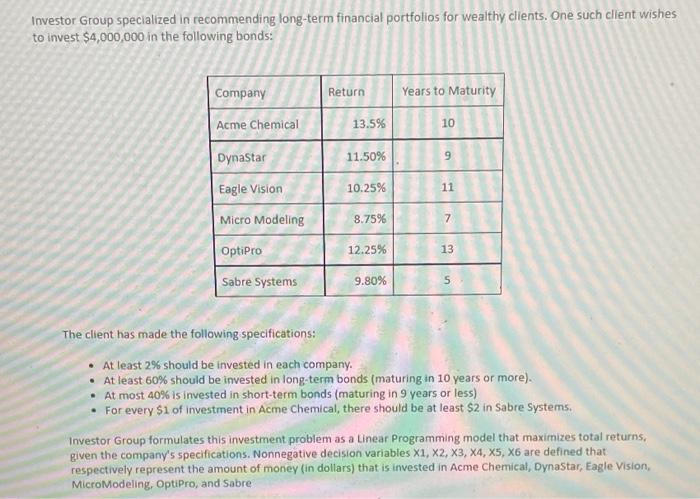

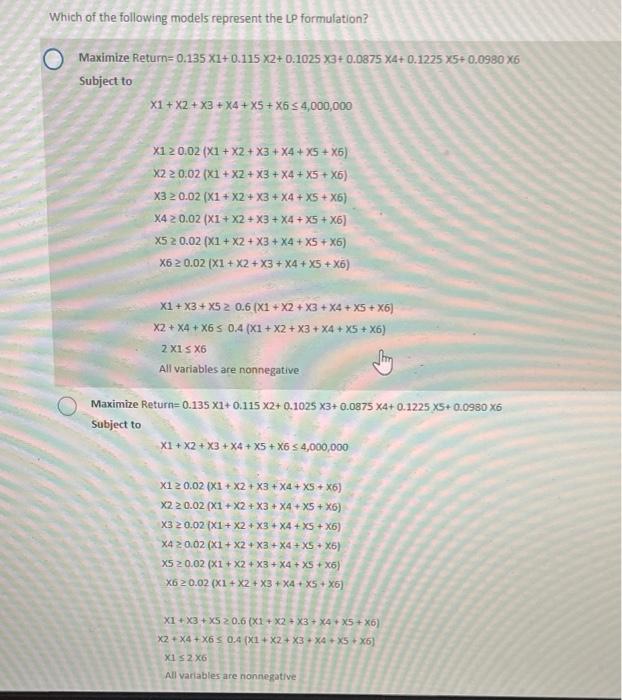

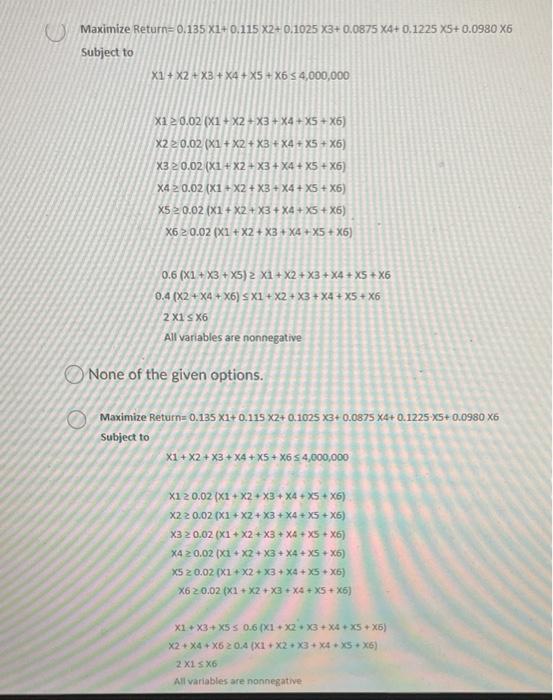

Investor Group specialized in recommending long-term financial portfolios for wealthy clients. One such client wishes to invest $4,000,000 in the following bonds: Company Return Years to Maturity Acme Chemical 13.5% 10 Dynastar 11.50% 9 Eagle Vision 10.25% 11 Micro Modeling 8.75% 7 OptiPro 12.25% 13 Sabre Systems 9.80% 5 The client has made the following specifications: At least 2% should be invested in each company. At least 60% should be invested in long-term bonds (maturing in 10 years or more). At most 40% is invested in short-term bonds (maturing in 9 years or less) For every $1 of investment in Acme Chemical, there should be at least $2 in Sabre Systems. Investor Group formulates this investment problem as a Linear Programming model that maximizes total returns, given the company's specifications. Nonnegative decision variables X1, X2, X3, X4, X5, X6 are defined that respectively represent the amount of money in dollars) that is invested in Acme Chemical, Dynastar, Eagle Vision, Micro Modeling, OptiPro, and Sabre Which of the following models represent the LP formulation? Maximize Return=0.135 X1+0.115 X2+0.1025 X3+ 0.0875 X4+0.1225 X5+ 0.0980 X6 Subject to X1 + x2 + x3 + x4 + X5 + X6 3 4,000,000 X1 20.02(x1 + x2 + x3 + x4 + XS + X6) X2 2 0.02 (X1 + x2 + x3 + x4 + X5 + X6) X3 2 0.02 (X1 + x2 + x3 + x4 + X5 + X6) X4 2 0.02 (X1 + x2 + x3 + x4 + X5 + X6) X5 2 0.02 (X1 + x2 + x3 + x4 + X5 + X6) X6 2 0.02 (X1 + x2 + x3 + x4 + X5 + X6) x1 + x3 + x5 2 0.6 [X1 + x2 + x3 + x4 + X5 + X6) x2 + x4 + X6 5 0.4 (X1 + x2 + x3 + x4 + X5 + X6) 2X1 S X6 All variables are nonnegative Maximize Return=0.135 X1+0.115 X2+0.1025 X3+0.0875 X4+ 0.1225 XS+ 0.0980 X6 Subject to X1 + x2 + x3 + x4 + X5 + X6 $ 4,000,000 X1 2 0.02 (XI + X2 + x3 + x4 + XS + X6) X2 2 0.02 (X1 + X2 + x3 + x4 + X5 + X6) X3 2 0.02 (X1 + x2 + x3 + x4 + X5 + X6) X4 20.02 (X1 + x2 * x3 + x4 + XS X6) X5 20.02. (X1 + x2 + x3 + x4 + XS + X6) X6 20.02 (X1 + X2 + x3 + x4 + XS + X6) X1 + X3 + XS 2 0.6 (x1 + x2 + x3 + x4 * X5 + X6) x2 + x4 + X6 $ 0.4 (X1 + x2 + x3 + x4 + X5 + X6) XIS 2 X6 All variables are nonnegative Maximize Return=0.135 XI+0,115 X2+0.1025 X3+ 0.0875 X4+ 0.1225 XS+ 0.0980 X6 Subject to X1 + x2 + x3 + x4 + X5 + X6 5 4,000,000 X1 20.02 X1 + x2 + x3 +X4+X5 + X6) X220.02(x1 + x2 + x3 + x4 + X5 + X6) X3 20.02 (X1 + x2 + x3 + x4 + X5 + X6) X4 2 0.02 (X1 + X2 + x3 + x4 + X5 + X6) X5 20.02 (X1 + x2 + x3 + x4 + X5+X5) X6 2 0.02 (X1 + x2 + x3 + x4 +X5+X5) 0.6 (X1 + X3 + XS) 2 X1 + X2 + x3 + x4 + X5 + X6 0.4 (x2 + x4 + X6) SX1 + X2 + x3 + x4 + X5 X6 2X1 S X6 All variables are nonnegative None of the given options. Maximize Return=0.135 X1+0.115 x2+0.1025 X3+ 0.0875 X4+ 0.1225 XS+ 0.0980 X6 Subject to X1 + x2 + x3 + x4 + X5 + X6 $ 4,000,000 X120.02 (X1 + X2 + x3 + x4 + X5 + X6) X220.02(X1 + x2 + x3 + x4 + X5 + X6) X3 2 0.02 (X1 + X2 + x3 + x4 + XS + X6) *4 20.02 X2 * x2 + x3 + x4 + X5 + X5) X5 20.02.(X2 + x2 + x3 + x2 + 25 + X6} X620.02 (X1 + x2 + x3 + x4 + X5+X6} X1 X3 X5 0.6 X1 + x2 * x3 + x4 + X5 + X6) X2 + X4+X6 20.4 (XI-X2 X3 X4 X5 X6) 2 X1 S X6 All variables are nonnegative