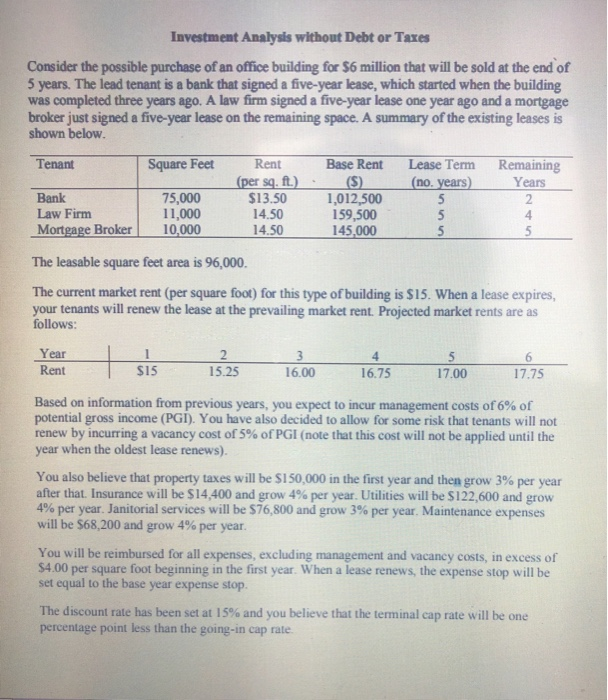

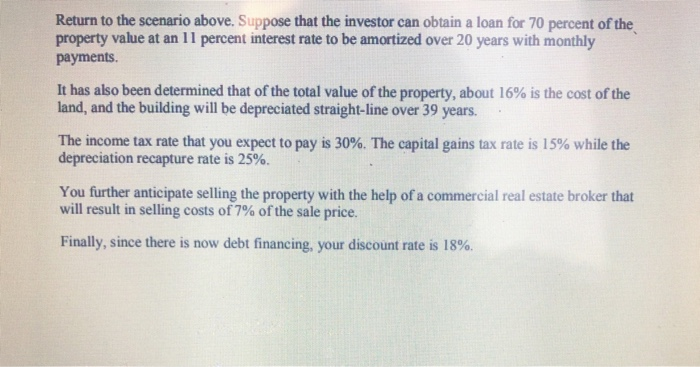

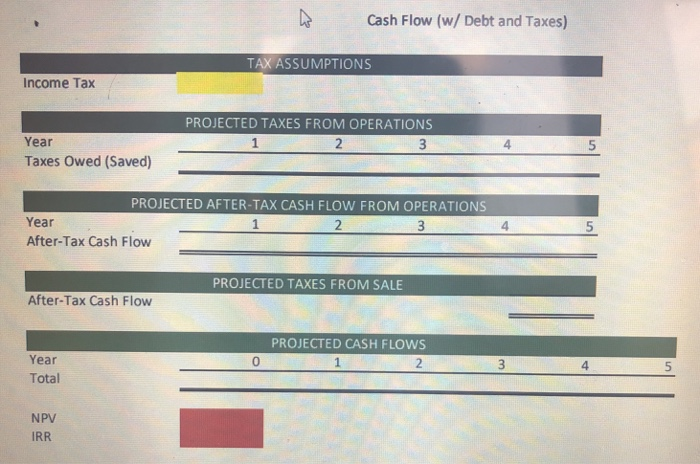

Investment Analysis without Debt or Taxes Consider the possible purchase of an office building for $6 million that will be sold at the end of 5 years. The lead tenant is a bank that signed a five-year lease, which started when the building was completed three years ago. A law firm signed a five-year lease one year ago and a mortgage broker just signed a five-year lease on the remaining space. A summary of the existing leases is shown below Square Feet ent Base Rent Lease Term Remaining Tenant ft. (no. years) Years Bank Law Firm 75,000 11,000 S13.50 14.50 1,012,500 159,500 4 The leasable square feet area is 96,000. The current market rent (per square foot) for this type of building is $15. When a lease expires, your tenants will renew the lease at the prevailing market rent. Projected market rents are as follows Year RentS15 15.25 16.00 16.75 17.00 17.75 Based on information from previous years, you expect to incur management costs of 6% of potential gross income (PGI). You have also decided to allow for some risk that tenants will not renew by incurring a vacancy cost of 5% of PGI (note that this cost will not be applied until the year when the oldest lease renews). You also believe that property taxes will be S 150,000 in the first year and then grow 3% per year after that. Insurance will be S 14,400 and grow 4% per year. Utilities will be S 122,000 and grow 4% per year. Janitorial services will be $76,800 and grow 3% per year. Maintenance expenses will be $68,200 and grow 4% per year. You will be reimbursed for all expenses, excluding management and vacancy costs, in excess of $4.00 per square foot beginning in the first year. When a lease renews, the expense stop will be set equal to the base year expense stop. The discount rate has been set at 15% and you believe that the terminal cap rate will be one percentage point less than the going-in cap rate Return to the scenario above. Suppose that the investor can obtain a loan for 70 percent of the property value at an 11 percent interest rate to be amortized over 20 years with monthly payments. It has also been determined that of the total value of the property, about 16% is the cost of the land, and the building will be depreciated straight-line over 39 years. The income tax rate that you expect to pay is 30%. The capital gains tax rate is 15% while the depreciation recapture rate is 25%. You further anticipate selling the property with the help of a commercial real estate broker that will result in selling costs of 7% of the sale price. Finally, since there is now debt financing, your discount rate is 18%. Cash Flow (w/ Debt and Taxes) TAX ASSUMPTIONS Income Tax PROJECTED TAXES FROM OPERATIONS Year Taxes Owed (Saved) 2 4 PROJECTED AFTER-TAX CASH FLOW FROM OPERATIONS Year After-Tax Cash Flow 4 PROJECTED TAXES FROM SALE After-Tax Cash Flow PROJECTED CASH FLOWS 0 Year Total 4 5 NPV IRR