Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Investors were discussing on their investing strategies, argued their philosophies and sharing their stock investing experiences on dated January 31, 2019 as under: Investor

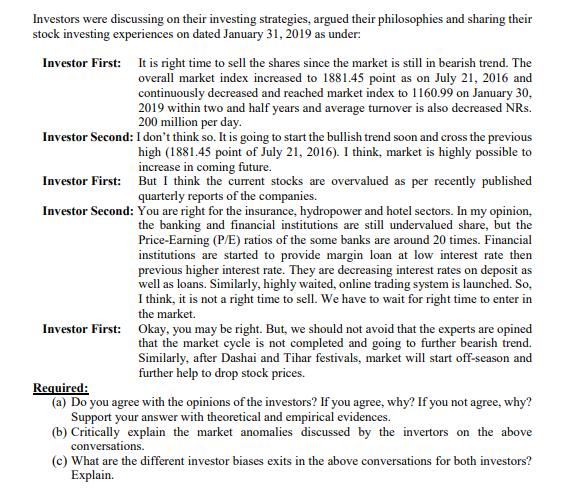

Investors were discussing on their investing strategies, argued their philosophies and sharing their stock investing experiences on dated January 31, 2019 as under: Investor First: It is right time to sell the shares since the market is still in bearish trend. The overall market index increased to 1881.45 point as on July 21, 2016 and continuously decreased and reached market index to 1160.99 on January 30, 2019 within two and half years and average turnover is also decreased NRs. 200 million per day. Investor Second: I don't think so. It is going to start the bullish trend soon and cross the previous high (1881.45 point of July 21, 2016). I think, market is highly possible to increase in coming future. Investor First: But I think the current stocks are overvalued as per recently published quarterly reports of the companies. Investor Second: You are right for the insurance, hydropower and hotel sectors. In my opinion, the banking and financial institutions are still undervalued share, but the Price-Earning (P/E) ratios of the some banks are around 20 times. Financial institutions are started to provide margin loan at low interest rate then previous higher interest rate. They are decreasing interest rates on deposit as well as loans. Similarly, highly waited, online trading system is launched. So, I think, it is not a right time to sell. We have to wait for right time to enter in the market. Investor First: Okay, you may be right. But, we should not avoid that the experts are opined that the market cycle is not completed and going to further bearish trend. Similarly, after Dashai and Tihar festivals, market will start off-season and further help to drop stock prices. Required: (a) Do you agree with the opinions of the investors? If you agree, why? If you not agree, why? Support your answer with theoretical and empirical evidences. (b) Critically explain the market anomalies discussed by the invertors on the above conversations. (c) What are the different investor biases exits in the above conversations for both investors? Explain.

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a The opinions of the investors in the conversation are based on their own perceptions and predictions of the market trend Investor First believes that it is the right time to sell due to the bearish ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started