Answered step by step

Verified Expert Solution

Question

1 Approved Answer

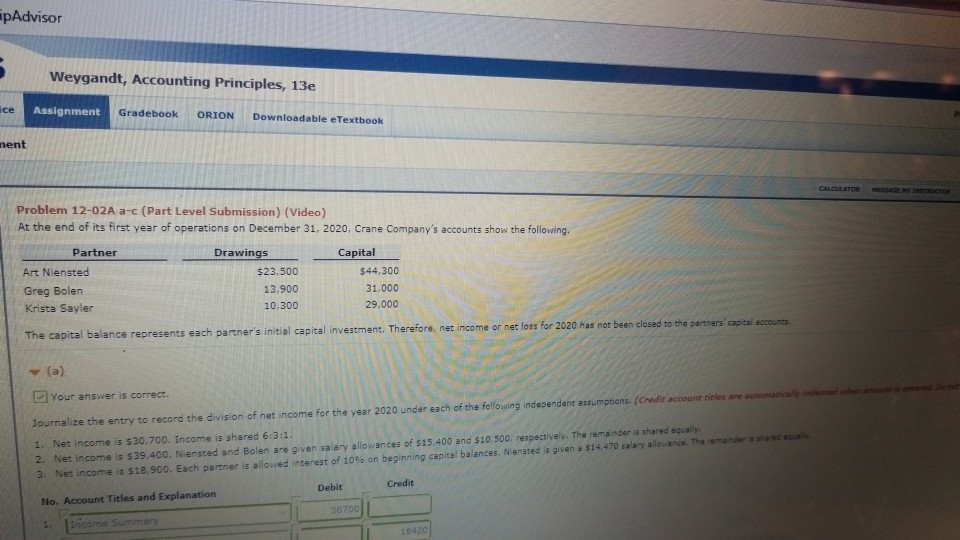

ipAdvisor Weygandt, Accounting Principles, 13e Assignment Gradebook ORION Downloadable eTextbook ent Problem 12-02A a-c (Part Level Submission) (Video) At the end of its first year

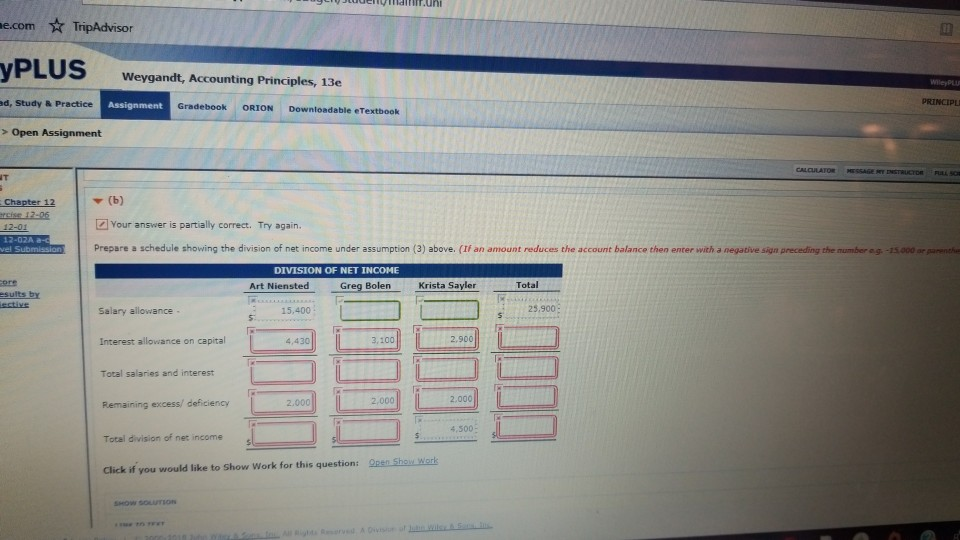

ipAdvisor Weygandt, Accounting Principles, 13e Assignment Gradebook ORION Downloadable eTextbook ent Problem 12-02A a-c (Part Level Submission) (Video) At the end of its first year of operations on December 31, 2020, Crane Company's accounts show the following Partner Dra Capital $23.500 13.900 10,300 $44,300 31,000 29,000 Art Niensted Greg Bolern Krista Sayler net loss for 2020 has not been closed to the partners capital accounts. The capital balance represents each partner's initial capital investment. Therefore, net income on Journalize the entry to record the division of net income for the year 2020 under each of the following independene assumptions. (Credit account ritles are 1. Net income is 530,700. Income is shared 6:3:1 2. Net income is s35.400. Niensted and Bolen are given salary ellowances of $15,400 and $10,500, respectively. The remainder is shared equalily 3. Net income s18,900. Each partner is allowed interest of 10% on beginning capital balances. Ne sted il given a s14 470 salary allowance. Th dris renal, Your answer is correct Credit Debit No. Account Titles and Explanation 30700 yinainm.uni e.com TripAdvisor yPLUS Weygandt, Accounting Principles, 13e d, Study & Practice PRINCIPLI Gradebook ORION Downloadable eTextbook > Open Assignment IT Your answer is partially correct. Try again. Prepare a schedule showing the division o net n come under assumption 3) above ri an amount reduces the account balance then enrerwth a ne atiesin pece ngthen m e ag r DIVISION OF NET INCOME ors esults byY ectixe Art Niensted Greg BolenKrista Sayler Total 25.900 Salary allowance 15,400 5. Interest allowance on capital 4,430 3,100 2.900 Total salaries and interest 2.000 2,000 2.000 4,500 Total division of net income Click if you would like to Show Work for this question: Qpen Shoy Works

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started