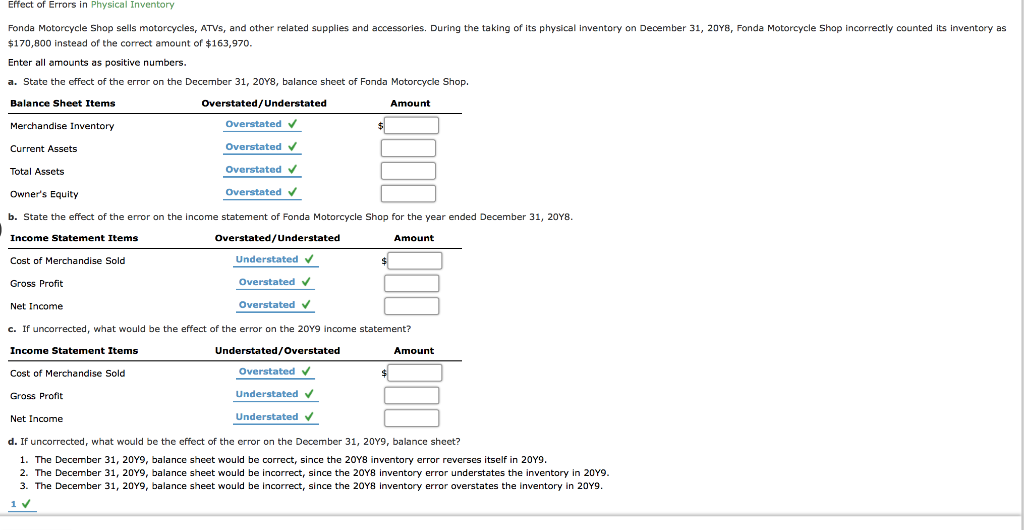

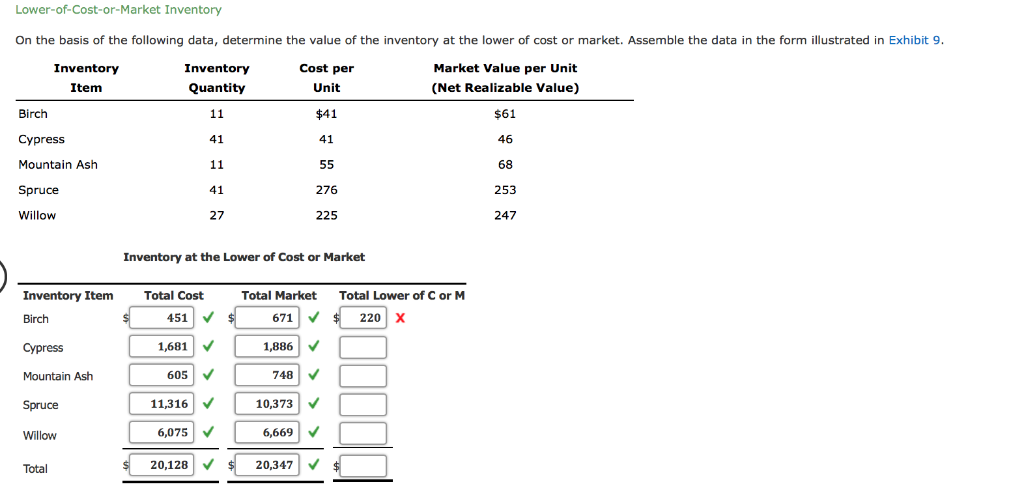

Inventory Turnover and days' sales in inventory Kracker Corp, Foodstuff, Inc., and Winston Stores, Inc. are three grocery chains in the United States. Inventory management. an important aspect of the grocery retail business. Recent balance sheets for these three companies indicated the following merchandise inventory (in millions) information: Kracker Foodstuff Winston Corp. Inc Stores Cost of merchandise sold $34,310.0 $34,675.0 $35,405,0 Inventory, beginning of year 1,993.7 2,131.8 1,598.6 year Inventory, end 1,954.3 2,048.2 1,505.4 the nearest day) for the three companies. Round all interim calculations a. & b. Detemine the inventory turnover and the number of days' sales in inventory (use 365 days and round one decimal plac, For days' sales in inventory, round final answers to the nearest day, and for inventory turnover, round to one decimal place. Company names Inventory Turnover Days' Sales in Inventory x days Kracker days Foodstuff Winston Stores days days' sales in inventory than Kracker c. The inventory turnover ratios and days' sales in inventory are similar for Kracker and Foodstuff. Winston Stores has a higher inventory turnover and a lower efficient than Winston Stores in managing inventory. and Foodstuff. These results suggest that Kracker and Foodstuff are less v d. If Kracker had Winston Stores' days' sales in inventory, how much additional cash flow would have been generated from the smaller inventory relative t its actual average inventory position? Round interim calculations to one decimal place and your final answer to the nearest million. million Feedback Check My Work a. 1. Determine the average daily cost of the merchandise sold by dividing the cost of goods sold by 365. 2. Divide the average inventory by the average daily cost of the merchandise sold. The average inventory is the total of the beginning and ending inventories divided two. 3. Divide the cost of goods sold by the average inventory. The average inventory is the total of the beginning and ending inventories divided by two. inventory? b. Use the hypothetical numbers and refigure the average inventory using the number of days' sales inventory calculation. Based on this, would Kracker have more or less cash tied up Effect of Errors in Physical Inventory Fonda Motorcycle Shop sells motorcycles, ATVS, and other related supplies and accessories. During the taking of its physical inventory on December 31, 20Y8, Fonda Motorcycle Shop incorrectly counted its inventory as $170,800 instead of the correct amount of $163,970. Enter all amounts as positive numbers. Fonda Motorcycle Shop. a. State the effect of the error on the December 31, 20Y8, balance sheet Balance Sheet Items overstated/Understated Amount Overstated Merchandise 1Inventory Overstated Current Assets Overstated Total Assets Overstated Owner's Equity b. State the effect of the error on the income statement Fonda Motorcycle Shop for the year ended December 31, 20Y8. Amount Income Statement Items Overstated/Understated Understated Cost of Merchandise Sold Overstated Gross Profit Overstated Net Income c. If uncorrected, what would be the effect of the error on the 20Y9 income statement? Understated/Overstated Income Statement Items Amount Overstated Cost of Merchandise Sold Understated Gross Profit Understated Net Income d. If uncorrected, what would be the effect f the error on the December 31, 20Y9, balance sheet? 1. The December 31, 20Y9, balance sheet would be correct, since the 20Y8 inventory error reverses itself in 20Y9 20Y9. 2. The December 31, 20Y9, balance sheet would be incorrect, since the 20Y8 innventory error understates the inventory 3. The December 31, 20Y9, balance sheet would be incorrect, since the 20Y8 inventory error overstates the inventory in 20Y9. 1 V Lower-of-Cost-or-Market Inventory the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9 On the basis Inventory Inventory Market Value per Unit Cost per Item Quantity Unit (Net Realizable Value) Birch 11 $41 $61 41 41 46 Cypress Mountain Ash 68 11 55 Spruce 41 276 253 Willow 27 247 225 Inventory at the Lower of Cost or Market Total Market Total Lower of C or M Inventory Item Total Cost 451 $ 671 220 X Birch 1,681 1,886 Cypress V 605 748 Mountain Ash 11,316 10,373 Spruce V 6,075 6,669 Willow 20,128 $ 20,347 Total