Question

Iqaluit Corporation recently announced a bonus plan to be awarded to the vice-president of the most profitable division. The three managers are to choose whether

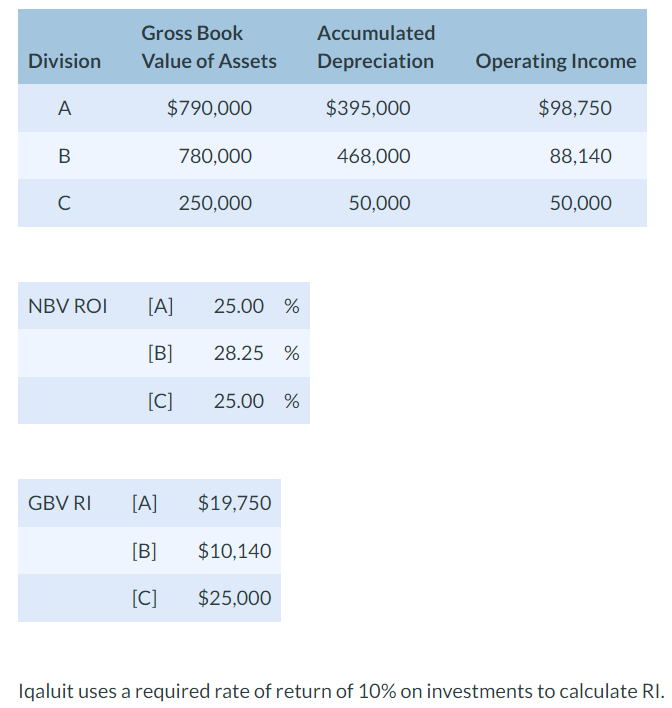

Iqaluit Corporation recently announced a bonus plan to be awarded to the vice-president of the most profitable division. The three managers are to choose whether the ROI or residual income (RI) will be used to measure profitability. In addition, they must decide whether investments will be measured using the gross book value (GBV) or net book value (NBV) of assets. Iqaluit defines income as operating income and investments as total assets. The following information is available for the year just ended:

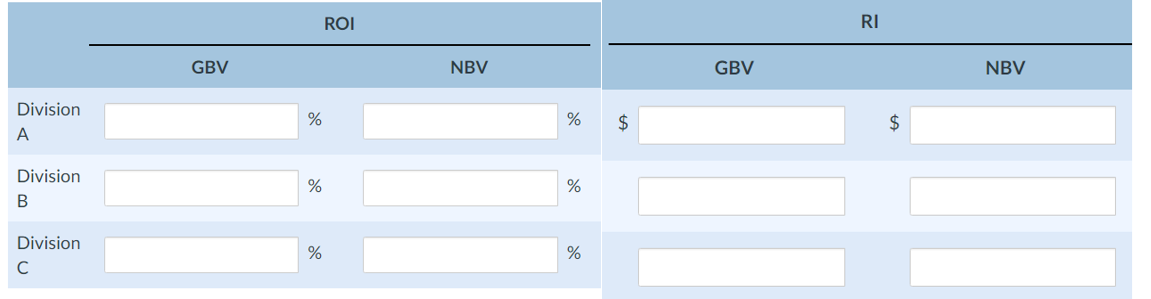

Calculate ROI and RI for all the three divisions by using GBV and NBV. (Round ROI to 2 decimal places, e.g. 15.25%.)  Which method for calculating performance did each vice-president use if each one wanted to show that his or her division had the best performance?

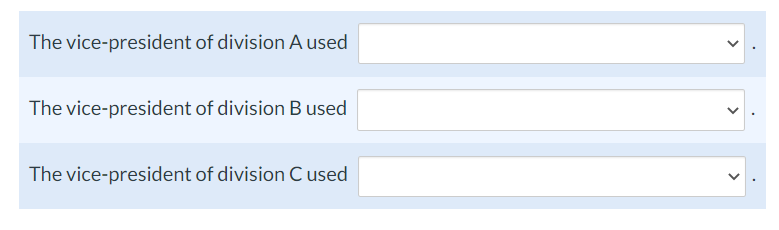

Which method for calculating performance did each vice-president use if each one wanted to show that his or her division had the best performance?

Gross Book Value of Assets Accumulated Depreciation Division Operating Income A $790,000 $395.000 $98,750 B 780,000 468,000 88,140 250,000 50,000 50,000 NBV ROI [A] 25.00 % [B] 28.25 % [C] 25.00 % GBV RI [A] $19,750 [B] $10,140 [C] $25,000 Iqaluit uses a required rate of return of 10% on investments to calculate RI. ROI RI GBV NBV GBV NBV Division % % $ $ Division B % % Division % % The vice-president of division A used The vice-president of division Cused >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started