Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This activity has two parts. In the first, you will look at the performance of six stocks over the last year (and yesterday) and

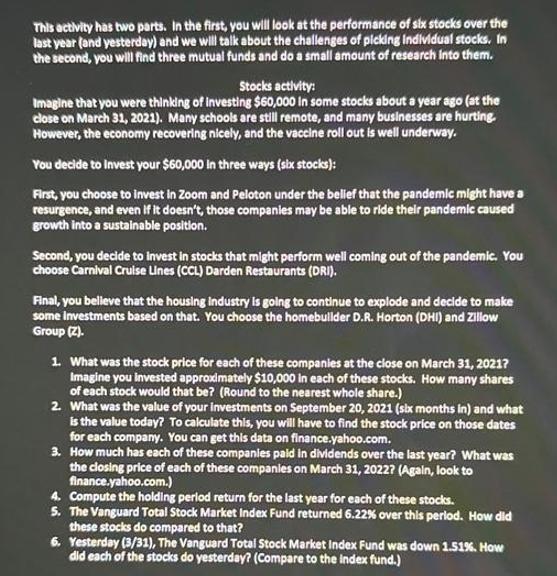

This activity has two parts. In the first, you will look at the performance of six stocks over the last year (and yesterday) and we will talk about the challenges of picking Individual stocks. In the second, you will find three mutual funds and do a small amount of research into them. Stocks activity: Imagine that you were thinking of investing $60,000 In some stocks about a year ago (at the close on March 31, 2021). Many schools are still remote, and many businesses are hurting. However, the economy recovering nicely, and the vaccine roll out is well underway. You decide to invest your $60,000 In three ways (six stocks): First, you choose to invest in Zoom and Peloton under the belief that the pandemic might have a resurgence, and even if it doesn't, those companies may be able to ride their pandemic caused growth into a sustainable position. Second, you decide to invest in stocks that might perform well coming out of the pandemic. You choose Carnival Cruise Lines (CCL) Darden Restaurants (DRI). Final, you believe that the housing industry is going to continue to explode and decide to make some Investments based on that. You choose the homebuilder D.R. Horton (DHI) and Zillow Group (Z). 1. What was the stock price for each of these companies at the close on March 31, 2021? Imagine you invested approximately $10,000 in each of these stocks. How many shares of each stock would that be? (Round to the nearest whole share.) 2. What was the value of your investments on September 20, 2021 (six months in) and what is the value today? To calculate this, you will have to find the stock price on those dates for each company. You can get this data on finance.yahoo.com. 3. How much has each of these companies paid in dividends over the last year? What was the closing price of each of these companies on March 31, 2022? (Again, look to finance.yahoo.com.) 4. Compute the holding period return for the last year for each of these stocks. 5. The Vanguard Total Stock Market Index Fund returned 6.22% over this period. How did these stocks do compared to that? 6. Yesterday (3/31), The Vanguard Total Stock Market Index Fund was down 1.51%. How did each of the stocks do yesterday? (Compare to the index fund.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started