ippose that the bid price of Google stock is $499 per share and the ask price is $502 per share. Google does not pay any

Answered step by step

Verified Expert Solution

Question

37 users unlocked this solution today!

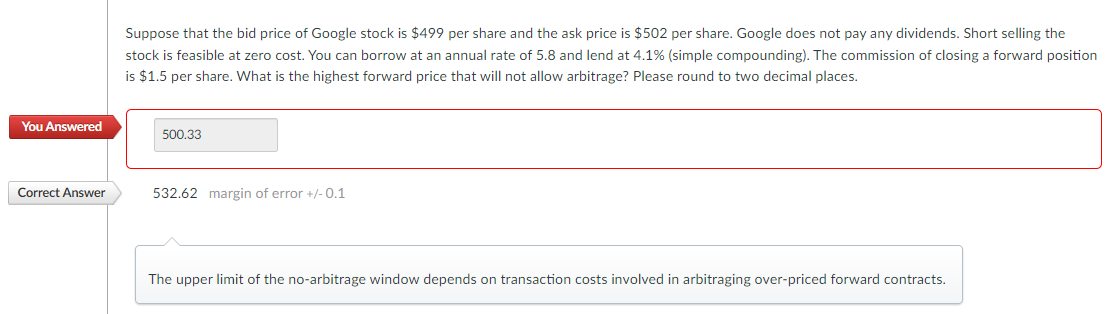

ippose that the bid price of Google stock is $499 per share and the ask price is $502 per share. Google does not pay any dividends. Short selling the tock is feasible at zero cost. You can borrow at an annual rate of 5.8 and lend at 4.1% (simple compounding). The commission of closing a forward position 51.5 per share. What is the highest forward price that will not allow arbitrage? Please round to two decimal places. 532.62 margin of error +/0.1 The upper limit of the no-arbitrage window depends on transaction costs involved in arbitraging over-priced forward contracts

ippose that the bid price of Google stock is $499 per share and the ask price is $502 per share. Google does not pay any dividends. Short selling the tock is feasible at zero cost. You can borrow at an annual rate of 5.8 and lend at 4.1% (simple compounding). The commission of closing a forward position 51.5 per share. What is the highest forward price that will not allow arbitrage? Please round to two decimal places. 532.62 margin of error +/0.1 The upper limit of the no-arbitrage window depends on transaction costs involved in arbitraging over-priced forward contracts Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards