Answered step by step

Verified Expert Solution

Question

1 Approved Answer

investment b*2 Invest Up Hardware operates a chain of hardware stores. Recent operations have been stable and profitable, resulting in a significant amount of cash

investment b*2

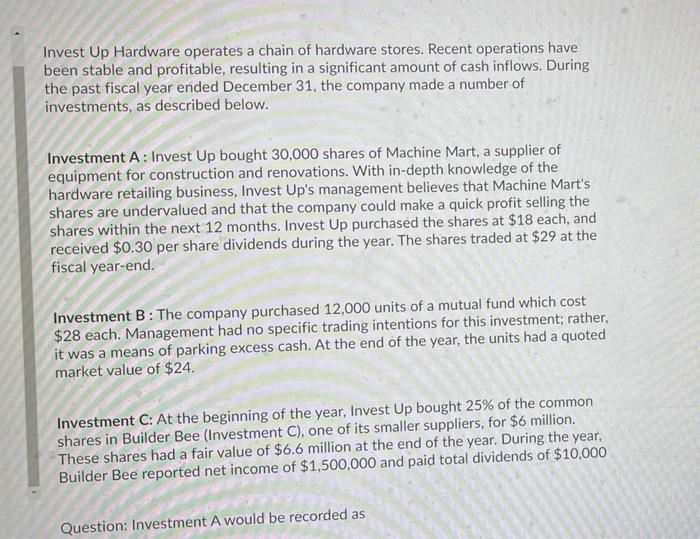

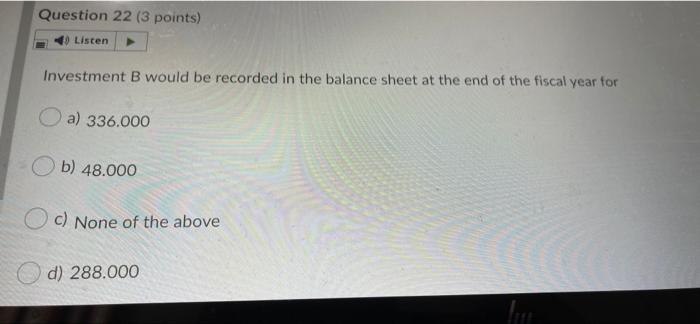

Invest Up Hardware operates a chain of hardware stores. Recent operations have been stable and profitable, resulting in a significant amount of cash inflows. During the past fiscal year ended December 31, the company made a number of investments, as described below. Investment A: Invest Up bought 30,000 shares of Machine Mart, a supplier of equipment for construction and renovations. With in-depth knowledge of the hardware retailing business, Invest Up's management believes that Machine Mart's shares are undervalued and that the company could make a quick profit selling the shares within the next 12 months. Invest Up purchased the shares at $18 each, and received $0.30 per share dividends during the year. The shares traded at $29 at the fiscal year-end. Investment B: The company purchased 12,000 units of a mutual fund which cost $28 each. Management had no specific trading intentions for this investment; rather, it was a means of parking excess cash. At the end of the year, the units had a quoted market value of $24. Investment C: At the beginning of the year, Invest Up bought 25% of the common shares in Builder Bee (Investment C), one of its smaller suppliers, for $6 million. These shares had a fair value of $6.6 million at the end of the year. During the year, Builder Bee reported net income of $1,500,000 and paid total dividends of $10,000 Question: Investment A would be recorded as Question 22 (3 points) Listen Investment B would be recorded in the balance sheet at the end of the fiscal year for a) 336.000 b) 48.000 c) None of the above d) 288.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started