Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Investing $500,000 sounds like a great idea, but you also want to spend some of this money. So you decide to use the $500,000 to

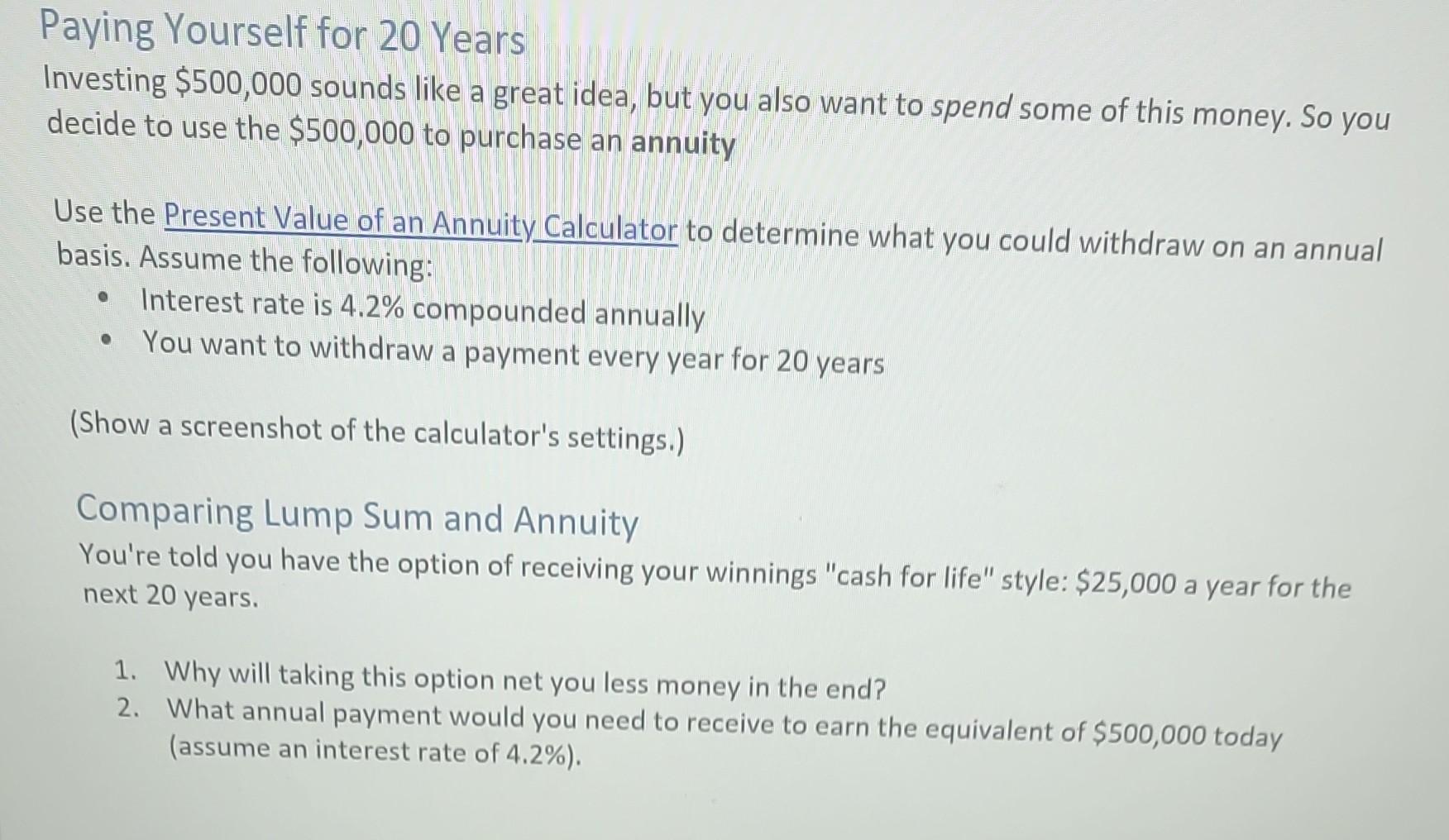

Investing $500,000 sounds like a great idea, but you also want to spend some of this money. So you decide to use the $500,000 to purchase an annuity Use the Present Value of an Annuity Calculator to determine what you could withdraw on an annual basis. Assume the following: - Interest rate is 4.2% compounded annually - You want to withdraw a payment every year for 20 years (Show a screenshot of the calculator's settings.) Comparing Lump Sum and Annuity You're told you have the option of receiving your winnings "cash for life" style: $25,000 a year for the next 20 years. 1. Why will taking this option net you less money in the end? 2. What annual payment would you need to receive to earn the equivalent of $500,000 today (assume an interest rate of 4.2% )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started