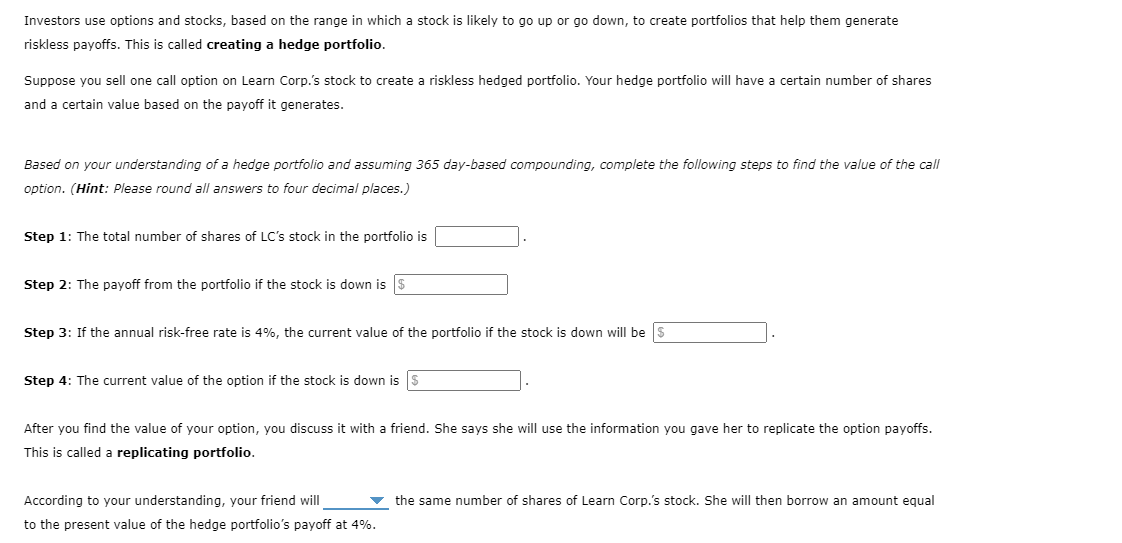

Investors use options and stocks, based on the range in which a stock is likely to go up or go down, to create portfolios that help them generate riskless payoffs. This is called creating a hedge portfolio. Suppose you sell one call option on Learn Corp.'s stock to create a riskless hedged portfolio. Your hedge portfolio will have a certain number of shares and a certain value based on the payoff it generates. Based on your understanding of a hedge portfolio and assuming 365 day-based compounding, complete the following steps to find the value of the call option. (Hint: Please round all answers to four decimal places.) Step 1: The total number of shares of LC's stock in the portfolio is Step 2: The payoff from the portfolio if the stock is down is Step 3: If the annual risk-free rate is 4%, the current value of the portfolio if the stock is down will be Step 4: The current value of the option if the stock is down is $ After you find the value of your option, you discuss it with a friend. She says she will use the information you gave her to replicate the option payoffs. This is called a replicating portfolio. the same number of shares of Learn Corp.'s stock. She will then borrow an amount equal According to your understanding, your friend will to the present value of the hedge portfolio's payoff at 4%. Investors use options and stocks, based on the range in which a stock is likely to go up or go down, to create portfolios that help them generate riskless payoffs. This is called creating a hedge portfolio. Suppose you sell one call option on Learn Corp.'s stock to create a riskless hedged portfolio. Your hedge portfolio will have a certain number of shares and a certain value based on the payoff it generates. Based on your understanding of a hedge portfolio and assuming 365 day-based compounding, complete the following steps to find the value of the call option. (Hint: Please round all answers to four decimal places.) Step 1: The total number of shares of LC's stock in the portfolio is Step 2: The payoff from the portfolio if the stock is down is Step 3: If the annual risk-free rate is 4%, the current value of the portfolio if the stock is down will be Step 4: The current value of the option if the stock is down is $ After you find the value of your option, you discuss it with a friend. She says she will use the information you gave her to replicate the option payoffs. This is called a replicating portfolio. the same number of shares of Learn Corp.'s stock. She will then borrow an amount equal According to your understanding, your friend will to the present value of the hedge portfolio's payoff at 4%