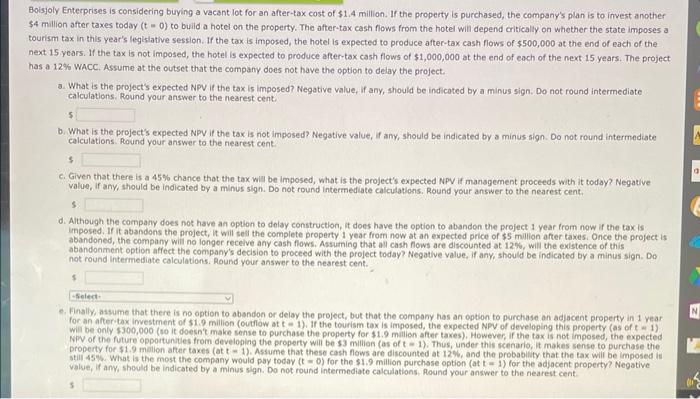

ioisjoly Enterprises is considering buying a vacent Iot for an after-tax cost of $1.4 million. If the property is purchased, the company's plan is to invest another i4 million after taxes today (t=0) to build a hotel on the property. The after-tax cash fiows from the hotel will depend criticaliy on whether the state imposes a ourism tax in this year's legisiative session. If the tax is imposed, the hotel is expected to produce after-tax cash flows of $500,000 at the end of each of the ext 15 ycars. If the tax is not imposed, the hotel is expected to produce after-tax cash flows of $1,000,000 at the end of each of the next 15 years. The project Ias a 12\% WACC. Assume at the outset that the company does not have the option to delay the project. a. What is the project's expected NPV if the tax is imposed? Negative value, if any, should be indicoted by a minus sign. Do not round intermediate calculations. Round your answer to the nearest cent. 5 b. What is the project's expected NPy if the tax is not imposed? Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest cent: 3 c. Given that there is a 45% chance that the tax wial be imposed, what is the project's expected NPV if management proceeds with it today? Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculatlons. Round your answer to the nearest cent. 5. d. Although the company does not have an option to delay construction, it does have the option to abandon the project 1 year trom now if the tax is imposed. If it abandons the project, it will seil the complete property 1 year from now at an expected price of \$5 million after taxes. Once the project is abandoned, the company will no longer recelve any cash flows. Assuming that all cash flows ace discounted at 12%, will the existence of this abandoniment option affect the company's decision to proceed with the project today? Negative value, if any; should be indicated by a minus sign. Do not round intermediate calculations. Hound your answer to the nearest cent. $ e. Finally, aswume that there is no option to absndon or delay the project, but that the company has an option to purchase an adjacent property in 1 year for an afteritax imvestment of $1.9 milion (outfow at t=1 ). If the tourism tax is imposed, the expected NPV of developing this property (as of t w i). will be only $300,000 (so it doesn't make sense to purchase the property for $1.9 million after taxes). However, if the tax is not imposed, the expected NPV of the future opportunites from developing the property will be $3 millien (as of t=1). Thus, under this scenario, it makes sense to purchase the property for $1.9 molion after taxes (at t=1 ). Assume that these cash flows are discounted at 12%, and the probability that the tax will be imposed is stili as What is the most the company would pay today (t=0) for the $1.9 million purchase option (at t=1 ) for the adjacent property? Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations, Round your answer to the nearest cent. 5