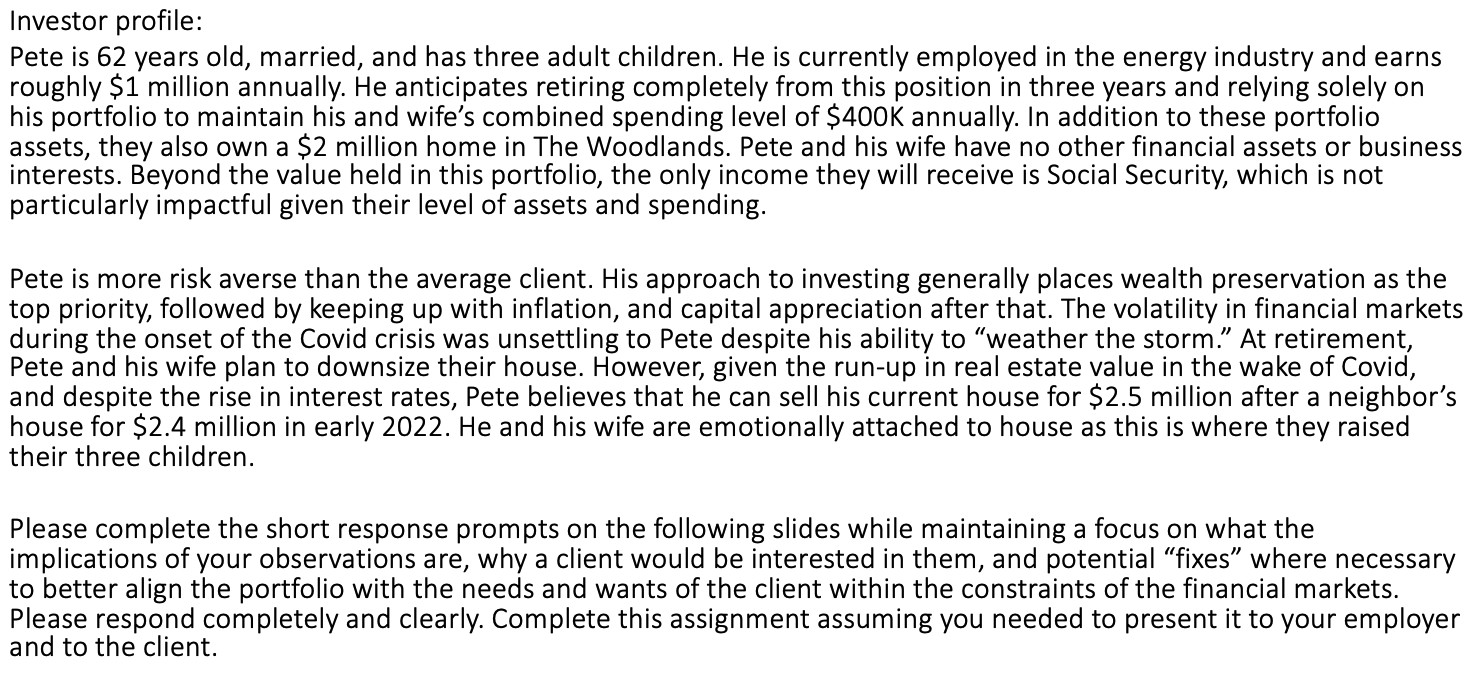

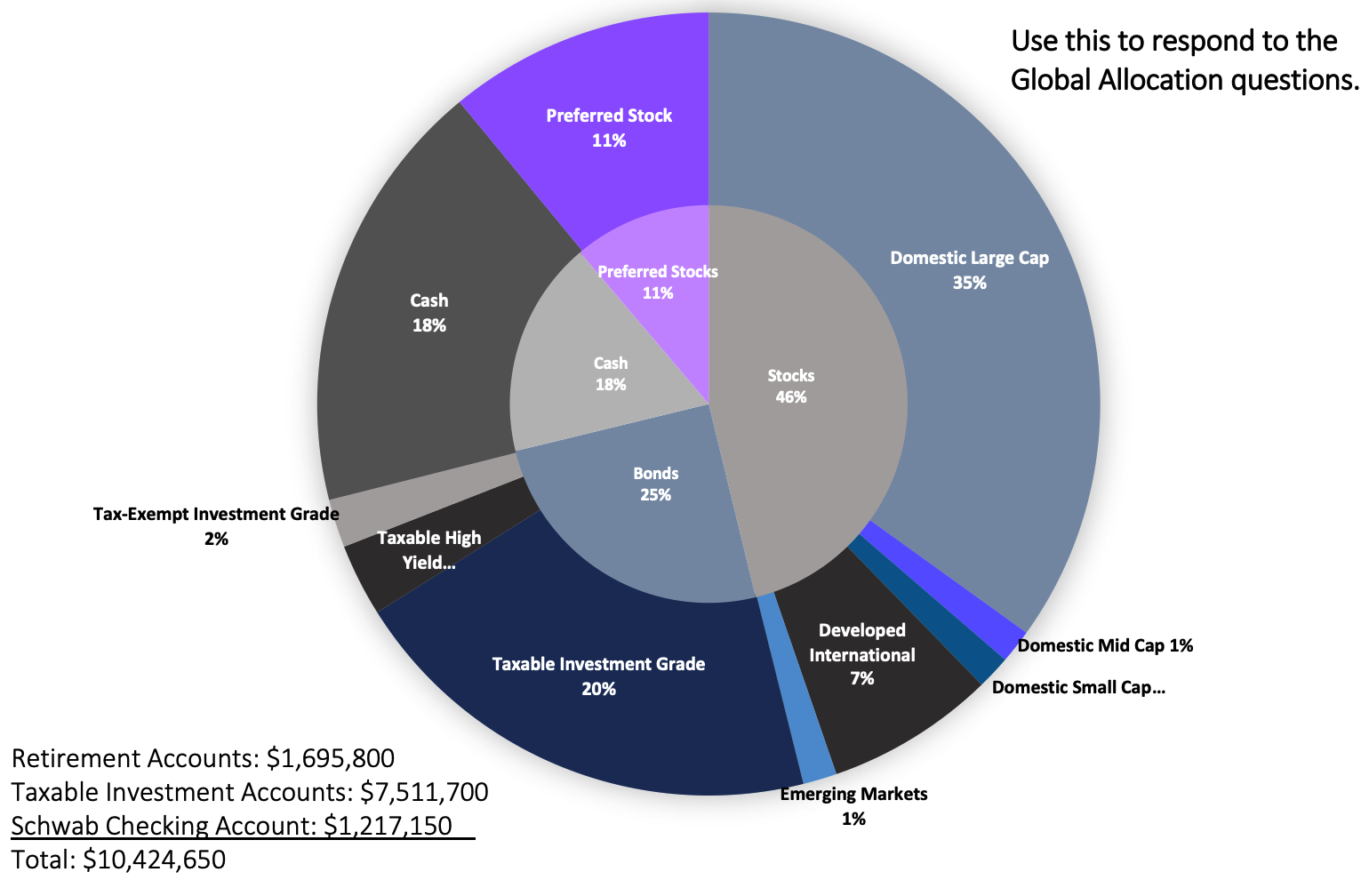

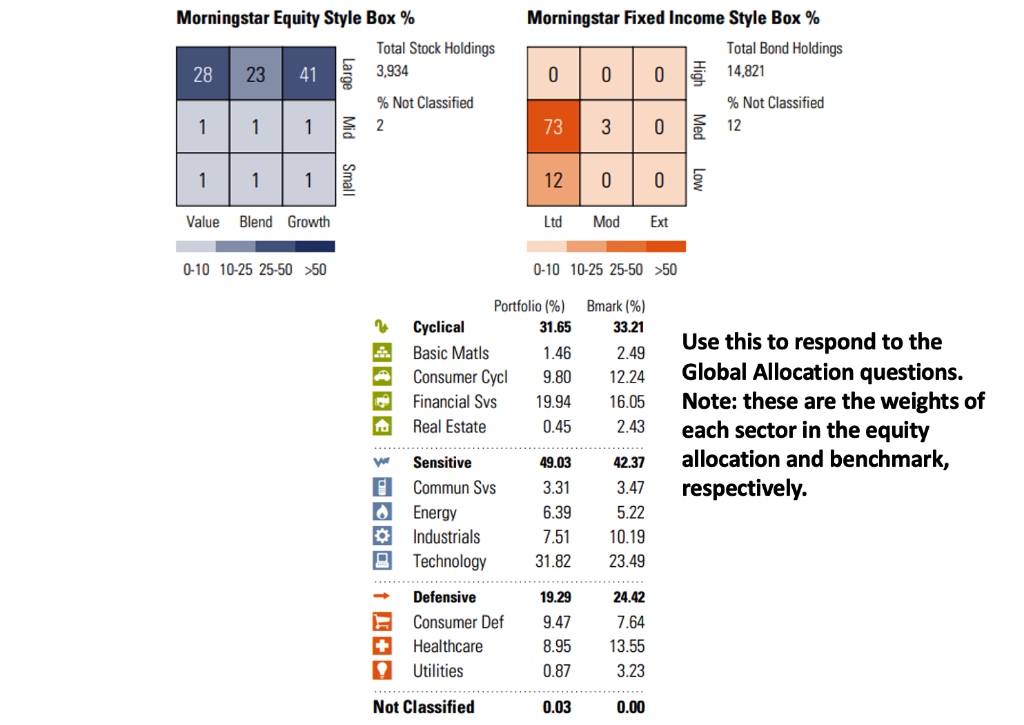

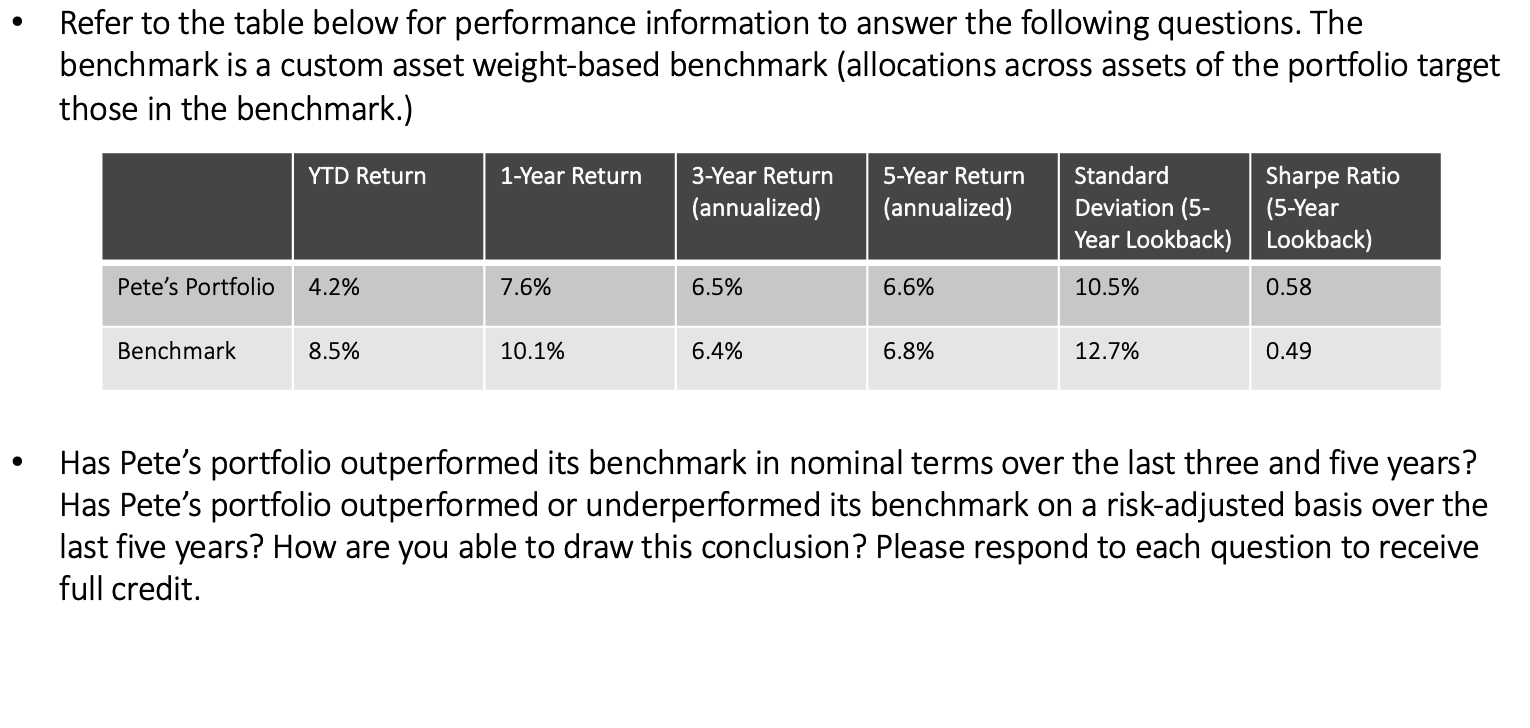

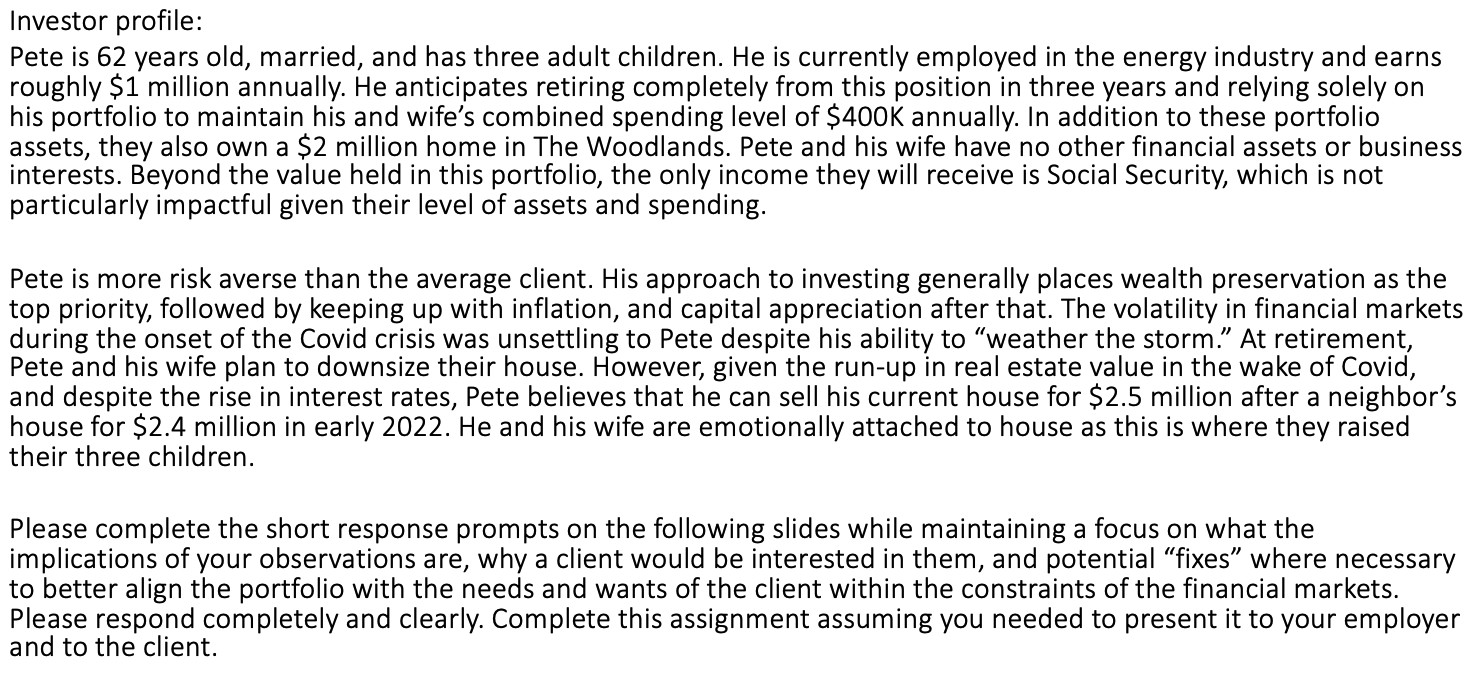

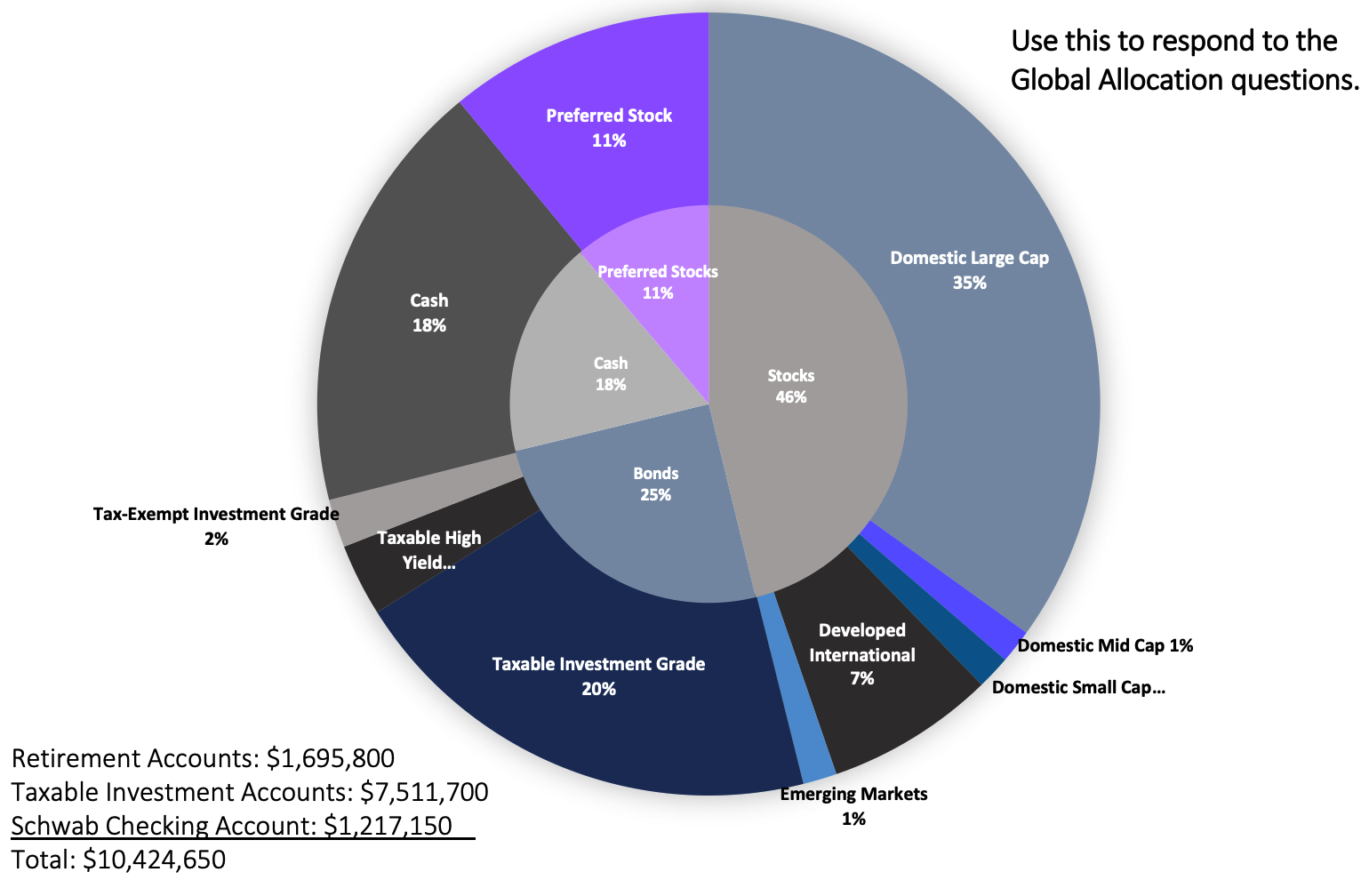

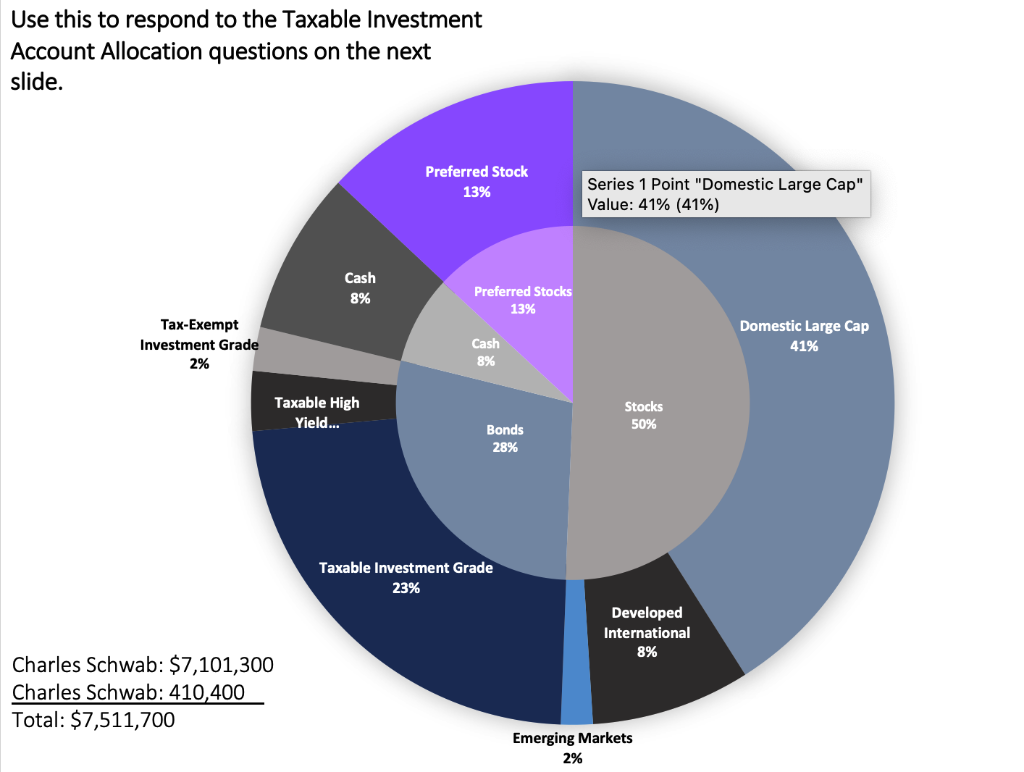

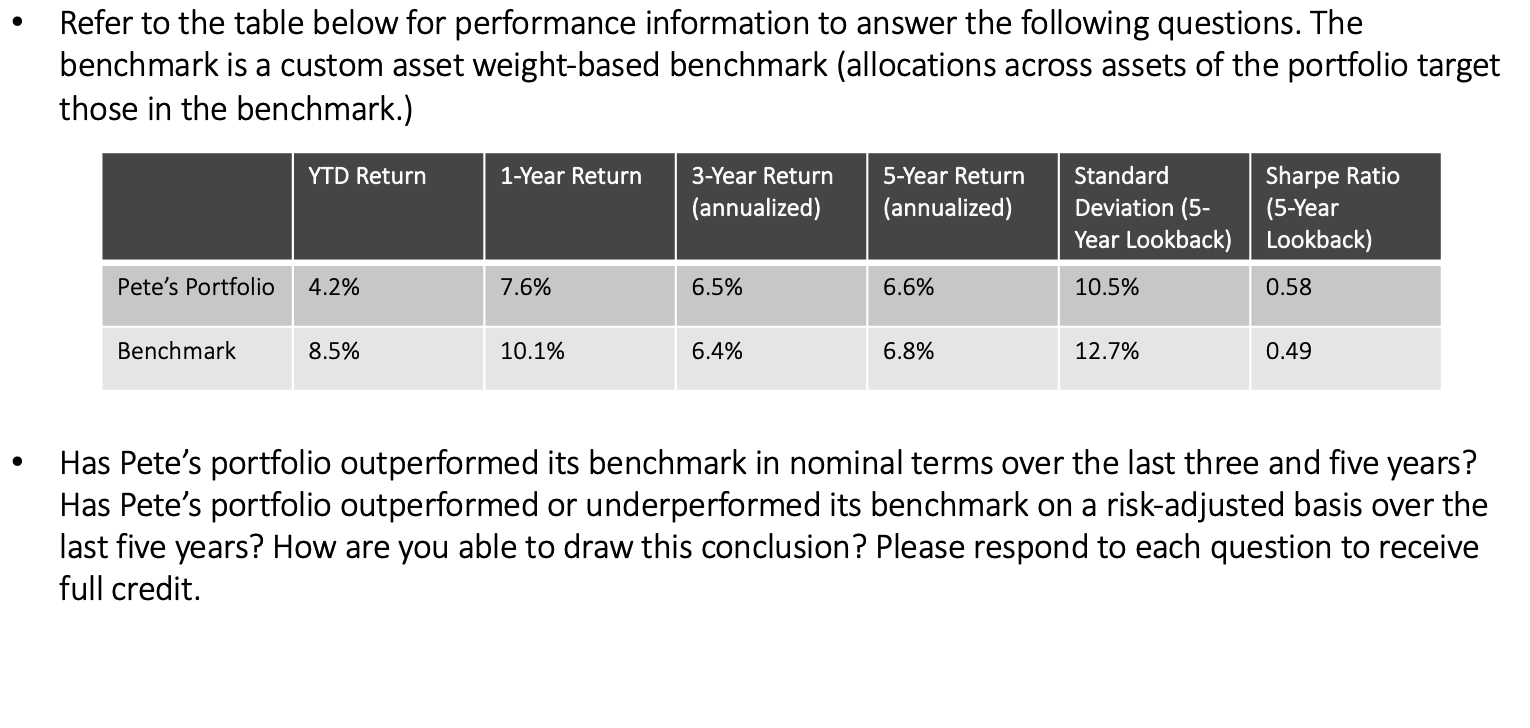

Investor profile: Pete is 62 years old, married, and has three adult children. He is currently employed in the energy industry and earns roughly $1 million annually. He anticipates retiring completely from this position in three years and relying solely on his portfolio to maintain his and wife's combined spending level of $400K annually. In addition to these portfolio assets, they also own a \$2 million home in The Woodlands. Pete and his wife have no other financial assets or business interests. Beyond the value held in this portfolio, the only income they will receive is Social Security, which is not particularly impactful given their level of assets and spending. Pete is more risk averse than the average client. His approach to investing generally places wealth preservation as the top priority, followed by keeping up with inflation, and capital appreciation after that. The volatility in financial markets during the onset of the Covid crisis was unsettling to Pete despite his ability to "weather the storm." At retirement, Pete and his wife plan to downsize their house. However, given the run-up in real estate value in the wake of Covid, and despite the rise in interest rates, Pete believes that he can sell his current house for $2.5 million after a neighbor's house for $2.4 million in early 2022 . He and his wife are emotionally attached to house as this is where they raised their three children. Please complete the short response prompts on the following slides while maintaining a focus on what the implications of your observations are, why a client would be interested in them, and potential "fixes" where necessary to better align the portfolio with the needs and wants of the client within the constraints of the financial markets. Please respond completely and clearly. Complete this assignment assuming you needed to present it to your employer and to the client. Morningstar Equity Style Box \% Morningstar Fixed Income Style Box \% TotalStockHoldings3,934%NotClassified2TotalBondHoldings14,821%NotClassified12 01010252550>50 Use this to respond to the Global Allocation questions. Note: these are the weights of each sector in the equity allocation and benchmark, respectively. Use this to respond to the Taxable Investment AcC slid Cha TotiCha Refer to the table below for performance information to answer the following questions. The benchmark is a custom asset weight-based benchmark (allocations across assets of the portfolio target those in the benchmark.) Has Pete's portfolio outperformed its benchmark in nominal terms over the last three and five years? Has Pete's portfolio outperformed or underperformed its benchmark on a risk-adjusted basis over the last five years? How are you able to draw this conclusion? Please respond to each question to receive full credit. Investor profile: Pete is 62 years old, married, and has three adult children. He is currently employed in the energy industry and earns roughly $1 million annually. He anticipates retiring completely from this position in three years and relying solely on his portfolio to maintain his and wife's combined spending level of $400K annually. In addition to these portfolio assets, they also own a \$2 million home in The Woodlands. Pete and his wife have no other financial assets or business interests. Beyond the value held in this portfolio, the only income they will receive is Social Security, which is not particularly impactful given their level of assets and spending. Pete is more risk averse than the average client. His approach to investing generally places wealth preservation as the top priority, followed by keeping up with inflation, and capital appreciation after that. The volatility in financial markets during the onset of the Covid crisis was unsettling to Pete despite his ability to "weather the storm." At retirement, Pete and his wife plan to downsize their house. However, given the run-up in real estate value in the wake of Covid, and despite the rise in interest rates, Pete believes that he can sell his current house for $2.5 million after a neighbor's house for $2.4 million in early 2022 . He and his wife are emotionally attached to house as this is where they raised their three children. Please complete the short response prompts on the following slides while maintaining a focus on what the implications of your observations are, why a client would be interested in them, and potential "fixes" where necessary to better align the portfolio with the needs and wants of the client within the constraints of the financial markets. Please respond completely and clearly. Complete this assignment assuming you needed to present it to your employer and to the client. Morningstar Equity Style Box \% Morningstar Fixed Income Style Box \% TotalStockHoldings3,934%NotClassified2TotalBondHoldings14,821%NotClassified12 01010252550>50 Use this to respond to the Global Allocation questions. Note: these are the weights of each sector in the equity allocation and benchmark, respectively. Use this to respond to the Taxable Investment AcC slid Cha TotiCha Refer to the table below for performance information to answer the following questions. The benchmark is a custom asset weight-based benchmark (allocations across assets of the portfolio target those in the benchmark.) Has Pete's portfolio outperformed its benchmark in nominal terms over the last three and five years? Has Pete's portfolio outperformed or underperformed its benchmark on a risk-adjusted basis over the last five years? How are you able to draw this conclusion? Please respond to each question to receive full credit