Investments and financial markets

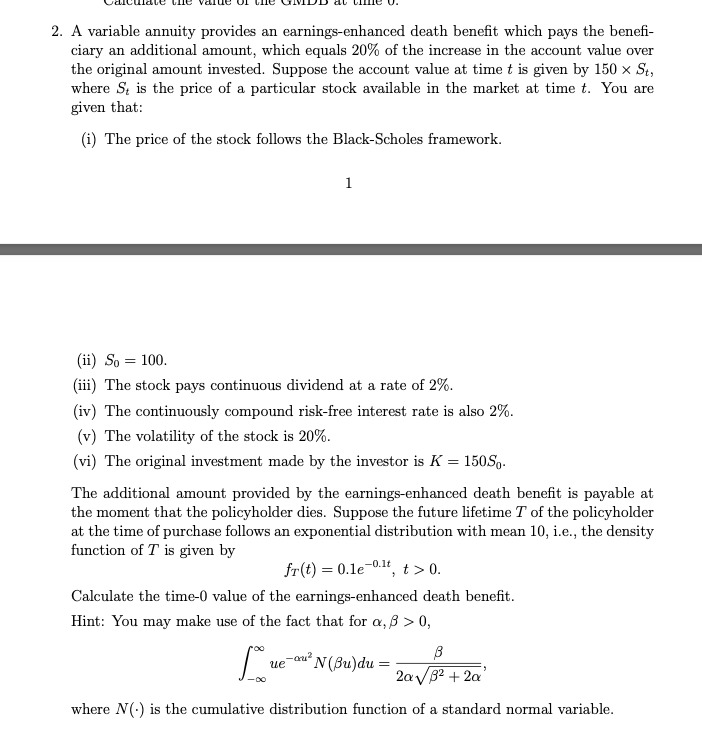

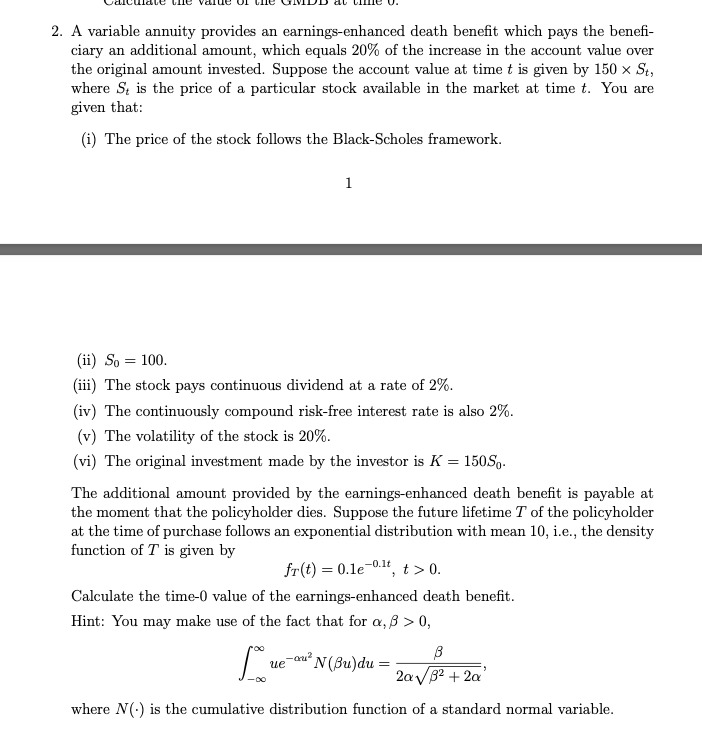

2. A variable annuity provides an earnings-enhanced death benefit which pays the benefi- ciary an additional amount, which equals 20% of the increase in the account value over the original amount invested. Suppose the account value at time t is given by 150 x St, where St is the price of a particular stock available in the market at time t. You are given that: (i) The price of the stock follows the Black-Scholes framework. 1 (ii) So = 100. (iii) The stock pays continuous dividend at a rate of 2%. (iv) The continuously compound risk-free interest rate is also 2%. (v) The volatility of the stock is 20%. (vi) The original investment made by the investor is K = 1505 The additional amount provided by the earnings-enhanced death benefit is payable at the moment that the policyholder dies. Suppose the future lifetime T of the policyholder at the time of purchase follows an exponential distribution with mean 10, i.e., the density function of T is given by fr(t) = 0.1e-0.1t, t>0. Calculate the time-0 value of the earnings-enhanced death benefit. Hint: You may make use of the fact that for a, 3 > 0, B N(Buldu 2a VB2 + 2a where N() is the cumulative distribution function of a standard normal variable. 2. A variable annuity provides an earnings-enhanced death benefit which pays the benefi- ciary an additional amount, which equals 20% of the increase in the account value over the original amount invested. Suppose the account value at time t is given by 150 x St, where St is the price of a particular stock available in the market at time t. You are given that: (i) The price of the stock follows the Black-Scholes framework. 1 (ii) So = 100. (iii) The stock pays continuous dividend at a rate of 2%. (iv) The continuously compound risk-free interest rate is also 2%. (v) The volatility of the stock is 20%. (vi) The original investment made by the investor is K = 1505 The additional amount provided by the earnings-enhanced death benefit is payable at the moment that the policyholder dies. Suppose the future lifetime T of the policyholder at the time of purchase follows an exponential distribution with mean 10, i.e., the density function of T is given by fr(t) = 0.1e-0.1t, t>0. Calculate the time-0 value of the earnings-enhanced death benefit. Hint: You may make use of the fact that for a, 3 > 0, B N(Buldu 2a VB2 + 2a where N() is the cumulative distribution function of a standard normal variable