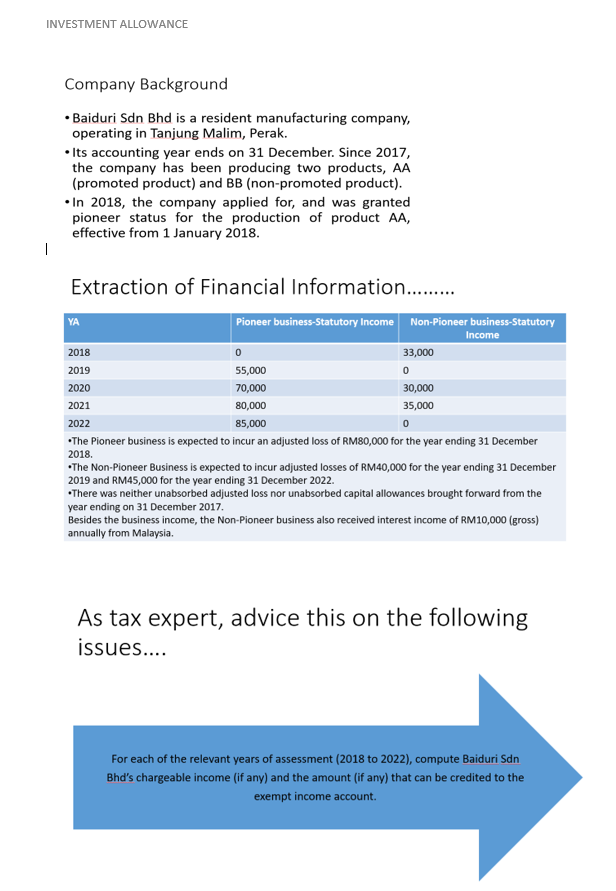

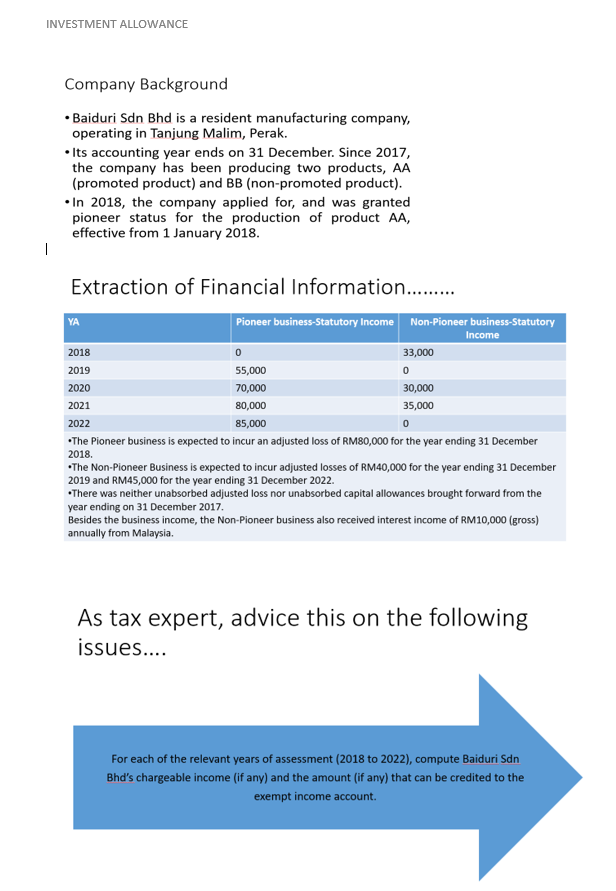

INVESTMENT ALLOWANCE Company Background Baiduri Sdn Bhd is a resident manufacturing company, operating in Tanjung Malim, Perak. Its accounting year ends on 31 December. Since 2017, the company has been producing two products, AA (promoted product) and BB (non-promoted product). In 2018, the company applied for, and was granted pioneer status for the production of product AA, effective from 1 January 2018. 1 Extraction of Financial Information......... YA Pioneer business-Statutory Income Non-Pioneer business-Statutory Income 2018 0 33,000 2019 55,000 0 2020 70,000 30,000 2021 80,000 35,000 2022 85,000 0 "The Pioneer business is expected to incur an adjusted loss of RM80,000 for the year ending 31 December 2018. *The Non-Pioneer Business is expected to incur adjusted losses of RM40,000 for the year ending 31 December 2019 and RM45,000 for the year ending 31 December 2022. There was neither unabsorbed adjusted loss nor unabsorbed capital allowances brought forward from the year ending on 31 December 2017. Besides the business income, the Non-Pioneer business also received interest income of RM10,000 (gross) annually from Malaysia. As tax expert, advice this on the following issues.... For each of the relevant years of assessment (2018 to 2022), compute Baiduri Sdn Bhd's chargeable income (if any) and the amount (if any) that can be credited to the exempt income account. INVESTMENT ALLOWANCE Company Background Baiduri Sdn Bhd is a resident manufacturing company, operating in Tanjung Malim, Perak. Its accounting year ends on 31 December. Since 2017, the company has been producing two products, AA (promoted product) and BB (non-promoted product). In 2018, the company applied for, and was granted pioneer status for the production of product AA, effective from 1 January 2018. 1 Extraction of Financial Information......... YA Pioneer business-Statutory Income Non-Pioneer business-Statutory Income 2018 0 33,000 2019 55,000 0 2020 70,000 30,000 2021 80,000 35,000 2022 85,000 0 "The Pioneer business is expected to incur an adjusted loss of RM80,000 for the year ending 31 December 2018. *The Non-Pioneer Business is expected to incur adjusted losses of RM40,000 for the year ending 31 December 2019 and RM45,000 for the year ending 31 December 2022. There was neither unabsorbed adjusted loss nor unabsorbed capital allowances brought forward from the year ending on 31 December 2017. Besides the business income, the Non-Pioneer business also received interest income of RM10,000 (gross) annually from Malaysia. As tax expert, advice this on the following issues.... For each of the relevant years of assessment (2018 to 2022), compute Baiduri Sdn Bhd's chargeable income (if any) and the amount (if any) that can be credited to the exempt income account