Question

Investment and Portfolio Answer the following questions. 1. Ajay has invested only in PPF A/c. which matures in 2024. For his short term goals, what

Investment and Portfolio

Answer the following questions.

1. Ajay has invested only in PPF A/c. which matures in 2024. For his short term goals, what kind of risk does he face? a) Investment Risk b) Liquidity Risk c) Regulatory Risk d) Default Risk

2. Anita is a conservative investor and puts her money only in Fixed Deposits which she rolls over every year. In a falling interest rate scenario, which risk can be of most concern to her? a) Re-investment Risk b) Default Risk C)Inflation Risk d) Taxation Risk

3. Standard Deviation of a security in a given period measures a) The deviation of returns from the security from their mean value in the period b) The range between lowest and highest return given by the security in the period c) The deviation of return on security from market return in the period d) The extent of lower return on security than the market in the period

4. For a portfolio of two securities to achieve diversification, the a) Correlation between the securities needs to be positive b) Correlation between the securities needs to be zero c)Correlation between the securities needs to be negative d) Correlation coefficient between the securities needs to be 0.5

5. The co-variance between two securities is 42.53, while their individual standard deviations are 13.98 and 3.35, respectively. Calculate the correlation coefficient (r) of these securities. a) 0.07 b) 0.82 C)1.10 d) 0.91

Problem Solving 1. Ralph's Ratchets Corporation purchased ratchets rotator one year ago for $6,500. During the year it generated $4,000 in cash flow. If Ralph sells it, he could receive $6,100 for it. What is ratchets rotator's rate of return?

2. Jeremy Irons purchased 100 shares of Ferro, Inc. common stock for $25 per share one year ago. During the year, Ferro, Inc. paid cash dividends of $2 per share. The stock is currently selling for $30 per share. If Jeremy sells all of his shares of Ferro, Inc. today, what rate of return would he realize?

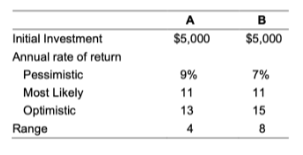

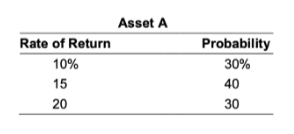

3. Given the following information about the two assets A and B, determine which asset is preferred.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started