Question

Investment opportunity set: (a) Using the expected returns and volatility numbers from previous question, plot your assets on the expected return-risk space. (b) Use Solver

Investment opportunity set:

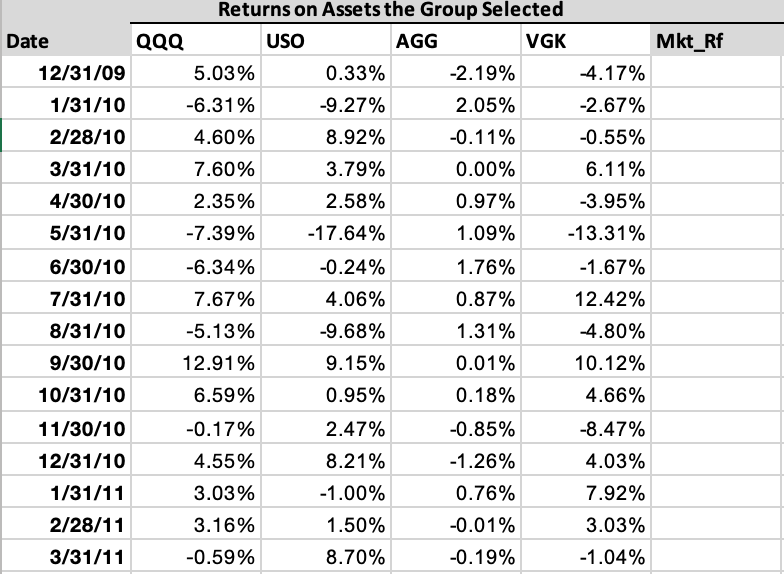

(a) Using the expected returns and volatility numbers from previous question, plot your assets on the expected return-risk space.

(b) Use Solver in Excel to find 5 portfolios on the minimum-variance frontier. Start by finding the global minimum variance portfolio. Next, find 3 portfolios on the efficient frontier (expected return higher than expected return on global minimum variance portfolio) and 1 portfolio with expected return below expected return on global minimum variance portfolio. You are using solver to find 5 different sets of weights (i.e. portfolios) in the four ETFs you selected that will minimize volatility for 5 different levels of expected returns. Include a table that consists of the weights, expected return, volatility, and Sharpe ratio for the 5 different portfolios on the minimum-variance frontier in the Word file.

(c) Add the minimum-variance frontier to your risk-return plot. Include this plot in the Word document.

Please explain by step how to get the mkt_Rf

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started