Answered step by step

Verified Expert Solution

Question

1 Approved Answer

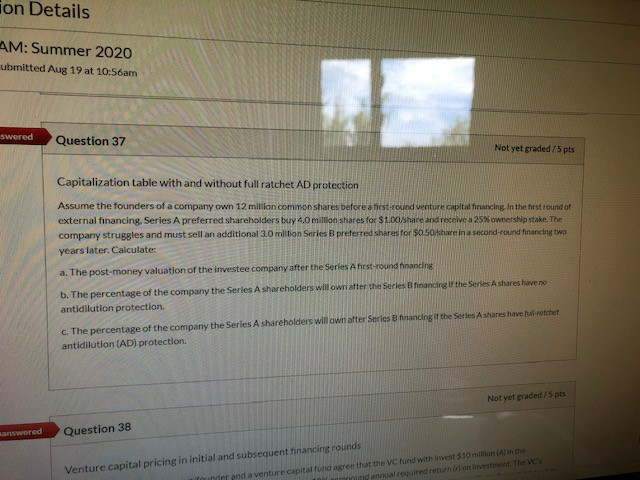

ion Details AM: Summer 2020 ubmitted Aug 19 at 10:56am swered Question 37 Not yet graded/5 pts Capitalization table with and without full ratchet AD

ion Details AM: Summer 2020 ubmitted Aug 19 at 10:56am swered Question 37 Not yet graded/5 pts Capitalization table with and without full ratchet AD protection Assume the founders of a company own 12 million common shares before a first round venture capital financing. In the first round of external financing Series A preferred shareholders buy 4.0 million shares for $1.00 share and receive a 25% ownership stakes. The company struggles and must sell an additional 3.0 million Series B preferred shares for $0 Soshareina second round financing two years later. Calculate: a. The post-money valuation of the investee company after the Series Afirst round financing b. The percentage of the company the Series A shareholders will own after the Series financing of the Series A shares have no antidilution protection. c. The percentage of the company the Series A shareholders will own after Series B financing if the Series A shares have ratchet antidilution (AD) protection Not yet graded/5 pts answered Question 38 Venture capital pricing in initial and subsequent financing rounds founder and a venture capital fund agree that the VC fund with invest $10 million in the wd annual required return on investment, The ion Details AM: Summer 2020 ubmitted Aug 19 at 10:56am swered Question 37 Not yet graded/5 pts Capitalization table with and without full ratchet AD protection Assume the founders of a company own 12 million common shares before a first round venture capital financing. In the first round of external financing Series A preferred shareholders buy 4.0 million shares for $1.00 share and receive a 25% ownership stakes. The company struggles and must sell an additional 3.0 million Series B preferred shares for $0 Soshareina second round financing two years later. Calculate: a. The post-money valuation of the investee company after the Series Afirst round financing b. The percentage of the company the Series A shareholders will own after the Series financing of the Series A shares have no antidilution protection. c. The percentage of the company the Series A shareholders will own after Series B financing if the Series A shares have ratchet antidilution (AD) protection Not yet graded/5 pts answered Question 38 Venture capital pricing in initial and subsequent financing rounds founder and a venture capital fund agree that the VC fund with invest $10 million in the wd annual required return on investment, The

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started