Answered step by step

Verified Expert Solution

Question

1 Approved Answer

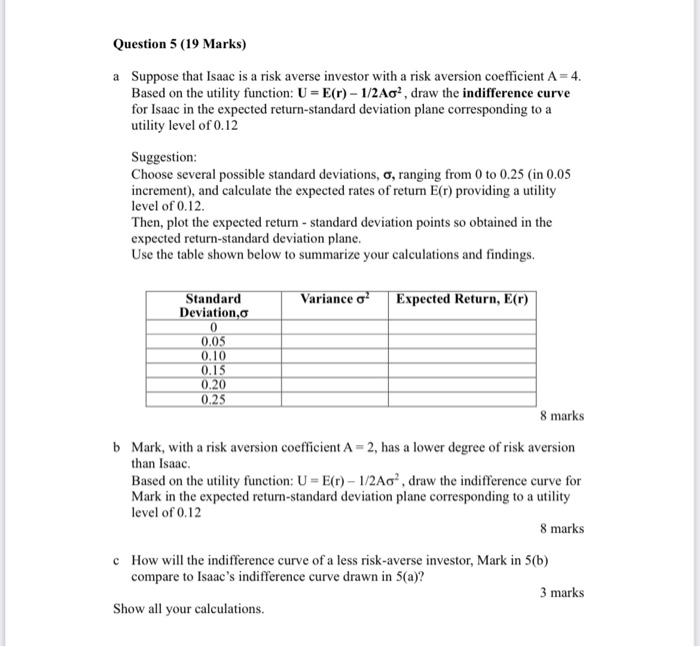

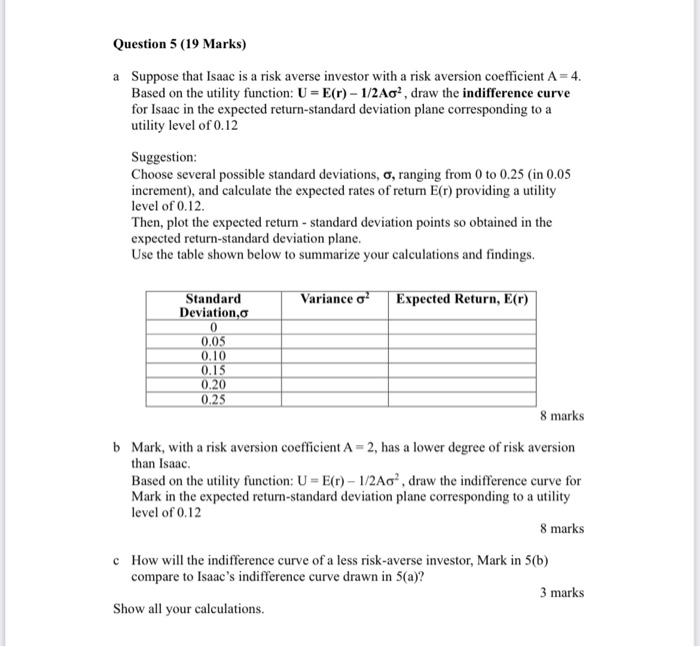

Investments Question 5 (19 Marks) a Suppose that Isaac is a risk averse investor with a risk aversion coefficient A=4. Based on the utility function:

Investments

Question 5 (19 Marks) a Suppose that Isaac is a risk averse investor with a risk aversion coefficient A=4. Based on the utility function: U = E(r) - 1/2 Ao?, draw the indifference curve for Isaac in the expected return-standard deviation plane corresponding to a utility level of 0.12 Suggestion: Choose several possible standard deviations, o, ranging from 0 to 0.25 (in 0.05 increment), and calculate the expected rates of return E(r) providing a utility level of 0.12. Then, plot the expected return - standard deviation points so obtained in the expected return-standard deviation plane. Use the table shown below to summarize your calculations and findings. Variance o Expected Return, E(r) Standard Deviation o 0 0,05 0.10 0.15 0.20 0.25 8 marks b Mark, with a risk aversion coefficient A = 2, has a lower degree of risk aversion than Isaac Based on the utility function: U = E(r) - 1/2A0?, draw the indifference curve for Mark in the expected return-standard deviation plane corresponding to a utility level of 0.12 8 marks c How will the indifference curve of a less risk-averse investor, Mark in 5(b) compare to Isaac's indifference curve drawn in (a)? 3 marks Show all your calculations. Question 5 (19 Marks) a Suppose that Isaac is a risk averse investor with a risk aversion coefficient A=4. Based on the utility function: U = E(r) - 1/2 Ao?, draw the indifference curve for Isaac in the expected return-standard deviation plane corresponding to a utility level of 0.12 Suggestion: Choose several possible standard deviations, o, ranging from 0 to 0.25 (in 0.05 increment), and calculate the expected rates of return E(r) providing a utility level of 0.12. Then, plot the expected return - standard deviation points so obtained in the expected return-standard deviation plane. Use the table shown below to summarize your calculations and findings. Variance o Expected Return, E(r) Standard Deviation o 0 0,05 0.10 0.15 0.20 0.25 8 marks b Mark, with a risk aversion coefficient A = 2, has a lower degree of risk aversion than Isaac Based on the utility function: U = E(r) - 1/2A0?, draw the indifference curve for Mark in the expected return-standard deviation plane corresponding to a utility level of 0.12 8 marks c How will the indifference curve of a less risk-averse investor, Mark in 5(b) compare to Isaac's indifference curve drawn in (a)? 3 marks Show all your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started