Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Investment Solution (IS) and ExpressIT (EIT) both need to borrow $100000 to finance the development of new products. IS can borrow fixed-interest-rate funds at 9

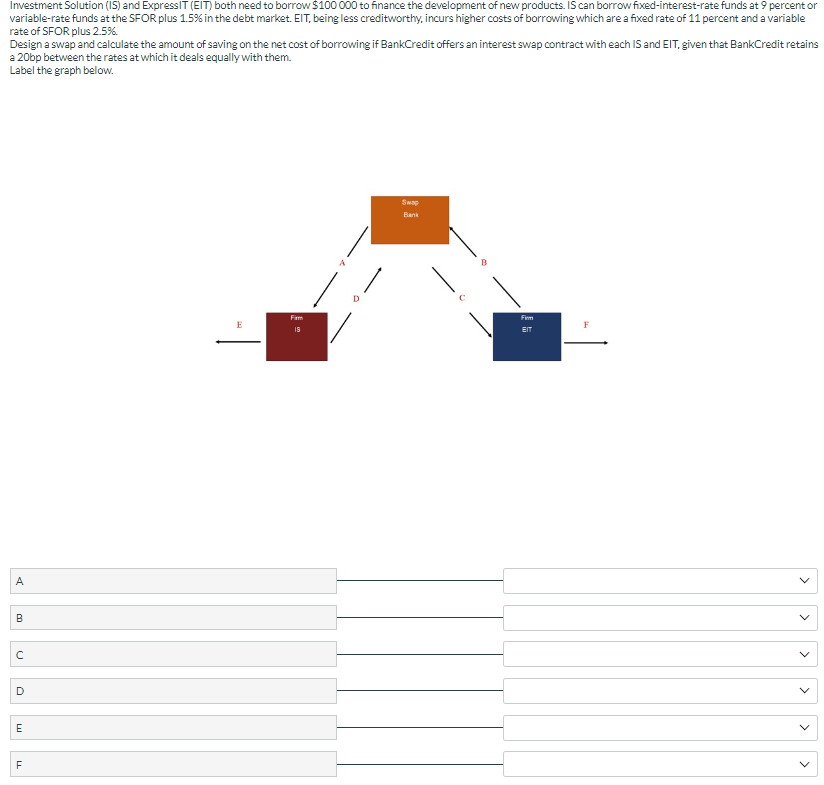

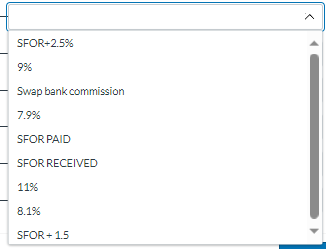

Investment Solution (IS) and ExpressIT (EIT) both need to borrow $100000 to finance the development of new products. IS can borrow fixed-interest-rate funds at 9 percent or variable-rate funds at the SFOR plus 1.5% in the debt market. EIT, being less creditworthy, incurs higher costs of borrowing which are a fixed rate of 11 percent and a variable rate of SFOR plus 2.5% Design a swap and calculate the amount of saving on the net cost of borrowing if BankCredit offers an interest swap contract with each IS and EIT, given that BankCredit retains a 20 bp between the rates at which it deals equally with them. Label the graph below. SFOR+2.5% 9% Swap bank commission 7.9% SFOR PAID SFOR RECEIVED 11% 8.1% SFOR+1.5 Investment Solution (IS) and ExpressIT (EIT) both need to borrow $100000 to finance the development of new products. IS can borrow fixed-interest-rate funds at 9 percent or variable-rate funds at the SFOR plus 1.5% in the debt market. EIT, being less creditworthy, incurs higher costs of borrowing which are a fixed rate of 11 percent and a variable rate of SFOR plus 2.5% Design a swap and calculate the amount of saving on the net cost of borrowing if BankCredit offers an interest swap contract with each IS and EIT, given that BankCredit retains a 20 bp between the rates at which it deals equally with them. Label the graph below. SFOR+2.5% 9% Swap bank commission 7.9% SFOR PAID SFOR RECEIVED 11% 8.1% SFOR+1.5

Investment Solution (IS) and ExpressIT (EIT) both need to borrow $100000 to finance the development of new products. IS can borrow fixed-interest-rate funds at 9 percent or variable-rate funds at the SFOR plus 1.5% in the debt market. EIT, being less creditworthy, incurs higher costs of borrowing which are a fixed rate of 11 percent and a variable rate of SFOR plus 2.5% Design a swap and calculate the amount of saving on the net cost of borrowing if BankCredit offers an interest swap contract with each IS and EIT, given that BankCredit retains a 20 bp between the rates at which it deals equally with them. Label the graph below. SFOR+2.5% 9% Swap bank commission 7.9% SFOR PAID SFOR RECEIVED 11% 8.1% SFOR+1.5 Investment Solution (IS) and ExpressIT (EIT) both need to borrow $100000 to finance the development of new products. IS can borrow fixed-interest-rate funds at 9 percent or variable-rate funds at the SFOR plus 1.5% in the debt market. EIT, being less creditworthy, incurs higher costs of borrowing which are a fixed rate of 11 percent and a variable rate of SFOR plus 2.5% Design a swap and calculate the amount of saving on the net cost of borrowing if BankCredit offers an interest swap contract with each IS and EIT, given that BankCredit retains a 20 bp between the rates at which it deals equally with them. Label the graph below. SFOR+2.5% 9% Swap bank commission 7.9% SFOR PAID SFOR RECEIVED 11% 8.1% SFOR+1.5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started