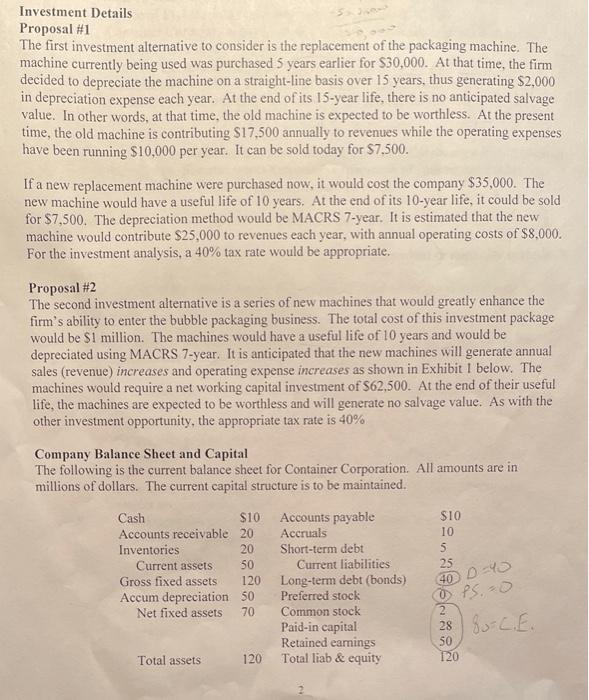

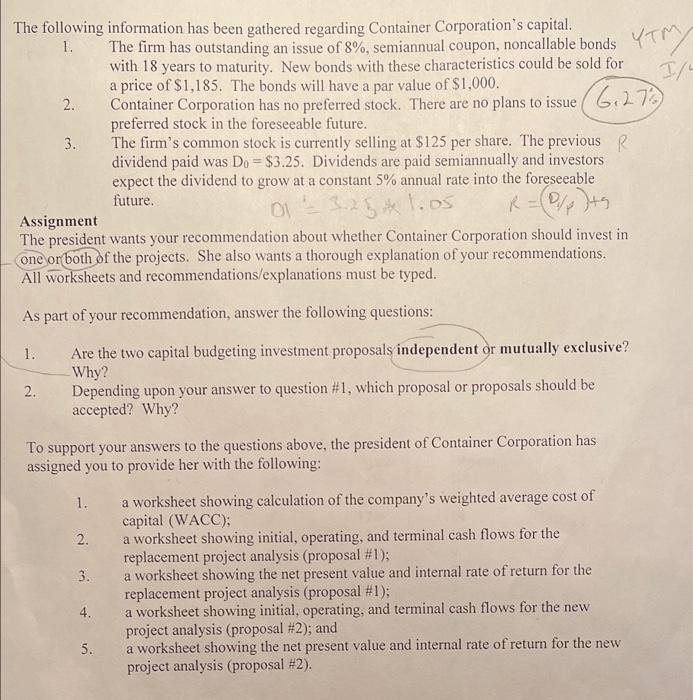

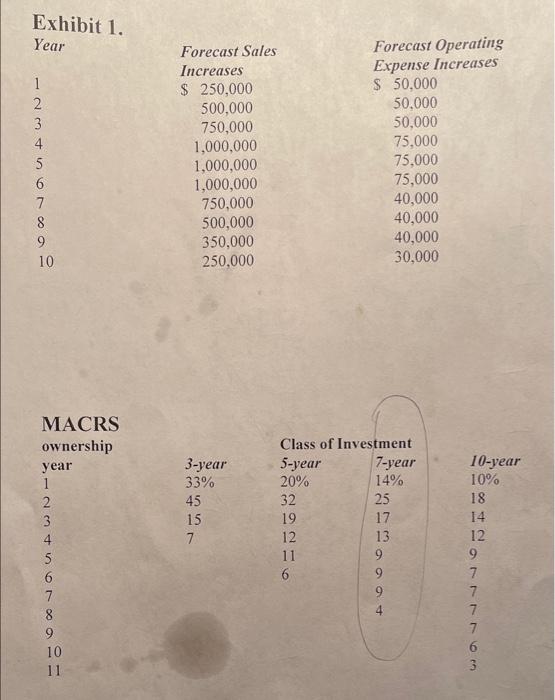

Investment Details Proposal #1 The first investment alternative to consider is the replacement of the packaging machine. The machine currently being used was purchased 5 years earlier for $30,000. At that time, the firm decided to depreciate the machine on a straight-line basis over 15 years, thus generating $2,000 in depreciation expense each year. At the end of its 15-year life, there is no anticipated salvage value. In other words, at that time, the old machine is expected to be worthless. At the present time, the old machine is contributing $17,500 annually to revenues while the operating expenses have been running $10,000 per year. It can be sold today for $7.500. If a new replacement machine were purchased now, it would cost the company $35,000. The new machine would have a useful life of 10 years. At the end of its 10-year life, it could be sold for $7,500. The depreciation method would be MACRS 7-year. It is estimated that the new machine would contribute $25,000 to revenues each year, with annual operating costs of $8.000. For the investment analysis, a 40% tax rate would be appropriate. Proposal #2 The second investment alternative is a series of new machines that would greatly enhance the firm's ability to enter the bubble packaging business. The total cost of this investment package would be $1 million. The machines would have a useful life of 10 years and would be depreciated using MACRS 7-year. It is anticipated that the new machines will generate annual sales (revenue) increases and operating expense increases as shown in Exhibit I below. The machines would require a networking capital investment of $62,500. At the end of their useful life, the machines are expected to be worthless and will generate no salvage value. As with the other investment opportunity, the appropriate tax rate is 40% Company Balance Sheet and Capital The following is the current balance sheet for Container Corporation. All amounts are in millions of dollars. The current capital structure is to be maintained. $10 40 D-45 Cash $10 Accounts payable Accounts receivable 20 Accruals Inventories 20 Short-term debt Current assets 50 Current liabilities Gross fixed assets 120 Long-term debt (bonds) Accum depreciation 50 Preferred stock Net fixed assets 70 Common stock Paid-in capital Retained earings Total assets 120 Total liab & equity = 0 Asean ops.=0 28 85C.E. 120 The following information has been gathered regarding Container Corporation's capital. 1. The firm has outstanding an issue of 8%, semiannual coupon, noncallable bonds yTM with 18 years to maturity. New bonds with these characteristics could be sold for I/ a price of $1,185. The bonds will have a par value of $1,000. 2. Container Corporation has no preferred stock. There are no plans to issue 6.27 preferred stock in the foreseeable future. 3. The firm's common stock is currently selling at $125 per share. The previous R dividend paid was Do = $3.25. Dividends are paid semiannually and investors expect the dividend to grow at a constant 5% annual rate into the foreseeable future. ON 1125*1.os R=0/ptg Assignment The president wants your recommendation about whether Container Corporation should invest in one or both of the projects. She also wants a thorough explanation of your recommendations. All worksheets and recommendations/explanations must be typed. As part of your recommendation, answer the following questions: 1. Are the two capital budgeting investment proposals independent or mutually exclusive? Why? Depending upon your answer to question #1, which proposal or proposals should be accepted? Why? 2. To support your answers to the questions above, the president of Container Corporation has assigned you to provide her with the following: 1. 2. 3. a worksheet showing calculation of the company's weighted average cost of capital (WACC); a worksheet showing initial, operating, and terminal cash flows for the replacement project analysis (proposal #1); a worksheet showing the net present value and internal rate of return for the replacement project analysis (proposal #1); a worksheet showing initial, operating, and terminal cash flows for the new project analysis (proposal #2); and a worksheet showing the net present value and internal rate of return for the new project analysis (proposal #2). 4. 5. Exhibit 1. Year 1 2 3 4 5 6 7 8 9 10 Forecast Sales Increases $ 250,000 500,000 750,000 1,000,000 1,000,000 1,000,000 750,000 500,000 350,000 250,000 Forecast Operating Expense Increases $ 50,000 50,000 50,000 75,000 75,000 75,000 40,000 40,000 40,000 30,000 MACRS ownership year 3-year 33% 45 15 7 -amora Class of Investment 5-year 7-year 20% 14% 32 25 19 17 12 13 11 9 6 9 9 4 5 6 10-year 10% 18 14 12 9 7 7 7 7 6 3 8 9 10 11