Answered step by step

Verified Expert Solution

Question

1 Approved Answer

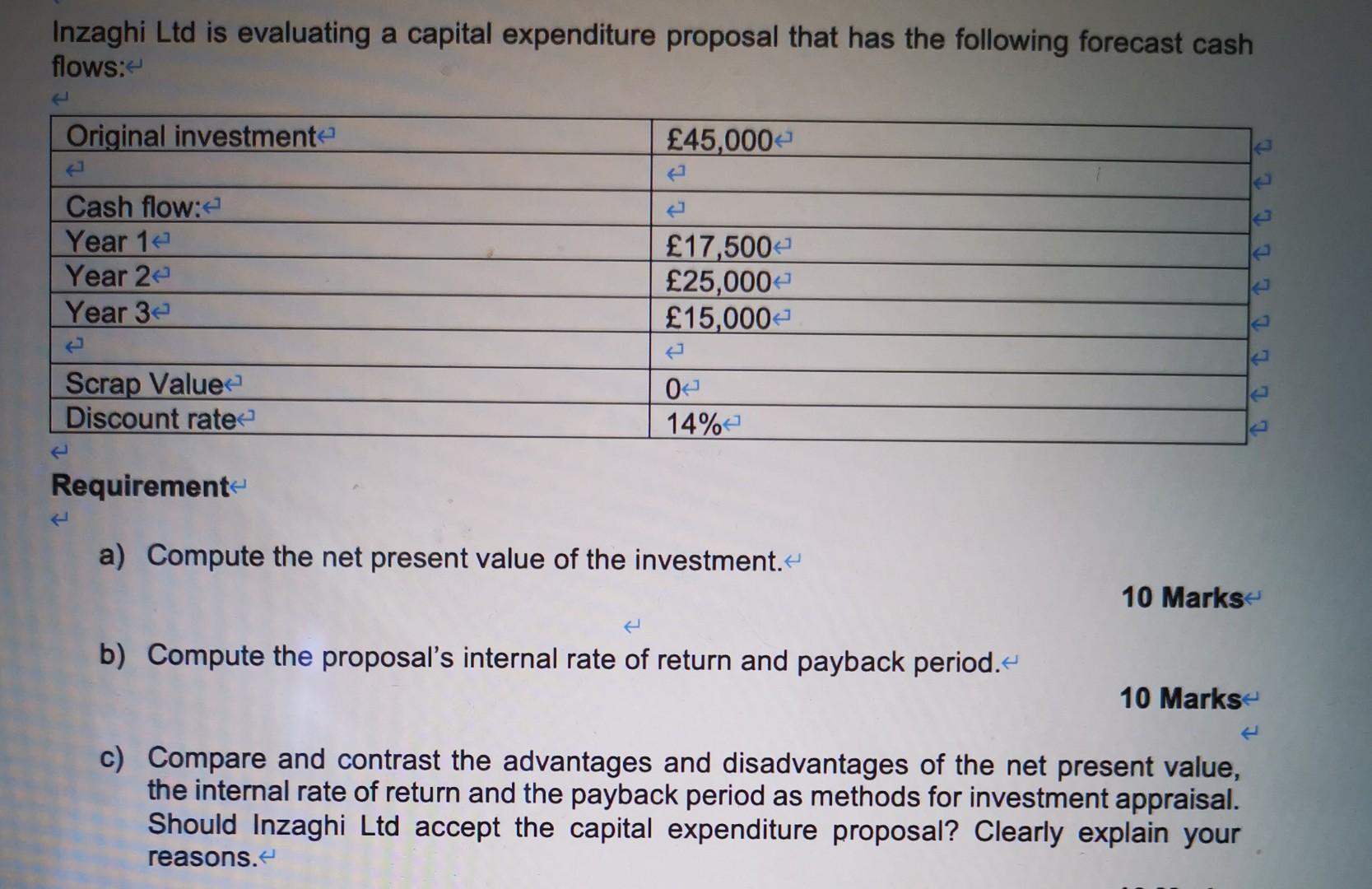

Inzaghi Ltd is evaluating a capital expenditure proposal that has the following forecast cash flows: Original investment 45,000 . 3 Cash flow: Year 1 Year

Inzaghi Ltd is evaluating a capital expenditure proposal that has the following forecast cash flows: Original investment 45,000 . 3 Cash flow: Year 1 Year 2e Year 32 17,500 25,000 15,000 3 Scrap Value Discount rate 02 14% 4 Requirement a) Compute the net present value of the investment. 10 Marks b) Compute the proposal's internal rate of return and payback period. 10 Marks c) Compare and contrast the advantages and disadvantages of the net present value, the internal rate of return and the payback period as methods for investment appraisal. Should Inzaghi Ltd accept the capital expenditure proposal? Clearly explain your reasons

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started