Answered step by step

Verified Expert Solution

Question

1 Approved Answer

investing: investing mutual funds inverse mutual funds, sometimes referred as bear market or short funds, seek to deliver the opposite of the performance of the

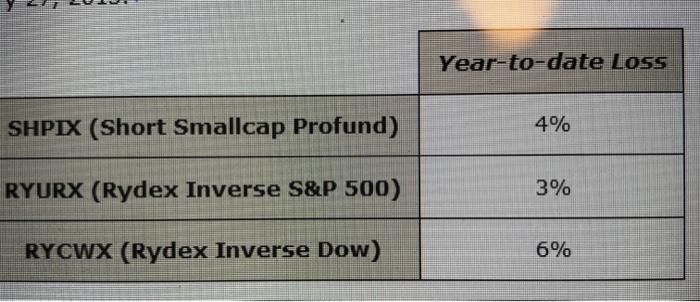

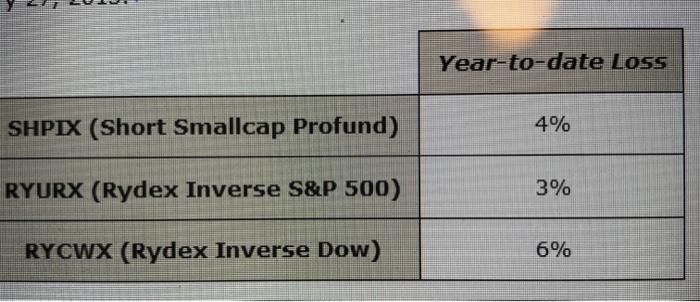

investing: investing mutual funds inverse mutual funds, sometimes referred as "bear market" or "short" funds, seek to deliver the opposite of the performance of the index or category they track, and can invest be used by traders to bet against the stock market. This question is based on the following table, which shows the performance of three such funds as of February 27, 2015.

you invested a total of $13,000 in the three funds at the beginning of 2015, including an equal amount in RYURX and RYCWX. your year to date loss from the first two funds amounted to $370 how much did you invest in each of the three funds?

SHIPX -

RYURX-

RYCWX-

hope this helps :)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started