Answered step by step

Verified Expert Solution

Question

1 Approved Answer

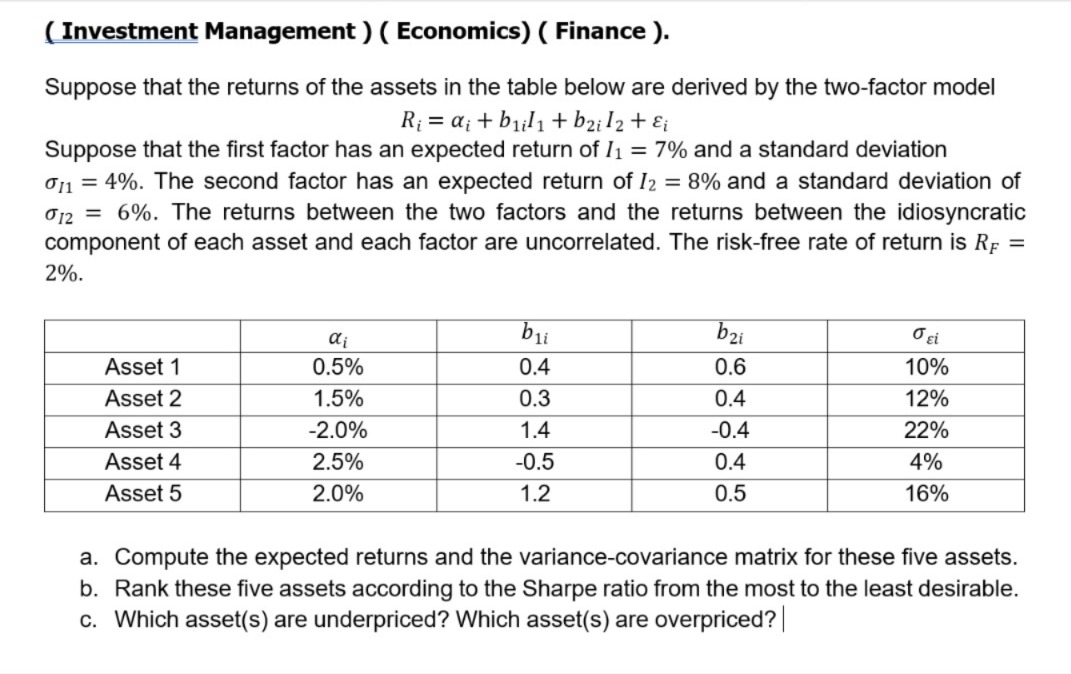

( Investment Management ) ( Economics ) ( Finance ) . Suppose that the returns of the assets in the table below are derived by

Investment Management Economics Finance

Suppose that the returns of the assets in the table below are derived by the twofactor model

Suppose that the first factor has an expected return of and a standard deviation

The second factor has an expected return of and a standard deviation of

The returns between the two factors and the returns between the idiosyncratic

component of each asset and each factor are uncorrelated. The riskfree rate of return is

a Compute the expected returns and the variancecovariance matrix for these five assets.

b Rank these five assets according to the Sharpe ratio from the most to the least desirable.

c Which assets are underpriced? Which assets are overpriced?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started