Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Investment Management Process Muggie and Lungowe Litooma, both in their 50s, have K100,000 to invest and plan to retire in 10 years. They are considering

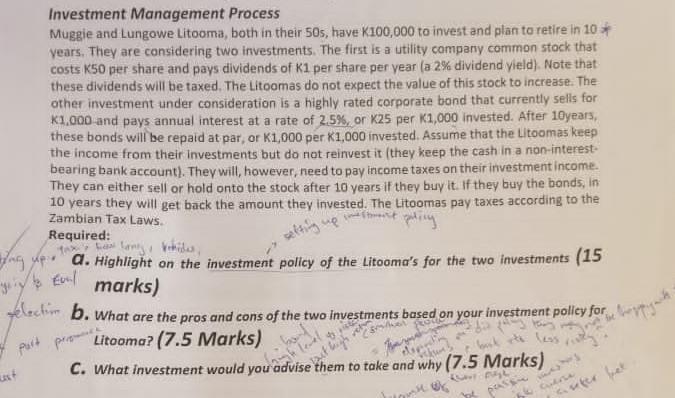

Investment Management Process Muggie and Lungowe Litooma, both in their 50s, have K100,000 to invest and plan to retire in 10 years. They are considering two investments. The first is a utility company common stock that costs K50 per share and pays dividends of K1 per share per year (a 2% dividend yield). Note that these dividends will be taxed. The Litoomas do not expect the value of this stock to increase. The other investment under consideration is a highly rated corporate bond that currently sells for K1,000 and pays annual interest at a rate of 2.5%, or K25 per K1,000 invested. After 10years, these bonds will be repaid at par, or K1,000 per K1,000 invested. Assume that the Litoomas keep the income from their investments but do not reinvest it (they keep the cash in a non-interest- bearing bank account). They will, however, need to pay income taxes on their investment income. They can either sell or hold onto the stock after 10 years if they buy it. If they buy the bonds, in 10 years they will get back the amount they invested. The Litoomas pay taxes according to the Zambian Tax Laws. Required: Tax Law Lanty kekides, mestiment a. Highlight on the investment policy of the Litooma's for the two investments (15 marks) electib. what are the pros and cons of the two investments based on your investment policy for Part Litooma? (7.5 Marks) ust C. What investment would you advise them to take and why (7.5 Marks) but high birkts less w figh se UK pues fecuerse anter fict Investment Management Process Muggie and Lungowe Litooma, both in their 50s, have K100,000 to invest and plan to retire in 10 years. They are considering two investments. The first is a utility company common stock that costs K50 per share and pays dividends of K1 per share per year (a 2% dividend yield). Note that these dividends will be taxed. The Litoomas do not expect the value of this stock to increase. The other investment under consideration is a highly rated corporate bond that currently sells for K1,000 and pays annual interest at a rate of 2.5%, or K25 per K1,000 invested. After 10years, these bonds will be repaid at par, or K1,000 per K1,000 invested. Assume that the Litoomas keep the income from their investments but do not reinvest it (they keep the cash in a non-interest- bearing bank account). They will, however, need to pay income taxes on their investment income. They can either sell or hold onto the stock after 10 years if they buy it. If they buy the bonds, in 10 years they will get back the amount they invested. The Litoomas pay taxes according to the Zambian Tax Laws. Required: Tax Law Lanty kekides, mestiment a. Highlight on the investment policy of the Litooma's for the two investments (15 marks) electib. what are the pros and cons of the two investments based on your investment policy for Part Litooma? (7.5 Marks) ust C. What investment would you advise them to take and why (7.5 Marks) but high birkts less w figh se UK pues fecuerse anter fict

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started