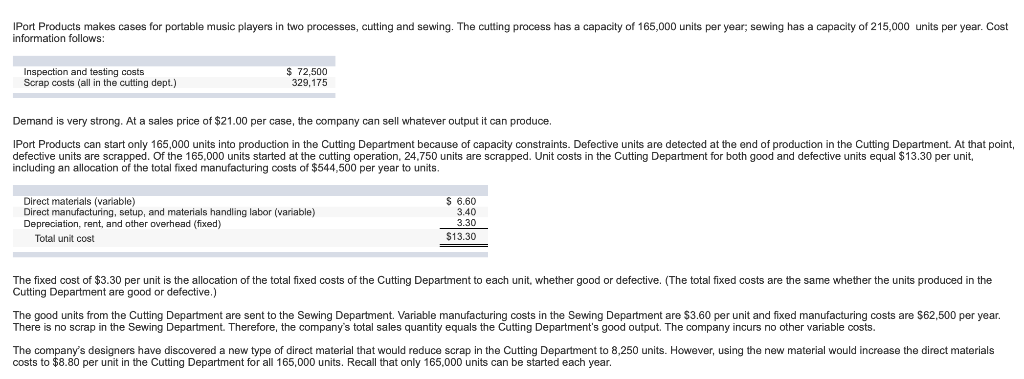

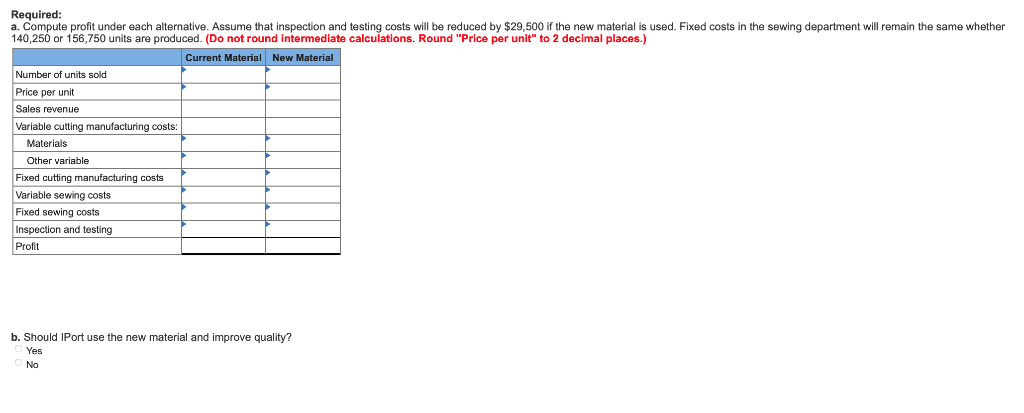

IPort Products makes cases for portable music players in two processes, cutting and sewing. The cutting process has a capacity information follows: 165,000 units per year; sewing has a capacity of 215,000 units per year. Cost 72,500 pcn and testing costs cutting dept.) very strong. At a sales price of $21.00 per case, the company can sell whatever output it can produce. Demand IPort Products can start only 165,000 units into production in the Cutting Department because of capacity constraints. Defective units are detected at the end of production in the Cutting Department. At that point, defective units are scrapped. Of the 165,000 units started at the cutting operation, 24,750 units are scrapped. Unit costs in the Cutting Department for both good and defective units equal $13.30 per unit including an allocation of the total fixed manufacturing costs of $544,500 per year to units. S 6.60 Direct materials (variable) and materials handling labor (variable) 3.30 Depreciation, rent, and other overhead (fixed) $13.30 Total unit cost The fixed cost of $3.30 per unit is the allocation of the total fixed costs of the Cutting Department to each unit, whether good or defective. (The total fixed costs are the same whether the units produced in the Cutting Department are good or defective.) The good units from the Cutting Department are sent to the Sewing Department. Variable manufacturing costs in the Sewing Department are $3.60 per unit and fixed manufacturing costs are $62,500 per year There is no scrap in the Sewing Department. Therefore, the company's total sales quantity equals the Cutting Department's good output. The company incurs no other variable costs. The company's designers have discovered a new type of direct material that would reduce scrap in the Cutting Department to 8,250 units. However, using the new material would increase the direct materials costs to $8.80 per unit in the Cutting Department for all 165,000 units. Recall that only 165,000 units can be started each year. Required: a. Compute profit under each alternative. Assume that inspection and testing costs will be reduced by $29,500 if the new material is used. Fixed costs in the sewing department will remain the same whether 140,250 or 156,750 units are produced. (Do not round intermediate calculations. Round "Price per unit" to 2 decimal places.) New Material Current Material Number of units sold Price per unit Sales revenue Variable cutting manufacturing costs: Materials Other variable Fixed cutting manufacturing costs Variable sewing costs Fixed sewing costs Inspection and testing Profit Should IPort use the new material and improve quality? No