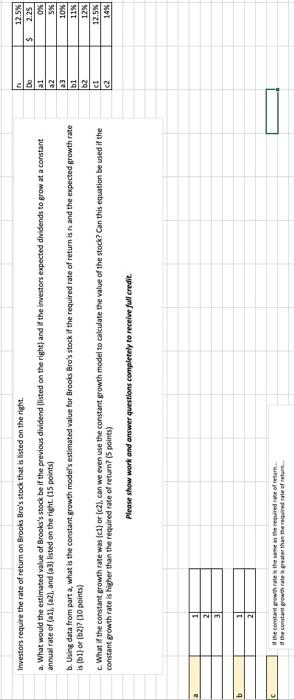

Investors require the rate of return on Brooks Bro's stock that is listed on the right. IN Do al a. What would the estimated value of Brooks's stock be if the previous dividend (listed on the right) and if the investors expected dividends to grow at a constant annual rate of (a1), (a2), and (a3) listed on the right. (15 points) a2 a3 b. Using data from part a, what is the constant growth model's estimated value for Brooks Bro's stock if the required rate of return is rs and the expected growth rate is (b1) or (b2)? (10 points) b1 b2 c1 c. What if the constant growth rate was (c1) or (c2), can we even use the constant growth model to calculate the value of the stock? Can this equation be used if the constant growth rate is higher than the required rate of return? (5 points) c2 Please show work and answer questions completely to receive full credit. 3 b C 1 2 If the constant growth rate is the same as the required rate of return... the constant growth rate is greater than the required rate of retur $ 12.5% 2.25 0% 5% 10% 11% 12% 12.5% 14% Investors require the rate of return on Brooks Bro's stock that is listed on the right. IN Do al a. What would the estimated value of Brooks's stock be if the previous dividend (listed on the right) and if the investors expected dividends to grow at a constant annual rate of (a1), (a2), and (a3) listed on the right. (15 points) a2 a3 b. Using data from part a, what is the constant growth model's estimated value for Brooks Bro's stock if the required rate of return is rs and the expected growth rate is (b1) or (b2)? (10 points) b1 b2 c1 c. What if the constant growth rate was (c1) or (c2), can we even use the constant growth model to calculate the value of the stock? Can this equation be used if the constant growth rate is higher than the required rate of return? (5 points) c2 Please show work and answer questions completely to receive full credit. 3 b C 1 2 If the constant growth rate is the same as the required rate of return... the constant growth rate is greater than the required rate of retur $ 12.5% 2.25 0% 5% 10% 11% 12% 12.5% 14%