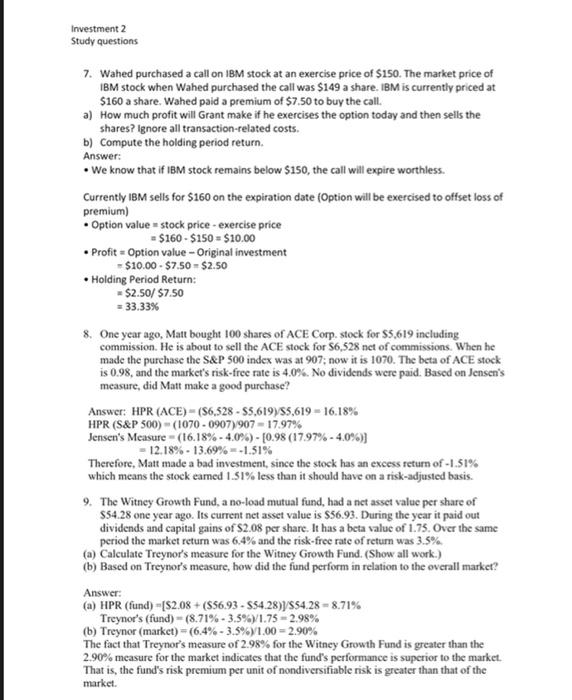

Investment 2 Study questions 7. Wahed purchased a call on IBM stock at an exercise price of $150. The market price of IBM stock when Wahed purchased the call was $149 a share. IBM is currently priced at $160 a share. Wahed paid a premium of $7.50 to buy the call. a) How much profit will Grant make if he exercises the option today and then sells the shares? Ignore all transaction-related costs. b) Compute the holding period return. Answer: We know that if IBM stock remains below $150, the call will expire worthless. Currently IBM sells for $160 on the expiration date (Option will be exercised to offset loss of premium) Option value = stock price - exercise price = $160-$150 = $10.00 Profit = Option value - Original investment -$10.00-$7.50 - $2.50 Holding Period Return: = $2.50/ $7.50 = 33.33% 8. One year ago, Matt bought 100 shares of ACE Corp. stock for $5,619 including commission. He is about to sell the ACE stock for $6,528 net of commissions. When he made the purchase the S&P 500 index was at 907; now it is 1070. The beta of ACE stock is 0.98, and the market's risk-free rate is 4.0%. No dividends were paid. Based on Jensen's measure, did Matt make a good purchase? Answer: HPR (ACE)-($6,528-$5,619)/55,619-16.18% HPR (S&P 500)-(1070-0907)/907-17.97% Jensen's Measure - (16.18% -4.0%) - [ 0.98 (17.97% -4.0%)] - 12.18% -13.69% -1.51% Therefore, Matt made a bad investment, since the stock has an excess return of -1.51% which means the stock earned 1.51% less than it should have on a risk-adjusted basis. 9. The Witney Growth Fund, a no-load mutual fund, had a net asset value per share of $54.28 one year ago. Its current net asset value is $56.93. During the year it paid out dividends and capital gains of $2.08 per share. It has a beta value of 1.75. Over the same period the market return was 6.4% and the risk-free rate of return was 3.5% (a) Calculate Treynor's measure for the Witney Growth Fund. (Show all work.) (b) Based on Treynor's measure, how did the fund perform in relation to the overall market? Answer: (a) HPR (fund) -[$2.08+ ($56.93-$54.28)]/$54.28-8.71% Treynor's (fund)-(8.71% -3.5%) /1.75 -2.98% (b) Treynor (market)-(6.4 % - 3.5 %)/1.00= 2.90% The fact that Treynor's measure of 2.98% for the Witney Growth Fund is greater than the 2.90% measure for the market indicates that the fund's performance is superior to the market. That is, the fund's risk premium per unit of nondiversifiable risk is greater than that of the market